District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers an extensive selection of legal document templates that you can download or print.

On the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords. You can access the most recent versions of forms like the District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt within seconds.

If you already have an account, Log In to download the District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt from the US Legal Forms library. The Download option will be available for each form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account for payment.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt. Every template you added to your account has no expiration date and is yours permanently. Thus, to download or print another copy, simply visit the My documents section and click on the form you need. Gain access to the District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have chosen the appropriate form for your area/region.

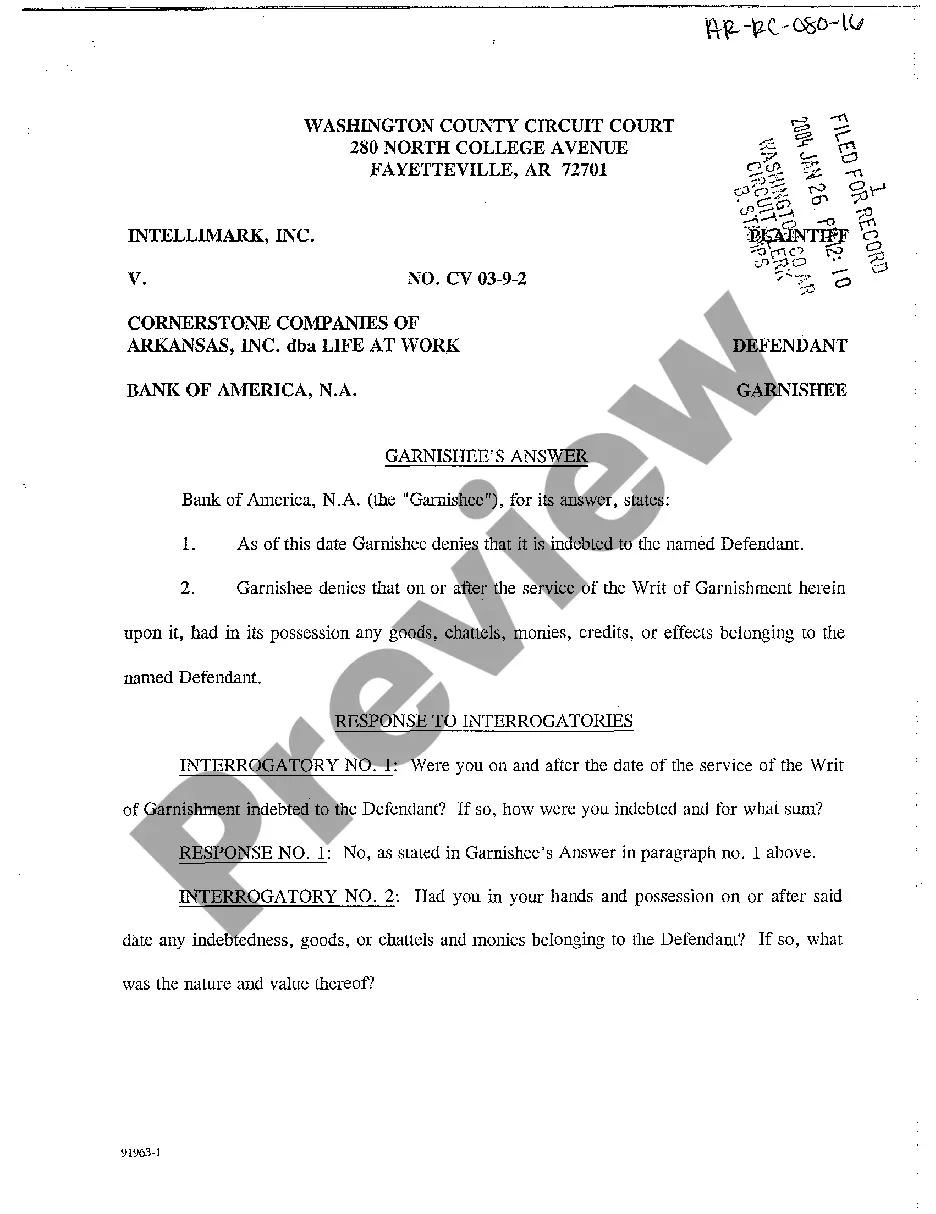

- Click on the Preview option to review the content of the form.

- Read the form details to confirm you have selected the right form.

- If the form does not meet your needs, utilize the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the pricing plan you prefer and provide your information to register for your account.

Form popularity

FAQ

To ask a debt collector to validate a debt, you must send a written request within 30 days of first being contacted. In your request, specify that you are requesting validation under the Fair Debt Collection Practices Act. Utilizing a District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt can help you format your request correctly and ensure you receive the necessary documentation.

A District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt does not automatically stop foreclosure. However, submitting a QWR can trigger a delay in the foreclosure process as the servicer must address your request. This gives you more time to explore your options and potentially resolve any disputes before further action is taken. Always consider seeking legal advice to understand your specific situation and options.

To write a letter requesting debt validation, start by clearly stating your intent to dispute the debt and request verification. Include your account details and express that you are submitting a District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt. Keep the letter concise and respectful, and ask for specific documentation to validate the debt. For detailed templates and guidance, visiting uslegalforms can simplify your experience.

A RESPA qualified written request is a formal communication that you can send to a servicer to address issues related to mortgage loans and debts. Specifically, this request seeks information about the validity of a debt and can support your rights as a consumer. It can also halt collections until you receive a proper response. Understanding how to craft this request is crucial, and uslegalforms offers helpful resources to guide you.

To dispute the validity of a debt, you can file a District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt. This formal request allows you to demand verification of the debt and ensures that the creditor provides proper documentation. It is essential to detail your concerns clearly in your request. Utilizing platforms like uslegalforms can guide you through the process and ensure your rights are protected.

To file a debt validation claim, first gather all necessary documentation related to the debt you are disputing. Then, draft a formal letter outlining your dispute and request for validation. Send this letter to the creditor while keeping copies for your records. A District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt can help ensure that your claim meets the requirements and is handled properly.

To write a qualified written request, start by clearly stating your request at the beginning of the document. Include your full name, address, and details about the debt, such as the account number. Ensure you express the specific issues you are disputing and what resolution you seek. A District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt can serve as a formalized way to articulate your concerns and requests.

Debt validation is a good idea as it protects your rights and ensures that you are not paying for a debt that is not valid. It allows you to request proof that the debt belongs to you, which can prevent issues later. Additionally, it gives you leverage in negotiations with creditors. Using a District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt can enhance your ability to validate the debt effectively.

When writing a letter to dispute the validity of a debt, start by stating your intent clearly at the top. Include your personal details and a comprehensive account of the debt you are disputing. Be sure to ask for specific validation of the debt and keep a copy of the letter for your records. Consider using a District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt template for a structured approach.

To dispute validation of debt, first request verification from the creditor. Send a written notice stating your dispute, and include any relevant details or documentation. The creditor is then required to provide proof that the debt is valid. Leveraging a District of Columbia Qualified Written RESPA Request to Dispute or Validate Debt can enhance the process, making it more official.