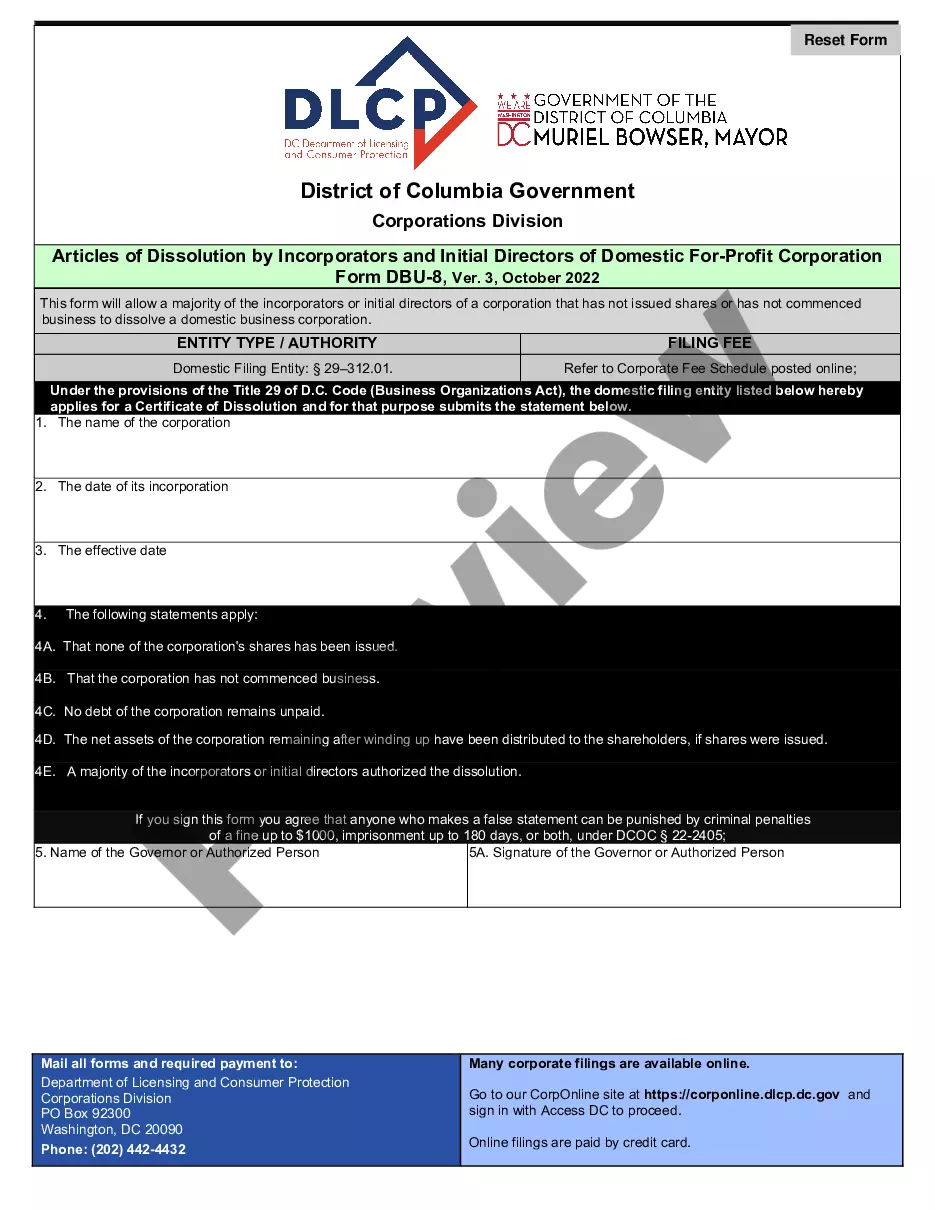

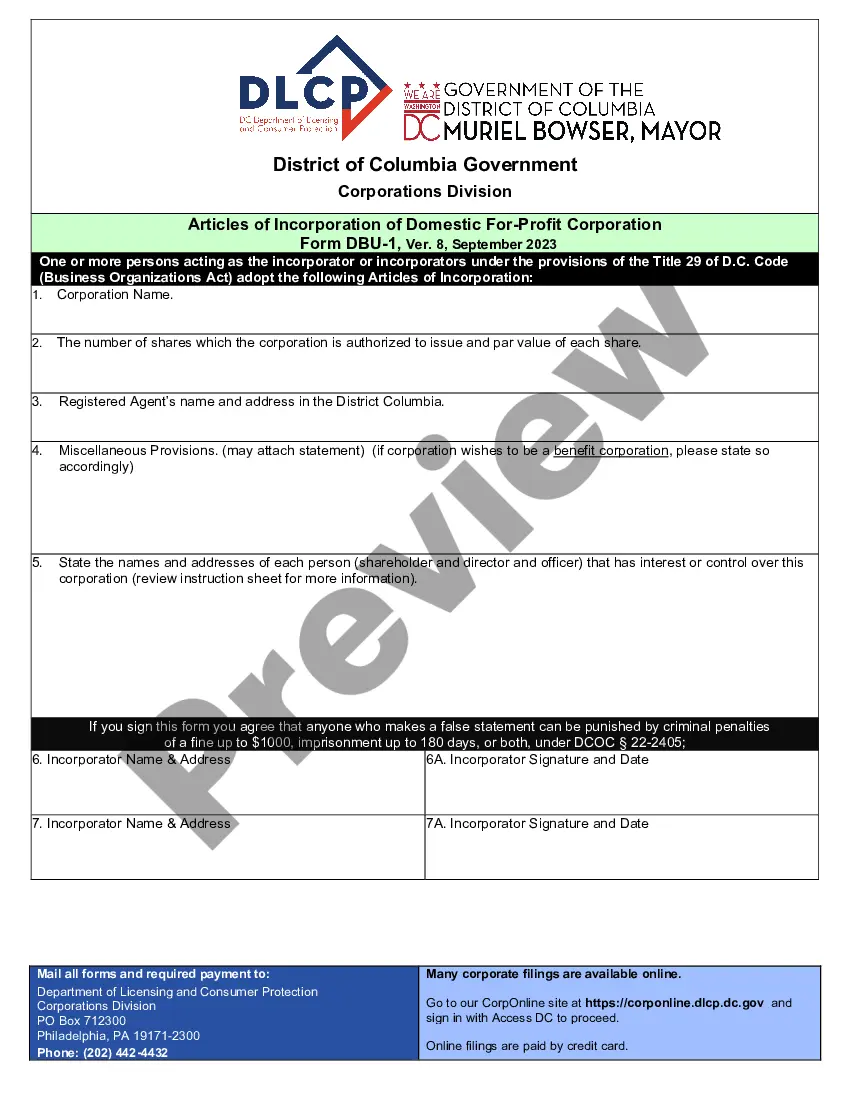

