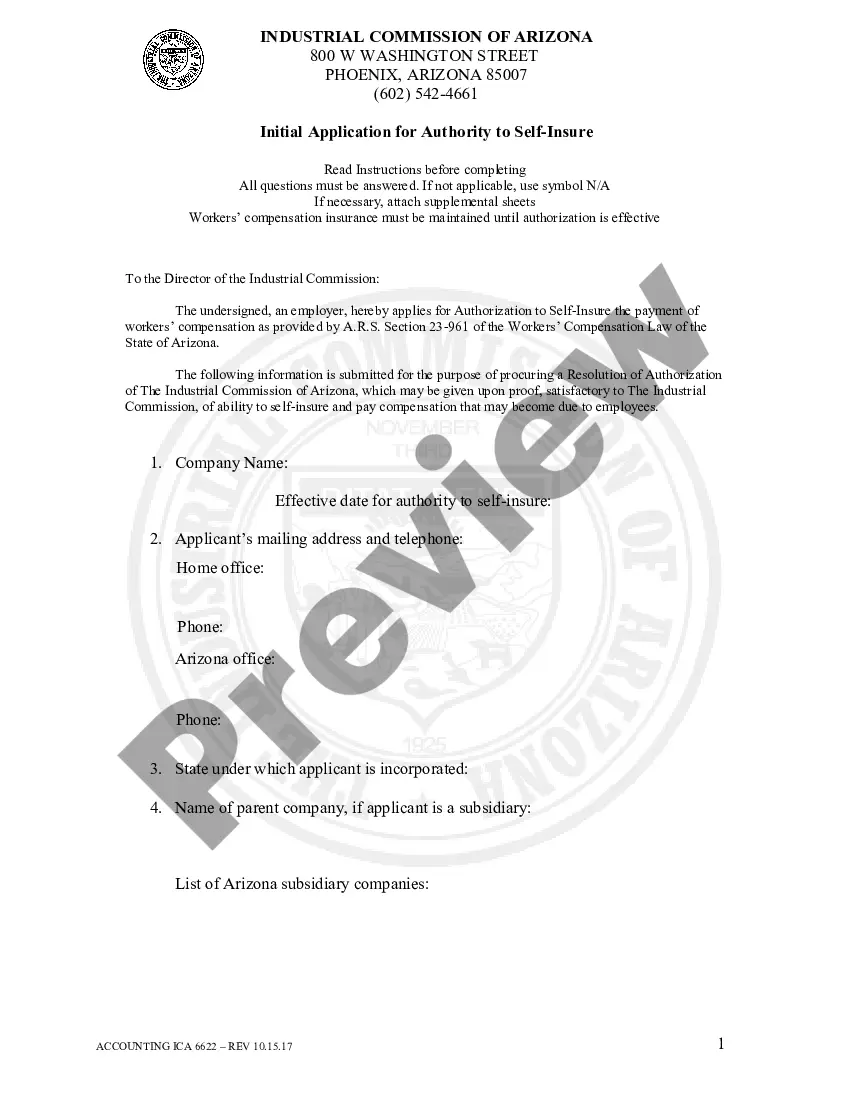

This is an official Workers' Compensation form for the state of Arizona.

Arizona Initial Pool Application For Authority To Self Insure

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Initial Pool Application For Authority To Self Insure?

If you are looking for accurate Arizona Application to Self-Insure Pool for Workers' Compensation forms, US Legal Forms is precisely what you require; acquire documents created and verified by state-certified attorneys.

Using US Legal Forms not only alleviates concerns regarding legal documents; furthermore, you save effort, time, and money! Downloading, printing, and submitting a professional document is considerably less costly than hiring a lawyer to handle it on your behalf.

And there you have it. In just a few straightforward steps, you will acquire an editable Arizona Application to Self-Insure Pool for Workers' Compensation. Once you create an account, any future orders will be processed even more efficiently. After obtaining a US Legal Forms subscription, simply Log In to your account and click the Download button located on the form's page. Later, when you wish to access this template again, you can always find it in the My documents section. Don't waste time sifting through numerous forms on various sites. Purchase professional templates from one reliable service!

- To begin, complete your registration process by providing your email and creating a password.

- Follow the instructions below to set up your account and obtain the Arizona Application to Self-Insure Pool for Workers' Compensation template to address your needs.

- Use the Preview feature or examine the document description (if available) to ensure that the form is suitable for you.

- Verify its validity in your jurisdiction.

- Click Buy Now to place an order.

- Choose a suggested payment option.

- Establish an account and pay using your credit card or PayPal.

Form popularity

FAQ

Yes, insurance is a requirement to register a car in Arizona. Drivers must provide proof of insurance coverage that meets state minimum requirements. Alternatively, if you self-insure, you need to have an approved Arizona Initial Pool Application For Authority To Self Insure, which shows you can cover potential liabilities.

You typically consider self-insuring when you have substantial assets to protect and a solid financial foundation. Additionally, if you find that traditional insurance premiums do not align with your budget or risk assessment, self-insuring may be viable. Submitting the Arizona Initial Pool Application For Authority To Self Insure is the first step toward this approach.

Yes, it is illegal not to have car insurance in Arizona. Drivers are required to have coverage that meets state minimums. If you choose to self-insure, you must complete the Arizona Initial Pool Application For Authority To Self Insure and meet specific financial criteria.

Yes, at one time, individuals were required to have health insurance under federal regulations. However, Arizona has its own health insurance marketplace providing various options. It’s wise to evaluate these options and determine what meets your needs without relying solely on federal mandates.

Yes, you can self-insure your car in Arizona. To do this, you must submit an Arizona Initial Pool Application For Authority To Self Insure. This application demonstrates your ability to cover potential losses without traditional insurance. Be sure to understand the financial responsibilities associated with self-insuring before making this decision.

Self-insurance poses several challenges, including the need for accurate risk assessment and sufficient capital to cover potential claims. Organizations must also maintain records effectively, ensuring compliance with state regulations. Successfully completing the Arizona Initial Pool Application For Authority To Self Insure can help clarify requirements and streamline this process.

Insurance can come with high costs, complex paperwork, and the challenge of navigating policy limitations. Premiums can increase unexpectedly, impacting budgets. Additionally, claims processes can be lengthy and frustrating, leaving businesses feeling unsupported. Understanding the Arizona Initial Pool Application For Authority To Self Insure may offer alternative solutions that better align with business goals.

Self-insurance is a risk management strategy where a business assumes its own risk rather than purchasing insurance from a provider. This means setting aside funds to cover potential losses or damages. The Arizona Initial Pool Application For Authority To Self Insure outlines the necessary steps for organizations looking to adopt this approach.

Self-service options can lead to confusion or mistakes without proper guidance or support. Users may find it challenging to navigate complex processes, resulting in wasted time or frustration. For those seeking clarity, platforms like US Legal Forms provide helpful resources to simplify the self-insurance application process.

Self-insurance can expose businesses to substantial financial risks if not managed correctly. Unexpected claims may arise, leading to significant out-of-pocket expenses that can strain company resources. Moreover, without proper risk assessment, organizations may find themselves inadequately prepared for larger, unforeseen claims.