District of Columbia Letter to Client - Status Report

Description

How to fill out Letter To Client - Status Report?

US Legal Forms - one of several largest libraries of authorized forms in the States - delivers a variety of authorized file web templates you may obtain or print out. Making use of the website, you will get 1000s of forms for business and individual uses, sorted by classes, states, or keywords and phrases.You can find the latest versions of forms much like the District of Columbia Letter to Client - Status Report in seconds.

If you already have a subscription, log in and obtain District of Columbia Letter to Client - Status Report through the US Legal Forms catalogue. The Obtain option will show up on each and every develop you perspective. You gain access to all earlier delivered electronically forms inside the My Forms tab of the bank account.

If you want to use US Legal Forms the very first time, listed below are straightforward recommendations to obtain started:

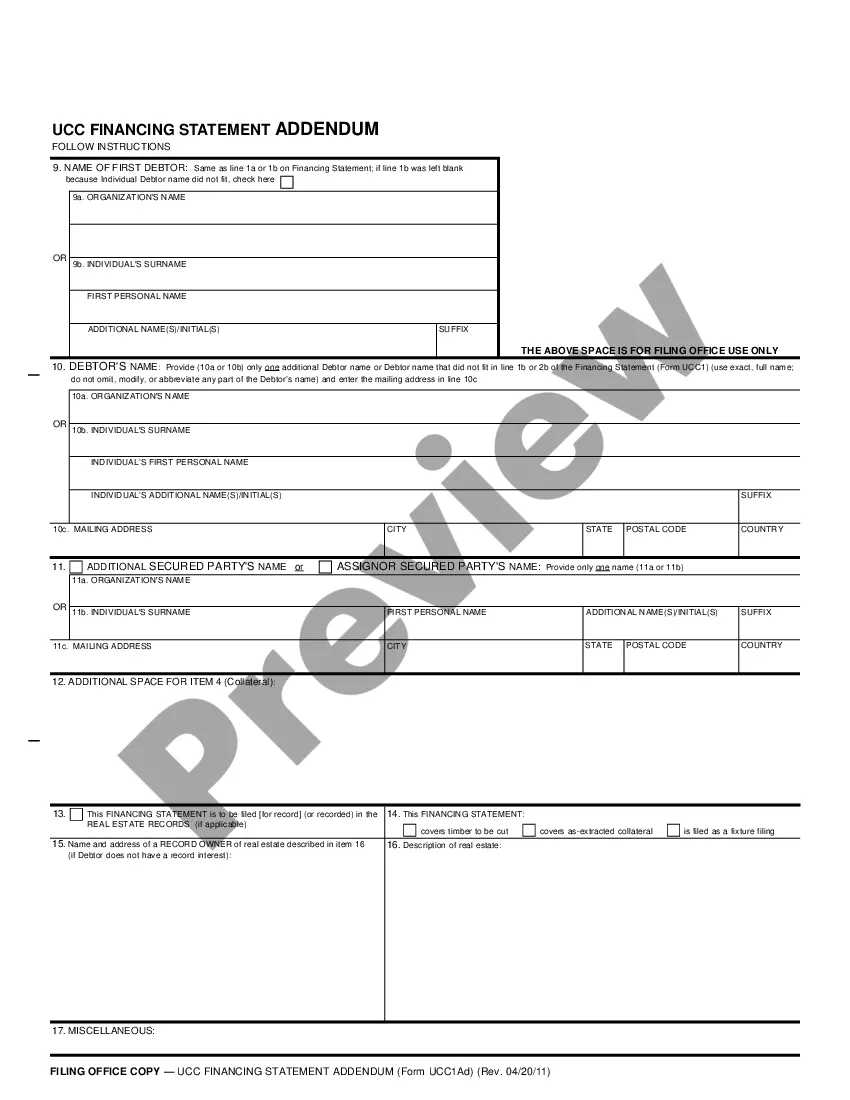

- Make sure you have chosen the best develop for your town/county. Click the Preview option to check the form`s articles. Read the develop information to ensure that you have selected the right develop.

- In the event the develop does not fit your needs, make use of the Lookup discipline near the top of the monitor to get the the one that does.

- Should you be content with the form, verify your choice by clicking on the Acquire now option. Then, opt for the pricing program you want and offer your qualifications to sign up to have an bank account.

- Process the transaction. Utilize your Visa or Mastercard or PayPal bank account to complete the transaction.

- Pick the format and obtain the form on the device.

- Make alterations. Fill out, modify and print out and indication the delivered electronically District of Columbia Letter to Client - Status Report.

Every web template you included in your money does not have an expiry date and is your own for a long time. So, if you want to obtain or print out an additional copy, just proceed to the My Forms portion and click about the develop you will need.

Obtain access to the District of Columbia Letter to Client - Status Report with US Legal Forms, the most comprehensive catalogue of authorized file web templates. Use 1000s of specialist and condition-specific web templates that meet your small business or individual requires and needs.

Form popularity

FAQ

Lien. A tax lien may be filed with the District of Columbia Recorder of Deeds if a taxpayer neglects or refuses to pay the District within 10 days after receiving a Notice of Tax Due and a demand for payment. The tax lien puts the public on notice that the District has a preferred claim over other creditors.

Hear this out loud PauseIn addition, if an individual is domiciled in another jurisdiction, they must file a DC individual income tax return if that individual maintained a place of abode for a total of 183 days or more during the year at issue.

Make your check or money order payable to the DC Treasurer and write your Social Security number, daytime phone number and the tax year on your payment. Individual Income Tax: Mail payment with payment voucher to the Office of Tax and Revenue, PO Box 96169, Washington, DC 20090-6169.

Hear this out loud PauseMyTax.DC.gov Visit the District's new online tax portal to view and pay your taxes.

For assistance with MyTax.DC.gov or account-related questions, please contact our e-Services Unit at (202) 759-1946 or email e-services.otr@dc.gov, am to pm, Monday through Friday.

The Role of Statute of Limitations on IRS Collections Meaning, the IRS can collect unpaid taxes for a total of ten years from the assessment date. After ten years have passed, the IRS must stop its collection efforts, barring any important exceptions.