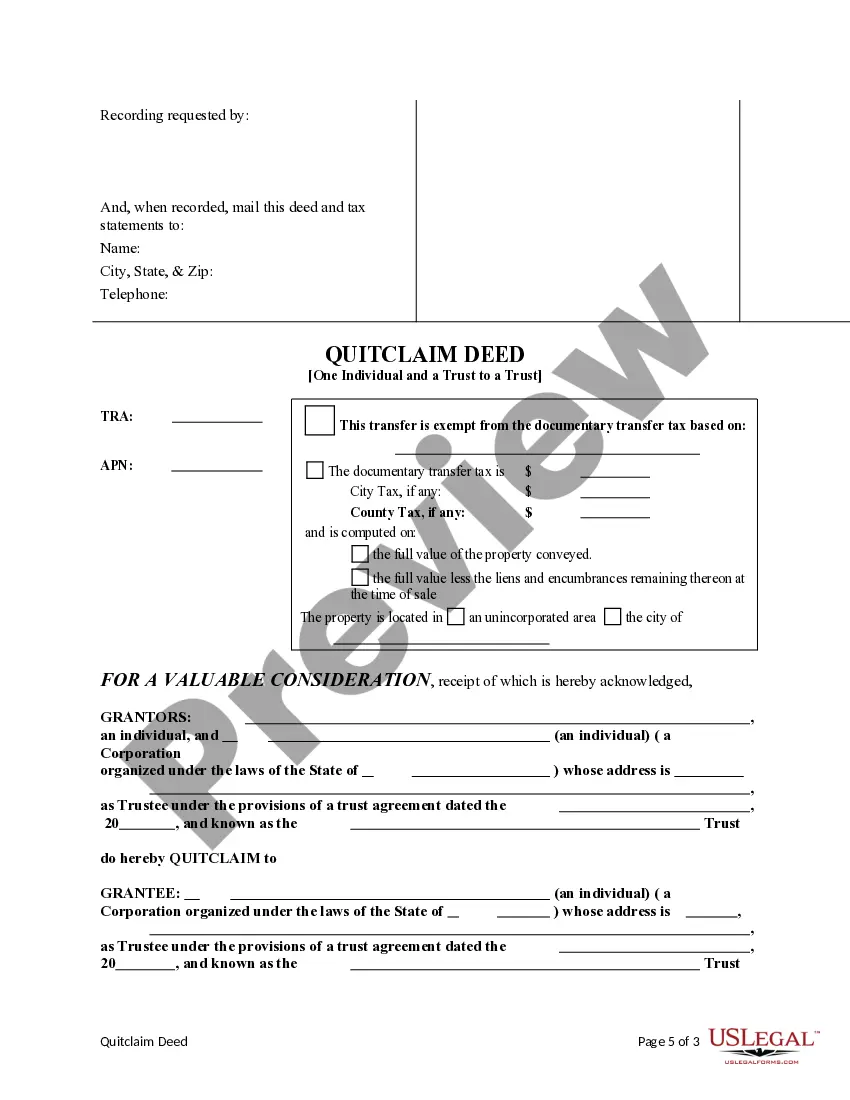

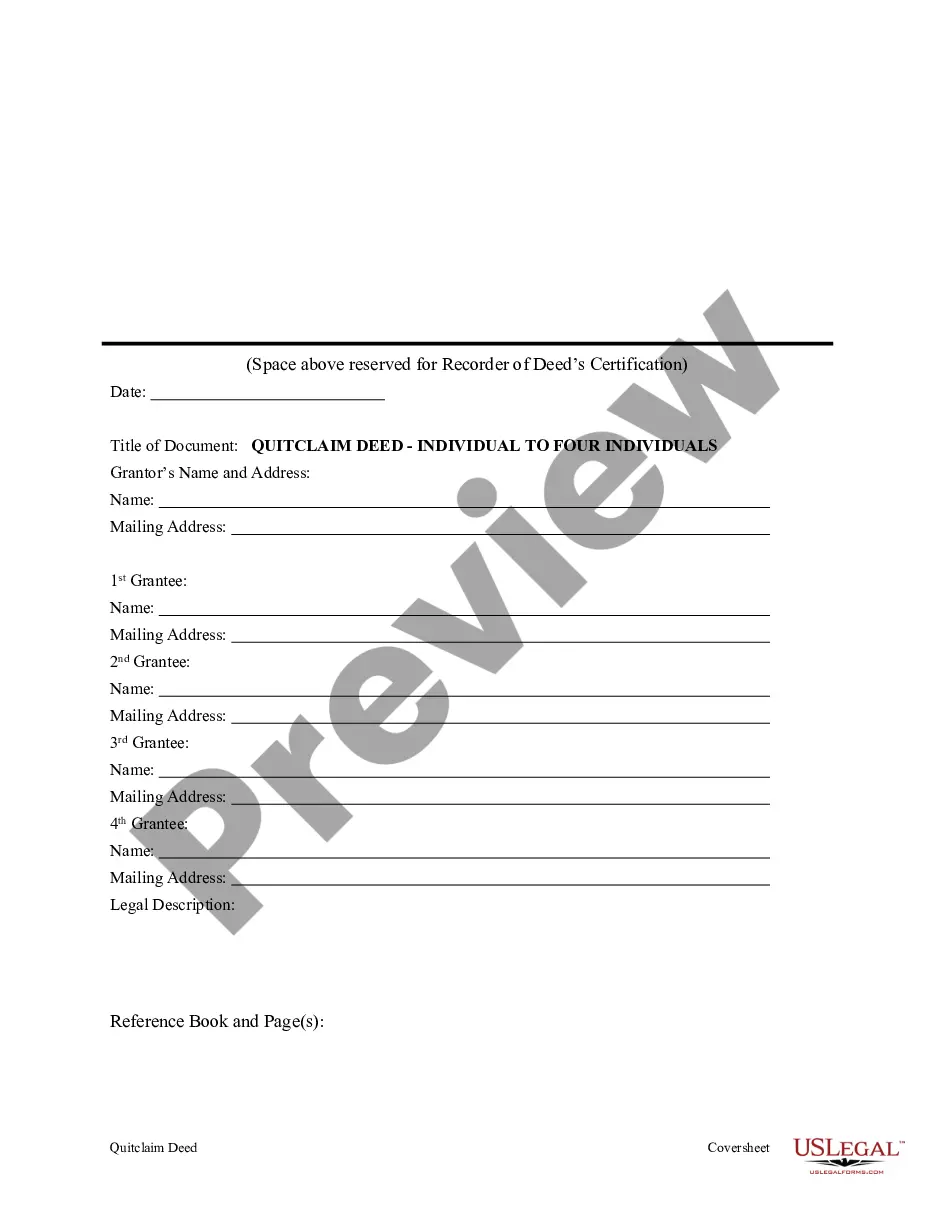

This form is a Quitclaim Deed where the Grantors are an individual and a trust and the Grantee is a trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

California Quitclaim Deed from an Individual and a Trust to a Trust

Description

How to fill out California Quitclaim Deed From An Individual And A Trust To A Trust?

If you're looking for accurate California Quitclaim Deed from an Individual and a Trust to a Trust examples, US Legal Forms is what you require; obtain documents crafted and reviewed by state-licensed legal experts.

Using US Legal Forms not only saves you from stress related to legal paperwork; it also helps you save time, effort, and money! Downloading, printing, and filling out a professional document is considerably cheaper than hiring an attorney to do it for you.

And that's it. In just a few simple clicks, you will have an editable California Quitclaim Deed from an Individual and a Trust to a Trust. When you establish an account, all future purchases will be processed even more effortlessly. If you possess a US Legal Forms subscription, simply Log In to your account and click the Download button you see on the form's page. Then, when you need to use this template again, you can always find it in the My documents section. Don't waste your time scouring numerous forms on various online platforms. Order precise templates from one reliable source!

- To begin, complete your registration process by entering your email and creating a password.

- Follow the instructions below to create an account and find the California Quitclaim Deed from an Individual and a Trust to a Trust template to address your needs.

- Utilize the Preview feature or review the document description (if available) to ensure that the form is the right one for you.

- Check its validity in your location.

- Click Buy Now to place your order.

- Select a preferred payment plan.

- Create an account and pay with your credit card or PayPal.

- Choose an appropriate file format and download the documents.

Form popularity

FAQ

A trust does not automatically supersede a quit claim deed. When you create a California Quitclaim Deed from an Individual and a Trust to a Trust, it allows for the transfer of property ownership while maintaining the terms of the trust. It's essential to understand that while the quit claim deed affects property title, the trust dictates how that property is managed. Therefore, both instruments play important, yet distinct, roles in property and estate planning.

