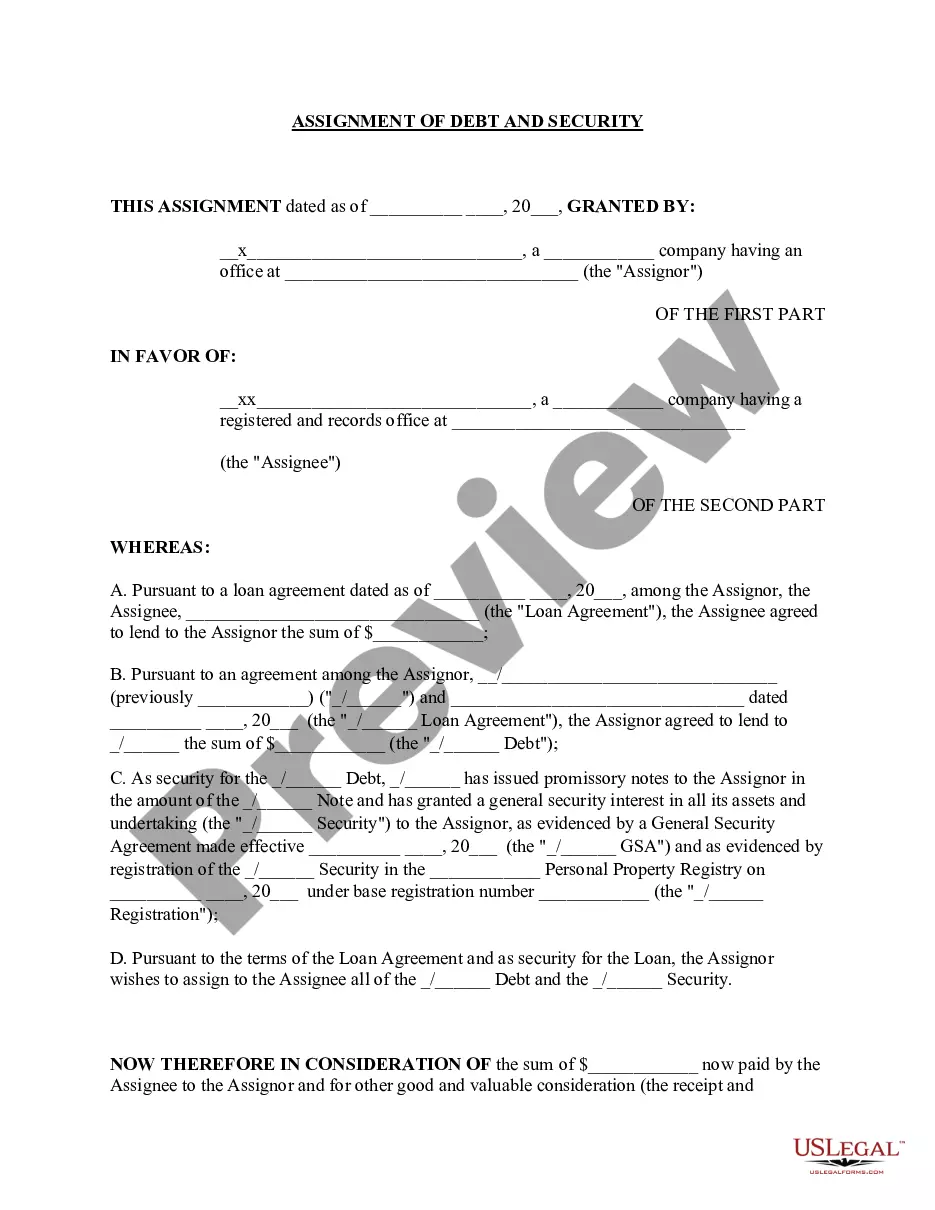

Assignment of Debt

Description

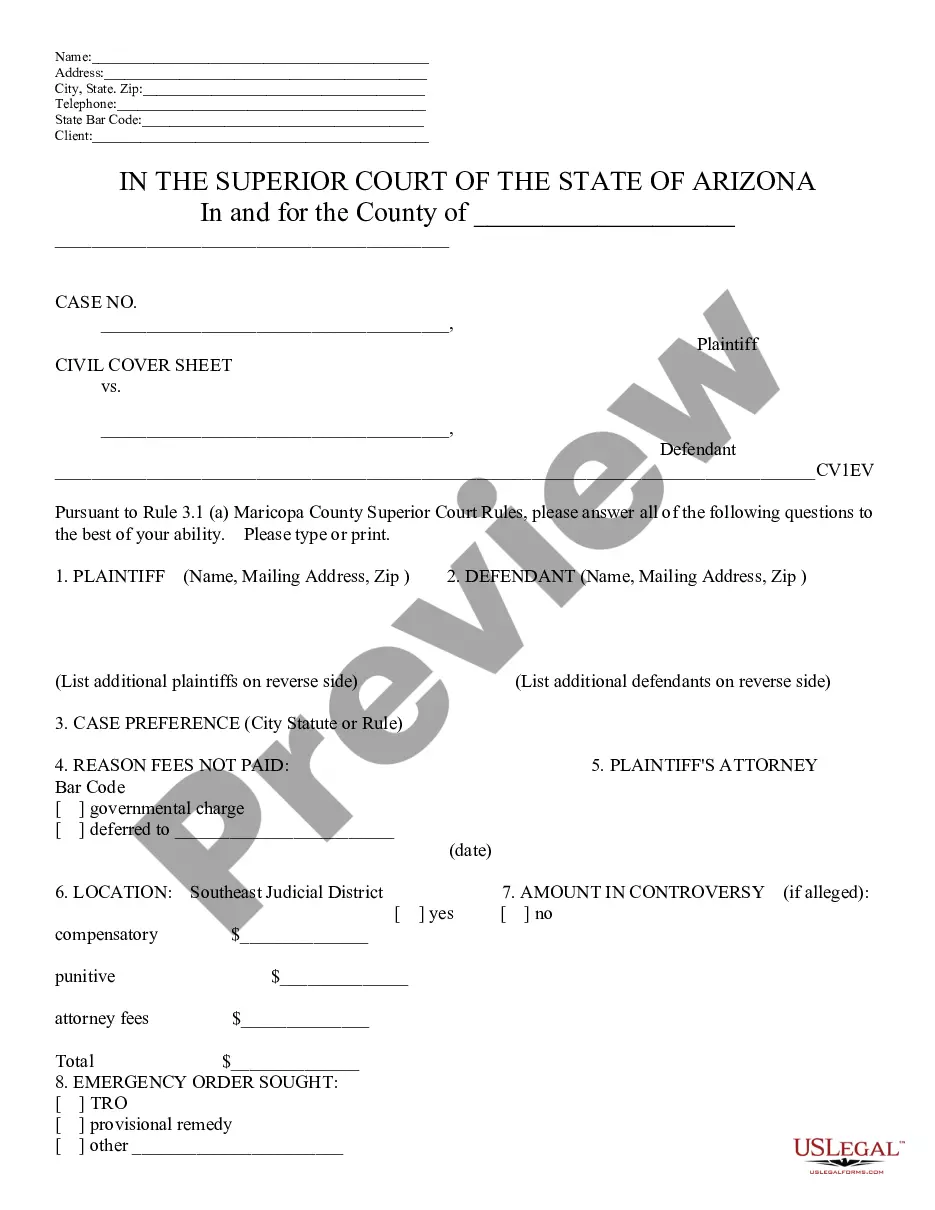

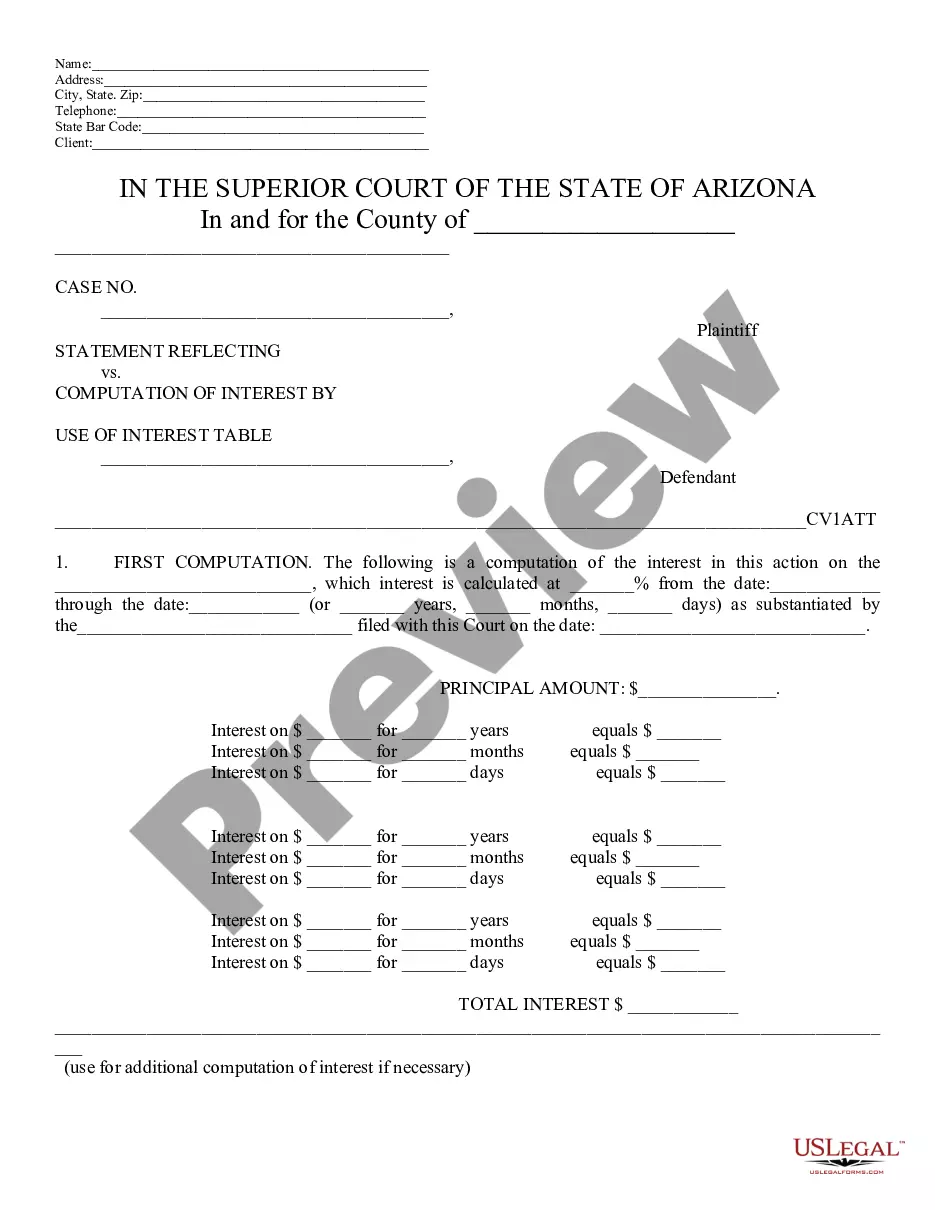

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Assignment Of Debt?

Aren't you sick and tired of choosing from numerous templates each time you want to create a Assignment of Debt? US Legal Forms eliminates the wasted time countless Americans spend browsing the internet for ideal tax and legal forms. Our skilled crew of lawyers is constantly upgrading the state-specific Forms library, so that it always offers the right files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have a subscription should complete simple actions before being able to get access to their Assignment of Debt:

- Utilize the Preview function and read the form description (if available) to make certain that it’s the proper document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate sample for your state and situation.

- Use the Search field on top of the page if you have to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your document in a convenient format to finish, create a hard copy, and sign the document.

As soon as you’ve followed the step-by-step instructions above, you'll always be capable of sign in and download whatever file you need for whatever state you need it in. With US Legal Forms, completing Assignment of Debt samples or other official files is simple. Get going now, and don't forget to look at your examples with accredited attorneys!

Form popularity

FAQ

When you sign a credit agreement there will have been a clause within the fine print. This will have stated that they are able to assign their rights to a third party. As you have signed for this, they do not need to ask your permission to 'sell' the debt and you are unfortunately unable to dispute it.

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.

The Debt Settlement Agreement is a contract signed between a creditor and debtor to re-negotiate or compromise on a debt. This is usually in the case when an individual wants to make a final payment for a debt that is owed.

It is not uncommon for a creditor (assignor) to transfer their right to receive payment of a debt (assignment) to a third party (assignee).The assignee of the debt can issue to the debtor company a statutory demand for the payment of the debt if the debt exceeds the statutory minimum, which is currently $2,000.

