Massachusetts Renunciation of Legacy to give Effect to Intent of Testator

Description

How to fill out Renunciation Of Legacy To Give Effect To Intent Of Testator?

Discovering the right lawful record web template can be quite a have a problem. Needless to say, there are tons of layouts available on the net, but how would you obtain the lawful kind you will need? Take advantage of the US Legal Forms website. The support provides a large number of layouts, like the Massachusetts Renunciation of Legacy to give Effect to Intent of Testator, which you can use for enterprise and personal needs. Each of the forms are checked by professionals and meet up with federal and state demands.

If you are currently authorized, log in to the account and click on the Acquire option to get the Massachusetts Renunciation of Legacy to give Effect to Intent of Testator. Make use of your account to search with the lawful forms you might have acquired previously. Go to the My Forms tab of your account and acquire an additional copy in the record you will need.

If you are a new end user of US Legal Forms, allow me to share simple directions that you can comply with:

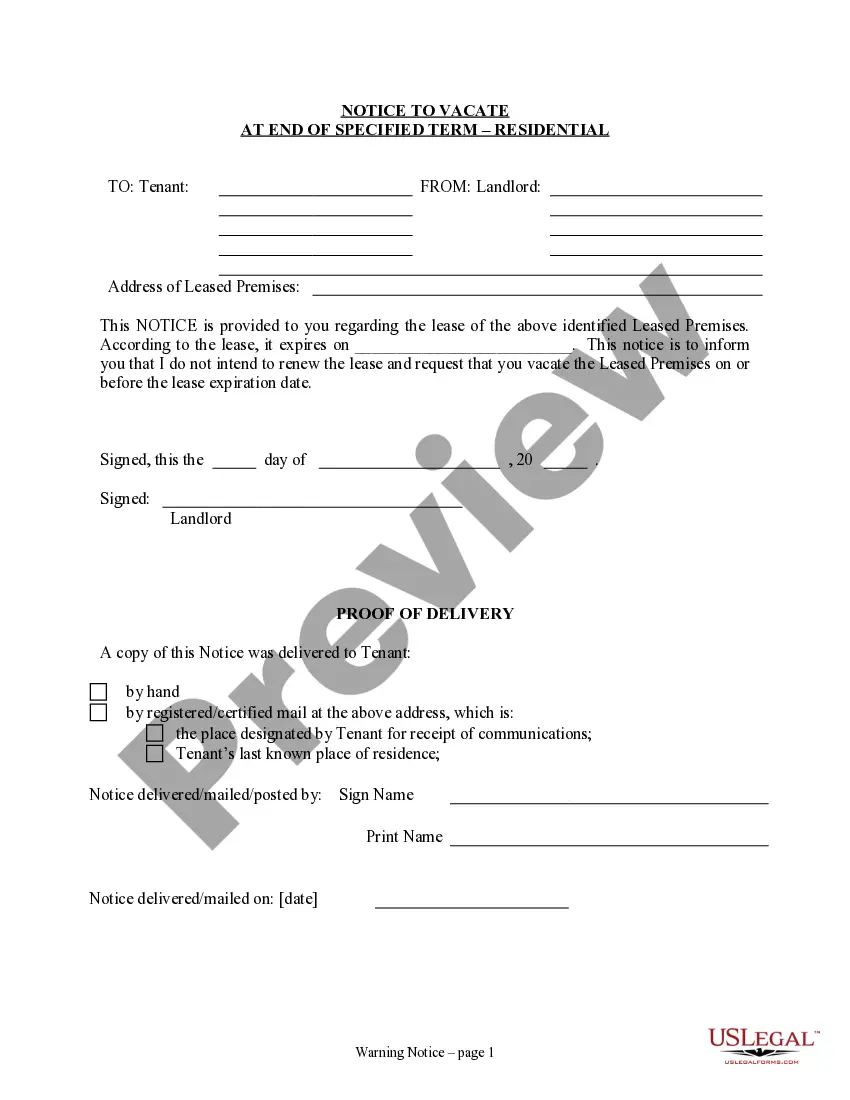

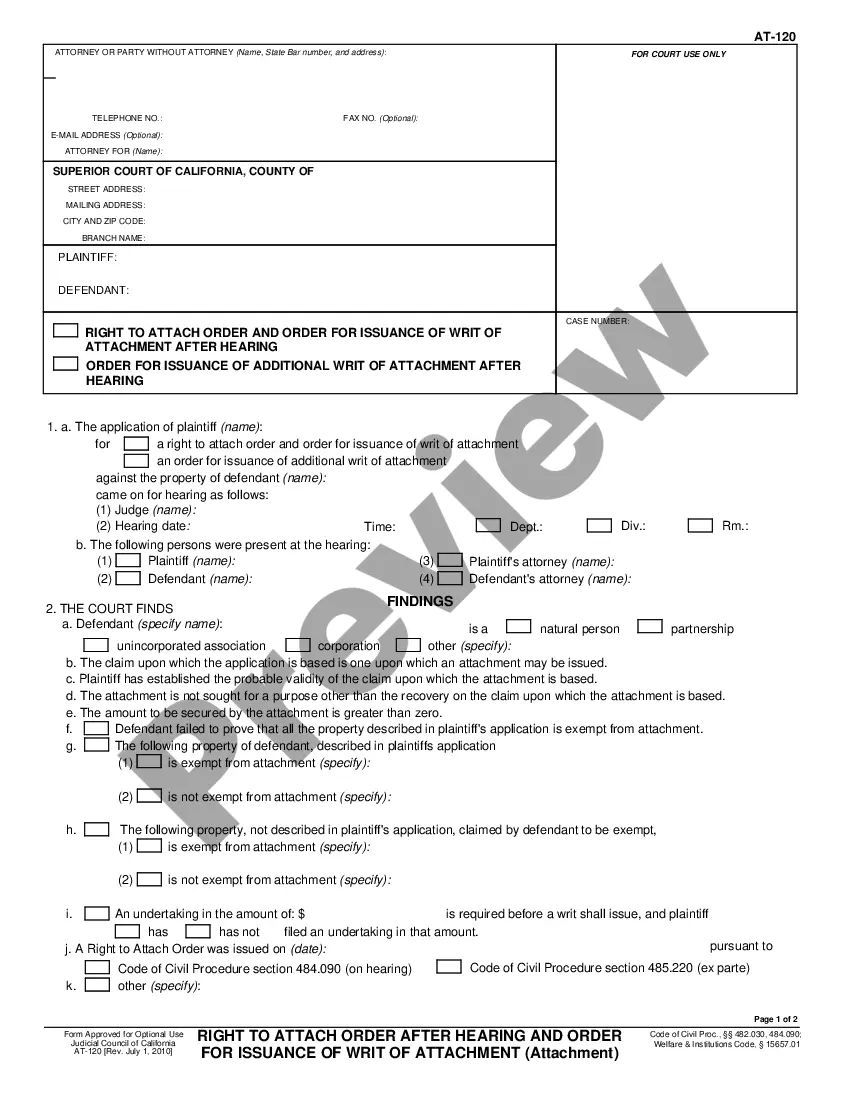

- Initial, make sure you have selected the appropriate kind to your town/region. You may look over the shape while using Review option and browse the shape description to guarantee this is the right one for you.

- In the event the kind will not meet up with your preferences, make use of the Seach industry to discover the appropriate kind.

- Once you are certain the shape would work, click on the Purchase now option to get the kind.

- Choose the pricing prepare you need and type in the required information. Design your account and pay money for the order making use of your PayPal account or Visa or Mastercard.

- Pick the document structure and down load the lawful record web template to the system.

- Complete, revise and produce and indicator the obtained Massachusetts Renunciation of Legacy to give Effect to Intent of Testator.

