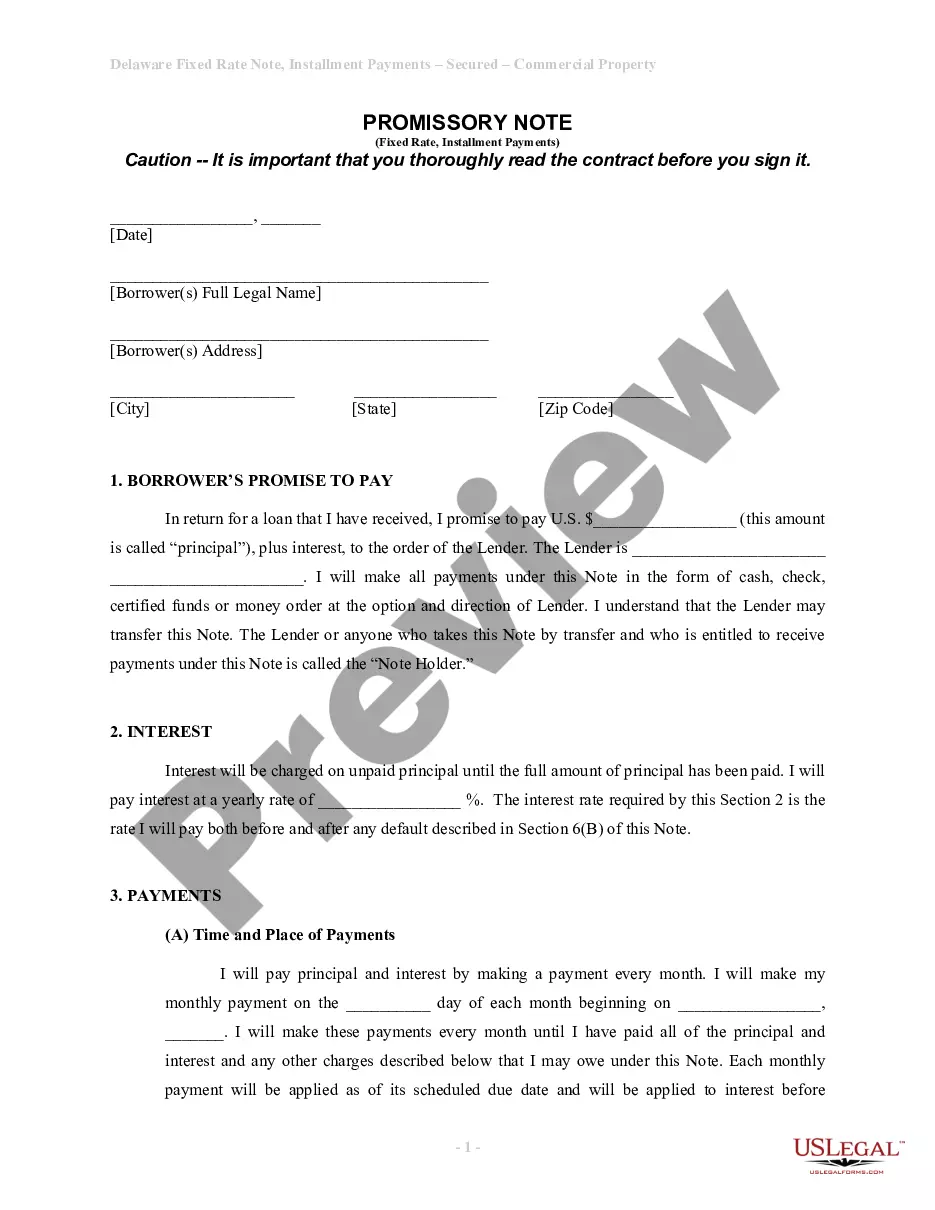

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Delaware Installments Fixed Rate Promissory Note Secured by Personal Property

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Installments Fixed Rate Promissory Note Secured By Personal Property?

