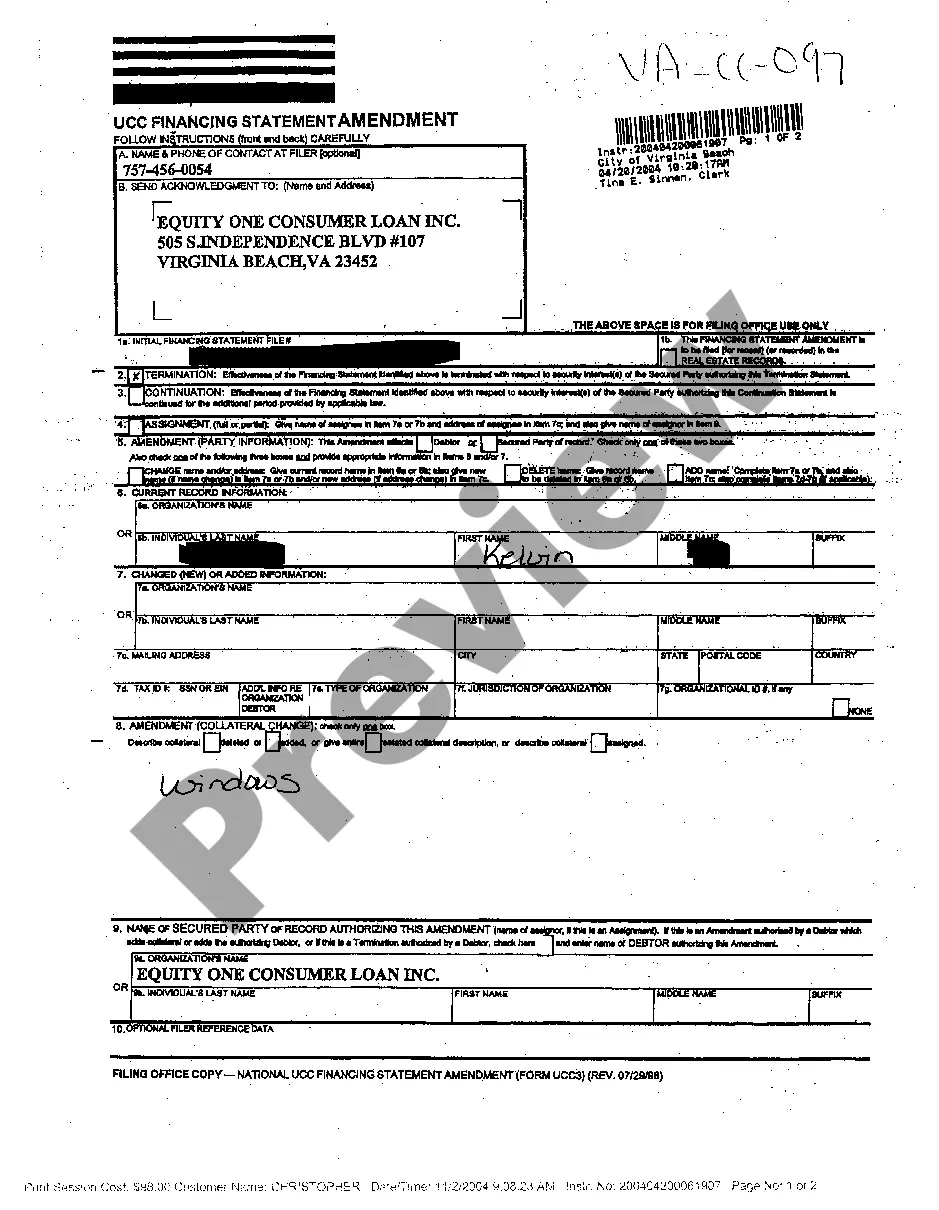

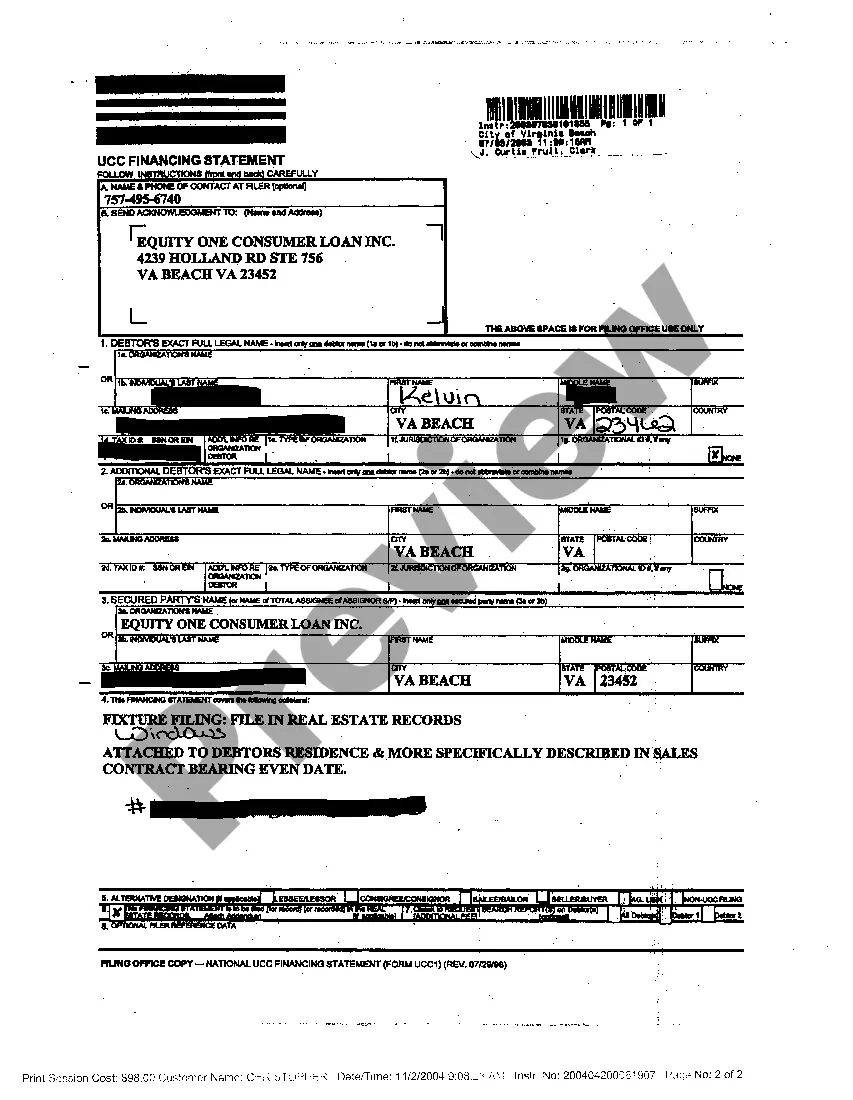

Virginia UCC Financing Statement Amendment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

UCC Financing Statement Amendment: A legal form (UCC5) submitted to amend the details of an originally filed UCC Financing Statement (UCC1). Amendments can include adding or removing collateral, changing debtor information or terminating the statement.

Security Interest: A legal claim on collateral provided by the debtor to the secured party as a security for repayment of a loan.National UCC: Refers to the uniform set of laws (Uniform Commercial Code) that regulate commercial transactions throughout the United States.

Step-by-Step Guide to Filing a UCC Financing Statement Amendment

- Review Original UCC Financing Statement: Identify the initial UCC1 filing that needs modification.

- Determine Amendment Type: Decide if the amendment is for a change, addition, or deletion of information.

- Complete the UCC5 Form: Fill out the UCC Financing Statement Amendment (UCC5) with accurate changes.

- Pay Required Fees: Check with your local Division of Corporations for applicable fees.

- Submit to the Appropriate Filing Office: File the amendment at the same office where the original UCC1 was filed.

- Confirmation: Receive confirmation and a filing statement as proof of the amendment.

Risk Analysis

- Inaccurate Information: Errors in the amendment can lead to legal disputes or issues in establishing priority of security interests.

- Failure to File on Time: Delay in filing an amendment might affect the secured party's interest, especially in cases of debtor default.

- Non-Compliance with UCC Regulations: Non-adherence to UCC rules could invalidate the security interest.

Common Mistakes & How to Avoid Them

- Incorrect Debtor Information: Always verify the debtor's legal name and address before filing.

- Overlooking Required Signatures: Ensure that all required parties sign the amendment form.

- Neglecting to Adhere to Filing Timelines: Keep track of filing deadlines to maintain the effectiveness of the filed statement.

Best Practices

- Regularly Review Filed UCC Statements: Monitoring statements can preempt the need for urgent amendments.

- Consult Legal Experts: Seek professional advice when in doubt about the filing process or compliance with the commercial code.

- Maintain Organized Records: Keep copies of all filed documents and correspondence related to the UCC filings.

FAQ

Q: What is a secured party? A: A secured party is an individual or entity that holds an interest in the debtor's collateral to secure repayment of a loan.

Q: How often can a financing statement be amended? A: A financing statement can be amended multiple times as long as the underlying debt obligation is active and both parties agree to the changes.