US Legal Forms is definitely the most significant local library of lawful forms in which you can see numerous record layouts. Take advantage of the company to down load appropriately-made papers that comply with status demands.

Form popularity

FAQ

If a beneficiary properly disclaims inherited retirement assets, their status as the beneficiary is fully annulled. Disclaiming inherited assets is often done to avoid taxes but also so that other individuals can receive the assets.

How to Disclaim an Inheritance Put the refusal in writing. ... That written refusal must be received by the executor/trustee and probate court within nine months of the person's passing (or for minors in Massachusetts, within 9 months from the date the recipient turns 18 years old).

In Massachusetts, to legally disclaim an inheritance, the beneficiary must file a written disclaimer within nine months of the death of the person who left the inheritance. This disclaimer must be filed with the probate court and must meet certain legal requirements.

The act, by the personal representative of a deceased person's estate, of transferring a legacy, or all or part of the residuary estate, to a beneficiary. An assent should only take place once the personal representative is satisfied that: The beneficiary is entitled to the legacy or share in the residuary estate.

In Massachusetts and in many other states, the legal doctrine of ?ademption by extinction? arises when a specific distribution of an asset in a Will cannot be fulfilled because the property no longer exists in the deceased's estate at the time of death.

Distribution of Assets if You Are Married with Children If you die without a will, your spouse inherits 100% of the remaining assets. However, over time, circumstances can change. Your spouse may remarry and have more children, potentially leaving your original children without the legacy you intended.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

This disclaimer should be signed, notarized, and filed with the probate court and/or the executor of the last will and testament in a timely manner. The IRS time frame is within nine months of the death of the decedent?or if the disclaiming beneficiary is a minor, after they reach age 21.