Illinois Deferred Compensation Agreement - Long Form

Description

How to fill out Deferred Compensation Agreement - Long Form?

You can dedicate hours online searching for the proper legal document format that meets both federal and state requirements you need. U.S. Legal Forms offers a vast array of legal templates that have been reviewed by experts.

You can download or print the Illinois Deferred Compensation Agreement - Long Form from their services.

If you possess a U.S. Legal Forms account, you can Log In and click the Download button. Afterwards, you can complete, modify, print, or sign the Illinois Deferred Compensation Agreement - Long Form. Every legal document template you obtain is yours permanently. To get another copy of any purchased form, visit the My documents section and click the corresponding button.

Select the format of your document and download it to your device. Make changes to your document if needed. You can complete, modify, and sign and print the Illinois Deferred Compensation Agreement - Long Form. Download and print numerous document templates using the U.S. Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

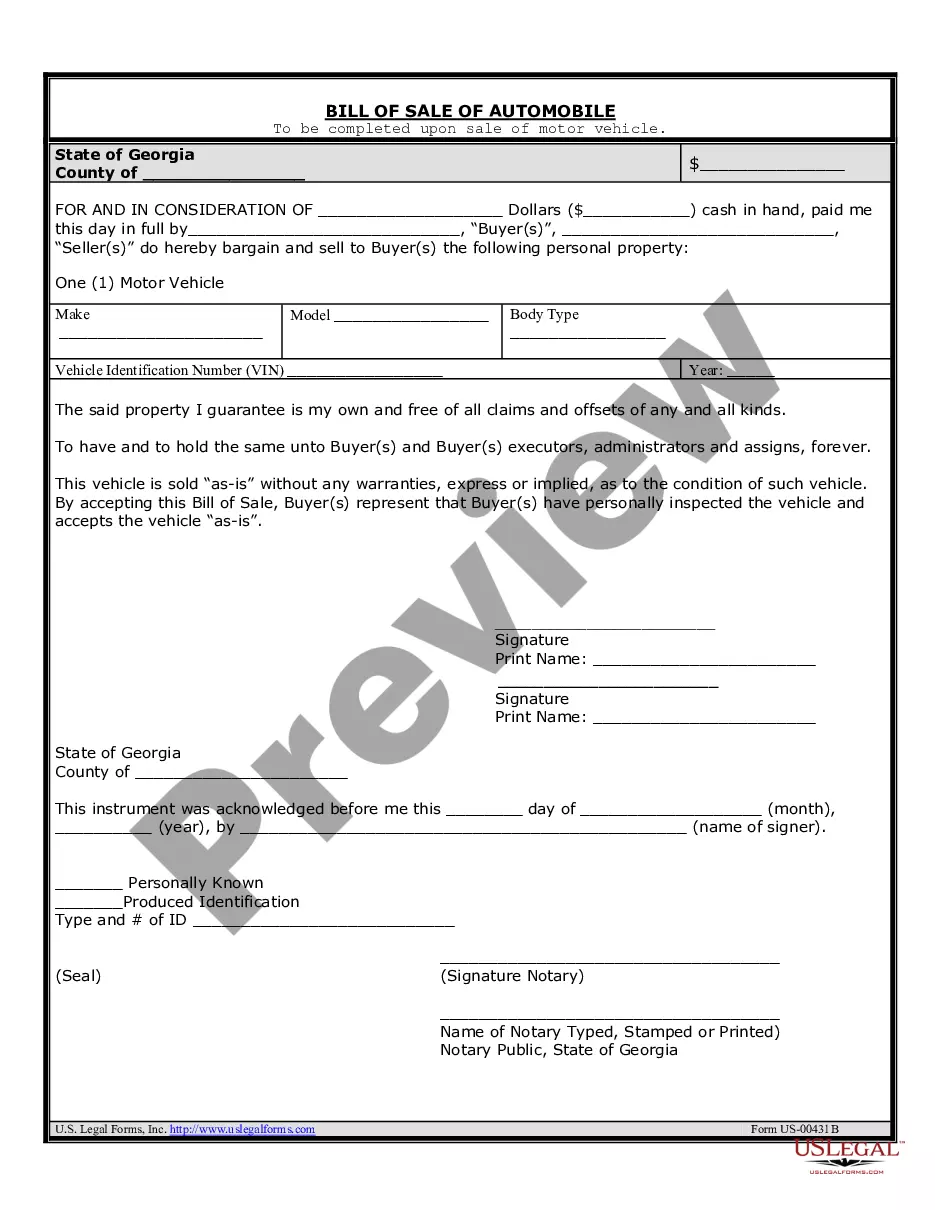

- First, ensure that you have chosen the correct document format for the county or city of your choice.

- Check the form description to confirm you have selected the appropriate template.

- If available, use the Review button to browse through the document template as well.

- If you wish to obtain another version of your template, use the Search field to find the format that suits your needs and requirements.

- Once you have found the template you want, click on Acquire now to continue.

- Select the pricing plan you prefer, enter your information, and sign up for a free account on U.S. Legal Forms.

- Complete the purchase. You can use your credit card or PayPal account to pay for the legal document.

Form popularity

FAQ

Deferred compensation itself is not taxable in Illinois until you withdraw the funds. This means you can reduce your current taxable income while saving for your future. However, when you take distributions from your Illinois Deferred Compensation Agreement - Long Form, they will be considered taxable income. It's essential to understand these tax implications as you plan your financial strategy.

Yes, an Illinois Deferred Compensation Agreement - Long Form can be a smart financial choice. It allows you to save for retirement while potentially reducing your taxable income. Moreover, these plans often provide growth opportunities based on investments, leading to increased savings over time. As you evaluate your financial future, this option might offer you the flexibility and benefits you need.

