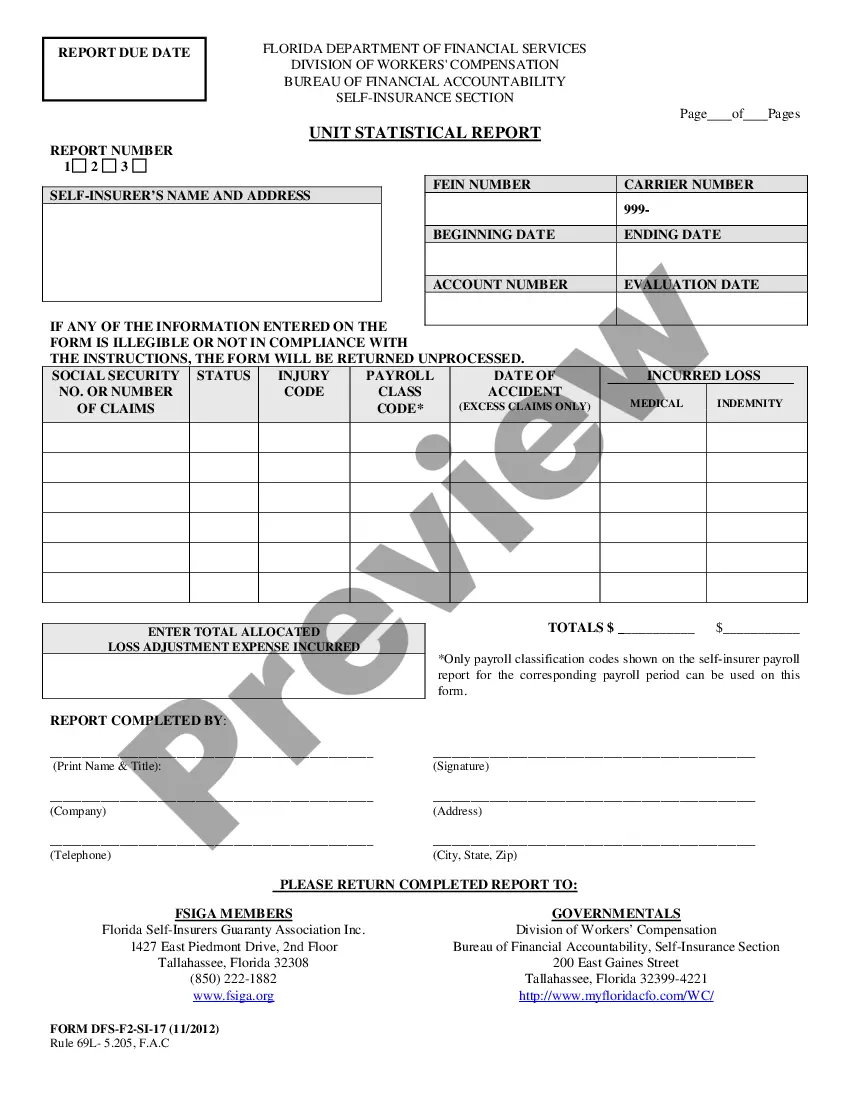

Florida Self-Insurer Payroll Report

Description

How to fill out Florida Self-Insurer Payroll Report?

Gain entry to the widest selection of legal documents.

US Legal Forms is basically a resource where you can locate any region-specific paperwork in just a few clicks, including Florida Self-Insurer Payroll Report samples.

No need to waste hours searching for a court-acceptable template.

Utilize the Preview feature if it's present to review the document's content. If everything is satisfactory, click on the Buy Now button. Following your selection of a pricing plan, create an account. Pay using a credit card or PayPal. Download the template to your device by clicking Download. That's all! You should submit the Florida Self-Insurer Payroll Report template and verify it. To confirm that everything is accurate, consult your local legal advisor for assistance. Register and easily access over 85,000 useful samples.

- Our experienced professionals ensure that you receive current examples at all times.

- To utilize the forms library, choose a subscription and create your account.

- If you have already done so, just Log In and click Download.

- The Florida Self-Insurer Payroll Report example will instantly be saved in the My documents section.

- To establish a new account, follow the straightforward instructions below.

- If you need to use region-specific documents, ensure you select the correct state.

- If available, review the description to grasp all the details of the document.

Form popularity

FAQ

Yes, many employers in Florida are required to carry workers' compensation insurance, especially those in the construction industry, regardless of the employee count. For other sectors, the requirement kicks in after you have four or more employees. This insurance protects both the employer and employees by providing coverage for work-related injuries. By efficiently managing this with tools like the Florida Self-Insurer Payroll Report, you can keep your business compliant and secure.

In Florida, you are not legally required to offer health insurance to your employees regardless of the number of employees you have. However, many businesses choose to offer it to attract and retain talent. Providing insurance can enhance employee satisfaction and loyalty. If you are navigating health insurance options, the Florida Self-Insurer Payroll Report can be beneficial in managing your obligations.

In Florida, if your business has four or more employees, you are required to provide workers' compensation insurance. This requirement applies to most industries. However, if your business is in the construction industry, you must have coverage even if you only have one employee. Don't let uncertainties about the Florida Self-Insurer Payroll Report hold your business back; it's crucial to stay compliant.

Yes, you can self-insure workers' compensation in Florida, provided you meet specific requirements set by the state. Companies must demonstrate financial stability and submit a Florida Self-Insurer Payroll Report to establish their eligibility for self-insurance. This process allows businesses to manage their own workers' compensation claims, giving them greater control over their insurance expenditures. If you're looking to navigate this process efficiently, consider using the US Legal Forms platform, which provides the necessary forms and guidance for your self-insurance needs.

Most employers in Florida must have workers' compensation insurance, especially if they have four or more employees, or one employee in the construction sector. This insurance safeguards workers against job-related injuries and protects employers from potential lawsuits. However, certain conditions can allow for exemptions, so it’s crucial to understand your specific situation. The Florida Self-Insurer Payroll Report offers insights into compliance and requirements.

Yes, employers in Florida can self-insure for workers' compensation, provided they meet specific financial qualifications and complete required applications. This self-insurance option can lead to flexible resource management for companies with adequate capital. It's essential to maintain compliance with state regulations to ensure the program runs smoothly and effectively. For more detailed information, refer to the Florida Self-Insurer Payroll Report.

In Florida, independent contractors are generally not required to have workers' compensation insurance unless they fall under certain classifications, like construction workers. However, hiring businesses might still prefer or require independent contractors to carry their insurance for liability protection. It’s advisable for independent contractors to consider acquiring coverage to safeguard against potential risks. You can find more insights on this topic in the Florida Self-Insurer Payroll Report.

To verify workers' compensation insurance in Florida, you can use the Florida Division of Workers' Compensation's online verification tools or contact their office directly. You'll need the employer's name or policy number to access the necessary information. This step is crucial for ensuring that businesses comply with state laws and offer protection to their workers. Refer to the Florida Self-Insurer Payroll Report for additional resources on verification.

A significant disadvantage of a self-insured program is the financial risk involved. Employers must set aside adequate resources to cover potential claims, which can be challenging for some businesses. Additionally, without the safety net of an insurance company, self-insurers could face substantial costs if a large claim arises. The Florida Self-Insurer Payroll Report provides essential guidance on managing these risks.

In Florida, most employers must carry workers' compensation insurance if they employ four or more employees. However, construction industry employers must have coverage even if they hire just one employee. This requirement helps protect both the employer and employee, ensuring that injured workers receive necessary benefits. You can find more information on this topic in the Florida Self-Insurer Payroll Report.