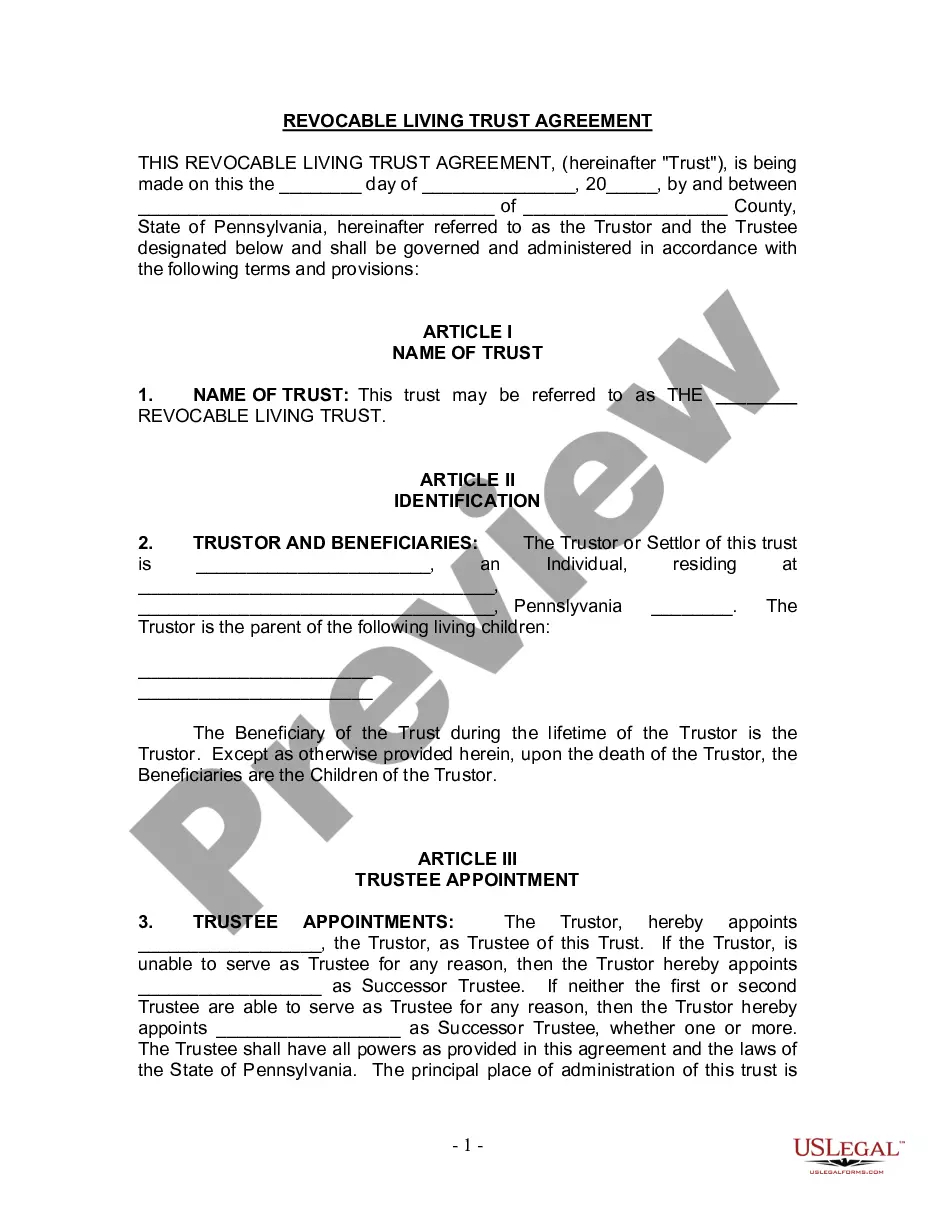

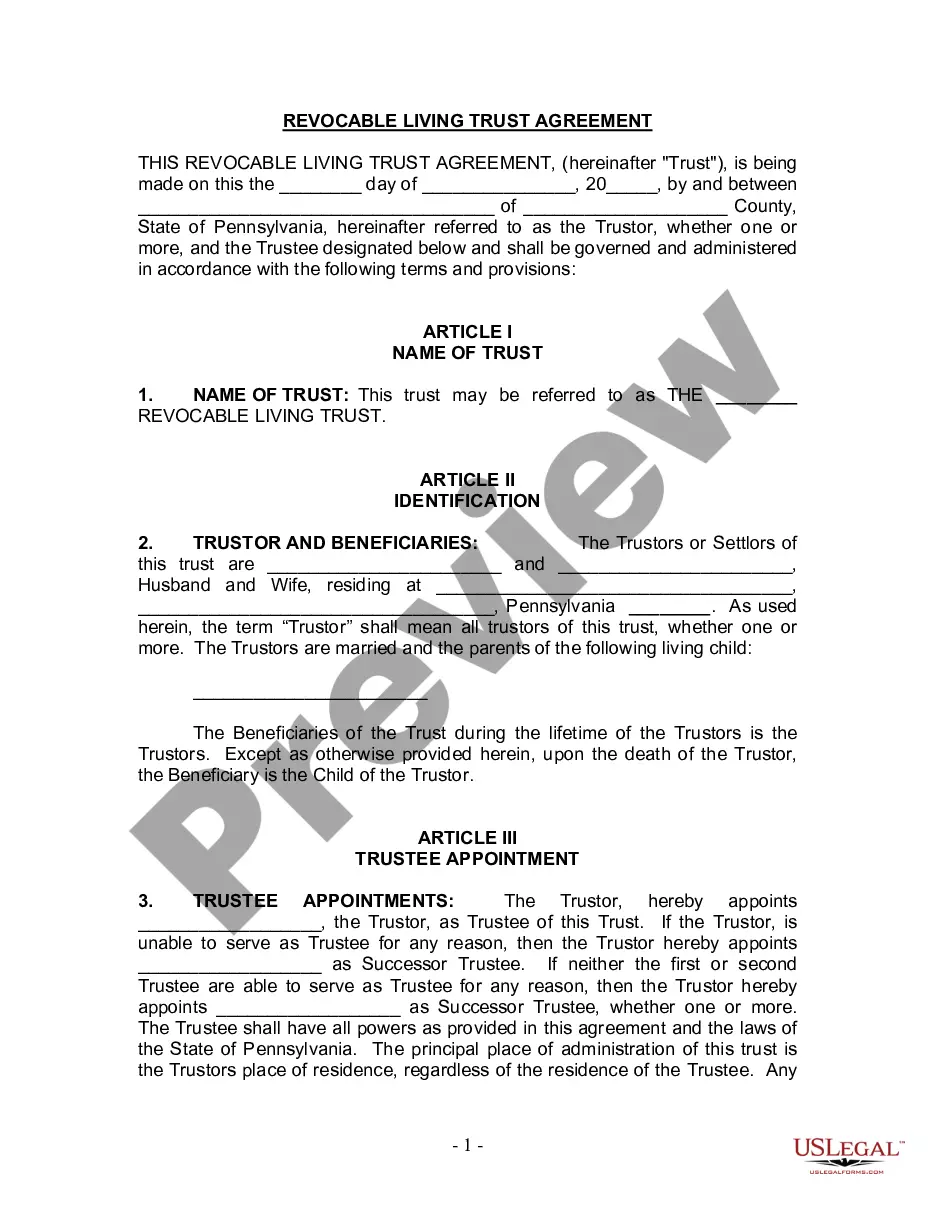

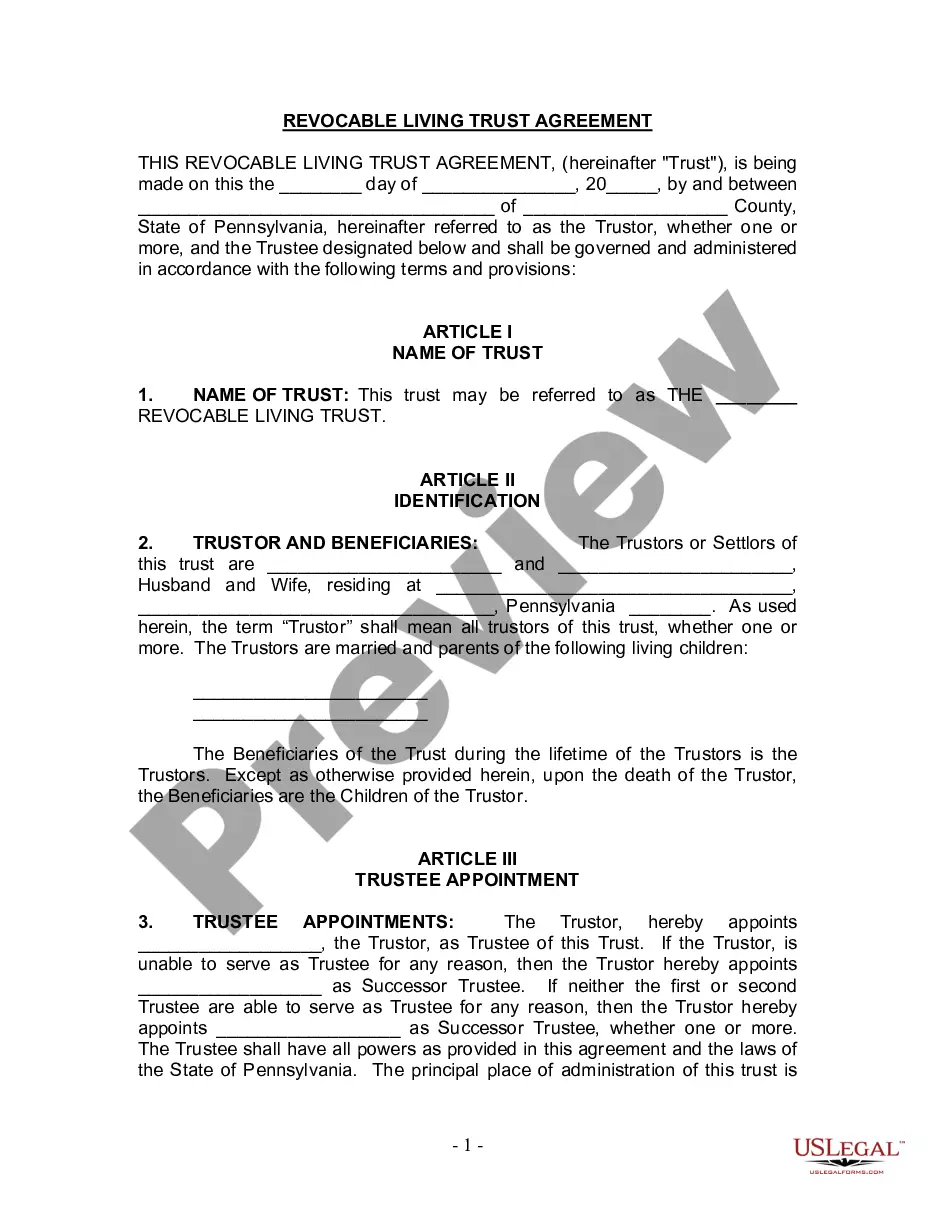

This is an official form from the District of Columbia Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by District of Columbia statutes and law.

District of Columbia Renunciation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out District Of Columbia Renunciation?

The greater the number of forms you are required to produce - the more nervous you feel.

You can locate a vast array of District of Columbia Renunciation forms online, yet, you are uncertain which ones to trust.

Eliminate the hassle to make finding samples easier with US Legal Forms. Receive professionally crafted documents that are designed to comply with state standards.

After entering the requested information to create your profile, complete your purchase using PayPal or a credit card. Choose a preferred document format and obtain your copy. Access every template you acquire in the My documents section. Simply navigate there to fill out a new version of the District of Columbia Renunciation. Even with professionally prepared forms, it’s still important to consider consulting your local attorney to double-check the completed form to ensure that your document is correctly filled out. Achieve more for less with US Legal Forms!

