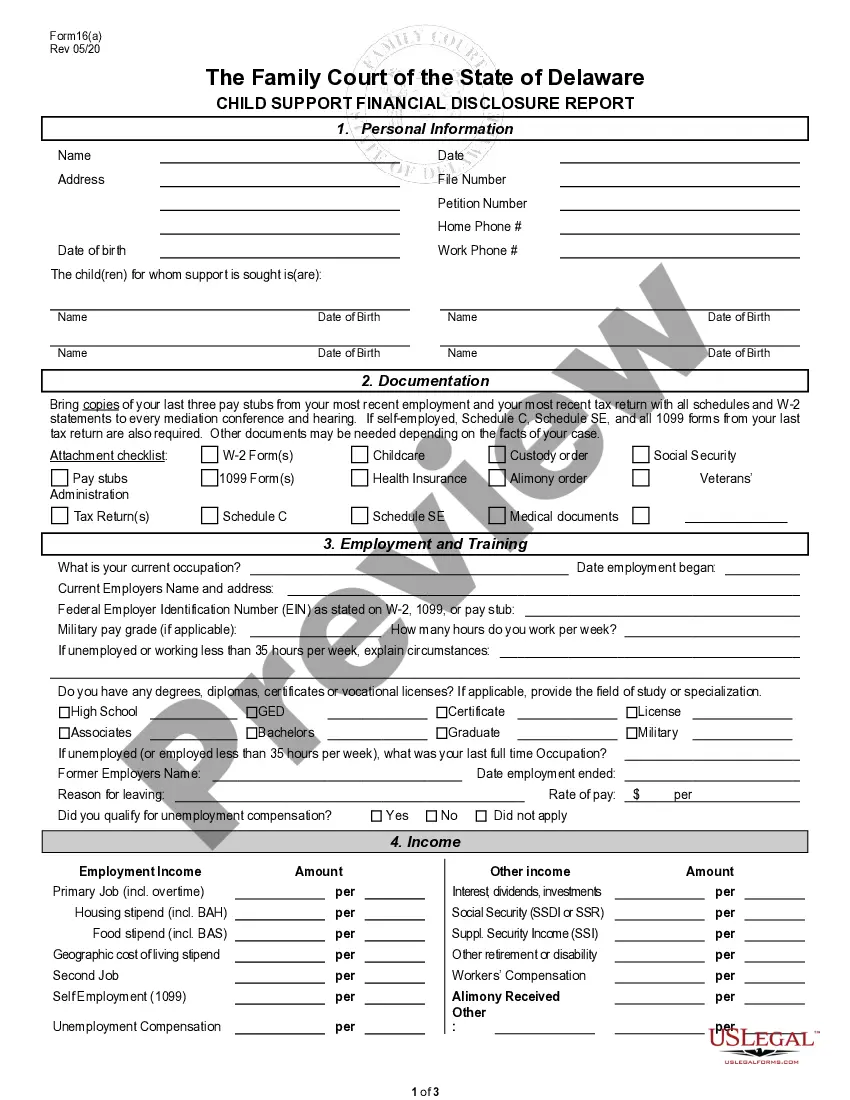

The Delaware Financial Report for Spousal Support (FRS) is a financial document that is required for court-ordered spousal support. This form is typically used by individuals who are seeking or receiving spousal support in the state of Delaware. It provides a comprehensive look at the financial situation of both spouses and helps the court determine the appropriate amount of spousal support. The FRS includes information on income, expenses, assets, liabilities, and other financial factors. It also includes information about any tax returns, child support payments, and other relevant financial documents. The two types of Delaware Financial Reports for Spousal Support are the Pre-Trial Financial Report and the Final Financial Report. The Pre-Trial Financial Report is typically used during the initial stages of the court proceedings and is used to provide an overview of the current financial situation of both spouses. The Final Financial Report is typically used after the court has ruled on spousal support and is used to provide a comprehensive view of the financial situation of both spouses.

