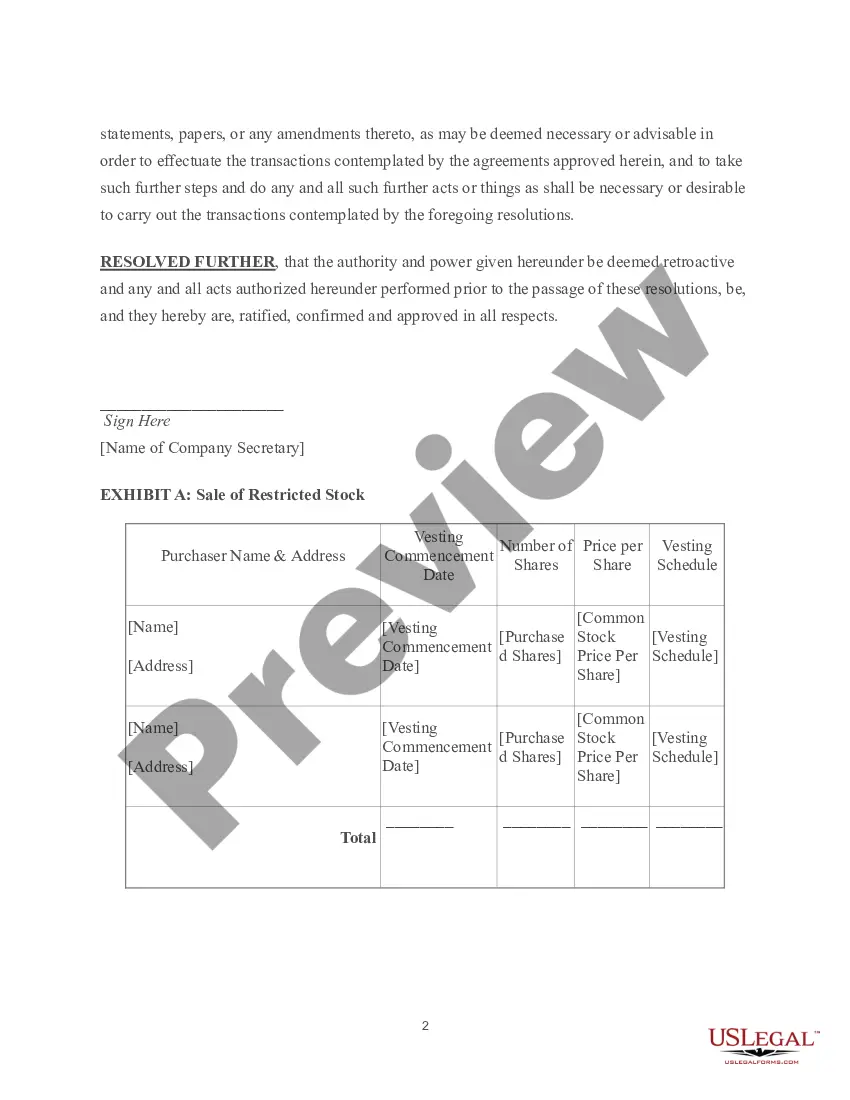

A Board Resolution Approving Sale of Restricted Stock is a document that is used to authorize and approve the sale of restricted stock. Restricted stock is a type of security that may only be traded under specific restrictions set by the issuer. This type of resolution is used when the board of directors of a company wishes to give permission for the sale of restricted stock, typically to a third party. There are two main types of Board Resolution Approving Sale of Restricted Stock. The first is a Private Sale Resolution, which authorizes and approves the sale of restricted stock to a third party who is not an officer, director, or affiliated with the company. The second is a Rule 144 Resolution, which authorizes and approves the sale of restricted stock in compliance with Rule 144 under the Securities Act of 1933. In addition to authorizing and approving the sale, a Board Resolution Approving Sale of Restricted Stock typically includes details of the sale, including the number of shares to be sold, the purchase price, and any applicable restrictions or conditions. It also includes the name and title of the individual(s) authorized to sign the resolution on behalf of the board of directors.

Board Resolution Approving Sale of Restricted Stock

Description

How to fill out Board Resolution Approving Sale Of Restricted Stock?

How much time and resources do you usually spend on drafting formal paperwork? There’s a greater opportunity to get such forms than hiring legal specialists or wasting hours searching the web for an appropriate template. US Legal Forms is the top online library that provides professionally designed and verified state-specific legal documents for any purpose, including the Board Resolution Approving Sale of Restricted Stock.

To get and complete an appropriate Board Resolution Approving Sale of Restricted Stock template, adhere to these simple instructions:

- Look through the form content to make sure it meets your state laws. To do so, check the form description or take advantage of the Preview option.

- If your legal template doesn’t satisfy your needs, find a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Board Resolution Approving Sale of Restricted Stock. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct document. Select the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally reliable for that.

- Download your Board Resolution Approving Sale of Restricted Stock on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously acquired documents that you safely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most reliable web services. Join us today!

Form popularity

FAQ

The Company's board of directors must approve all stock option grants, including the name of the recipient, the number of shares, the vesting schedule and the exercise price. This can be done either in a board meeting or via unanimous written consent.

At its core, an equity-based incentive plan is used to attract, retain, and incentivize employees. Companies often reward employees, partners, directors, contractors, or others by granting them shares or units (these terms are used interchangeably herein) in an equity plan.

Equity incentive plan board approval allows the Board of a corporation to approve an equity incentive plan and set how many of the company's shares will be held by the plan. Boards are often required to approve an equity incentive plan.

If a company wishes to issue additional shares to a new shareholder, all existing shareholders within the company must pass a special board resolution to that effect.

Before company shares may be sold or transferred from one person to another, the company must establish a resolution to sell corporate shares. The sale of this stock must be approved by the company's board of directors. Afterwards, shares would be eligible to be sold from one person to another.

Granting an option requires the formal approval of your company's Board of Directors, either at a formal Board meeting or by a written consent signed by all of the members of the Board.

While it is possible for companies to award equity incentive compensation without using an equity incentive plan, a well drafted plan greatly reduces administrative burdens and streamlines the process for each individual grant of equity compensation.

A corporate resolution stock transfer is necessary before company shares are eligible for transfer from one person to another. Generally, your company's board of directors will approve the resolution and then distribute copies of the resolution to stockholders.