- If you currently possess a US Legal Forms subscription, Log In to your account, and you will discover the Download option on the District of Columbia Renunciation’s page.

- If you’ve never utilized our website before, follow the registration process using these instructions.

- Ensure the District of Columbia Renunciation is applicable in your state.

- Verify your selection by reviewing the description or by using the Preview feature if available for the chosen document.

- Click on Buy Now to initiate the signup process and select a pricing plan that suits your requirements.

Form popularity

FAQ

In the District of Columbia, a renunciation must typically be witnessed by an individual who is neutral and not a beneficiary in the estate. This witness confirms that you have made the renunciation voluntarily and with a clear understanding of its implications. Engaging professional services, like those offered on the UsLegalForms platform, can help ensure the witnessing process meets legal requirements.

One of the benefits of a District of Columbia Renunciation is the opportunity to avoid complex tax implications that may arise from accepting an inheritance. Additionally, renouncing can allow the estate to be distributed more clearly and fairly among remaining beneficiaries. This option can also reduce potential conflicts among heirs, promoting a smoother estate settlement process.

The primary purpose of renunciation is to allow individuals to refuse an inheritance that they may not want or cannot manage. This decision can benefit both the rejecting party and other heirs by simplifying the distribution of the estate. Understanding the significance of a District of Columbia Renunciation can help in making informed choices during estate planning.

Renunciation can have several consequences, including the loss of any rights to the assets you decline. It might also affect your relationship with other beneficiaries, as they will receive your portion. Being aware of these potential outcomes is essential when considering a District of Columbia Renunciation, as it can significantly impact your financial situation.

The legal effect of a District of Columbia Renunciation is that it effectively removes your claims from the estate, transferring your portion to other predetermined beneficiaries. This action facilitates the proper execution of the will and ensures that the estate is distributed according to the testator's wishes. It is a binding decision that requires careful consideration.

