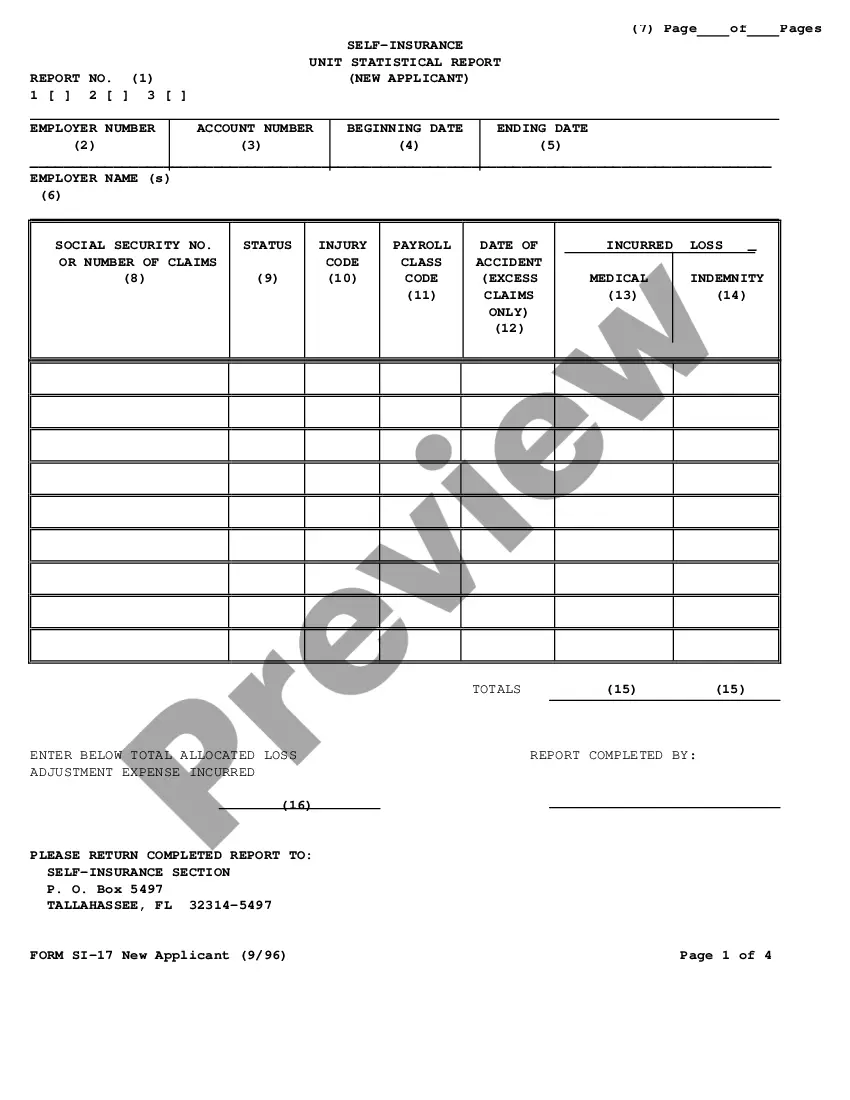

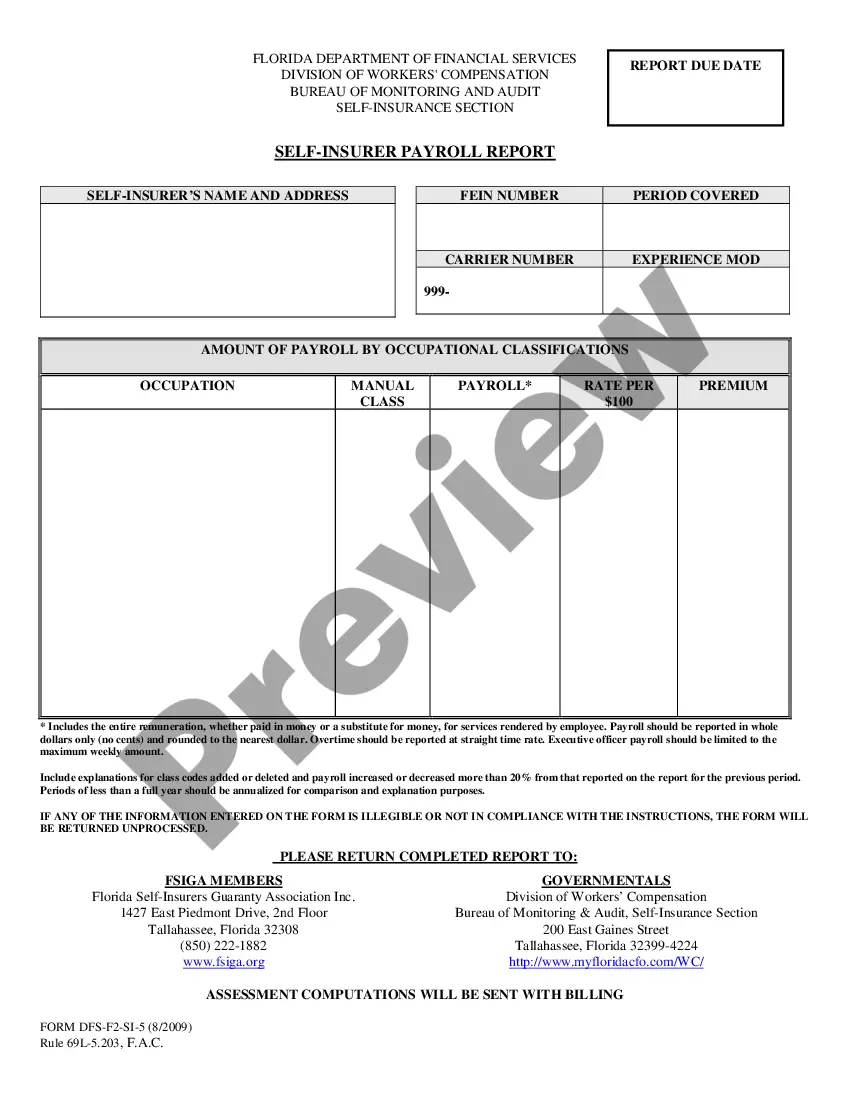

Florida Self-Insurance Unit Statistical Report

Description

How to fill out Florida Self-Insurance Unit Statistical Report?

Obtain one of the most extensive collections of authorized documents.

US Legal Forms is a platform where you can discover any state-specific form in just a few clicks, such as Florida Self-Insurance Unit Statistical Report examples.

No need to invest hours searching for a court-acceptable template. Our skilled experts ensure that you always have access to the latest samples.

After selecting a pricing option, register your account. Pay using a card or PayPal. Save the document to your device by clicking on the Download button. That's it! You should submit the Florida Self-Insurance Unit Statistical Report template and verify it. To confirm that everything is accurate, contact your local legal advisor for assistance. Sign up and easily browse through more than 85,000 useful templates.

- To utilize the document library, choose a subscription, and set up an account.

- If you have already signed up, simply Log In and then click Download.

- The Florida Self-Insurance Unit Statistical Report example will swiftly be stored in the My documents tab (a section for all documents you save on US Legal Forms).

- To create a new account, refer to the brief instructions below.

- If you need to use a state-specific document, make sure to specify the correct state.

- If possible, review the description to understand all the details of the document.

- Utilize the Preview feature if it's available to check the contents of the document.

- If everything is accurate, click on the Buy Now button.

Form popularity

FAQ

Most businesses in Florida are required to have workers' compensation insurance if they employ four or more people. This mandate is crucial for protecting both the employees and the business from financial liabilities associated with workplace injuries. Referring to the Florida Self-Insurance Unit Statistical Report can provide insights into compliance and insurance options. USLegalForms simplifies the process of obtaining the necessary documentation to ensure you meet these requirements.

Yes, Florida allows companies to self-insure their workers' compensation coverage. To do this, businesses must comply with the regulations set forth by the Florida Self-Insurance Unit, including submitting the Florida Self-Insurance Unit Statistical Report. This self-insurance option offers more flexibility and control over claims management for eligible businesses. At USLegalForms, we can assist you in understanding the requirements and steps for effective self-insurance.

