Delaware Certificate of Correction of Partnership

Description

How to fill out Delaware Certificate Of Correction Of Partnership?

Filling out official documents can be quite an anxiety unless you have ready-made fillable templates. With the US Legal Forms online repository of formal papers, you can trust the blanks you acquire, as all of them adhere to federal and state regulations and are examined by our specialists.

So if you need to complete the Delaware Certificate of Correction of Partnership, our service is the ideal location to download it.

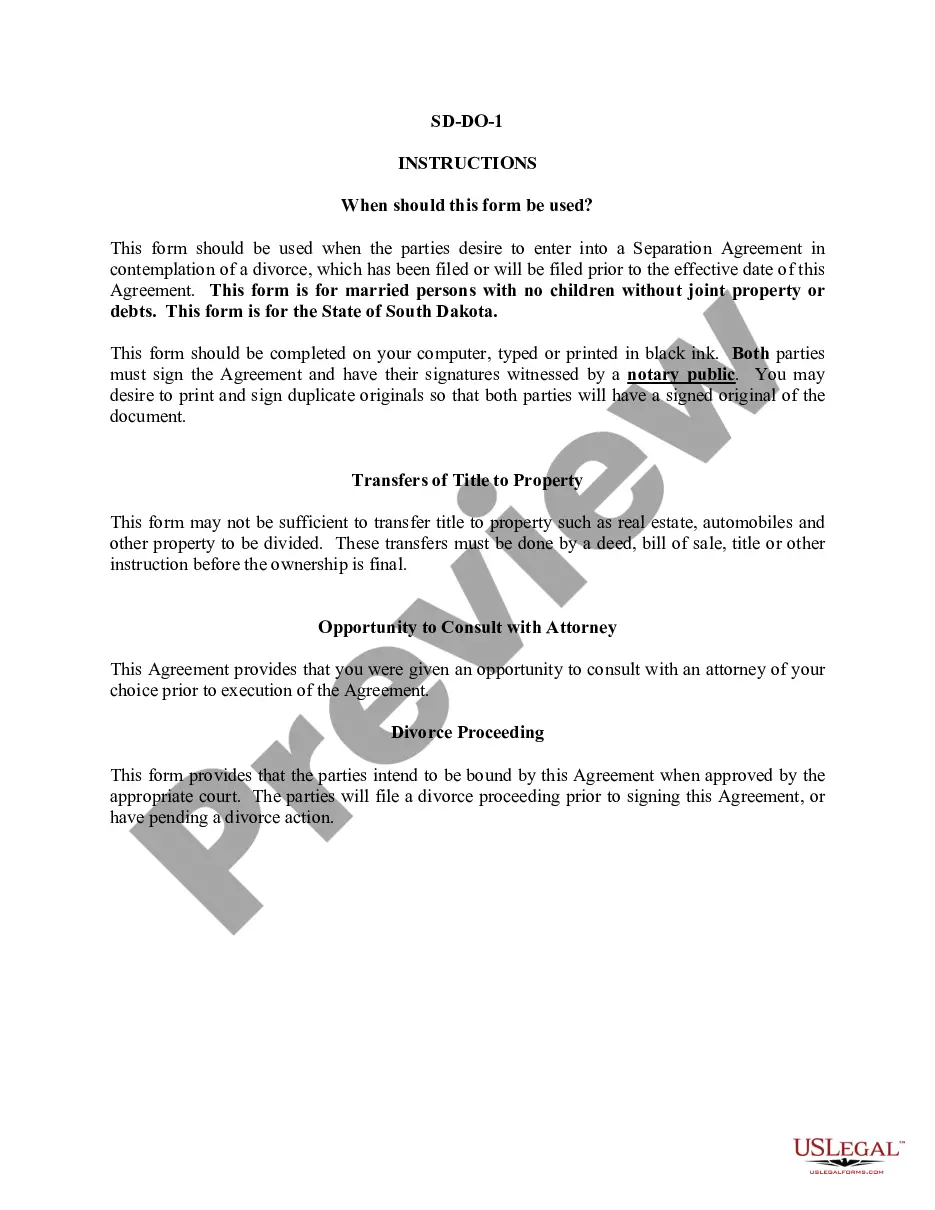

Here’s a brief guide for you: Document compliance verification. You must thoroughly examine the content of the form you desire and verify whether it meets your requirements and adheres to your state legal obligations. Previewing your document and reviewing its general description will assist you in doing so.

