Indiana Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

Selecting the optimal legal document design can be rather challenging.

Clearly, there are numerous templates accessible online, but how do you obtain the legal document you desire.

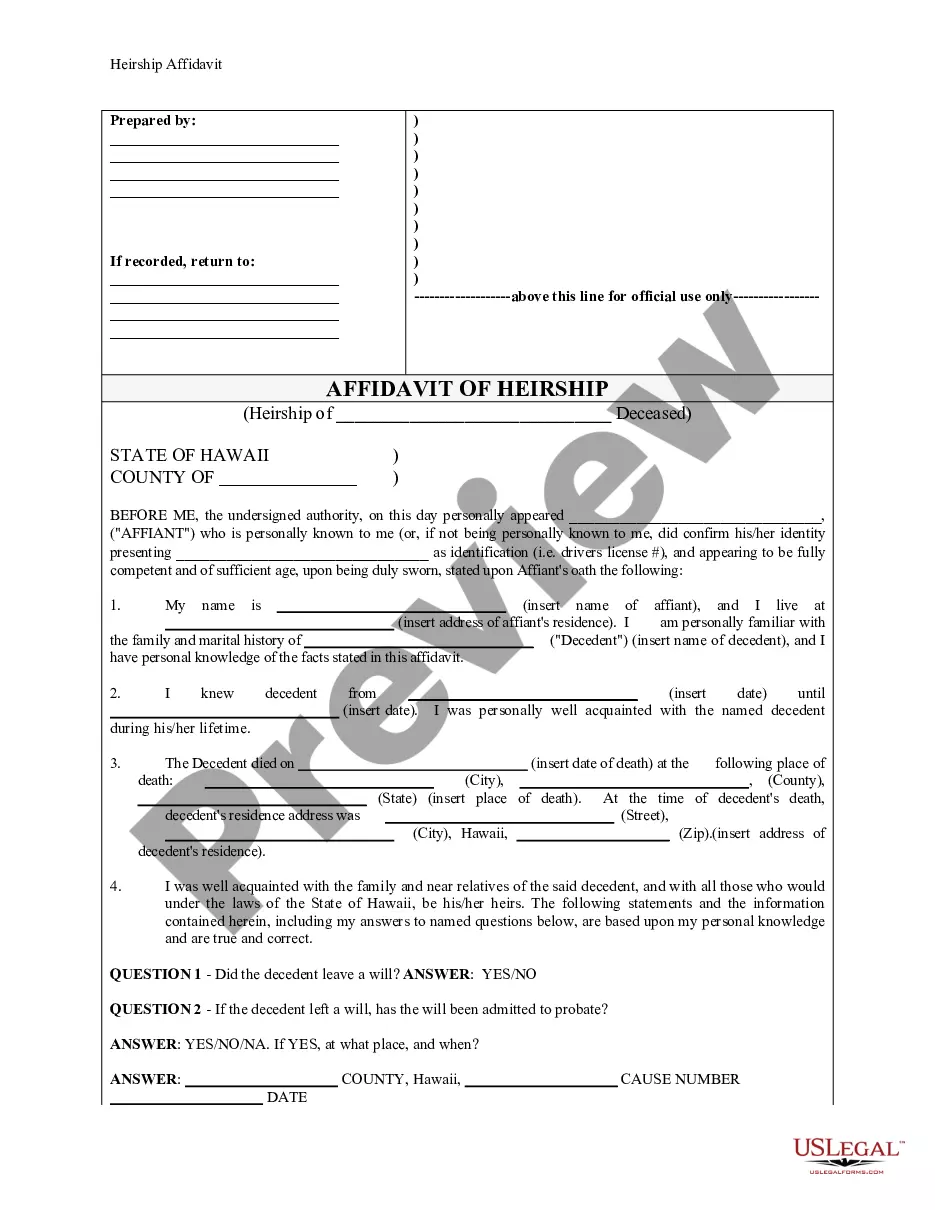

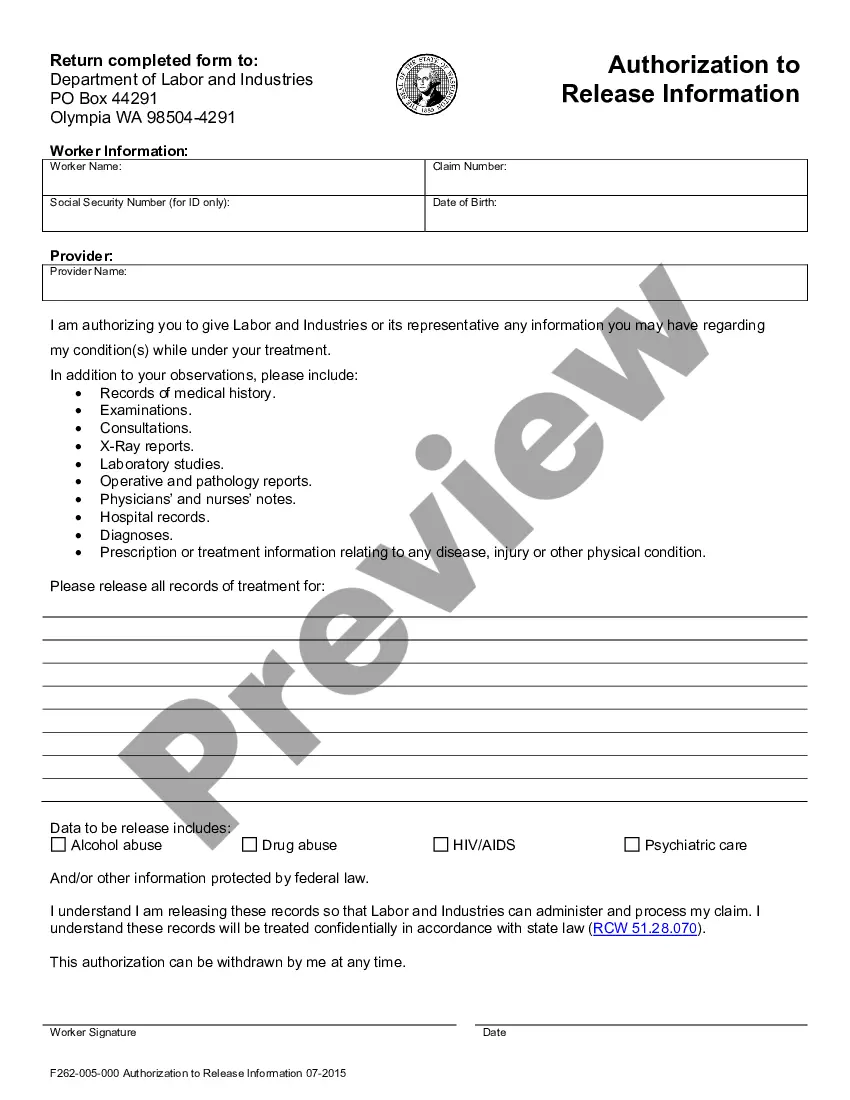

Utilize the US Legal Forms website. The service offers a vast array of templates, such as the Indiana Nonqualified Defined Benefit Deferred Compensation Agreement, which can be utilized for business and personal needs.

If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are certain the form is correct, click the Get now button to obtain the form. Choose the pricing plan you want and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document design to your device. Complete, edit, print and sign the acquired Indiana Nonqualified Defined Benefit Deferred Compensation Agreement. US Legal Forms is indeed the largest repository of legal forms where you can find numerous document templates. Utilize the service to obtain professionally-crafted documents that comply with state regulations.

- All of the templates are reviewed by experts and meet both federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to acquire the Indiana Nonqualified Defined Benefit Deferred Compensation Agreement.

