An escrow may be terminated according to the escrow agreement when the parties have performed the conditions of the escrow and the escrow agent has delivered the items to the parties entitled to them according to the escrow instructions. An escrow may be prematurely terminated by cancellation after default by one of the parties or by mutual consent. An escrow may also be terminated at the end of a specified period if the parties have not completed it within that time and have not extended the time for performance.

California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow

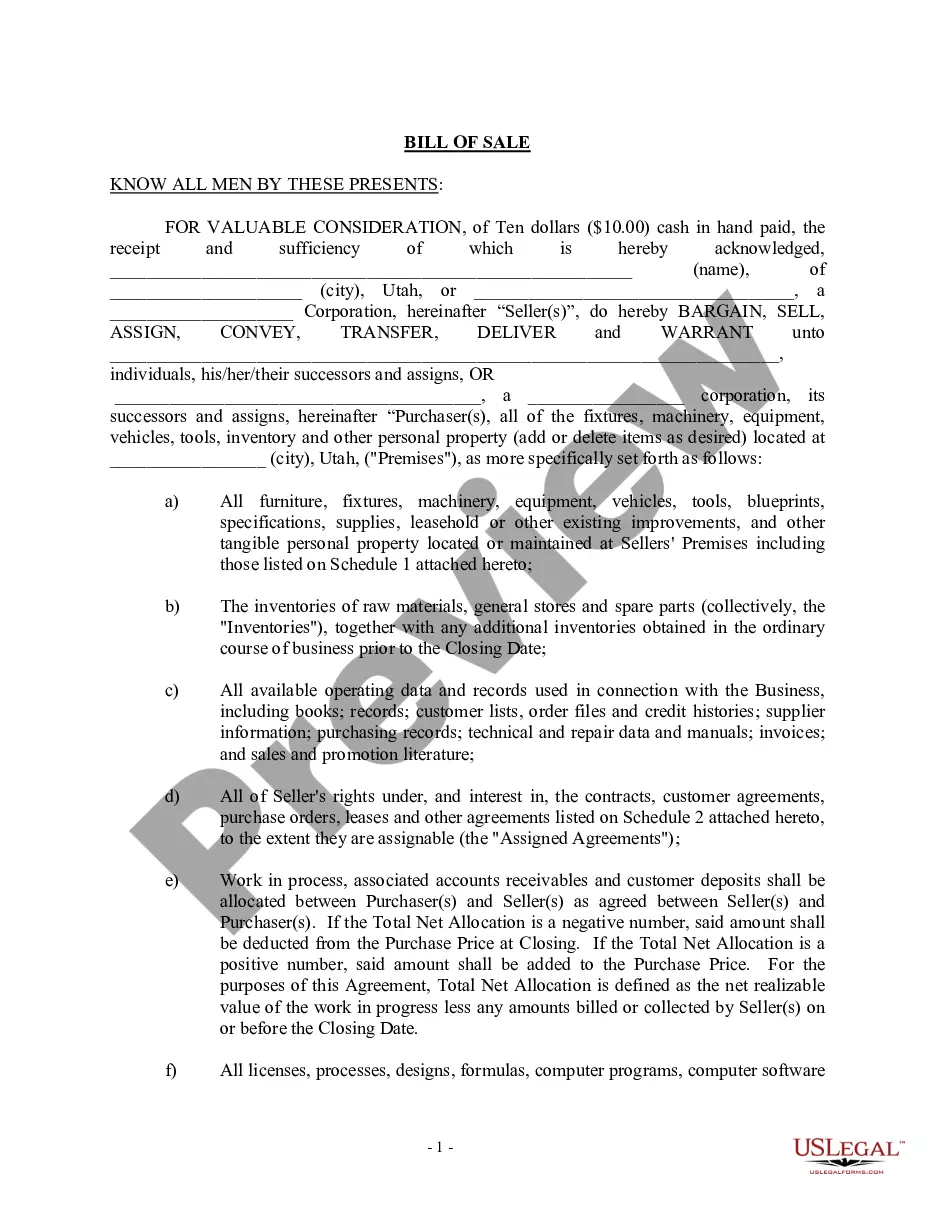

Description

How to fill out Instructions To Title Company To Cancel Escrow And Disburse The Funds Held In Escrow?

Finding the correct legal document template can be a challenge. There are numerous templates available online, but how do you locate the legal form you require.

Utilize the US Legal Forms platform. The service offers a vast array of templates, including the California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow, suitable for both business and personal use. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to access the California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow. Use your account to browse through the legal forms you have purchased previously. Navigate to the My documents section in your account and obtain another copy of the document you need.

US Legal Forms is the largest repository of legal documents where you can find various file templates. Leverage the service to obtain professionally crafted documents that adhere to state regulations.

- First, ensure you have selected the correct form for your city/state. You can review the document using the Preview button and read the description to confirm it meets your requirements.

- If the form does not suit your needs, use the Search field to find the appropriate document.

- Once you are certain that the form is right, click the Buy now button to purchase the form.

- Choose your preferred payment option and enter the necessary information. Create your account and complete the payment using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Fill out, edit, print, and sign the downloaded California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow.

Form popularity

FAQ

An escrow letter of credit is a financial instrument that guarantees a third-party payment under specific conditions. Essentially, it serves as a safety net ensuring that funds will be available for disbursement upon meeting agreed-upon obligations. Understanding the implications of an escrow letter of credit is necessary when utilizing the California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow.

A letter of instruction is a document that directs how to manage a particular situation or transaction related to escrow services. It provides clear details on what actions should be taken by the escrow agent concerning the funds or assets involved. When dealing with California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow, this letter is paramount for executing your wishes accurately.

Withdrawing from escrow involves submitting a request to the escrow agent or title company, detailing your intention to cancel the escrow. You must follow specified procedures outlined in your escrow instructions and any relevant agreements. In California, the California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow guide you through this process to ensure a smooth withdrawal.

Escrow instructions are detailed guidelines that tell the escrow agent how to manage the funds and responsibilities during a transaction. These instructions outline the conditions that must be satisfied before the agent can release the funds or assets. In California, adhering to the California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow is vital to ensure both parties fulfill their obligations properly.

The letter of instruction for escrow is a formal document that specifies how the funds in escrow should be handled. This letter directs the title company or escrow agent to take specific actions, such as disbursing funds or canceling the escrow. When you utilize the California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow, this letter becomes essential in guiding the transaction process smoothly.

An escrow letter is a document that outlines the terms and conditions under which funds or assets are held in escrow. This letter serves as a guide for the title company or escrow agent. Essentially, it is part of the broader process to ensure proper management during transactions. In the context of California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow, the letter plays a critical role in providing clarity to all parties involved.

Escrow often takes around 30 days in California due to the time needed to complete inspections, appraisals, and necessary paperwork. Many factors contribute to this timeframe, including negotiations and securing financing. If you’re looking to expedite or understand your options, refer to the California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow.

Yes, sellers can back out of escrow in California, but it typically requires a valid reason as outlined in the contract. If both parties agree, they can mutually cancel the escrow. Ensure you review the California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow for instructions on how to proceed effectively.

California's escrow law mandates that all funds involved in the transaction be held by a neutral third party. This protects both the buyer and seller while ensuring proper compliance with regulatory standards. For anyone looking to navigate the complexities, refer to the California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow for practical assistance.

To cancel an escrow in California, you generally need to submit a written request to your title company. Provide all relevant details about the escrow, including the escrow number and the parties involved. It’s beneficial to consult the California Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow for a comprehensive overview of the process.