District of Columbia Sample Performance Review for Nonexempt Employees

Description

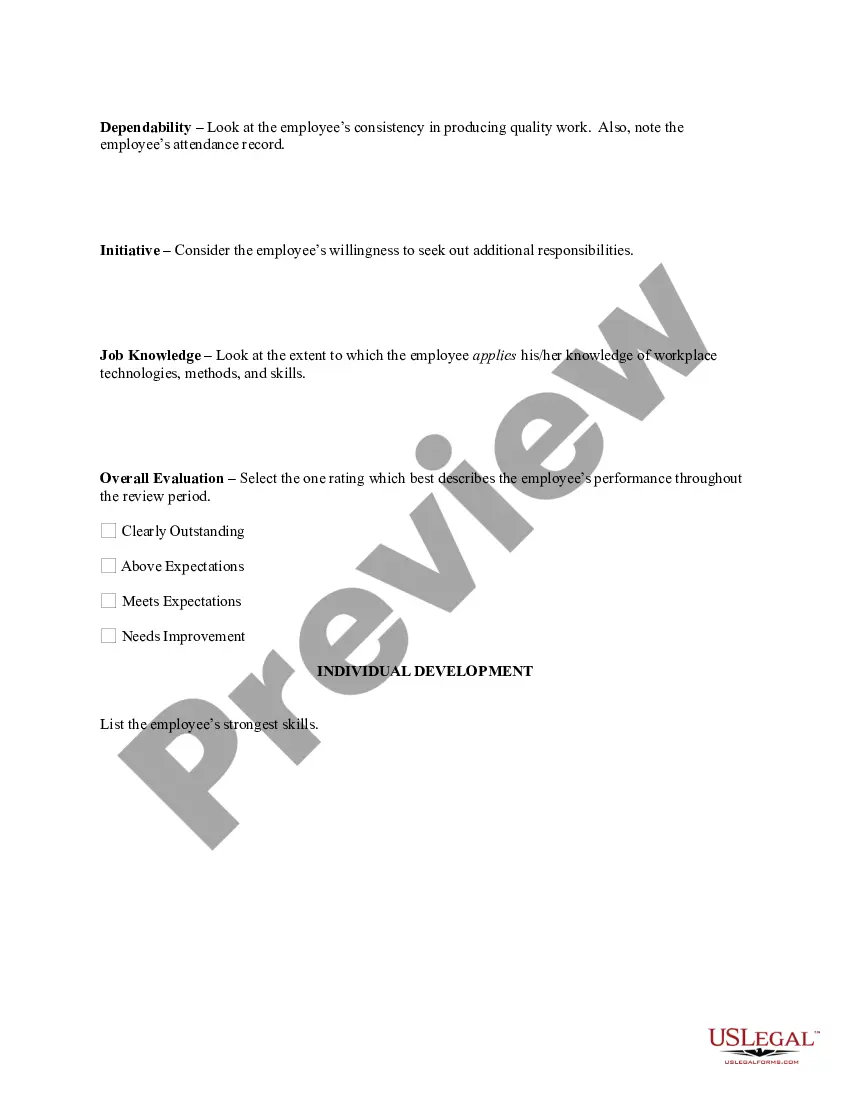

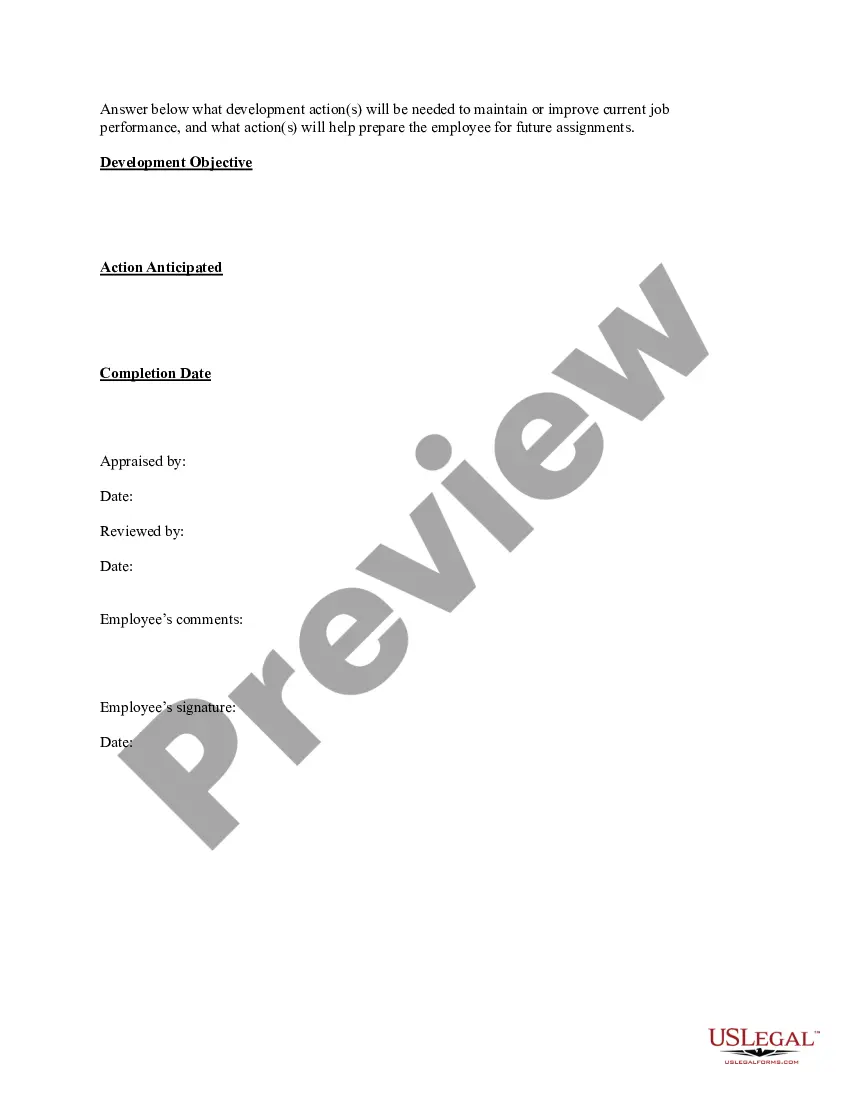

How to fill out Sample Performance Review For Nonexempt Employees?

Have you ever been in a situation where you require documents for either business or specific needs almost every workday.

There are numerous authorized document templates accessible online, but locating ones you can rely on is not straightforward.

