Indiana Deferred Compensation Agreement - Long Form

Description

How to fill out Deferred Compensation Agreement - Long Form?

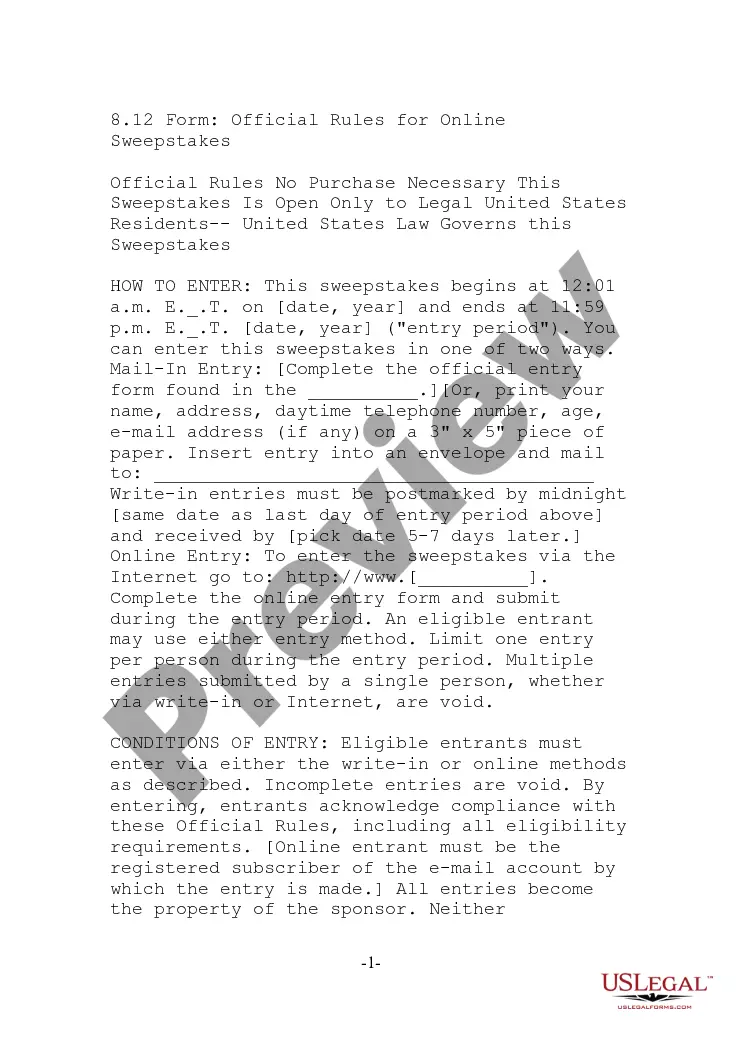

Finding the appropriate legal document template can be a challenge. Certainly, there are numerous templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Indiana Deferred Compensation Agreement - Long Form, which can be used for both business and personal purposes.

All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to get the Indiana Deferred Compensation Agreement - Long Form. Use your account to browse through the legal forms you have previously obtained. Go to the My documents section of your account to retrieve an additional copy of the document you need.

Complete, edit, print, and sign the acquired Indiana Deferred Compensation Agreement - Long Form. US Legal Forms is the largest collection of legal documents where you can find numerous document templates. Take advantage of the service to download professionally crafted paperwork that meets state requirements.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, confirm that you have selected the correct form for your city/state. You can view the form using the Preview option and read the form description to ensure it is indeed the right one for you.

- If the form does not suit your needs, use the Search box to find the correct form.

- Once you are convinced that the form is appropriate, click on the Purchase now button to obtain the form.

- Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the order using your PayPal account or credit card.

- Select the document format and download the legal document template on your device.

Form popularity

FAQ

Compensation. plan. A 457(b) plan for government employees is employer sponsored and allows you to contribute part of your salary toward your retirement savings while deferring taxes on that income. In some cases, employers may also contribute to the plan, also on a tax-deferred basis.

The basic limit on elective deferrals is $20,500 in 2022, $19,500 in 2020 and 2021, $19,000 in 2019, $18,500 in 2018, and $18,000 in 2015 - 2017, or 100% of the employee's compensation, whichever is less.

There are two main types of nonqualified deferred compensation plans from which small business owners may choose: supplemental executive retirement plans (SERPs) and deferred savings plans. These two options share several common characteristics, but there are also important differences between the two.

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

Deferred compensation is a portion of an employee's compensation that is set aside to be paid at a later date. In most cases, taxes on this income are deferred until it is paid out. Forms of deferred compensation include retirement plans, pension plans, and stock-option plans.

A deferred compensation plan is another name for a 457(b) retirement plan, or 457 plan for short. Deferred compensation plans are designed for state and municipal workers, as well as employees of some tax-exempt organizations. The content on this page focuses only on governmental 457(b) retirement plans.

What is a deferred compensation plan? A deferred compensation plan is another name for a 457(b) retirement plan, or 457 plan for short. Deferred compensation plans are designed for state and municipal workers, as well as employees of some tax-exempt organizations.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

Deferred compensation plans come in two types qualified and non-qualified. Qualified retirement plans such as 401(k), 403(b) and 457 plans, are offered to all employees and are taxed when the contribution is made to the account.

How does deferred compensation work? Your company will designate an amount you may defer and for how long you may defer that amountusually five years, 10 years or until you retire.