Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children

Description

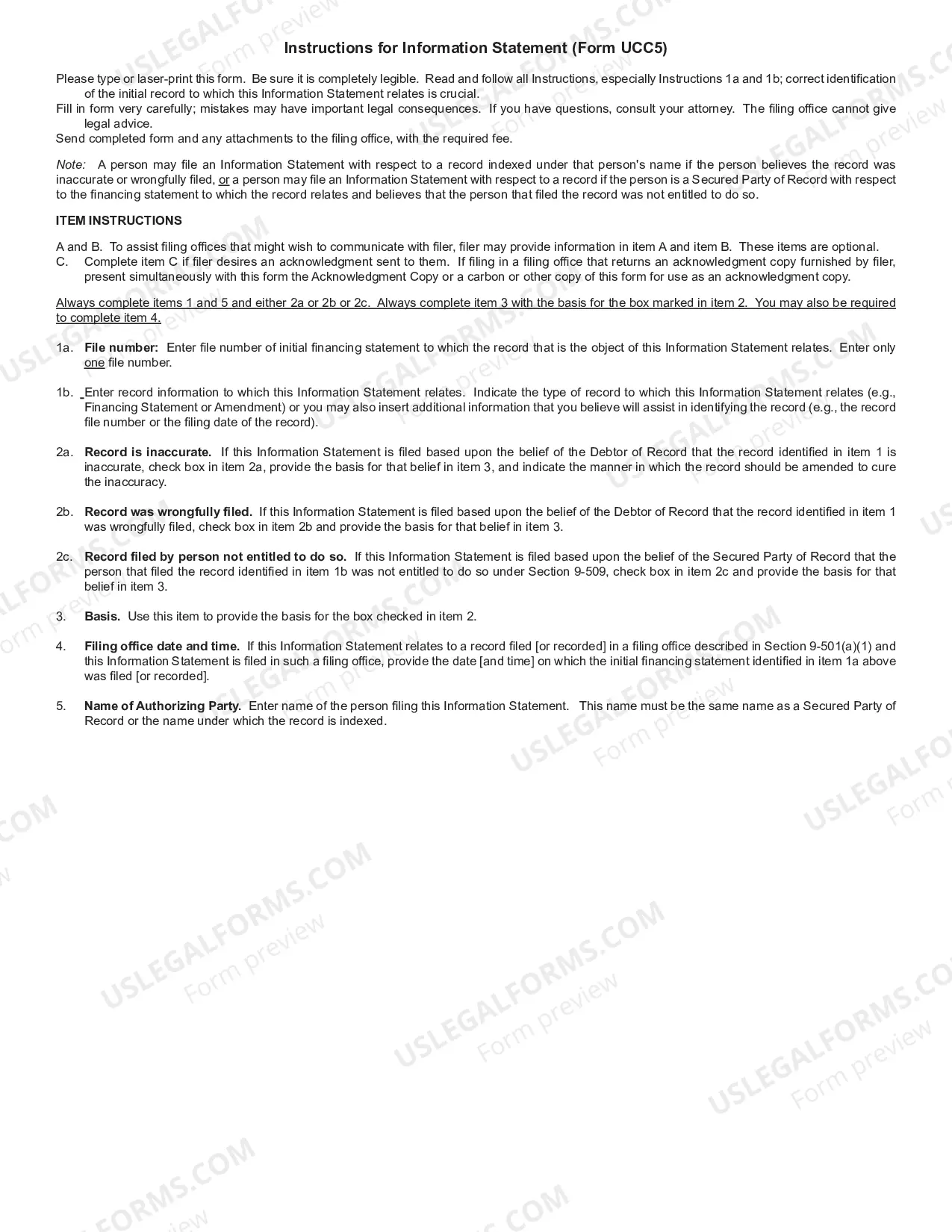

How to fill out Pennsylvania Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With Children?

The work with documents isn't the most uncomplicated task, especially for those who rarely work with legal paperwork. That's why we recommend making use of accurate Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children samples created by skilled attorneys. It gives you the ability to eliminate difficulties when in court or dealing with formal organizations. Find the files you require on our website for high-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the template web page. Soon after getting the sample, it’ll be saved in the My Forms menu.

Customers with no a subscription can easily get an account. Use this short step-by-step help guide to get the Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children:

- Ensure that the document you found is eligible for use in the state it’s needed in.

- Verify the document. Utilize the Preview option or read its description (if readily available).

- Click Buy Now if this file is the thing you need or utilize the Search field to find another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

After finishing these easy actions, you can fill out the sample in a preferred editor. Double-check filled in details and consider requesting a legal representative to examine your Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children for correctness. With US Legal Forms, everything gets much easier. Give it a try now!

Form popularity

FAQ

Trust is a feeling that somebody or something can be relied upon, or will turn out to be good. It is the feeling of being sure about something, even if it cannot be proved. The word "trust" can be a noun or a verb:(Verb): I trust you completely (same meaning).

A God who does care, even when it feels like He doesn't. Trusting in God means that whatever we suffer, in the end, can be used for our all of our ultimate good.

Trust is an abstract mental attitude toward a proposition that someone is dependable. Trust is a feeling of confidence and security that a partner cares. Trust is a complex neural process that binds diverse representations into a semantic pointer that includes emotions.

What Is Trust In A Relationship? Trust is the faith you have in someone that they will always remain loyal to you and love you. To trust someone means that you can rely on them and are comfortable confiding in them because you feel safe with them.