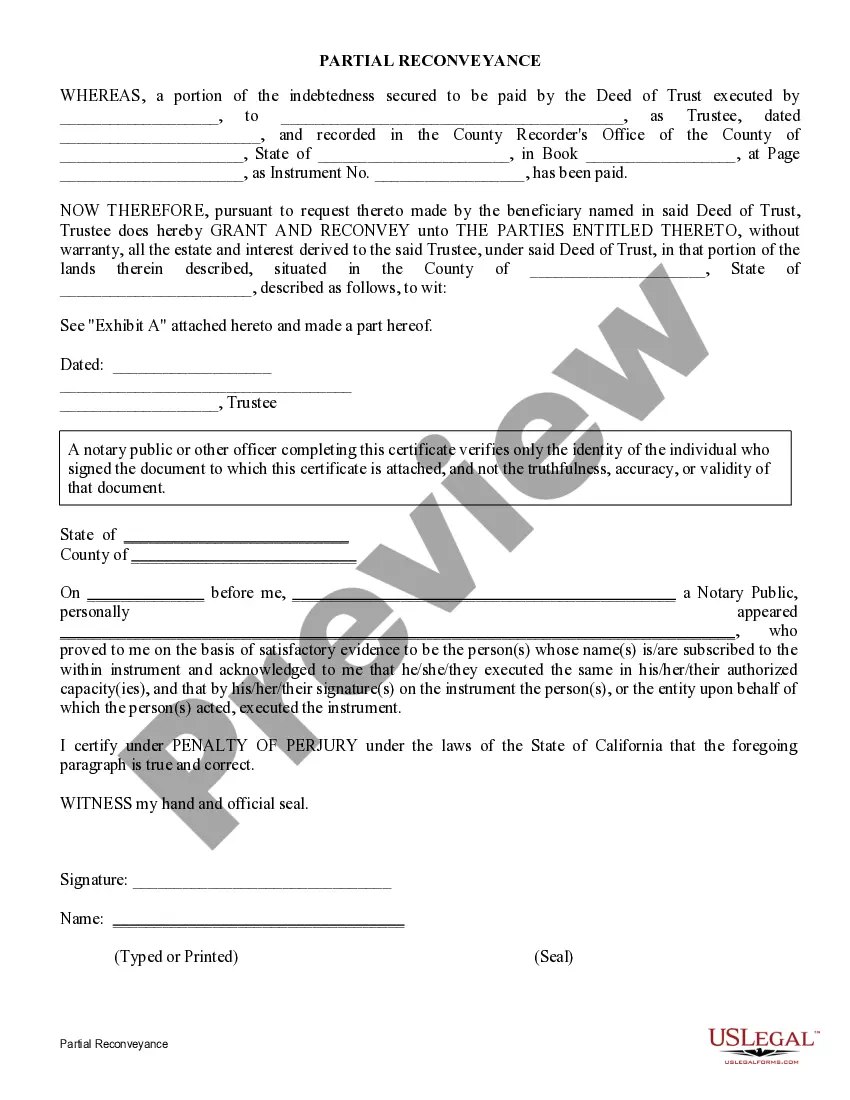

California Request for Full Re conveyance is a legal document used to transfer a deed of trust from a lender to the borrower after the loan has been paid in full. It is also known as a deed of reconveyance or reconveyance deed. This document is commonly used in California to release a borrower from the obligation of the loan and to indicate that the lien has been extinguished. It is recorded with the county recorder's office and serves as proof that the loan has been paid off. There are two types of California Request for Full Re conveyance: a Substitution of Trustee form and a Release of Deed of Trust form. The Substitution of Trustee form is used when a new trustee is appointed to the loan and the original trustee is released from the obligation. The Release of Deed of Trust form is used to release the deed of trust from the borrower and the lender and to discharge the loan obligation. Once the California Request for Full Re conveyance is recorded with the county recorder's office, it is a legally binding document that indicates the loan has been paid in full and the lien has been extinguished.

California Request for Full Reconveyance

Description

How to fill out California Request For Full Reconveyance?