The greater the number of documents you need to organize - the more apprehensive you become.

You can discover countless Delaware Installments Fixed Rate Promissory Note Secured by Personal Property templates online, but you are unsure which of them to trust.

Eliminate the hassle and simplify finding examples with US Legal Forms. Obtain precisely crafted paperwork that is designed to comply with the state regulations.

Access each template you acquire in the My documents section. Simply visit there to create a new copy of your Delaware Installments Fixed Rate Promissory Note Secured by Personal Property. Even when dealing with properly composed forms, it’s still important to consider consulting with a local attorney to review the completed form to ensure that your document is accurately completed. Achieve more for less with US Legal Forms!

- Verify that the Delaware Installments Fixed Rate Promissory Note Secured by Personal Property is valid in your state.

- Double-check your choice by reading the description or using the Preview option if available for the selected document.

- Press Buy Now to initiate the registration process and select a pricing plan that fits your needs.

- Enter the required information to create your account and pay for the order using your PayPal or credit card.

- Choose a convenient document format and download your example.

Form popularity

FAQ

A Delaware Installments Fixed Rate Promissory Note Secured by Personal Property is classified as a secured promissory note. This means the note is backed by collateral, which in this case is personal property. If the borrower defaults, the lender can take possession of the collateral to recover the owed amount. This arrangement can provide peace of mind to lenders, knowing there is a tangible asset tied to the agreement.

The document that secures the promissory note to real property is commonly known as a security agreement or a mortgage. This instrument links the Delaware Installments Fixed Rate Promissory Note Secured by Personal Property to the specified piece of real estate. It gives the lender the right to claim the secured property if the borrower defaults on the terms. Clear documentation is key to protecting the interests of both parties involved.

When writing a promissory note with collateral, you should begin by stating the principal amount and interest rate. Include a clear description of the collateral backing the Delaware Installments Fixed Rate Promissory Note Secured by Personal Property, along with the repayment terms. It is crucial to specify the rights of both the borrower and the lender should a default occur. This structure safeguards both parties and ensures clarity in the agreement.

To secure a promissory note with real property, you first need to identify the property you wish to use as collateral. Then, a security agreement must be created that details the terms of the Delaware Installments Fixed Rate Promissory Note Secured by Personal Property. This document should clearly outline the rights of both parties and the consequences in case of default. Consulting with legal professionals can help ensure that all necessary steps are covered.

Yes, you can create your own promissory note. However, it is essential to include all necessary elements and adhere to your state’s legal requirements. Using a template from UsLegalForms can simplify this process, ensuring that your Delaware Installments Fixed Rate Promissory Note Secured by Personal Property is both valid and effective.

While hiring a lawyer is not mandatory, consulting one can be beneficial. A legal expert can ensure that your Delaware Installments Fixed Rate Promissory Note Secured by Personal Property includes all necessary elements and complies with local laws. This can help mitigate risks and avoid potential legal disputes in the future.

Legal requirements for a promissory note include clarity of terms, the amount owed, and consideration. These elements ensure that the note is enforceable in court. A Delaware Installments Fixed Rate Promissory Note Secured by Personal Property must also detail the collateral to guarantee the lender's security.

Creating a secured promissory note involves several steps. First, you need to draft the note, clearly outlining the terms, including the collateral involved. You can utilize platforms like UsLegalForms to ensure that your Delaware Installments Fixed Rate Promissory Note Secured by Personal Property meets all legal requirements and protects your interests.

Absolutely, a promissory note can be secured by real property. However, this typically involves a mortgage or deed of trust rather than just a standard promissory note. For a Delaware Installments Fixed Rate Promissory Note Secured by Personal Property, the focus is more on personal property, but real property can also serve as a viable option.

Notarization is not typically required for a secured promissory note, but it can add an extra level of authenticity. Specifically, a Delaware Installments Fixed Rate Promissory Note Secured by Personal Property may be more credible if notarized. This step can help serve as evidence of the agreement in the event of a dispute.