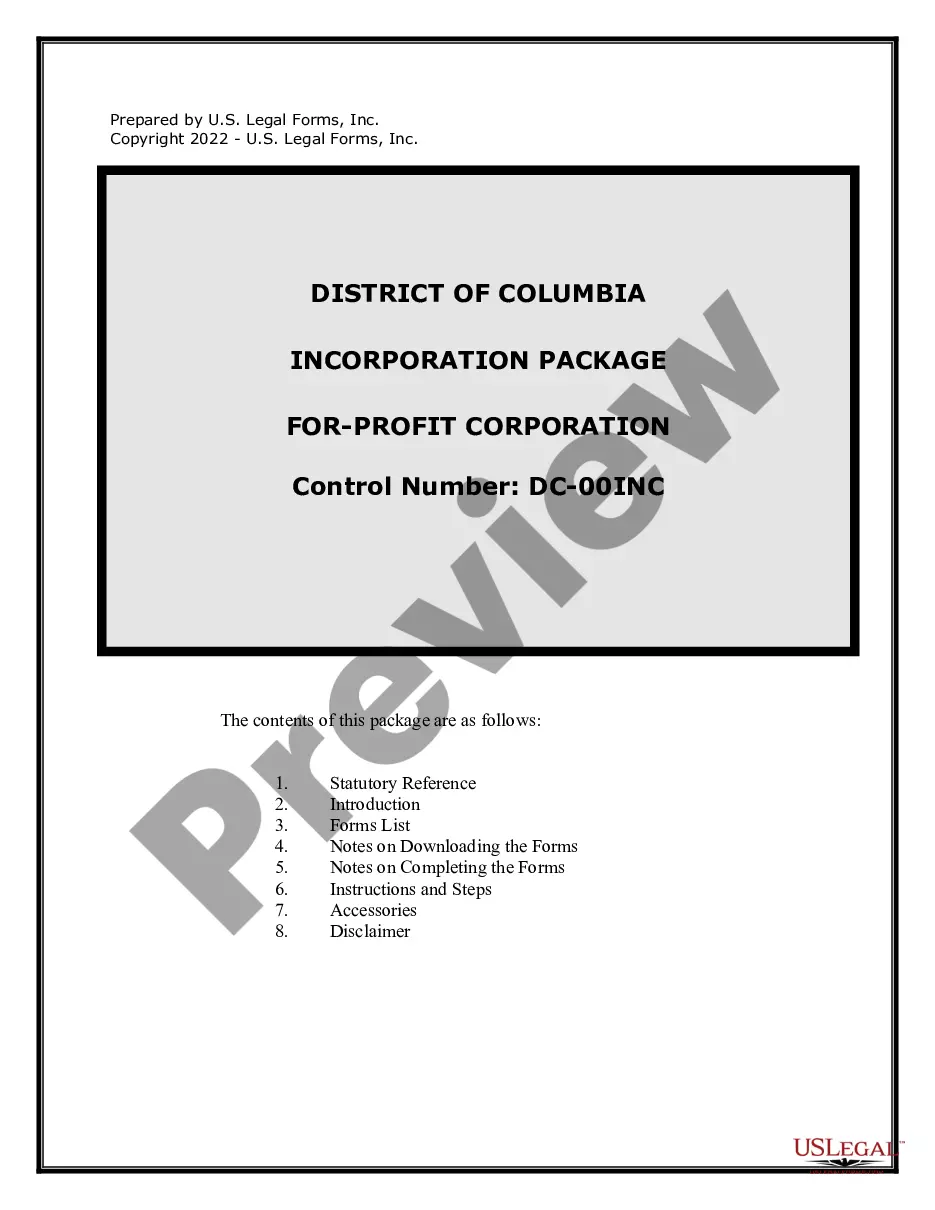

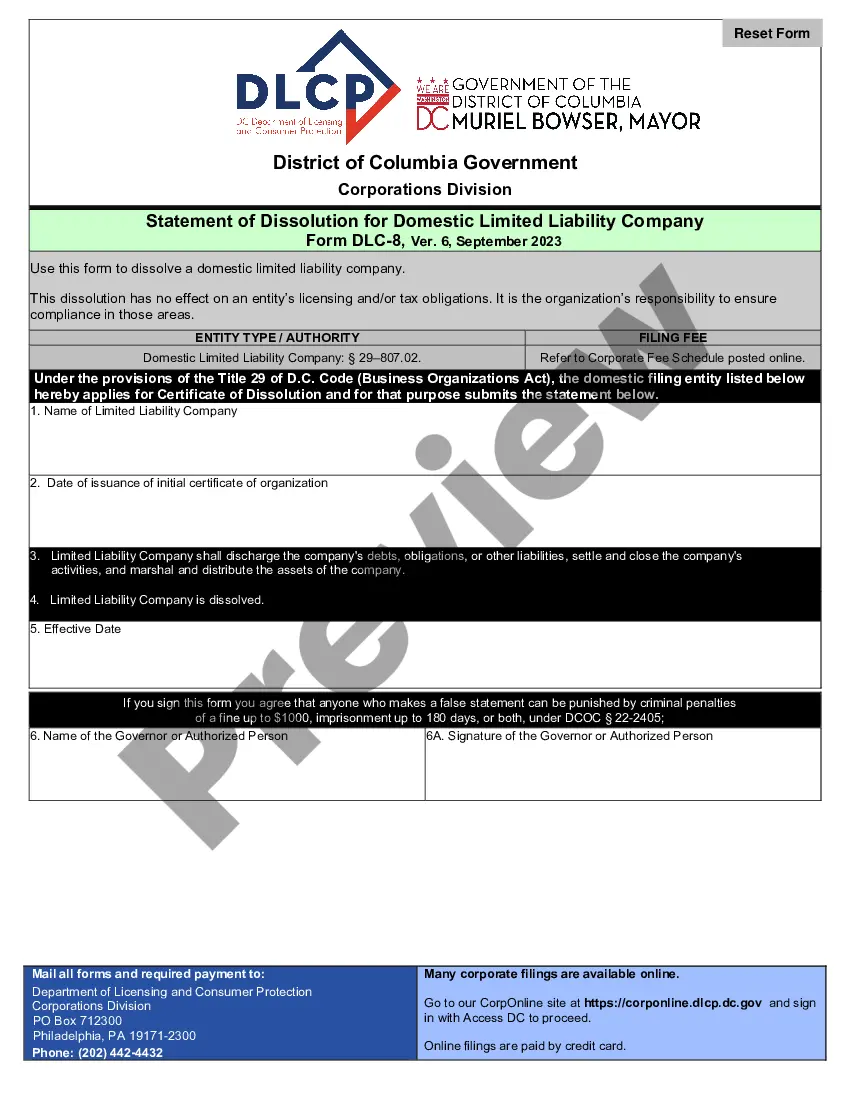

Contains all forms to dissolve a corporation in the District of Columbia.

