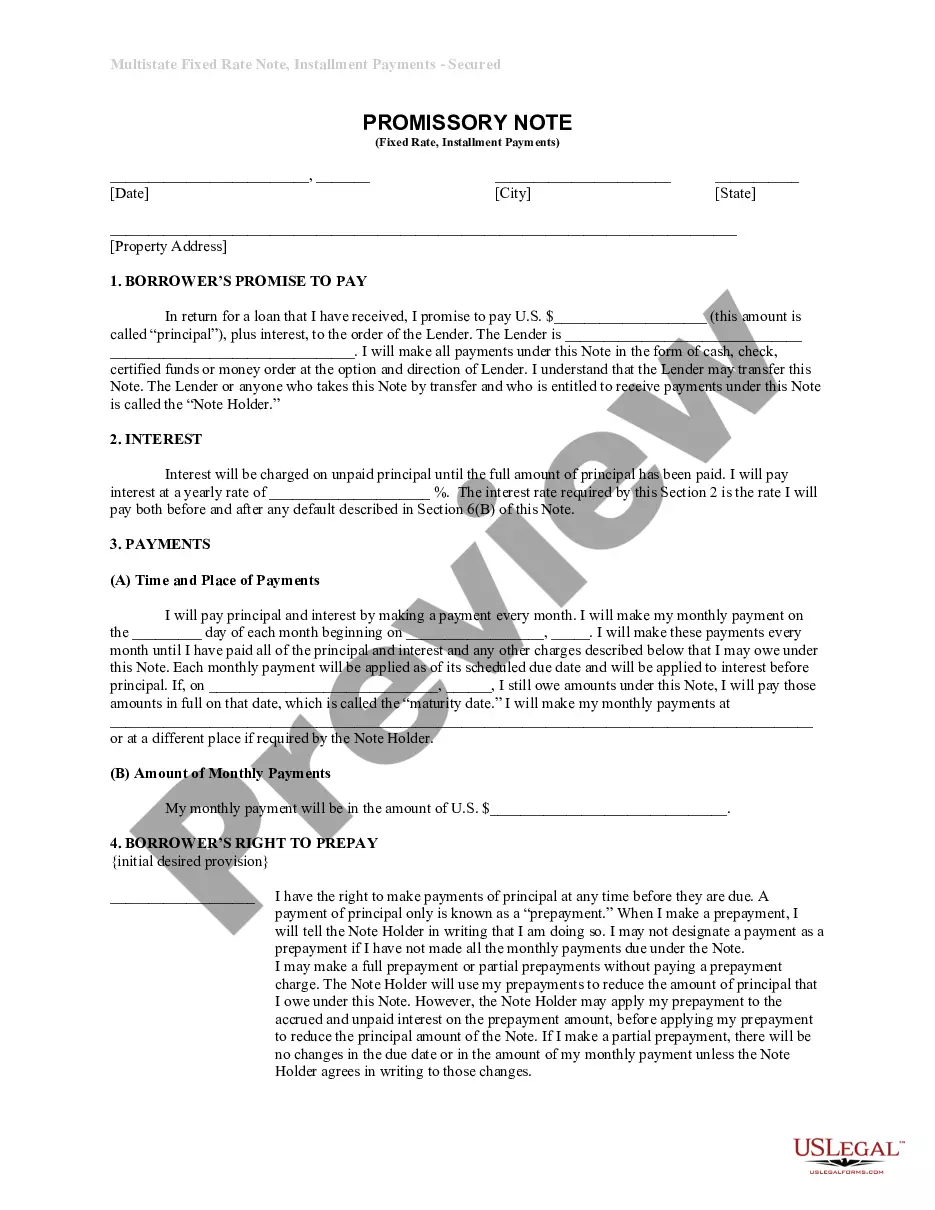

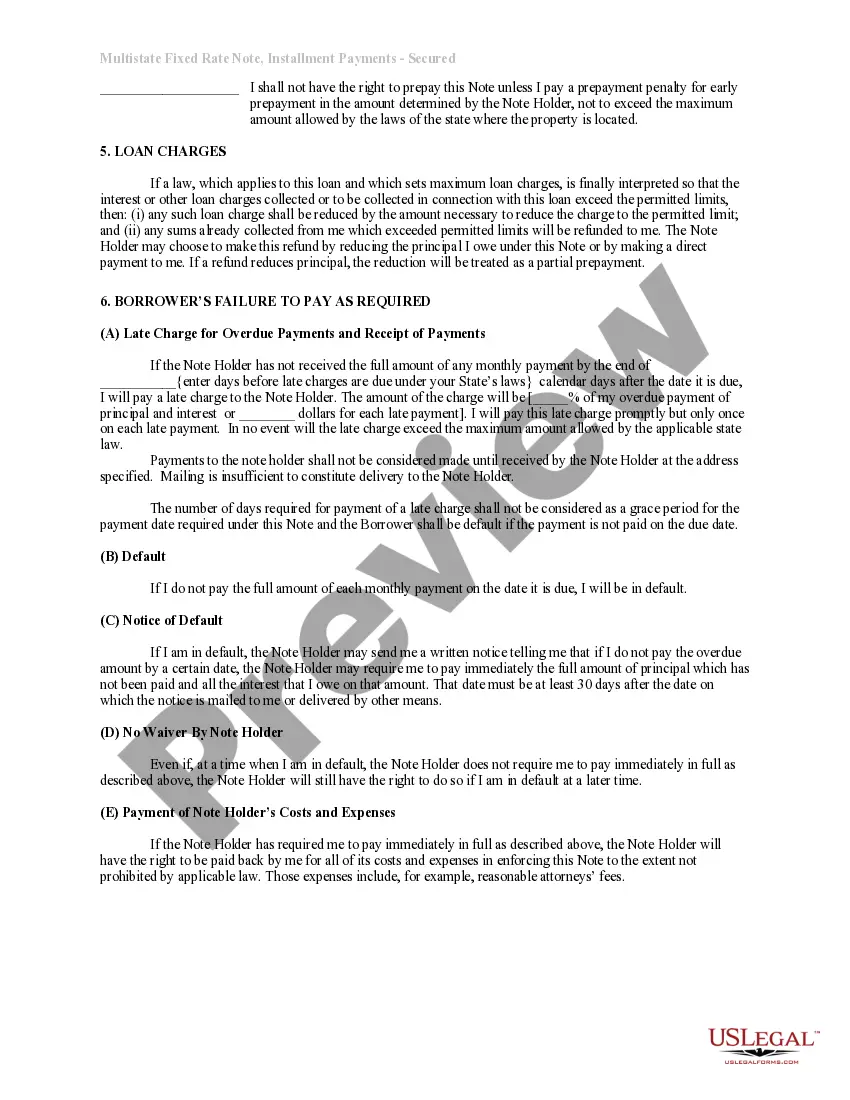

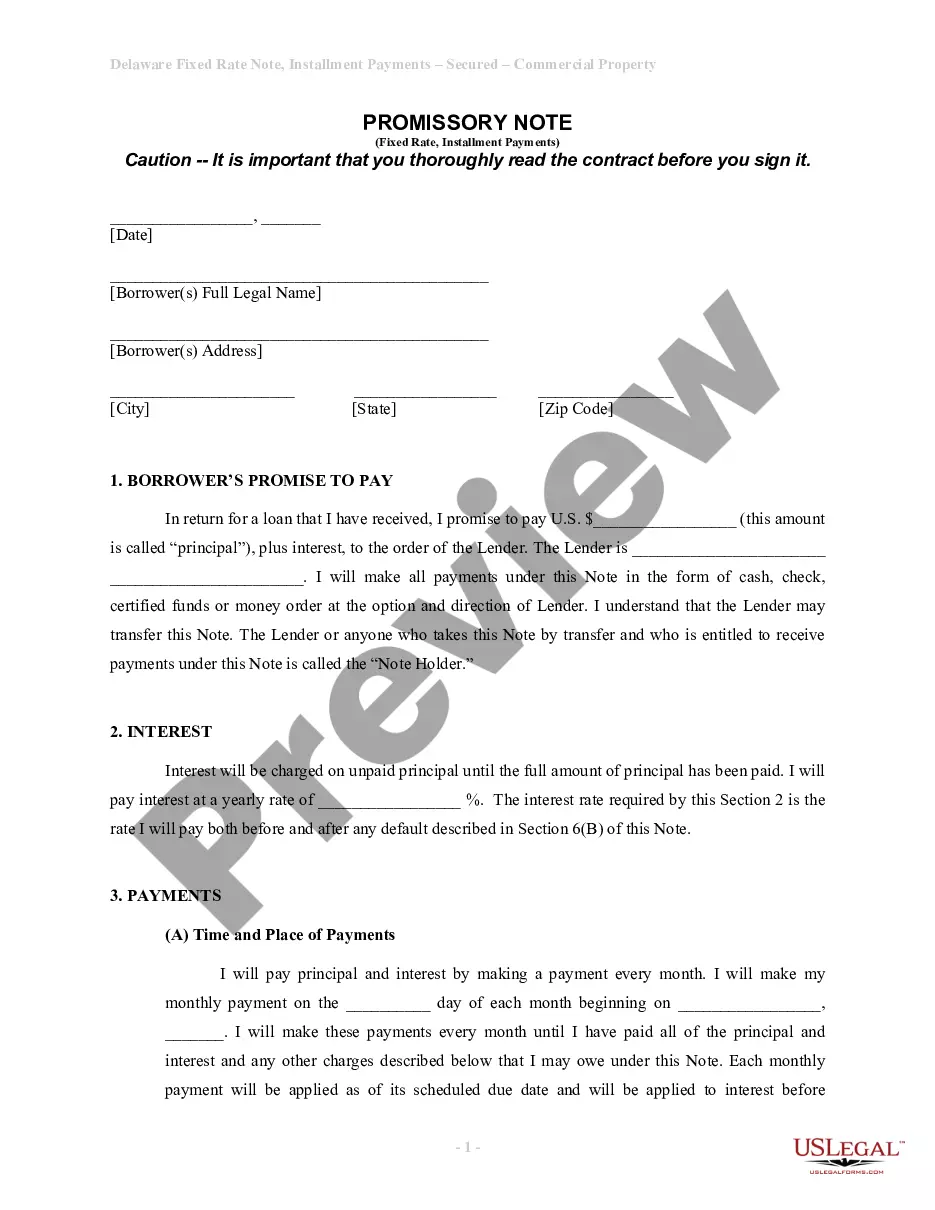

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

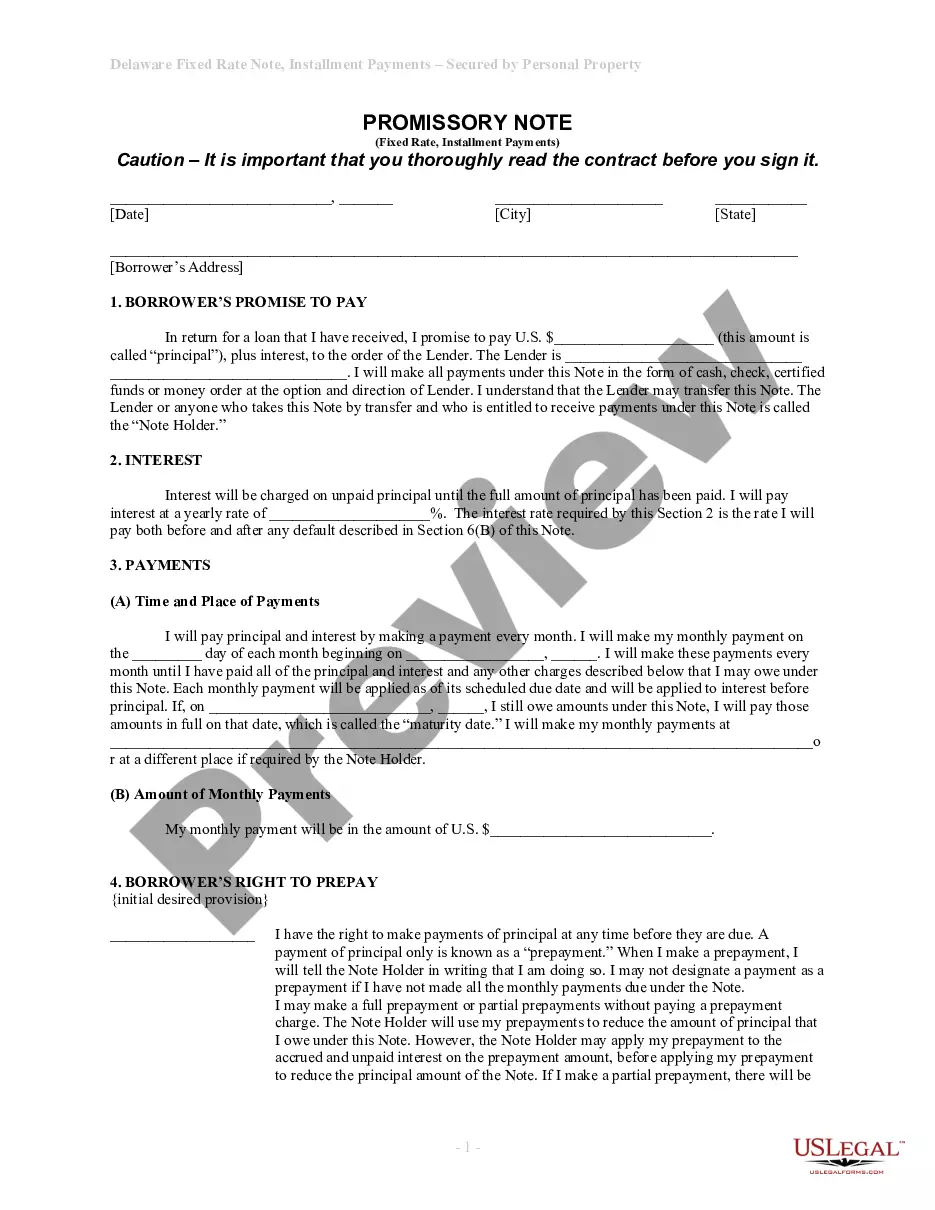

Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

The greater the number of documents you are required to produce - the more anxiety you experience.

You can find a vast array of Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate templates online, however, you may be uncertain which ones are reliable.

Eliminate the stress and simplify the process of finding examples with US Legal Forms.

Input the requested information to create your account and purchase your order using PayPal or a credit card.

- If you possess a US Legal Forms subscription, sign in to your account, and you will see the Download button on the page for the Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

- If you have not previously utilized our platform, complete the registration process by following these steps.

- Ensure the Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate is legitimate in your state.

- Verify your choice by reviewing the description or by utilizing the Preview mode if available for the chosen document.

- Simply click Buy Now to initiate the registration process and select a pricing plan that suits your needs.