- Use your account to browse through the legal documents you have previously purchased.

- Visit the My documents section of your account and obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the right form for your city/state. You can view the form using the Review button and read the form description to confirm it is suitable for you.

Form popularity

FAQ

A nonqualified deferred compensation arrangement is essentially a contractual agreement that permits employees to postpone receiving a portion of their earnings. Unlike traditional retirement plans, this type does not have federal contribution limits, making it appealing for high-earners. If you are exploring ways to enhance your retirement savings, an Indiana Nonqualified Defined Benefit Deferred Compensation Agreement may be an excellent option to consider.

qualified deferred compensation arrangement is a financial agreement between an employer and an employee that allows the employee to defer a part of their income until a later date. This arrangement is advantageous for executives and highly compensated employees as it often helps in tax planning. When considering such an agreement, specifically an Indiana Nonqualified Defined Benefit Deferred Compensation Agreement, make sure to evaluate its alignment with your longterm financial goals.

A 401k plan is a qualified retirement plan that offers tax advantages and follows strict contribution limits, while a deferred compensation plan allows for higher contribution amounts without those limits. Unlike 401k plans, funds in a deferred compensation plan are not protected from creditors, adding another layer of risk. Thus, understanding these differences is crucial if you're looking into options like an Indiana Nonqualified Defined Benefit Deferred Compensation Agreement.

The 10-year rule for nonqualified deferred compensation requires that distributions must occur at least 10 years after the deferral period ends. This rule was established as a part of tax laws aimed at preventing immediate taxation at the time of deferral. Therefore, if you're considering an Indiana Nonqualified Defined Benefit Deferred Compensation Agreement, you should be prepared for this timeline and plan your retirement strategy accordingly.

While nonqualified deferred compensation plans offer specific advantages, they also come with risks. For instance, funds in these plans are subject to the employer's creditors, potentially putting your savings at risk if the company faces financial issues. Additionally, you might face tax implications based on the timing of distributions. It's essential to weigh these disadvantages when considering an Indiana Nonqualified Defined Benefit Deferred Compensation Agreement.

Participating in a nonqualified deferred compensation plan can be a strategic move for your financial future. It allows you to set aside a portion of your income for retirement without the same contribution limits imposed on traditional plans. If you earn above the limits of qualified plans, this option can help you supplement your retirement income effectively. Consider consulting with a financial advisor to see how an Indiana Nonqualified Defined Benefit Deferred Compensation Agreement fits your goals.

An example of a nonqualified deferred compensation plan is the Indiana Nonqualified Defined Benefit Deferred Compensation Agreement. This agreement allows employers to offer additional retirement benefits to key employees beyond the limits set by qualified plans. These plans can be tailored to fit the needs of the organization and its executives, providing great flexibility. By utilizing this type of plan, companies can enhance their overall compensation strategies while retaining valuable talent.

To effectively setup a nonqualified deferred compensation plan, begin by identifying your company’s goals and objectives for the program. Then, engage legal professionals to create the Indiana Nonqualified Defined Benefit Deferred Compensation Agreement, ensuring it includes clear terms for contribution, vesting, and payout options. Finally, communicate the plan's details to eligible employees, emphasizing its benefits and potential impacts on their financial future.

Setting up an Indiana Nonqualified Defined Benefit Deferred Compensation Agreement involves several key steps. First, employers should outline eligibility criteria and plan benefits tailored to their workforce. Next, it's essential to work with legal and financial advisors to draft the plan documents, ensuring compliance with applicable laws while addressing the unique needs of the organization.

A nonqualified deferred compensation plan is a type of retirement plan that allows employers to provide additional compensation to select employees. Unlike qualified plans, these agreements are not subject to the same regulatory requirements, giving employers flexibility in design. The Indiana Nonqualified Defined Benefit Deferred Compensation Agreement specifically offers a secure way to plan for financial needs after employment.