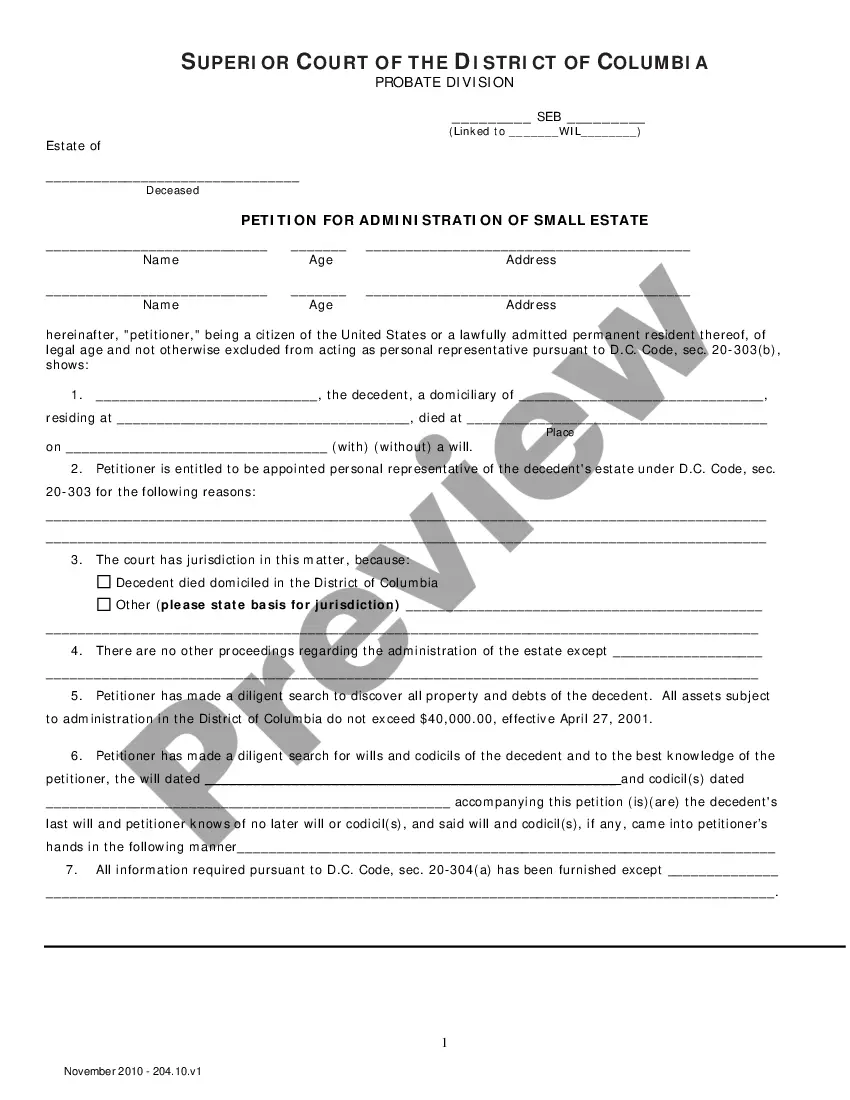

This is an official form from the District of Columbia Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by District of Columbia statutes and law.

District of Columbia Instructions for Completing Petition for Small Estate Affidavit

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out District Of Columbia Instructions For Completing Petition For Small Estate Affidavit?

The greater the documentation you need to prepare - the more anxious you become.

You can discover a vast array of District of Columbia Guidelines for Completing Petition for Small Estate Affidavit templates online, yet you may be uncertain about which ones to rely on.

Eliminate the inconvenience and make locating examples more effortless with US Legal Forms.

Opt for a convenient document format and obtain your copy. Access every file you download in the My documents section. Simply navigate there to prepare a new version of your District of Columbia Guidelines for Completing Petition for Small Estate Affidavit. Even with expertly drafted forms, it is still essential to consider consulting a local attorney to verify that your document is accurately filled out. Achieve more for less with US Legal Forms!

- Obtain precisely drafted documents that comply with state requirements.

- If you already have a subscription to US Legal Forms, Log In to your account, and you'll find the Download button on the District of Columbia Guidelines for Completing Petition for Small Estate Affidavit page.

- If you haven't used our website before, complete the registration process by following these steps.

- Verify whether the District of Columbia Guidelines for Completing Petition for Small Estate Affidavit is applicable in your state.

- Review your choice by examining the description or using the Preview option if available for the selected document.

Form popularity

FAQ

Filing estate papers generally involves gathering essential documents, completing necessary forms, and submitting them to the appropriate court or agency. This process can differ based on the type of estate and local regulations. Utilizing the District of Columbia Instructions for Completing Petition for Small Estate Affidavit will provide you with a clear roadmap to ensure that all filings are done accurately and timely.

To file an estate tax return, you typically need the deceased’s will, death certificate, records of all assets, and financial statements. Additionally, any relevant tax documents, such as income tax returns for the deceased, are necessary. Guidance from the District of Columbia Instructions for Completing Petition for Small Estate Affidavit can simplify this documentation process for you.

In most cases, you should file for probate within a few weeks to a few months after a person's death, depending on state laws. Filing sooner can help prevent legal complications and allow for a smoother administration of the estate. For those utilizing the District of Columbia Instructions for Completing Petition for Small Estate Affidavit, timely action is essential in moving through the process efficiently.

Yes, estates may need to file a federal tax return if they earn income exceeding a certain threshold during the administration process. While this may not be necessary for smaller estates, adhering to the requirements is crucial to avoid penalties. The District of Columbia Instructions for Completing Petition for Small Estate Affidavit will provide you with insights on how to approach these tax matters effectively.

The 3-year rule states that an estate must be settled within three years of the deceased's passing. This timeframe often impacts how the estate is handled, particularly regarding tax implications and distribution of assets. If you're navigating this process, the District of Columbia Instructions for Completing Petition for Small Estate Affidavit can help you understand your next steps.

To obtain an EIN for an estate, you can apply online through the IRS website or submit Form SS-4 by mail. The application process is straightforward and requires basic information about the estate. Completing the process correctly is vital; hence, refer to the District of Columbia Instructions for Completing Petition for Small Estate Affidavit to ensure compliance and correct details.

To obtain a small estate affidavit in the District of Columbia, start by checking the eligibility criteria defined by local laws. You can find the necessary forms online through the DC Superior Court's website, or you may choose to access resources from UsLegalForms for guidance. Following the District of Columbia Instructions for Completing Petition for Small Estate Affidavit will ensure you complete your affidavit accurately.

You generally do not need an EIN to complete a small estate affidavit, unless there are income-generating assets involved. However, if the estate generates income, or if you plan to open a bank account for the estate, an EIN will be necessary. Ensure that you follow the District of Columbia Instructions for Completing Petition for Small Estate Affidavit for detailed requirements regarding this process.

In many cases, small estates do not require an EIN; however, it depends on the specific circumstances. If the estate has income or will be reported on a tax return, an EIN may be needed. Reviewing the requirements for small estates and consulting the District of Columbia Instructions for Completing Petition for Small Estate Affidavit can help clarify this matter for you.

An Employer Identification Number (EIN) is typically required for estates that have income-generating assets or require tax filings. If the estate is expected to have any income after the decedent's passing, obtaining an EIN is essential. This number helps manage tax obligations and ensures compliance with IRS regulations. It is advisable to consult the District of Columbia Instructions for Completing Petition for Small Estate Affidavit for further clarity.