Delaware Financial Report for Spousal Support

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

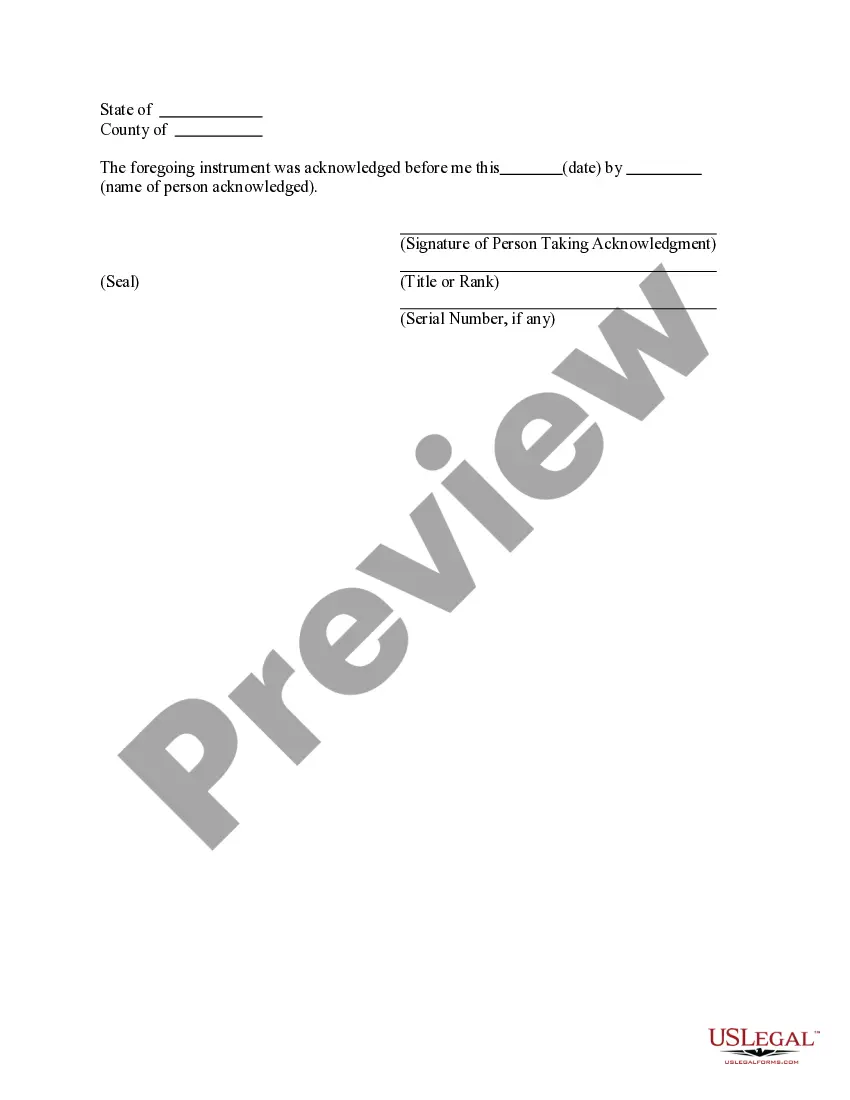