In Florida, independent contractors are generally not required to carry workers' compensation insurance. However, if you work in certain industries, this requirement may change based on your specific circumstances. Understanding the Florida Self-Insurance Unit Statistical Report can help you assess the risks associated with not having insurance. At USLegalForms, we provide valuable resources to help independent contractors navigate these decisions effectively.

Yes, you can self-insure workers' compensation in Florida, but it requires meeting specific criteria mandated by state regulations. Your business must demonstrate its financial capabilities and ability to cover workers' compensation claims independently. Utilizing the Florida Self-Insurance Unit Statistical Report can help you understand the nuances of this process and ensure compliance with legal requirements. Being well-prepared will enhance your self-insurance strategy in this area.

To be self-insured in Florida, you need a clear understanding of your financial capacity and a comprehensive risk management strategy. Regular assessments and effective claims management practices are crucial for managing potential liabilities. The Florida Self-Insurance Unit Statistical Report can be a valuable tool in determining your readiness for self-insurance. By using this report, you can make informed decisions that align with your business goals.

One major disadvantage of a self-insured program is the potential risk of high financial exposure. If your business faces significant claims, it may strain your financial resources. Moreover, self-insurance requires diligent record-keeping and risk management practices, which can be a challenge for some companies. The Florida Self-Insurance Unit Statistical Report can help you evaluate the risks and rewards associated with self-insurance before making a decision.

In Florida, businesses looking to self-insure must meet certain criteria, including adequate net worth and the ability to demonstrate financial stability. Additionally, companies must submit a detailed application to the Florida Self-Insurance Unit, along with the necessary documentation. The Florida Self-Insurance Unit Statistical Report provides insights into these requirements, making your application process more manageable. By adhering to these guidelines, your business can confidently pursue self-insurance.

To be self-insured, a business must assess its financial health and risk management strategies thoroughly. Companies should have enough financial reserves to cover potential claims, which can vary based on the industry. Utilizing the Florida Self-Insurance Unit Statistical Report can assist you in understanding the risks involved and the requirements needed for successful self-insurance. This preparation ensures that your business is ready to take on this responsibility.