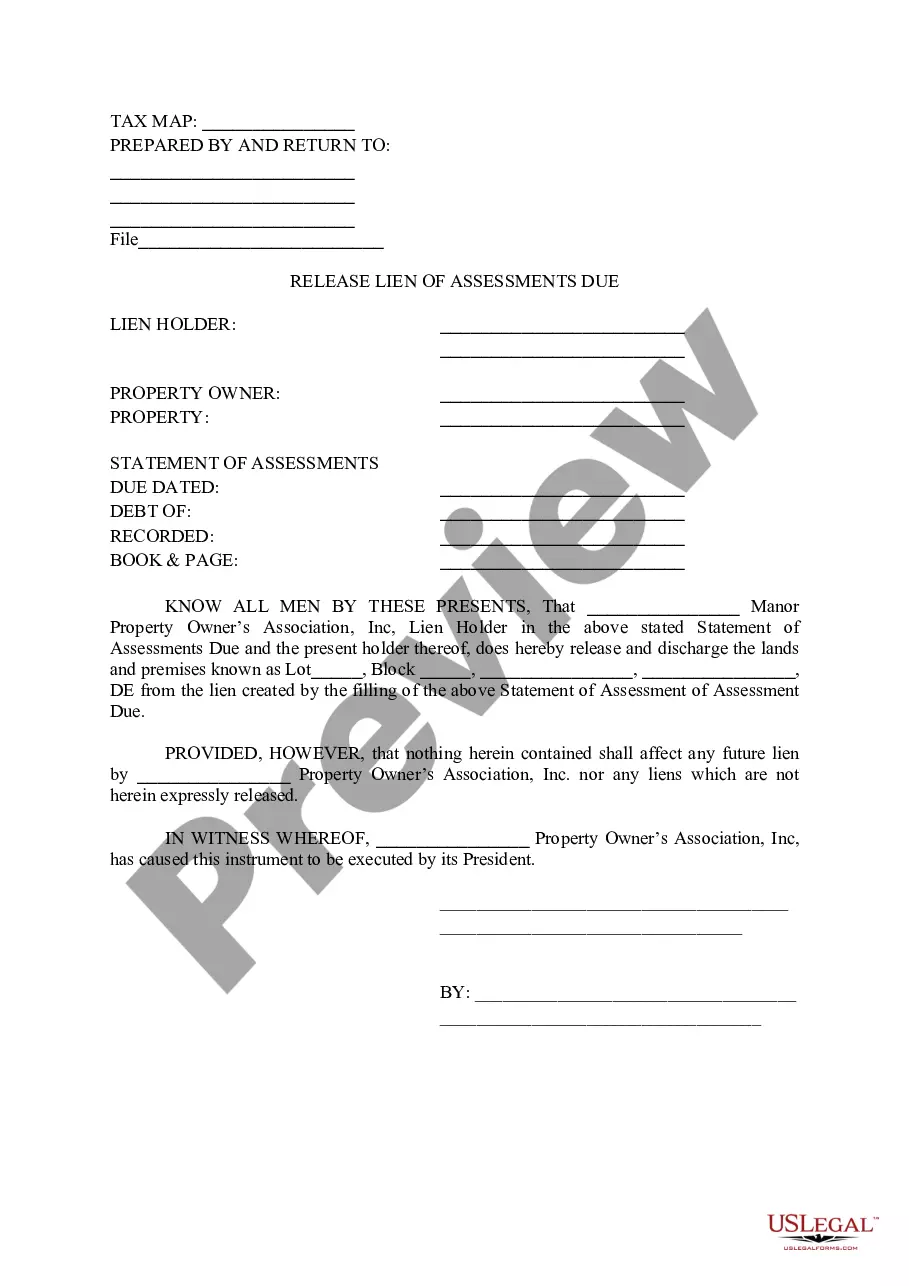

Delaware Release Lien of Assessments Due

Description

How to fill out Delaware Release Lien Of Assessments Due?

Utilize US Legal Forms to acquire a downloadable Delaware Release Lien of Assessments Due.

Our court-recognized forms are created and frequently revised by experienced attorneys.

We possess the largest Forms library available on the internet and provide reasonably priced and precise templates for consumers, lawyers, and small to medium-sized businesses (SMBs).

US Legal Forms supplies thousands of legal and tax templates and packages for both business and personal requirements, including the Delaware Release Lien of Assessments Due. Over three million users have successfully accessed our platform. Select your subscription plan and receive high-quality forms in just a few clicks.

- Ensure you select the correct template according to the state it is required for.

- Examine the document by reviewing the description and utilizing the Preview feature.

- Click Purchase Now if it’s the document you require.

- Create your account and complete payment via PayPal or credit/debit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search engine if you wish to locate another document template.

Form popularity

FAQ

Yes, you can file a lien on your own in Delaware, but it is advisable to seek guidance to avoid common pitfalls. You will need to complete the necessary forms and submit them to the appropriate government office. Using uslegalforms can simplify this process, providing you with the right templates and instructions to effectively manage your Delaware Release Lien of Assessments Due.

To put a lien on a property in Delaware, first, you must have a valid reason, such as unpaid assessments. After this, fill out the required paperwork and file it with the county government where the property is located. This process will help establish your legal claim through a Delaware Release Lien of Assessments Due, ensuring your rights are protected.

To file a lien on property in Delaware, you should start by gathering relevant documentation about the debt owed. Next, complete the necessary lien forms and submit them to the appropriate county recorder's office. Once filed, ensure you properly notify the property owner, as this is essential for enforcing your Delaware Release Lien of Assessments Due.

To conduct a lien search in Delaware, you can start by visiting the Delaware Division of Corporations website. There, you will find resources to check for any liens or assessments due against a property. Additionally, you can explore local county offices or utilize platforms like US Legal Forms for comprehensive tools related to the Delaware Release Lien of Assessments Due. This process ensures you have all the information needed to make informed decisions regarding any potential liens.

If you are wondering about your refund status in Delaware, you can easily track it online. The Delaware Division of Revenue provides a user-friendly platform where you can check the status of your refund. Just enter your details, and you will receive updates. For further assistance, consider utilizing services like U.S. Legal Forms, which guide you through obtaining a Delaware Release Lien of Assessments Due and help you navigate tax matters.

Chapter 81 of Title 25 of Delaware details the laws surrounding property assessments and liens. This chapter defines how property assessments are conducted and how property owners can address and release any liens related to assessments due. Utilizing the Delaware Release Lien of Assessments Due can guide you through the required procedures to resolve these assessments. Familiarizing yourself with this chapter can empower you as a property owner.

A lien release is a document that is filed in the public land records as the official notice that the lien is removed. Once payment has been received, a contractor has a duty to remove any lien that was filed against the property.

The main purpose of a lien waiver is to provide protection to the paying party. In exchange for such payment, the lien waiver waives the payee's right to file a lien for the exact value of the payment they have received.

In California, only the lien holder the mortgage lender can remove the lien. California law is fairly strict, however, as it give the lender just 30 days to issue and record the appropriate release.

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.