To set up an Illinois Deferred Compensation Agreement - Long Form, first, check with your employer for available options or providers. After that, fill out the required forms and designate how much you want to contribute from each paycheck. Make sure to keep copies of your documents for your records. Additionally, consider utilizing tools available on the uslegalforms platform to simplify the setup process.

Starting an Illinois Deferred Compensation Agreement - Long Form is a straightforward process. Begin by reviewing your employer's available plans and selecting one that fits your needs. Next, complete the necessary paperwork and establish your contribution amount. Finally, make sure to monitor your investments periodically to ensure they align with your long-term financial goals.

When considering an Illinois Deferred Compensation Agreement - Long Form, it's essential to assess your financial situation. Typically, setting aside 5% to 10% of your paycheck is advisable, but this can vary based on personal goals and expenses. By contributing consistently, you can build a substantial nest egg over time. Remember, each individual's situation is unique, so consult with a financial advisor if you're unsure.

To avoid paying taxes on deferred compensation, you can utilize specific tax-deferred investment options offered by your plan. Timing your withdrawals strategically can also help you manage your tax exposure when you take distributions. Working with an Illinois Deferred Compensation Agreement - Long Form provides clarity on tax implications and helps you develop a strategy to minimize your tax obligations effectively.

The amount you should contribute to your deferred compensation plan depends on your financial goals, income, and retirement needs. Generally, experts recommend contributing as much as you can afford while still maintaining a balanced budget. Exploring options with an Illinois Deferred Compensation Agreement - Long Form enables you to calculate ideal contribution levels based on your specific financial situation.

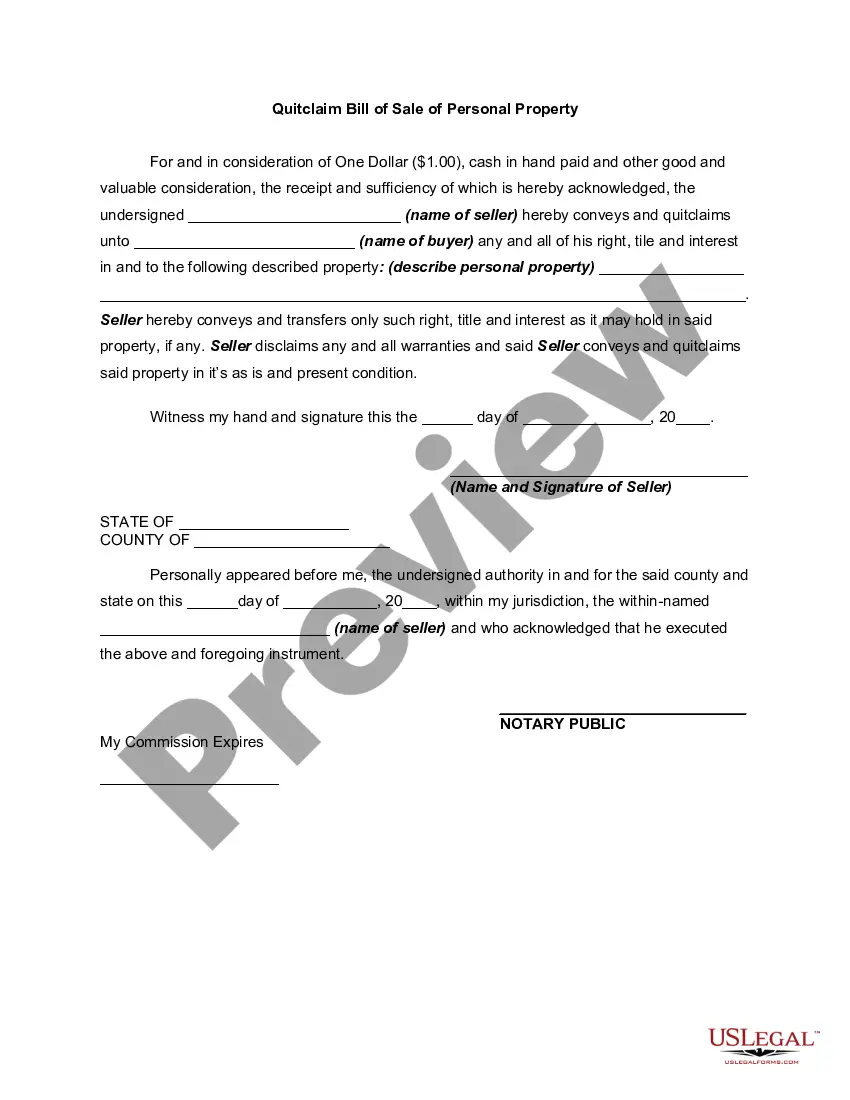

A typical deferred compensation plan allows employees to set aside a portion of their income for future payment, usually after retirement. These plans can take various forms, such as salary deferral or bonuses, and may include investment options. Utilizing an Illinois Deferred Compensation Agreement - Long Form helps you structure these payments properly, ensuring you maximize your financial growth.

The 10 year rule for deferred compensation states that some plans require distributions to be made over a period of ten years after the employee's separation from service. This allows employees to manage their income and tax liability more effectively. With an Illinois Deferred Compensation Agreement - Long Form, understanding these rules is essential to plan your finances and make the most of your retirement benefits.

The federal tax rate for deferred compensation depends on your overall income during the year you withdraw funds. Generally, amounts taken from an Illinois Deferred Compensation Agreement - Long Form are taxed as ordinary income when distributed. It is advisable to consider your tax implications carefully to optimize your financial strategy.