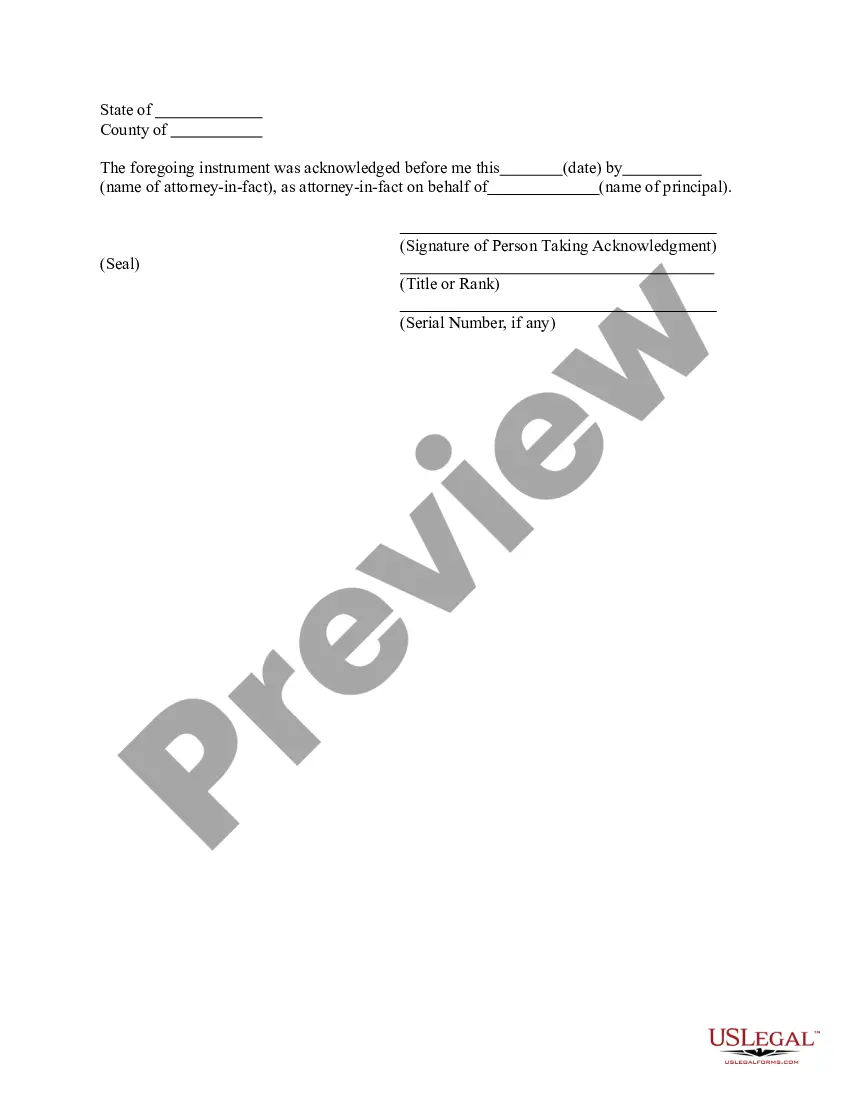

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

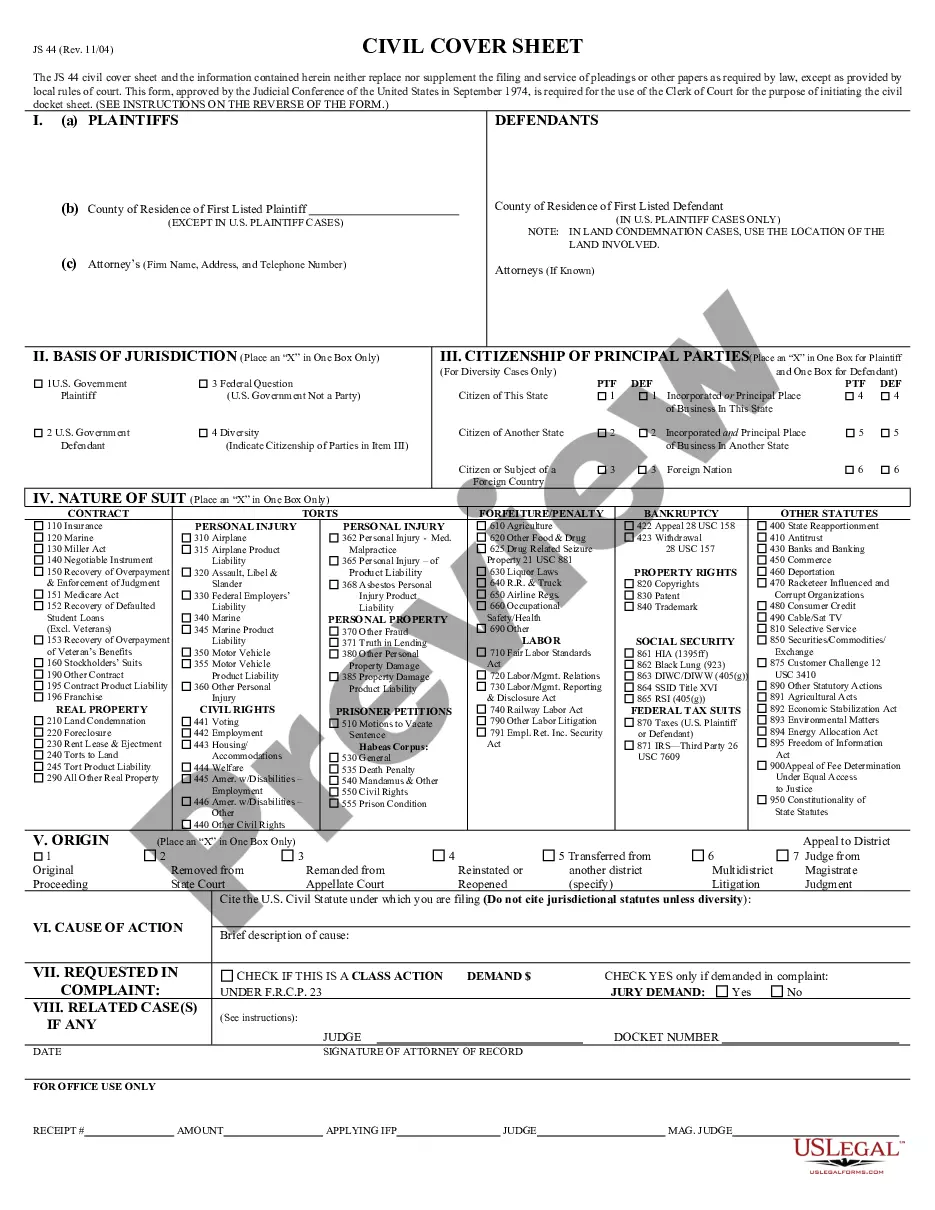

Looking for another form?

