District of Columbia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

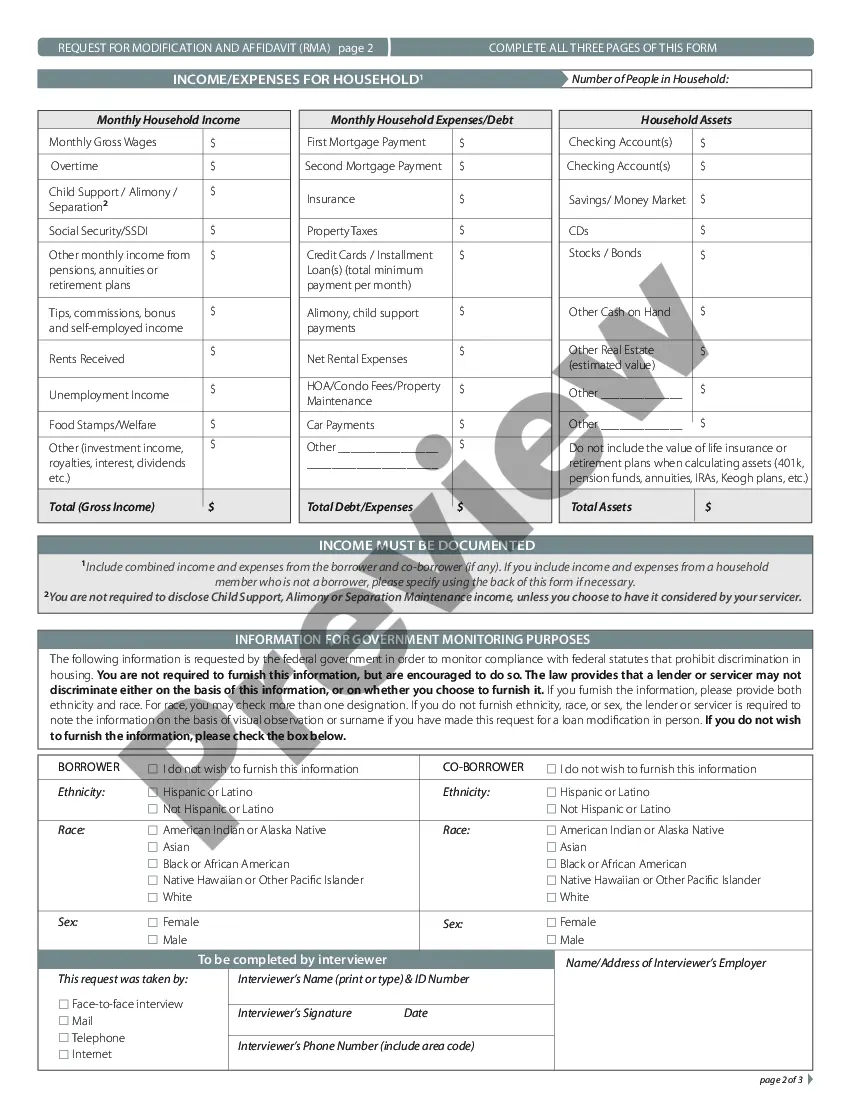

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

You can spend hours online attempting to locate the valid document template that meets the federal and state requirements you desire.

US Legal Forms offers a vast array of valid templates that can be reviewed by professionals.

You can actually download or print the District of Columbia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP from the service.

First, ensure you have selected the correct document template for the county/region of your choice.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

