Selecting the finest authorized document template can be a challenge. Clearly, there are numerous templates available online, but how can you find the legal form you need? Utilize the US Legal Forms website. This service provides a vast array of templates, such as the District of Columbia Qualified Written Request as outlined in Section 6 of the Real Estate Settlement Procedures Act - RESPA, which you can utilize for both business and personal needs. All forms are vetted by professionals and adhere to federal and state regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the District of Columbia Qualified Written Request as defined in Section 6 of the Real Estate Settlement Procedures Act - RESPA. Use your account to search the legal documents you have previously acquired. Navigate to the My documents section of your account and download another copy of the document you need.

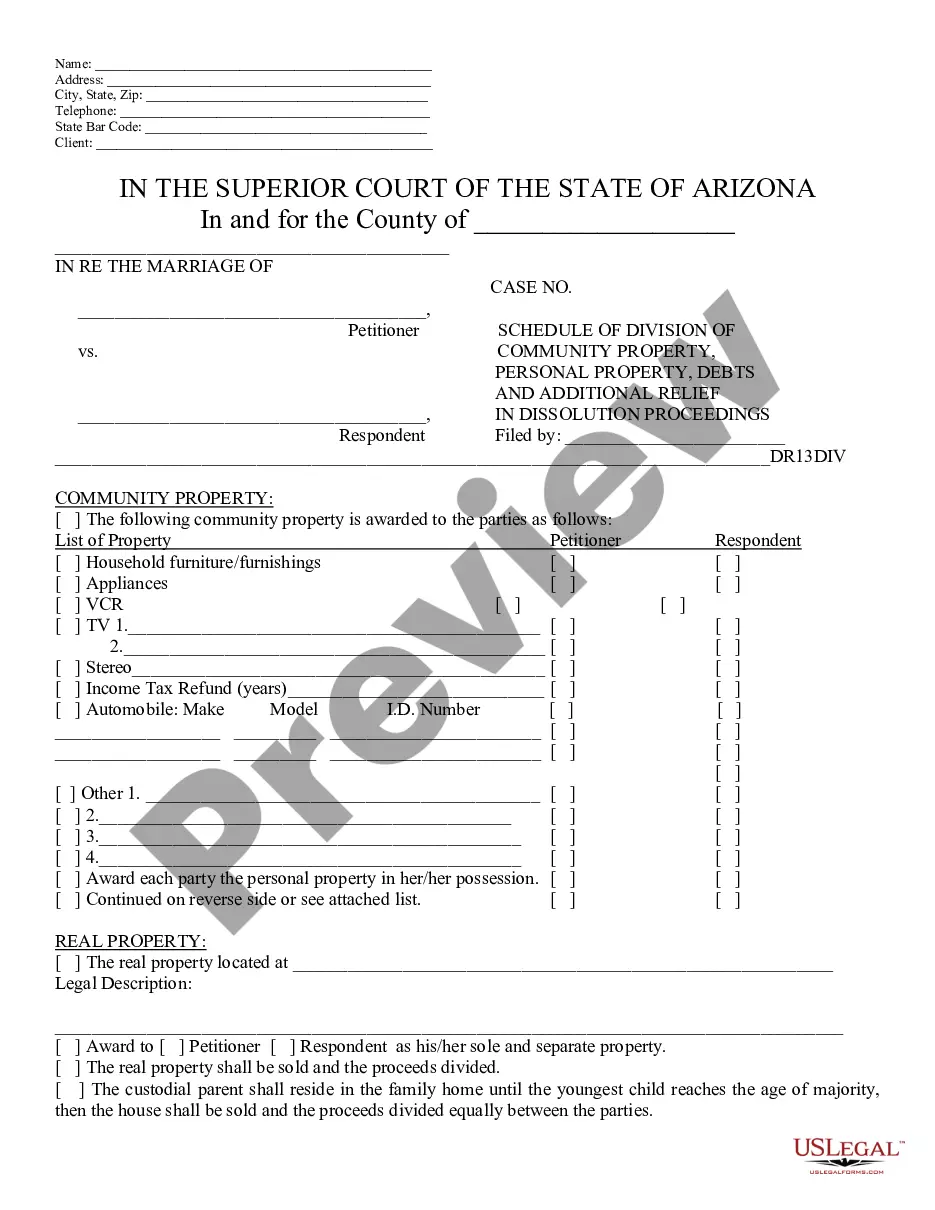

If you are a new user of US Legal Forms, here are straightforward instructions you can follow: First, ensure you have chosen the correct form for your city/region. You can preview the form using the Review button and read the form description to confirm it is suitable for you. If the form does not meet your needs, utilize the Search feature to find the appropriate form. When you are confident the form is right, click the Get now button to acquire the document. Select the pricing plan you desire and input the necessary information. Create your account and pay for the order using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, modify, print, and sign the acquired District of Columbia Qualified Written Request as stated in Section 6 of the Real Estate Settlement Procedures Act - RESPA.

US Legal Forms is the largest repository of legal documents where you can discover various document templates. Take advantage of the service to acquire professionally crafted documents that comply with state requirements.

- Ensure proper form selection based on location.

- Preview forms using review options.

- Check descriptions for suitability.

- Utilize search features if needed.

- Confirm details before proceeding.

- Download and manage document formats.