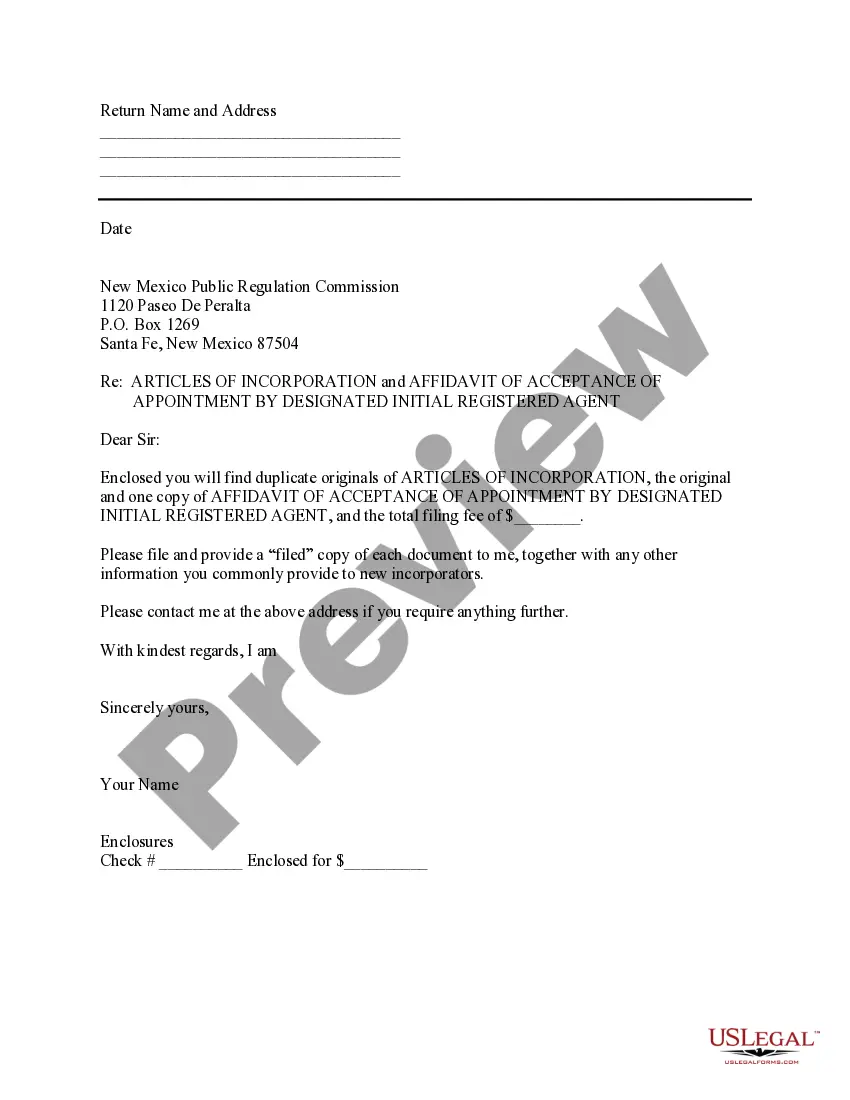

US Legal Forms provides thousands of form templates, including the District of Columbia Sample Performance Review for Nonexempt Employees, which are designed to comply with state and federal requirements.

If you find the correct form, click Acquire now.

Select the pricing plan you prefer, fill in the required information to set up your account, and proceed to purchase your order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the District of Columbia Sample Performance Review for Nonexempt Employees template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Locate the form you need and verify it is for the correct state/region.

- Use the Preview button to review the form.

- Check the details to ensure you have selected the right form.

- If the form is not what you are looking for, utilize the Search box to find the form that fits your needs and criteria.

Form popularity

FAQ

It is not illegal for an employer to refrain from providing a performance review. However, lacking regular feedback can impact employee morale and productivity. Utilizing resources like a District of Columbia Sample Performance Review for Nonexempt Employees can encourage employers to adopt a more consistent reviewing process.

It's perfectly acceptable to ask your employer if you will have a performance review. Open communication shows your commitment to your role and personal development. By initiating this conversation, you're demonstrating your interest in how to improve and succeed. A District of Columbia Sample Performance Review for Nonexempt Employees can guide you in these discussions.

Notice is not required by either party based on the fact that DC is an "employment at will" state, meaning that an employer or employee may terminate the relationship at any time, without a reason, without cause. 3.

District of Columbia's Overtime Minimum Wage Overtime is paid at the rate of 1-1/2 times the hourly wage rate after forty (40) hours of actual work in a seven-day workweek, with the exception of certain salaried employees who meet the definition of an executive, administrative, or professional.

Beginning July 1, 2022, the minimum wage in the District of Columbia will increase from $15.20 per hour to $16.10 per hour for all workers, regardless of the size of the employer.

Some types of jobs, including outside sales staff and airline employees, are considered exempt by the FLSA, but for most professions, there are three tests that determine whether an individual is exempt, which include: The employee is paid a minimum of $455 per week ($23,600 per year)

Effect of the New Regulations on Your Nonprofit Beginning January 1, 2020, the threshold for the salary level test will increase to $684 per week, or $35,568 per year.

That means that 80% of the total work hours must be given to full-time employees. Those employees must be given a minimum of 30 hours a week of work. Part-time employees must be given at least 20 hours a week of work that is scheduled for a minimum shift of 4 hours per night.

To be considered "exempt," these employees must generally satisfy three tests: Salary-level test. Effective January 1, 2020, employers must pay employees a salary of at least $684 per week. The FLSA's minimum salary requirement is set to remain the same in 2022.

Short answer: Full-time employment is usually considered between 30-40 hours a week, while part-time employment is usually less than 30 hours a week.