Form popularity

FAQ

Yes, promissory notes can be backed by collateral, which adds security for the lender. When a borrower offers collateral, such as real estate, it mitigates the lender's risk. A Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate typically includes property as collateral, making it a reliable option.

No, a promissory note and a lien are not the same. The promissory note is a document stating a borrower's obligation to repay, while a lien is a legal right to take possession of property. In the context of a Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the lien acts as security for the note, ensuring the lender's investment is protected.

A promissory note can hold up in court if it meets specific legal requirements. It must clearly outline the terms of repayment and be signed by both parties. With a Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate, having clear terms strengthens its enforceability in legal situations.

Yes, a promissory note can definitely be secured by real property. This means that if the borrower fails to repay, the lender can claim the property as a form of repayment. Specifically, a Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate ensures that real estate serves as collateral, providing additional security for the lender.

The amount you will take home from $100,000 after taxes in Delaware will depend on your specific tax situation, including income deductions and credits. Typically, state income tax rates range from 2.2% to 6.6%, which affects the final amount you receive. Understanding these implications is vital, especially if you plan to invest in a Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate. For clear calculations and personalized tax advice, resources like uslegalforms can be beneficial.

Delaware state taxes generally follow the federal tax deadlines, with the typical deadline being April 30 for individual filers. However, extensions can be requested, allowing for more time to file without penalties. If you are considering a Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate, staying aware of deadlines is crucial to maintain compliance and avoid unnecessary fees. For assistance, uslegalforms can provide the necessary documentation to manage deadlines effectively.

To fill out a promissory demand note, start by entering the date and the amount borrowed. Next, specify the terms for repayment, which might include conditions for when the lender can demand full repayment. For a Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate, make sure to detail any collateral involved. Utilizing uslegalforms can provide you with clear templates and guidance for correctly completing this type of note.

The format of a promissory note typically includes sections for the date, borrower information, lender information, the principal amount, interest rate, repayment schedule, and signatures. Each section should be clearly labeled for easy understanding. When creating a Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate, following a structured format can help ensure that all critical details are included. You can find professional templates that guide you in this format at uslegalforms.

A simple promissory note includes a statement of the debt, the repayment schedule, and the borrower's signature. For instance, a borrower might agree to repay $10,000 with monthly installments over five years at a fixed interest rate. When dealing with a Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate, capturing these elements helps maintain clarity and enforceability. Using templates from uslegalforms can simplify this process.

Yes, a handwritten promissory note is legal as long as it meets certain requirements. It must clearly state the amount owed, the terms of repayment, and be signed by the borrower. However, for a Delaware Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it is advisable to use a more formal template. This approach ensures that all necessary legal aspects are covered, protecting the interests of both parties.