How to fill out Delaware Financial Report For Spousal Support?

Managing legal documents necessitates focus, precision, and utilizing well-crafted templates. US Legal Forms has been assisting individuals nationwide in this area for 25 years, so when you select your Delaware Financial Report for Spousal Support template from our platform, you can trust it meets federal and state standards.

Using our service is straightforward and quick. To obtain the necessary documents, all you need is an account with an active subscription. Here’s a concise guide for you to locate your Delaware Financial Report for Spousal Support in just a few minutes.

All documents are designed for multiple uses, including the Delaware Financial Report for Spousal Support featured on this page. Should you require them in the future, you can fill them out without additional payment - simply access the My documents section within your profile and finalize your document whenever you need it. Try US Legal Forms to efficiently tackle your business and personal documentation while ensuring total legal compliance!

- Ensure to meticulously review the form contents and its alignment with general and legal requirements by either previewing it or perusing its description.

- Seek an alternative official template if the one you've opened does not fit your circumstances or state laws (the link for this is at the top page corner).

- Log in to your account and retrieve the Delaware Financial Report for Spousal Support in your preferred format. If it’s your initial time utilizing our service, click Buy now to proceed.

- Create an account, select your subscription option, and settle the payment using your credit card or PayPal account.

- Select the format in which you wish to receive your document and click Download. Print the blank version or upload it to a specialized PDF editor for a paperless submission.

Form popularity

FAQ

Avoiding alimony in Delaware typically involves demonstrating financial independence or negotiating a settlement. Factors such as the length of the marriage and each spouse's income can influence these decisions. Seeking guidance from uslegalforms can provide you with a tailored Delaware Financial Report for Spousal Support, helping you explore legal options while making informed choices.

Yes, alimony is considered taxable income, which can impact your eligibility for the earned income credit. Since this includes payments you receive, it’s essential to factor this into your financial reports. A Delaware Financial Report for Spousal Support can help clarify your total income, aiding you in claiming any credits you're eligible for.

Yes, the IRS verifies alimony payments to ensure accurate reporting. They may match the information you provide with your former spouse's tax filings. This makes it crucial to maintain records, and utilizing a Delaware Financial Report for Spousal Support can help you document these payments correctly.

Yes, you must report alimony as income on your federal tax return. The IRS requires that you include all alimony payments received in your taxable income. The Delaware Financial Report for Spousal Support can assist you in understanding how these payments affect your overall taxes, ensuring you're compliant and informed.

After divorce papers are filed in Delaware, the process typically involves serving the other spouse with the paperwork. Following this, both parties may engage in negotiations regarding spousal support, asset division, and any child-related issues. It’s essential during this time to prepare a thorough Delaware Financial Report for Spousal Support to support your claims and facilitate smoother discussions. Clarity on financial matters significantly aids in the progression of the divorce.

While there is no fixed amount a wife is entitled to in a divorce in Delaware, courts typically strive for an equitable division of assets and responsibilities. This division may include alimony, marital property, and other financial aspects. To accurately assess potential entitlements, utilizing a Delaware Financial Report for Spousal Support can be tremendously helpful. It offers a detailed overview of financial assets that can inform the final settlement.

The 1 3 rule suggests that the duration of alimony may be set at one-third the length of the marriage. This guideline helps determine how long spousal support may be provided to the lower-earning spouse. Understanding the 1 3 rule is vital when preparing a Delaware Financial Report for Spousal Support, as it aids in setting realistic expectations. You can leverage this knowledge in your negotiations.

Alimony in Delaware can be temporary or permanent, depending on the circumstances of the marriage and the financial needs of the receiving spouse. The court considers factors such as the length of the marriage and the ability of the receiving spouse to support themselves. If you need clarity on your alimony situation, a comprehensive Delaware Financial Report for Spousal Support can provide valuable insights. It is essential to understand your rights in this process.

In Delaware, a wife may be entitled to various forms of financial support, including alimony and a share of marital property. The specifics depend on factors such as the length of the marriage and each spouse’s financial situation. A Delaware Financial Report for Spousal Support can deeply influence the distribution during divorce proceedings. Therefore, it is crucial for the wife to gather all relevant financial data.

In Delaware, a spouse may qualify for alimony based on several factors, such as financial dependency, length of the marriage, and the recipient's ability to become self-sufficient. The Delaware Financial Report for Spousal Support is an important tool in this evaluation, as it outlines financial needs and obligations. Courts aim to ensure that the support is fair and reasonable according to the situation of both spouses.