District of Columbia Dissolution Package to Dissolve Corporation

Description

How to fill out District Of Columbia Dissolution Package To Dissolve Corporation?

The increased quantity of documentation you have to complete - the more nervous you feel.

You can locate numerous District of Columbia Dissolution Packages to Dissolve Corporation templates online, but you remain unsure which ones to trust.

Remove the difficulty of finding samples more easily by using US Legal Forms. Obtain professionally crafted documents that are designed to meet state requirements.

Provide the requested information to create your account and pay for your order with PayPal or credit card. Choose a suitable file format and download your template. Access each sample you download in the My documents section. Visit there to prepare a new copy of your District of Columbia Dissolution Package to Dissolve Corporation. Even when using expertly crafted templates, it's important to consider consulting a local attorney to review the completed form to ensure your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you have a US Legal Forms subscription, Log In to your account, and you'll see the Download button on the District of Columbia Dissolution Package to Dissolve Corporation’s page.

- If you’ve never used our platform before, follow these instructions to complete the registration process.

- Confirm that the District of Columbia Dissolution Package to Dissolve Corporation is valid in your state.

- Verify your choice by reviewing the description or using the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and select a pricing plan that fits your requirements.

Form popularity

FAQ

The process of dissolving a company generally involves several key steps. First, the corporation must settle any debts and obligations, followed by filing dissolution documents with the state. The District of Columbia Dissolution Package to Dissolve Corporation offers a comprehensive guide to navigate this process smoothly and ensures that you don’t miss any critical steps.

To dissolve a corporation with the IRS, you first need to ensure that your business meets all tax obligations. Then, you can file your final tax return and indicate that it is the final return for your corporation. Additionally, consider utilizing the District of Columbia Dissolution Package to Dissolve Corporation, which simplifies the process and ensures all necessary paperwork is completed accurately.

Shutting down a company involves several steps, including notifying employees, settling debts, and completing necessary paperwork. One effective method is to use a District of Columbia Dissolution Package to Dissolve Corporation, which guides you through legal requirements and ensures that all necessary notifications and filings are handled properly. This approach minimizes complications and helps you close your business responsibly.

A corporation may choose to dissolve for various reasons. Initially, it can be due to financial challenges that make ongoing operations unsustainable. Additionally, a corporation might dissolve when its goals have been achieved, and there is no further need for the entity. Utilizing a District of Columbia Dissolution Package to Dissolve Corporation can streamline this process.

Dissolving a company and closing it are related but not identical concepts. When you dissolve a company, you complete legal processes that formally end its existence, often using the District of Columbia Dissolution Package to Dissolve Corporation. Conversely, closing a company can imply stopping operations without the formal dissolution process. To protect your interests, it is advisable to formally dissolve the company.

Dissolving a company involves several steps. First, hold a meeting to vote on the dissolution and ensure all necessary approvals are in place. Afterward, you need to file the District of Columbia Dissolution Package to Dissolve Corporation with the Secretary of State. Complete any required notifications and final tax filings to wrap up the business's activities, ensuring compliance with legal obligations.

When dissolving a company, start by holding a formal vote among directors and shareholders to approve the decision. Next, prepare and file the District of Columbia Dissolution Package to Dissolve Corporation to make it official. You should also settle any debts, notify stakeholders, and distribute remaining assets. This ensures a smooth closure of your business operations.

To notify the IRS of the dissolution of your corporation, you must file your final tax return for the year in which you dissolve. Ensure you indicate that it is your final return by checking the appropriate box on the form. Additionally, providing documentation of the dissolution, such as the District of Columbia Dissolution Package to Dissolve Corporation, can help clarify your status. This step is essential for closing your tax obligations with the IRS.

Canceling your business license in Washington, D.C., entails a series of straightforward actions. You must contact the appropriate licensing authority and fulfill any pending requirements. The District of Columbia Dissolution Package to Dissolve Corporation is a valuable resource that helps guide you through each necessary step to ensure your cancellation is executed properly.

To cancel your D.C. business license, file a formal cancellation request with the appropriate office. Ensure that you handle any remaining obligations related to your business. Utilizing the District of Columbia Dissolution Package to Dissolve Corporation provides you with detailed steps and forms to facilitate this cancellation without complications.