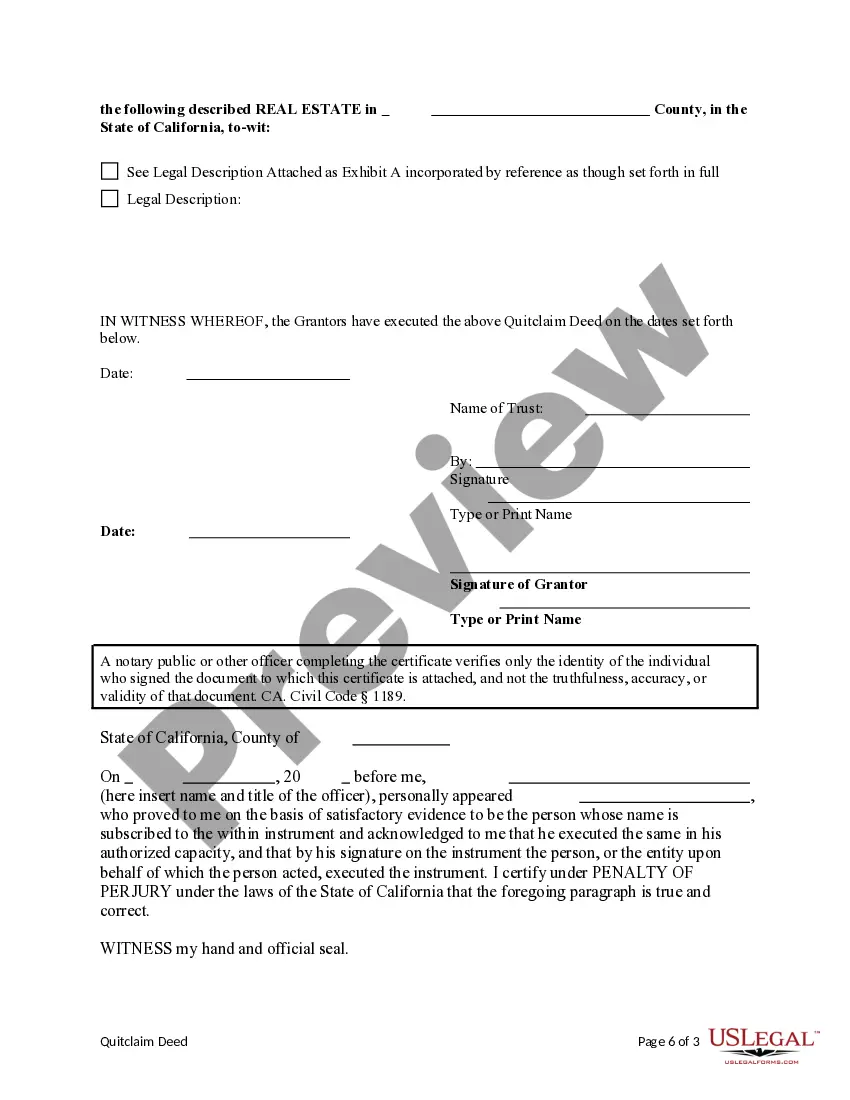

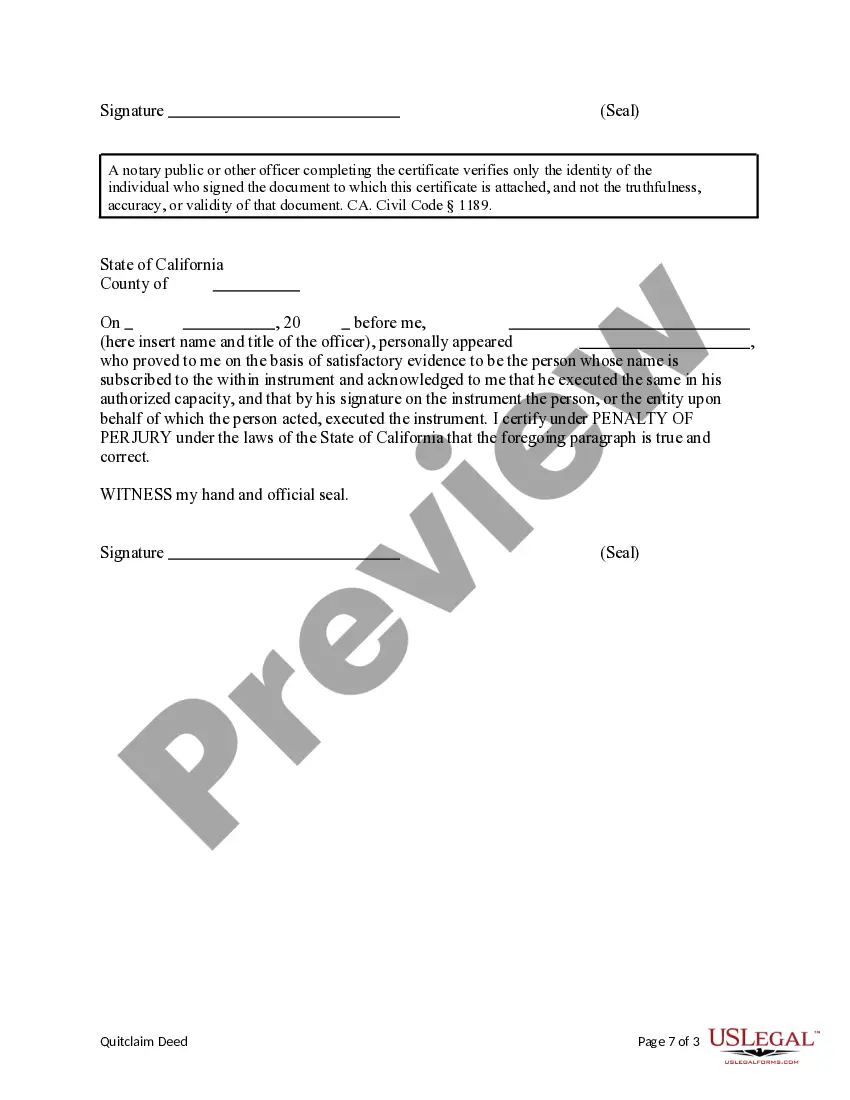

To transfer a deed to a living trust in California, you will need to complete a California Quitclaim Deed from an Individual and a Trust to a Trust. This process involves filling out the deed form, signing it with a notary, and recording it with the county recorder's office. Ensuring the proper execution of this deed is crucial, as it legally transfers your property into the trust. If you're uncertain about the steps, uslegalforms provides useful resources and templates to simplify the task.

While placing your house in a trust can provide benefits, such as avoiding probate, it may come with certain disadvantages. You may face upfront costs related to creating the trust and executing a California Quitclaim Deed from an Individual and a Trust to a Trust. Additionally, after transferring the property, you must maintain trust records and manage assets according to the trust terms, which can be an ongoing responsibility. It's wise to consider these factors carefully.

To put your property in a trust in California, you first create the trust document, clearly specifying the assets included. Next, you execute a California Quitclaim Deed from an Individual and a Trust to a Trust to transfer ownership. It is essential to sign this deed in front of a notary and then record it with your local county office. For additional guidance, uslegalforms offers templates and support to help streamline this process.