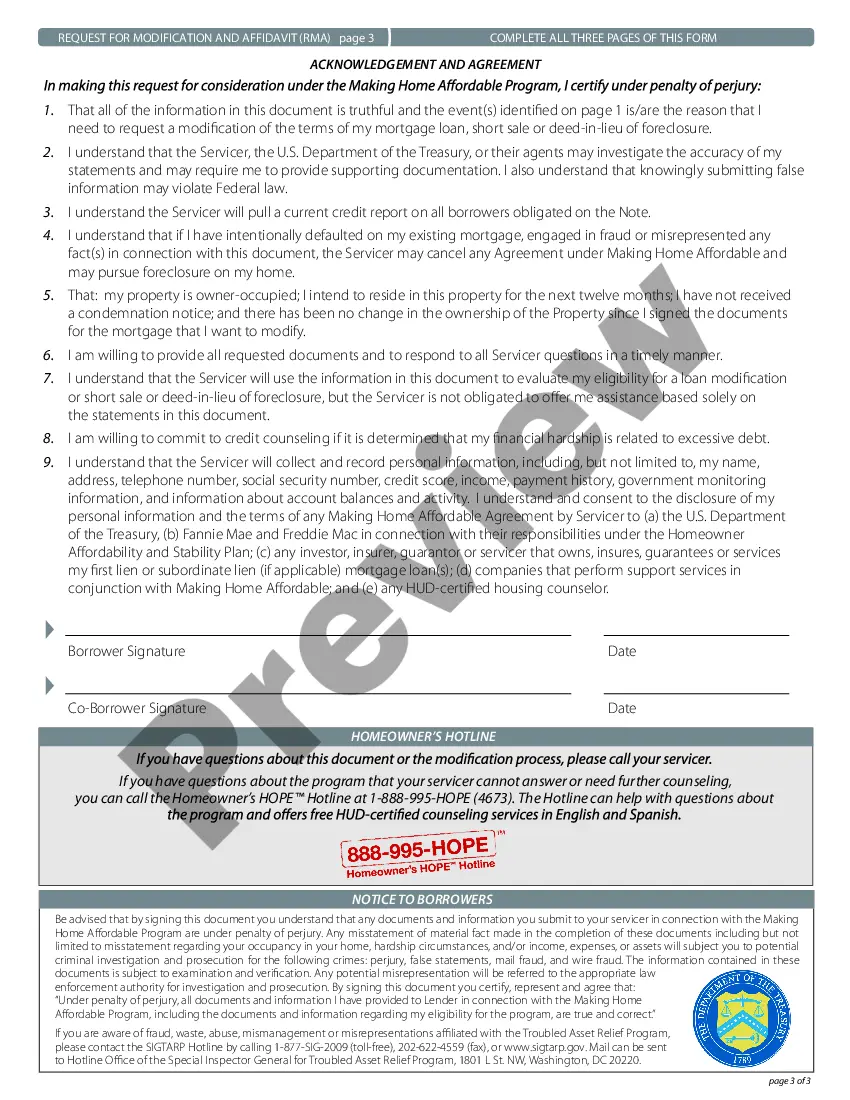

- Subsequently, you can complete, edit, print, or sign the District of Columbia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

- Every valid document template you purchase is yours for an extended period.

- To obtain an additional copy of any acquired form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

To apply for a loan modification, start by gathering all necessary financial documents, such as income statements and bank statements. Next, you can complete the District of Columbia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP application, ensuring you include accurate details about your financial hardship. Additionally, platforms like uslegalforms can assist you in understanding the required forms and steps to increase your chances of success in the application process.

While getting approved for a loan modification can feel challenging, it largely depends on your financial situation and how you present your case. The District of Columbia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP offers options for many homeowners facing hardship. If you provide all necessary documentation and demonstrate your need, you increase your chances of approval. It helps to utilize resources like uslegalforms to navigate the application process smoothly.

A good hardship letter for a loan modification should clearly explain your financial difficulties and the reasons behind them. Be honest and provide relevant details, such as job loss, medical expenses, or divorce. You should also express your desire to keep your home and your plan to improve your financial situation. Remember, the District of Columbia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP requires genuine circumstances to qualify.

To start the process of requesting a mature modification on your loan, you'll want to gather all necessary documentation related to your current loan. Then, go to the official platform for the District of Columbia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Follow the step-by-step procedure outlined on the site to submit your request, ensuring you provide accurate and complete information. If you need assistance, consider using uslegalforms, which offers guidance to help you navigate the process smoothly.

The approval timeline for a District of Columbia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP varies based on several factors. Generally, the review process can take anywhere from 30 to 90 days, depending on the lender’s workload and the completeness of your application. To expedite the process, ensure you submit all required documents promptly and follow up with your lender regularly. Patience and clear communication often lead to smoother approvals.

The process of obtaining a loan modification through a District of Columbia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP starts with evaluating your financial situation. From there, you gather the necessary documentation and complete the required application forms. After submitting your application, the lender will review your information, and promptly communicate any decisions or requests for further details. Remaining proactive and in touch with your lender throughout this process is vital for achieving a favorable outcome.

For a District of Columbia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, specific requirements must be met. You must demonstrate a financial hardship, provide adequate documentation regarding your income and expenses, and be able to show that your mortgage is not currently in foreclosure. Additionally, you need to have a qualifying loan type and sufficient income to support the modified payment terms once approved.

The process for a District of Columbia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP generally begins with gathering relevant financial documents, such as proof of income and hardship letters. Next, you submit your application to your lender, who will review your information and make a determination on your eligibility. After submission, communication with your lender is essential to ensure you provide any additional information they may require. Finally, if approved, you will receive the terms of your modified loan.

Several factors can disqualify you from a District of Columbia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Common disqualifiers include a lack of sufficient income to cover the modified payments, recent bankruptcy filings, or failure to provide necessary documentation. Additionally, if your home is not your primary residence or if you are not experiencing a financial hardship, you may not be eligible. It is crucial to review your situation carefully to understand your eligibility.

The HAMP loan modification program is designed to assist struggling homeowners in keeping their homes. By utilizing the District of Columbia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you can alter the terms of your mortgage to make payments more manageable. This program helps stabilize the housing market by providing borrowers with a lifeline, reducing monthly payments, and preventing foreclosures. It's essential to understand how HAMP works and how to apply for it.