Indiana Deferred Compensation Agreement - Short Form

Description

How to fill out Deferred Compensation Agreement - Short Form?

Are you presently situated in an area where you require documentation for possibly business or personal purposes almost every workday.

There is a multitude of legal document templates available online, but finding reliable forms can be challenging.

US Legal Forms offers a vast array of form templates, including the Indiana Deferred Compensation Agreement - Short Form, which can be completed to meet federal and state specifications.

Once you acquire the appropriate form, click on Buy now.

Select your desired pricing plan, complete the necessary information to create your account, and pay for the transaction using PayPal or credit card. Choose a convenient paper format and download your copy.

- If you are currently familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Indiana Deferred Compensation Agreement - Short Form template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the appropriate region/state.

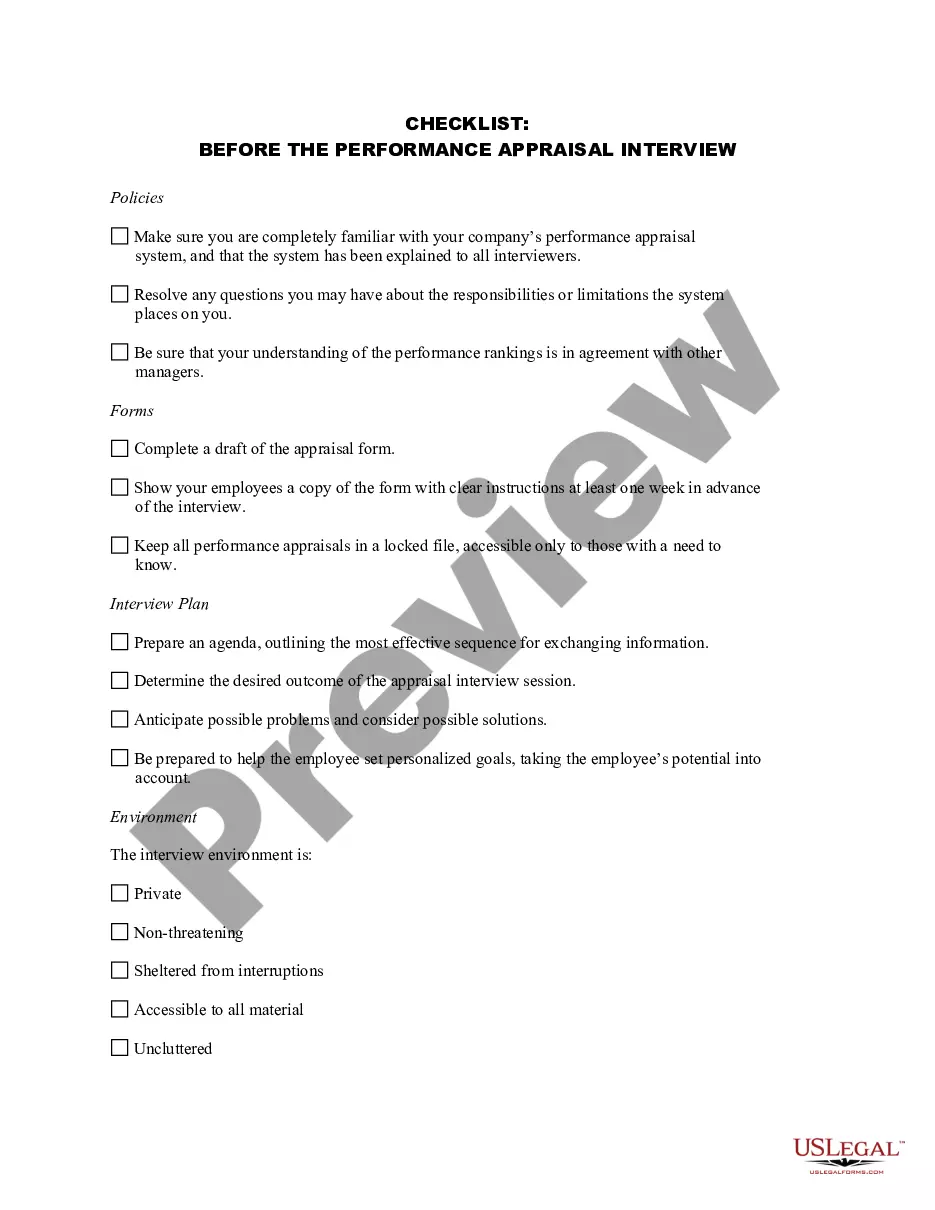

- Utilize the Preview button to review the form.

- Read the description to ensure that you have selected the correct form.

- If the form does not meet your requirements, use the Lookup field to find the form that aligns with your needs.

Form popularity

FAQ

PEBSCO is the largest, most experienced administrator of deferred compensation plans in the United States, serving over 2,500 government bodies with over 320,000 participants. In the State of Illinois PEBSCO administers plans for 65 jurisdictions.

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

The main distinguishing factor between 457 and 401(k) is how the retirement plan is offered. 457 plans are common in government entities such as state governments, as well as non-profit organizations. In contrast, 401(k)s are offered by private companies to their employees.

Deferred compensation plans are funded informally. There is essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

If you participate in a deferred compensation plan, you can contribute a portion of your salary to a retirement account. That money and any earnings you accumulate are not taxed until you withdraw them.

Deferred compensation plans come in two types qualified and non-qualified. Qualified retirement plans such as 401(k), 403(b) and 457 plans, are offered to all employees and are taxed when the contribution is made to the account.

A 457(b) plan is offered through your employer, and contributions are taken from your paycheck on a pre-tax basis, which lowers your taxable income. Unlike a 401(k) or 403(b), if you leave a job or retire before age 59½ and need to withdraw your retirement funds from a 457(b), you won't pay a 10% tax penalty.

Deferred compensation is a portion of an employee's compensation that is set aside to be paid at a later date. In most cases, taxes on this income are deferred until it is paid out. Forms of deferred compensation include retirement plans, pension plans, and stock-option plans.

You can take the distribution in a lump sum or regular installments, paying tax when you receive the income. You can also arrange to withdraw some of it when you anticipate a need, such as paying for your kids' college tuition. While the IRS has few restrictions, your employer will probably have their own rules.