California Application To Exceed Fee

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Application To Exceed Fee?

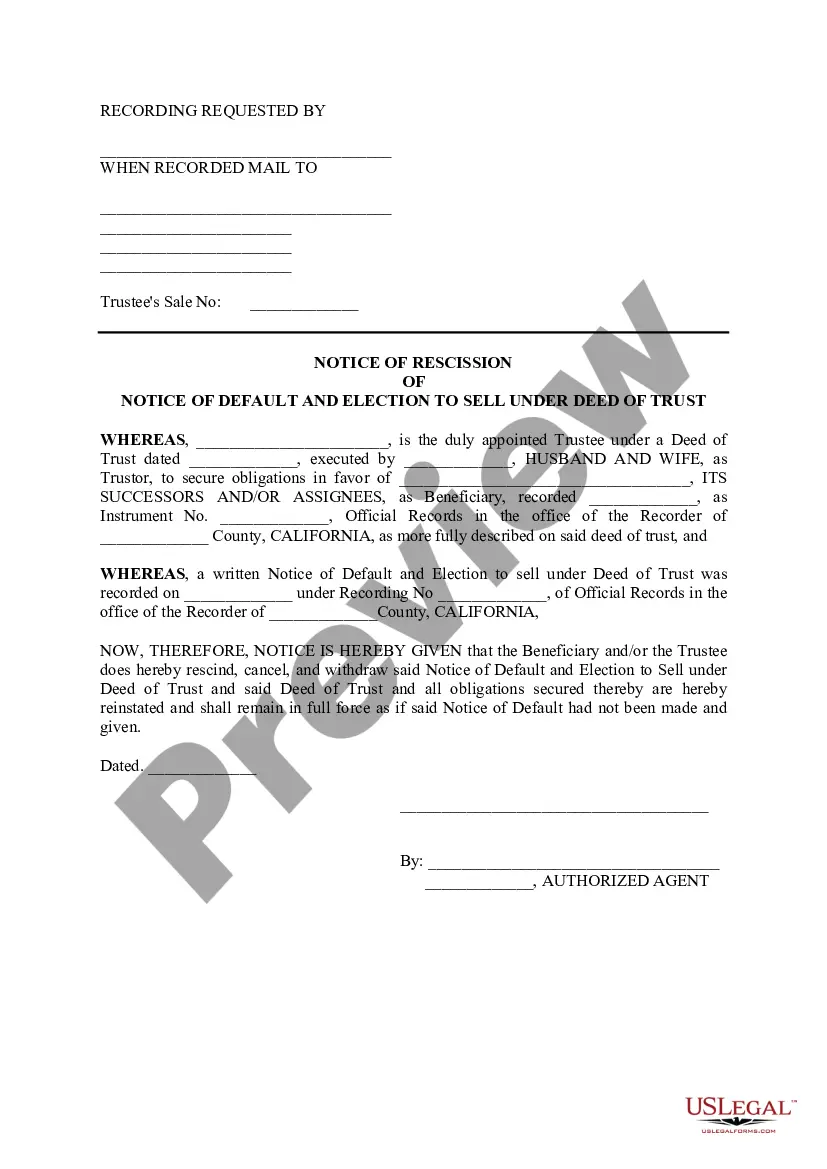

If you're looking for precise California Notice of Rescission of Notice of Default and Election to duplicates, US Legal Forms is what you require; find documents provided and verified by attorneys licensed by the state.

Using US Legal Forms not only prevents you from issues related to legal paperwork; it also saves you time, effort, and money! Downloading, printing, and completing a professional document is far less costly than hiring a lawyer to do it on your behalf.

And that's it. With just a few simple steps, you obtain an editable California Notice of Rescission of Notice of Default and Election to. After you set up your account, future orders will be processed even more smoothly. Once you have a US Legal Forms subscription, just Log In to your account and click the Download button you will find on the form’s page. Then, when you need to access this sample again, you will always find it in the My documents section. Don’t waste your time and energy searching through numerous forms on different websites. Obtain professional templates from one secure service!

- Start by completing your registration process by providing your email and creating a secure password.

- Follow the instructions provided below to set up an account and locate the California Notice of Rescission of Notice of Default and Election to template for your needs.

- Utilize the Preview feature or review the file description (if available) to ensure that the template is the one you are looking for.

- Verify its validity in your state.

- Click Buy Now to place your order.

- Select a preferred pricing plan.

- Create an account and pay via credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

To waive your right, you must give the creditor your own written statement describing the emergency and stating that you are waiving your right to rescind. The statement must be dated and signed by you and anyone else who shares in ownership of the home.

After you've received a Notice of Default, you have 3 months in which to attempt to get your loan current. As mentioned above, that means paying all back payments, interest, fees, property taxes, and insurance. After 3 months, the bank can officially set a date for the auction of your home.

A notice of rescission is a form given with the intention of terminating a contract, provided that the contract entered into is a voidable one. It releases the parties from obligations set forth in the contract, effectively restoring them to the positions they were in before the contract existed.

For example, the right of rescission does not apply to a business purpose loan, even though the loan is secured by the customer's principal dwelling.

The right of rescission refers to the right of a consumer to cancel certain types of loans. If you are refinancing a mortgage, and you want to rescind (cancel) your mortgage contract; the three-day clock does not start until. You sign the credit contract (usually known as the Promissory Note)

It takes several months for a lender to foreclose on a California property. If everything goes according to schedule, the process typically takes approximately 120 days about four months but the process can take as long as 200 or more days to conclude.

Established by the Truth in Lending Act (TILA) under U.S. federal law, the right of rescission allows a borrower to cancel a home equity loan, line of credit, or refinance with a new lender, other than with the current mortgagee, within three days of closing.

The right of rescission is the right of a borrower to cancel a home equity loan, line of credit or refinancing agreement within a 3-day period without financial penalty. It was born out of the Truth in Lending Act (TILA).

In CA a Notice of Default does not expire.