Yes, a quitclaim deed can be used to transfer property out of a trust, provided the trustee executes it properly. This action needs to adhere to the trust’s directives, and it often requires additional documentation to ensure compliance with state law. Utilizing resources like US Legal Forms can help streamline this process, offering templates and guidance for your specific needs.

The choice between a quitclaim deed and a trust largely depends on your specific needs. A quitclaim deed is a simple way to transfer property without warranty, while a trust provides more comprehensive estate planning and protection for inherited assets. Consider your long-term goals to determine the best option for managing and transferring your property.

To transfer a deed to a trust in California, you'll need to prepare and execute a new deed that names the trust as the grantee. You must also sign the deed in front of a notary public and then record it with the county recorder’s office. This process helps confirm that the property is now held under the terms of the trust, ensuring your estate plan is in place.

Yes, you can perform a quitclaim deed from a trust to transfer property to another party or trust. This process allows the trustee to relinquish any claim they may have to the property held in the trust. It's important to ensure that the quitclaim deed is properly executed and recorded to maintain clear title.

A quitclaim deed cannot be used to resolve title disputes or to transfer property that is heavily encumbered by liens or mortgages. Additionally, if the property is under a divorce agreement or bankruptcy proceedings, a quitclaim deed might not be appropriate. In these cases, further legal actions may be needed, such as a court order, to effectuate the transfer.