Iowa Nonqualified Defined Benefit Deferred Compensation Agreement

Description

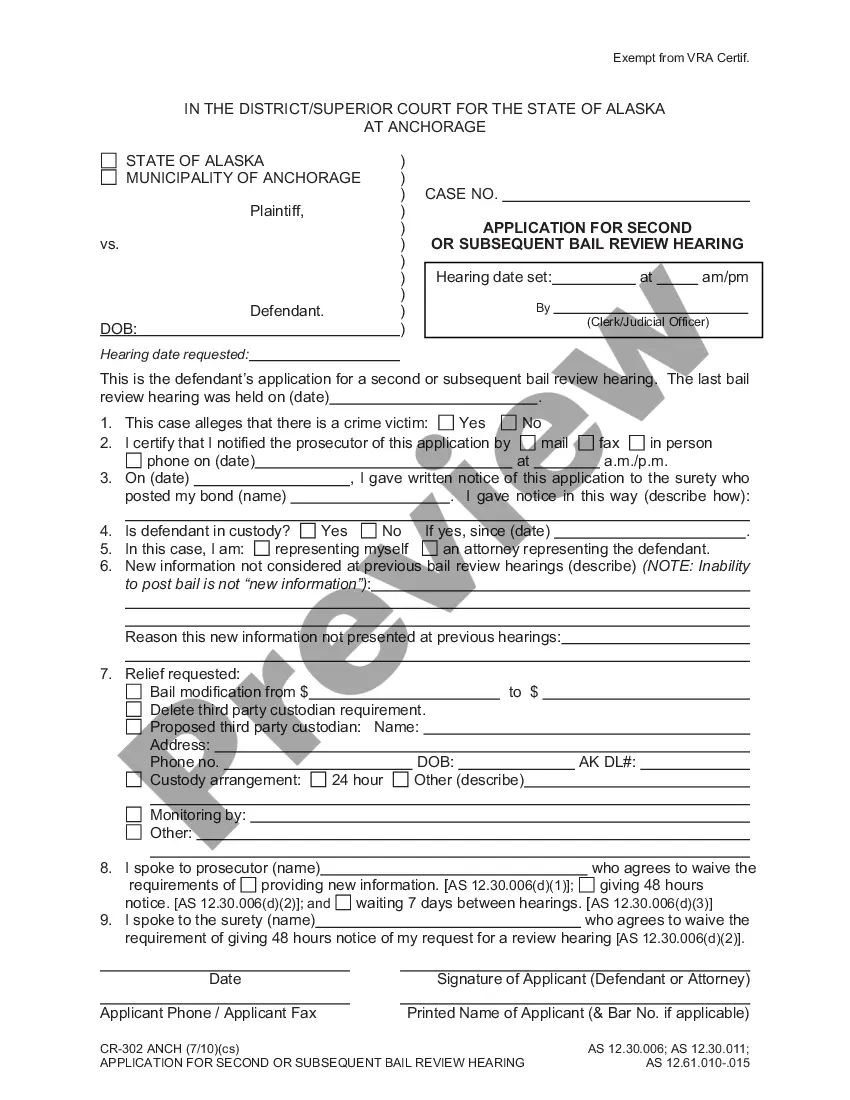

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

Selecting the optimal genuine document template can be challenging.

Certainly, there are multiple templates accessible online, but how can you locate the authentic version you seek.

Utilize the US Legal Forms website.

First, ensure you have chosen the correct form for your city/county. You can review the document using the Review button and examine the form summary to confirm it is right for you.

- The platform provides a vast array of templates, including the Iowa Nonqualified Defined Benefit Deferred Compensation Agreement, which you can utilize for business and personal purposes.

- All documents are evaluated by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Iowa Nonqualified Defined Benefit Deferred Compensation Agreement.

- Use your account to search for the official forms you have obtained previously.

- Navigate to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps to follow.

Form popularity

FAQ

Non-qualified deferred compensation plans, such as the Iowa Nonqualified Defined Benefit Deferred Compensation Agreement, do not require IRS approval before implementation. However, it's essential to ensure that these plans comply with tax regulations to avoid penalties. Consulting with professionals is a prudent choice to navigate compliance, ensuring your plan operates effectively within the legal framework.

In Iowa, certain types of retirement income, such as Social Security benefits and pension payouts, may not be subject to state income tax. Additionally, some retired individuals may qualify for specific exclusions based on income levels or age. It's wise to consult with a knowledgeable advisor regarding how your Iowa Nonqualified Defined Benefit Deferred Compensation Agreement fits into the broader scope of retirement income to ensure you minimize taxable amounts.

Line 14 on the Iowa Schedule 1 refers to the reporting of Iowa’s nonqualified deferred compensation income. This is where taxpayers must report any deferred compensation they have earned but have not yet received. Understanding how to report this income correctly is vital for maintaining compliance with Iowa tax laws, particularly when dealing with your Iowa Nonqualified Defined Benefit Deferred Compensation Agreement.

The 10 year rule for deferred compensation generally requires that employees must receive their deferred benefits no later than ten years after they stop working for the employer. This rule applies to nonqualified deferred compensation plans and ensures that employees cannot postpone their funds indefinitely. It is crucial to structure your Iowa Nonqualified Defined Benefit Deferred Compensation Agreement to align with these guidelines to optimize your tax benefits.

The 10 year rule stipulates that if you participate in a nonqualified deferred compensation plan, you must receive your benefits within ten years of separation from service. This rule ensures that you cannot defer income indefinitely, creating a clear timeline for benefit realization. It is essential to understand how this impacts your Iowa Nonqualified Defined Benefit Deferred Compensation Agreement. Compliance with this rule can help avoid unexpected tax consequences.

An employee typically must make a deferral election before the start of the calendar year in which they wish to defer income. This decision is often irrevocable and requires careful consideration of future income and tax implications. Knowing when to make this election can significantly affect your retirement planning. The Iowa Nonqualified Defined Benefit Deferred Compensation Agreement provides the framework for making these important decisions.

A notable disadvantage of a nonqualified deferred compensation plan is that it does not offer the same level of creditor protection as qualified plans. If your employer faces bankruptcy, your deferred amounts may be at risk. Additionally, since these plans are not regulated like other retirement accounts, you may face less oversight. It's important to consider these factors when evaluating an Iowa Nonqualified Defined Benefit Deferred Compensation Agreement.

A 401k plan is a qualified retirement plan that comes with strict regulations and contribution limits. In contrast, a deferred compensation plan is non-qualified, providing more flexibility regarding how much you can defer and when you can receive it. This difference allows you to tailor your retirement planning more effectively. Utilizing an Iowa Nonqualified Defined Benefit Deferred Compensation Agreement can clarify which option best suits your financial goals.

qualified deferred compensation arrangement allows employees to defer a portion of their income until a later date, usually at retirement. These plans are not subject to the same regulatory requirements as qualified plans, offering more flexibility in terms of contributions and payout structures. With an Iowa Nonqualified Defined Benefit Deferred Compensation Agreement, you can better navigate these arrangements. Always consult a financial advisor to understand the implications.

Participating in a nonqualified deferred compensation plan can be beneficial, especially for high earners looking to save more for retirement. This plan allows you to defer a portion of your income, which may lower your current tax burden. Consider your financial situation and retirement goals carefully. Using the Iowa Nonqualified Defined Benefit Deferred Compensation Agreement can help you make informed decisions.