In the context of a will, renunciation means that a beneficiary voluntarily declines to accept their share of an inheritance. This act allows the deceased's assets to pass directly to the next eligible heirs without legal complications. Understanding the implications of a District of Columbia Renunciation is crucial for anyone involved in the estate planning process.

After you declare a District of Columbia Renunciation, the assets you renounce are transferred to other beneficiaries as specified in the will or trust. This process ensures that you relinquish any claims to the estate, allowing for a smooth transition of assets. It's essential to understand that once you renounce, you cannot change your mind and claim those assets later.

A letter of renunciation is a formal notice where an individual declares their intention to decline a certain role or inheritance. This letter is essential for clarifying your decision and ensuring that it is understood legally. In the realm of District of Columbia renunciation, drafting a clear and precise letter protects you from potential legal repercussions.

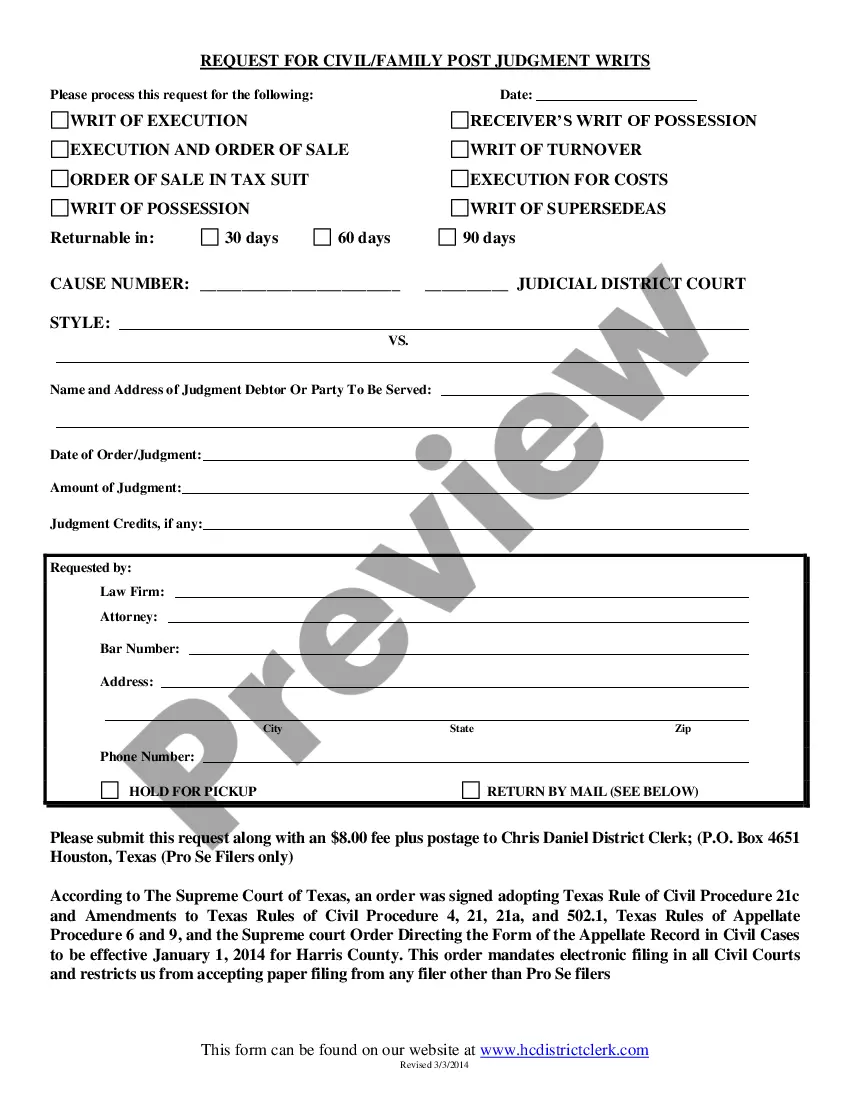

A renunciation form serves as a standardized document to officially refuse to accept an inheritance or position, like executor of an estate. By using this form, you ensure that your renunciation adheres to legal standards set forth by the estate laws. Utilizing platforms like uslegalforms can simplify the completion of this renunciation form and ensure it is filed correctly.

DC Code 20 101 G outlines the legal framework for renunciation in the District of Columbia. Specifically, it describes the guidelines for property and inheritance disclaimers. Familiarity with this code can assist you in understanding your rights and responsibilities, making the District of Columbia renunciation process clearer and more manageable.