- Retrieving your Delaware Certificate of Correction of Partnership from our repository is as easy as 1-2-3.

- Previously registered users with an active subscription need merely Log In and click the Download button after they find the correct template.

- Subsequently, if necessary, users can select the same blank from the My documents tab of their account.

- Nonetheless, even if you are not acquainted with our service, signing up with a valid subscription will require only a few minutes.

Form popularity

FAQ

The file number on a Delaware certificate of formation is a unique identifier assigned by the state to your business entity. This number is crucial for record-keeping and filing purposes, as it helps you track your Delaware Certificate of Correction of Partnership and any other legal documents. Always keep this number accessible, especially when modifying your business information.

The certificate of amendment in Delaware usually costs around $200, although some specific amendments may incur different fees. When you need to amend your business documents, using a service like uslegalforms can provide you with accurate information and assist with the necessary steps, ensuring compliance with regulations related to the Delaware Certificate of Correction of Partnership.

Processing a Delaware entity formation generally takes one to two weeks, depending on the workload at the state office. If there are any issues with the submitted documents, this may extend the timeframe. To avoid potential delays, you can rely on uslegalforms for expert assistance in ensuring your application is correctly submitted.

The timeframe for obtaining a Certificate of Formation can vary. Typically, in Delaware, you can expect processing to take approximately one to two weeks. However, if you're seeking a fast-track option, expedited services are often available. By utilizing the services of uslegalforms, you can streamline this process for a timely response.

A certificate of conversion in Delaware allows a business entity to change its form, such as transitioning from a partnership to a limited liability company. This process is crucial when a partnership seeks to modify its legal structure for liability protection or tax advantages. By filing a Delaware Certificate of Correction of Partnership, you ensure that all aspects of the conversion comply with state laws. Using US Legal Forms makes the filing process straightforward and efficient.

The certificate of limited partnership is an official document that registers a limited partnership with the state of Delaware. It includes specific information, such as the partnership's name, the details of the general partners, and the duration of the partnership. This certificate is essential for establishing the partnership's legal status and protecting the liability of limited partners. If you need to make corrections to this document, a Delaware Certificate of Correction of Partnership provides an efficient way to amend any inaccuracies.

A certificate of good standing in Delaware validates that your business entity is compliant with state regulations and has met all tax obligations. Obtaining this certificate is often necessary for various business activities, such as securing loans or conducting business transactions. It reflects your entity's current status and ensures all formalities are fulfilled. If your partnership document has errors, a Delaware Certificate of Correction of Partnership can help maintain your good standing.

A certificate of limited partnership in Delaware is a legal document filed to officially form a limited partnership. This certificate outlines vital information such as the partnership's name, duration, and the details of general and limited partners involved. Filing this certificate is crucial because it establishes the partnership's legal existence and protects the limited partners’ liability. When making changes to an existing limited partnership, utilizing a Delaware Certificate of Correction of Partnership can help rectify any discrepancies in the original filing.

To change the ownership of a Delaware corporation, you typically need to update the stock transfer ledger, reflecting new ownership details. If ownership changes affect the governance structure or the corporation's articles of incorporation, you may also need to file additional documents with the Delaware Secretary of State. It’s crucial to ensure that all changes are properly documented to avoid legal complications. In some cases, a Delaware Certificate of Correction of Partnership might also be relevant if a partnership is involved.

The primary difference between an LLC and a limited partnership lies in the management structure and liability. An LLC offers liability protection to all members, allowing them to participate in management without personal risk, while in a limited partnership, only the general partner has full managerial authority and bears unlimited liability. Each structure has unique benefits that cater to different business needs. For those considering a Delaware Certificate of Correction of Partnership, understanding these differences is essential.