Massachusetts Renunciation of Legacy by Child of Testator

Description

How to fill out Renunciation Of Legacy By Child Of Testator?

US Legal Forms - one of many largest libraries of lawful forms in the United States - provides an array of lawful file themes it is possible to down load or produce. Making use of the website, you may get 1000s of forms for organization and personal uses, categorized by types, says, or search phrases.You will discover the most recent types of forms like the Massachusetts Renunciation of Legacy by Child of Testator within minutes.

If you have a subscription, log in and down load Massachusetts Renunciation of Legacy by Child of Testator from your US Legal Forms local library. The Acquire option will show up on each and every develop you perspective. You have access to all in the past saved forms from the My Forms tab of your own account.

If you wish to use US Legal Forms initially, allow me to share basic directions to obtain started out:

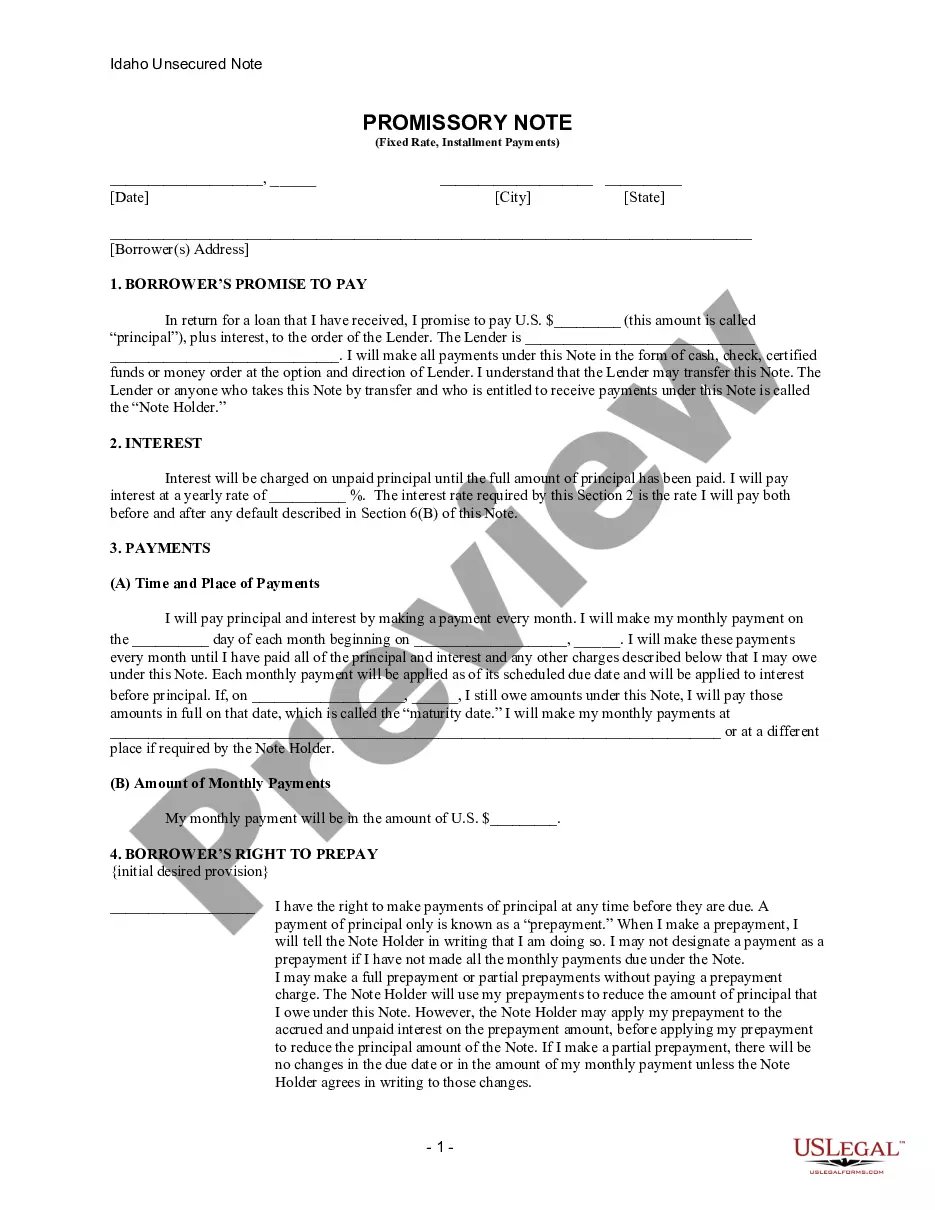

- Be sure to have chosen the proper develop to your area/state. Select the Review option to check the form`s content material. See the develop outline to actually have selected the right develop.

- In case the develop does not fit your specifications, take advantage of the Research industry on top of the display to get the one that does.

- When you are pleased with the shape, verify your choice by simply clicking the Acquire now option. Then, pick the pricing prepare you prefer and supply your references to sign up for the account.

- Method the purchase. Utilize your charge card or PayPal account to complete the purchase.

- Choose the formatting and down load the shape on your own device.

- Make adjustments. Complete, edit and produce and signal the saved Massachusetts Renunciation of Legacy by Child of Testator.

Each format you included with your bank account lacks an expiry day and is also yours permanently. So, if you wish to down load or produce an additional copy, just proceed to the My Forms section and click about the develop you require.

Obtain access to the Massachusetts Renunciation of Legacy by Child of Testator with US Legal Forms, the most comprehensive local library of lawful file themes. Use 1000s of expert and state-particular themes that fulfill your company or personal demands and specifications.

Form popularity

FAQ

Even if an estate contains probate assets, you might be surprised to learn you may not need to go through a full formal probate. If the value of the decedent's estate is less than $25,000 and does not contain any real property, than a limited version of probate called Voluntary Administration may qualify.

In Massachusetts, creating a living trust will help you avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will) naming someone to take over as trustee after your death (called a successor trustee).

How to Disclaim an Inheritance Put the refusal in writing. ... That written refusal must be received by the executor/trustee and probate court within nine months of the person's passing (or for minors in Massachusetts, within 9 months from the date the recipient turns 18 years old).

The personal representative can close the estate by filing a sworn statement, which says that debts, taxes, and other expenses have been paid and that the estate assets have been transferred to the people entitled to inherit them.

(1) If the testator had no child living when the will was executed, an omitted after-born or after-adopted child receives a share in the estate equal in value to that which the child would have received had the testator died intestate, unless the will devised all or substantially all the estate to the other parent of ...

Distribution of Assets if You Are Married with Children If you die without a will, your spouse inherits 100% of the remaining assets. However, over time, circumstances can change. Your spouse may remarry and have more children, potentially leaving your original children without the legacy you intended.

If the decedent died with a will ? The person with legal priority is the person named in the will to serve as personal representative or executor. If the decedent died without a will ? The person with legal priority is the surviving spouse.

If the decedent died without a will You'll need to file: Petition for Informal Probate of Will and/or Appointment of Personal Representative (MPC 150) Surviving Spouse, Children, Heirs at Law (MPC 162)