Illinois Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

Are you currently located in a situation where you need documents for either business or personal purposes on a daily basis.

There are various legal document templates available online, but finding trustworthy forms isn’t easy.

US Legal Forms provides thousands of document templates, such as the Illinois Nonqualified Defined Benefit Deferred Compensation Agreement, designed to meet federal and state regulations.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Illinois Nonqualified Defined Benefit Deferred Compensation Agreement at any time if needed. Simply click the required form to download or print the template.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Illinois Nonqualified Defined Benefit Deferred Compensation Agreement template.

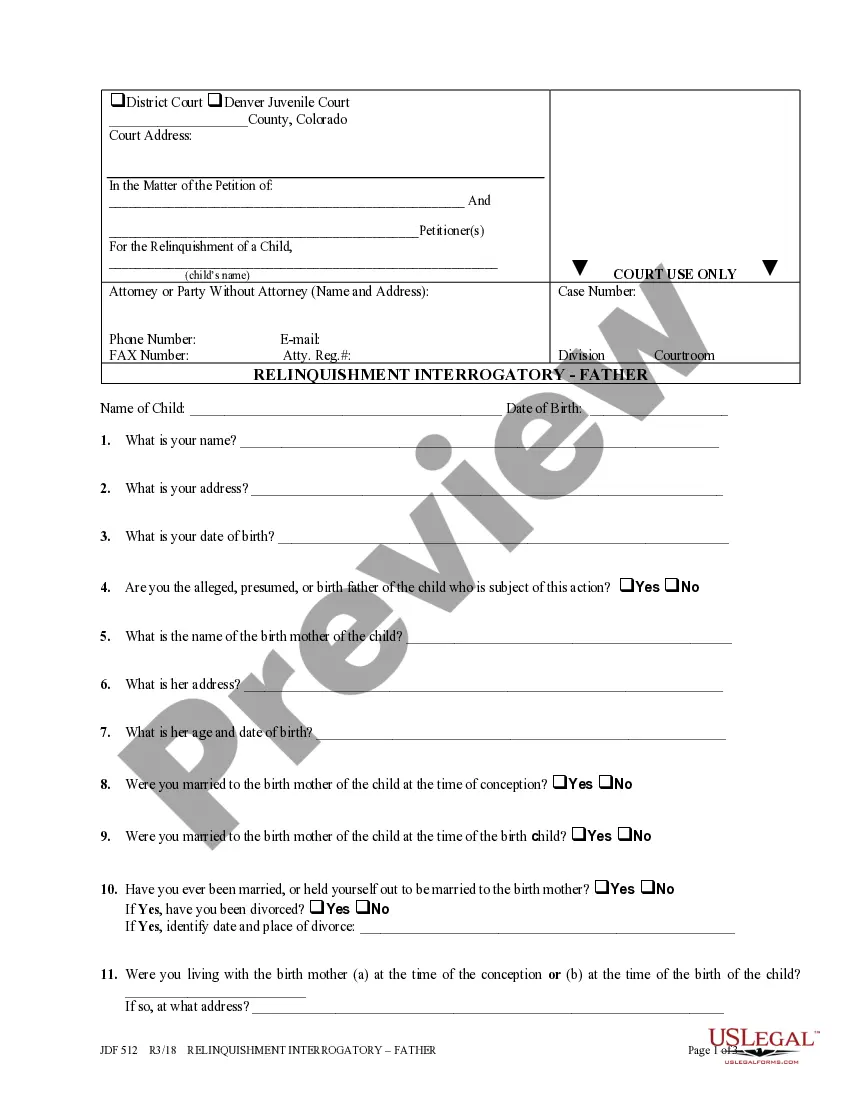

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it matches the correct city/state.

- Use the Review button to examine the form.

- Check the description to verify that you have selected the right document.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that fulfills your needs and requirements.

- Once you find the correct form, click on Get now.

- Select the pricing plan you desire, provide the necessary information to create your account, and pay for your order using PayPal or credit card.

Form popularity

FAQ

While nonqualified deferred compensation is often derived from your salary, it is not recognized as earned income until you receive it. This distinction is significant for tax purposes and understanding your overall financial strategy. The Illinois Nonqualified Defined Benefit Deferred Compensation Agreement allows for careful planning to maximize potential tax benefits down the line.

A 401k plan is a qualified retirement savings option that typically has contribution limits and tax advantages. In contrast, a deferred compensation plan, like the Illinois Nonqualified Defined Benefit Deferred Compensation Agreement, allows for higher contribution limits and does not offer immediate tax benefits. Understanding these differences can help you choose the right plan for your retirement goals.

Participating in a nonqualified deferred compensation plan can be advantageous if you're looking for additional retirement savings options beyond traditional methods. It allows you to save more while deferring taxation on that income. The Illinois Nonqualified Defined Benefit Deferred Compensation Agreement can be a strong choice for people who anticipate being in a higher tax bracket in the future.

qualified deferred compensation arrangement permits employees to defer a portion of their earnings to a future date, usually retirement. Unlike qualified plans, these arrangements do not have to adhere to strict IRS requirements, thus offering more options. With the Illinois Nonqualified Defined Benefit Deferred Compensation Agreement, participants can enjoy the benefits of structured savings and potential tax advantages.

A nonqualified deferred compensation arrangement is a financial plan that allows you to postpone income until a later date. This type of agreement is not subject to the same regulations as qualified plans, giving you more flexibility in how you save for retirement. The Illinois Nonqualified Defined Benefit Deferred Compensation Agreement is a specific example that provides benefits tailored to your unique financial situation.

To set up an Illinois Nonqualified Defined Benefit Deferred Compensation Agreement, begin by consulting with a tax advisor or financial planner. They can guide you through compliance requirements and necessary documentation. Once you establish the plan terms and structure, it is essential to communicate the benefits to participating employees, ensuring they understand how the plan can support their financial goals.

A nonqualified deferred compensation plan is an agreement that enables employees to defer a portion of their earnings to a later date, often until retirement. The Illinois Nonqualified Defined Benefit Deferred Compensation Agreement is tailored to provide benefits beyond standard retirement plans, allowing for greater contribution limits and custom benefit formulations. These plans effectively help employees manage their tax liabilities and plan for future financial needs.

An example of a nonqualified deferred compensation plan is the Illinois Nonqualified Defined Benefit Deferred Compensation Agreement, which allows specific employees to set aside a portion of their income for future distribution. This arrangement often includes features such as investment options and payout schedules to meet the needs of the employee. It is a powerful tool for individuals seeking to enhance their retirement strategy.

Yes, Illinois Nonqualified Defined Benefit Deferred Compensation Agreements can be an excellent choice for high earners looking to save additional funds for retirement. These plans allow employees to defer income and taxes until retirement, promoting long-term savings. Plus, they provide flexibility in benefit design, allowing for tailored solutions that fit individual financial goals.

In Illinois, certain types of retirement income are not taxable, including Social Security benefits and some pensions. This can provide you with more options when planning your retirement income strategy. Understanding these nuances can help you optimize your financial future, especially if you have an Illinois Nonqualified Defined Benefit Deferred Compensation Agreement in place.