If you’re searching for a way to appropriately complete the California Request for Full Reconveyance without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every private and business situation. Every piece of documentation you find on our online service is designed in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Follow these straightforward guidelines on how to acquire the ready-to-use California Request for Full Reconveyance:

- Ensure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and select your state from the dropdown to find an alternative template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to save your California Request for Full Reconveyance and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it quickly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!

What Is A Reconveyance? A reconveyance is the return of a property's title ? sans mortgage lien ? to the original owner after they've fulfilled their obligations pursuant to the mortgage or deed of trust.

In a nutshell, the Substitution of Trustee and Deed of Reconveyance is a legal document that evidences security interest is being release by a lender. In most cases, the document shows that a loan has been paid off. Property owners may even receive this document if they have refinanced a loan.

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien. Most importantly, a deed of full reconveyance, known as a satisfaction of mortgage in some states, transfers title back to the borrower.

Generally, when the borrower pays off the loan, the Trustee will record a Reconveyance.

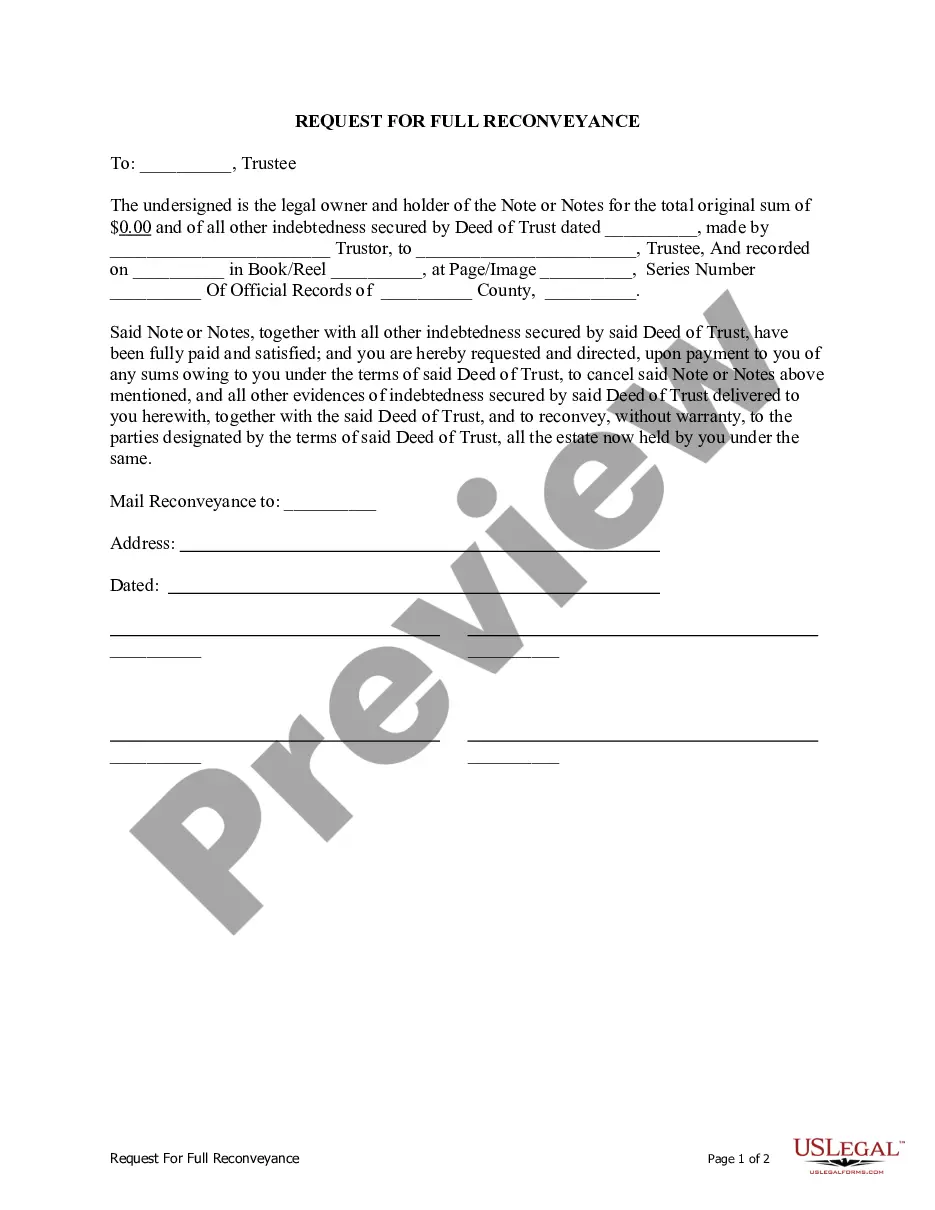

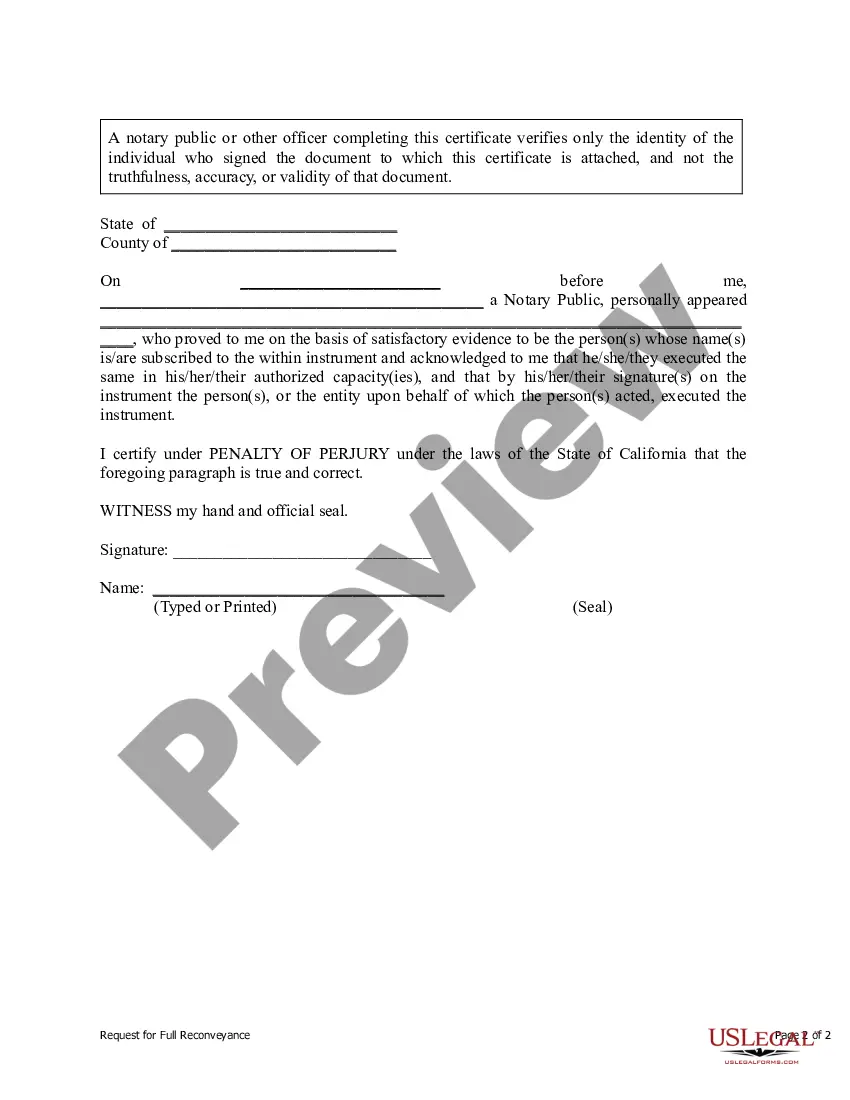

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

The trustor is the term used for the debtor purchasing the property, while the trustee is the title holder, often a bank or escrow company.

Once a loan has been paid off, and at the express direction of the lender (called the beneficiary), the trustee executes and delivers the deed of reconveyance to the trustor along with the original note (marked ?canceled? or ?paid in full?) and deed of trust.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.