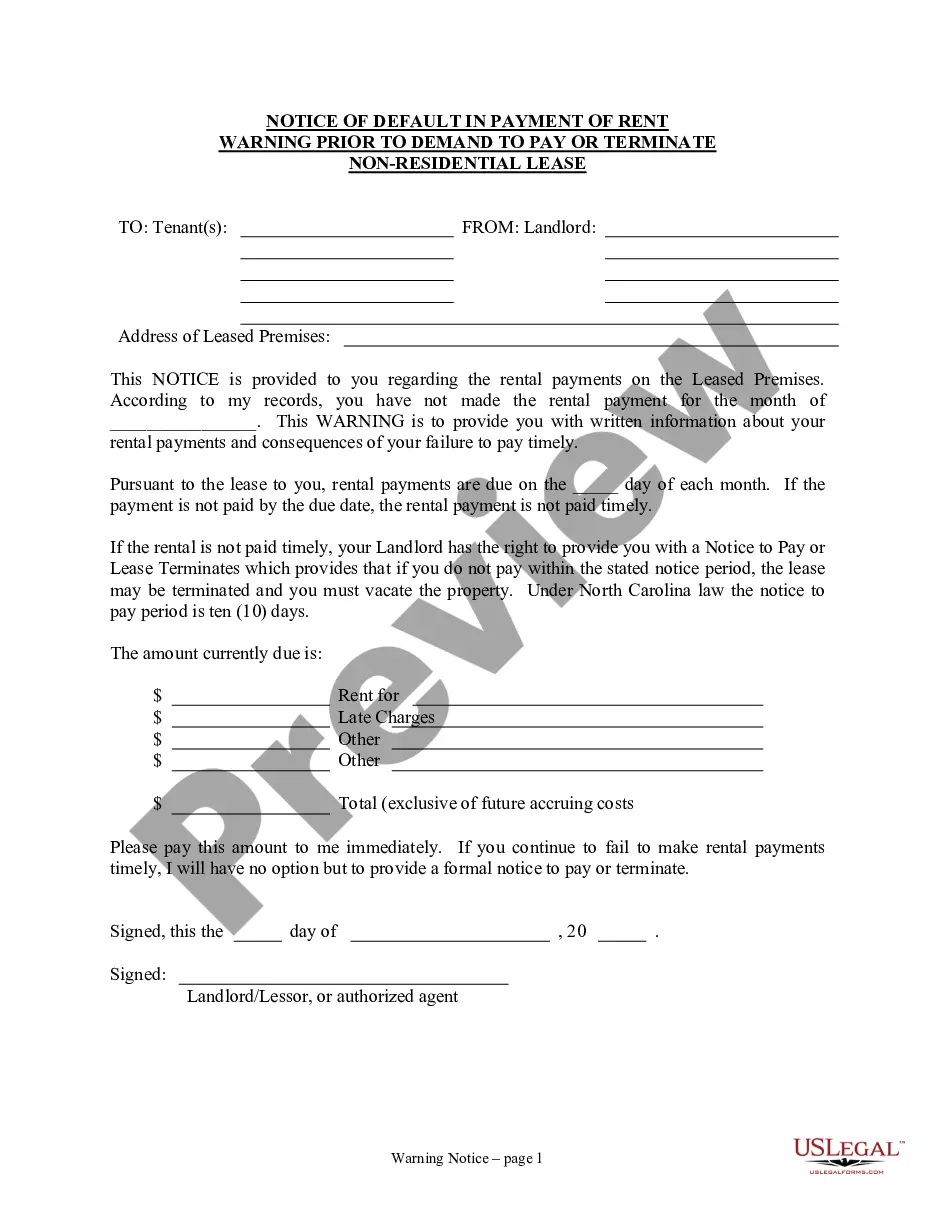

A Notice of Assignment is used to inform debtors that a third party has 'purchased' their debt. The new company (assignee) takes over collection procedures, but can sometimes hire a debt collection agency to recover the money on their behalf. There are two types of debt assignment: Legal Assignment.

Original creditor and collection agent's company name. Date the letter was written. Your name. Your account number. Outstanding balance owed on the account (optional) Amount agreed to as settlement. Terms and amounts of payments to be made (if not a lump-sum)

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

The creditor and/or debt collectors name. The date the letter was drafted. Your name. Your account number.