How to fill out Virginia UCC Financing Statement Amendment?

Searching for a Virginia UCC Financing Statement Amendment online might be stressful. All too often, you find files that you simply believe are fine to use, but find out later they are not. US Legal Forms offers over 85,000 state-specific legal and tax documents drafted by professional lawyers according to state requirements. Get any form you are looking for within minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll instantly be added in in your My Forms section. In case you don’t have an account, you need to sign-up and choose a subscription plan first.

Follow the step-by-step recommendations below to download Virginia UCC Financing Statement Amendment from our website:

- See the form description and click Preview (if available) to verify whether the template meets your expectations or not.

- If the document is not what you need, find others using the Search engine or the listed recommendations.

- If it’s appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the document in a preferable format.

- Right after downloading it, you can fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms catalogue. In addition to professionally drafted samples, customers can also be supported with step-by-step instructions regarding how to get, download, and fill out templates.

Form popularity

FAQ

A UCC-3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC-1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC-3 with the Secretary of State's office in the appropriate state.

A UCC-3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC-1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC-3 with the Secretary of State's office in the appropriate state.

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

When the debtor has satisfied all amounts owed to the lender, a UCC-3 termination statement (now called a UCC termination statement) is routinely filed to terminate the security interest perfected by the UCC-1 financing statement.

After receiving your request, the lender has 20 days to terminate the UCC filing.

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

When the debtor has satisfied all amounts owed to the lender, a UCC-3 termination statement (now called a UCC termination statement) is routinely filed to terminate the security interest perfected by the UCC-1 financing statement.

A UCC1 financing statement is effective for a period of five years. A record that is not continued before its lapse date will cease to be effective, costing the secured party their perfected status and perhaps their priority position to collect. Once a financing statement has lapsed, it cannot be revived.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.