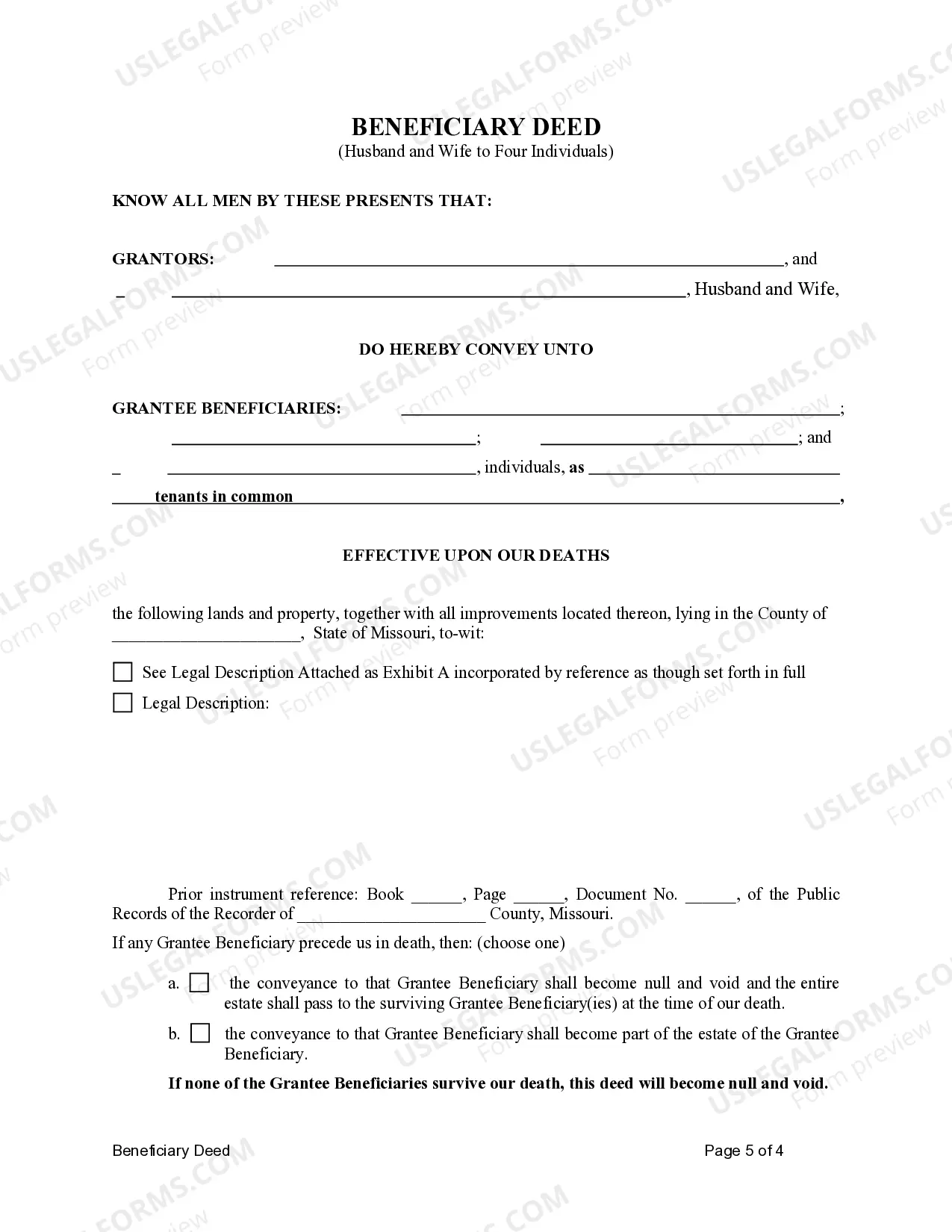

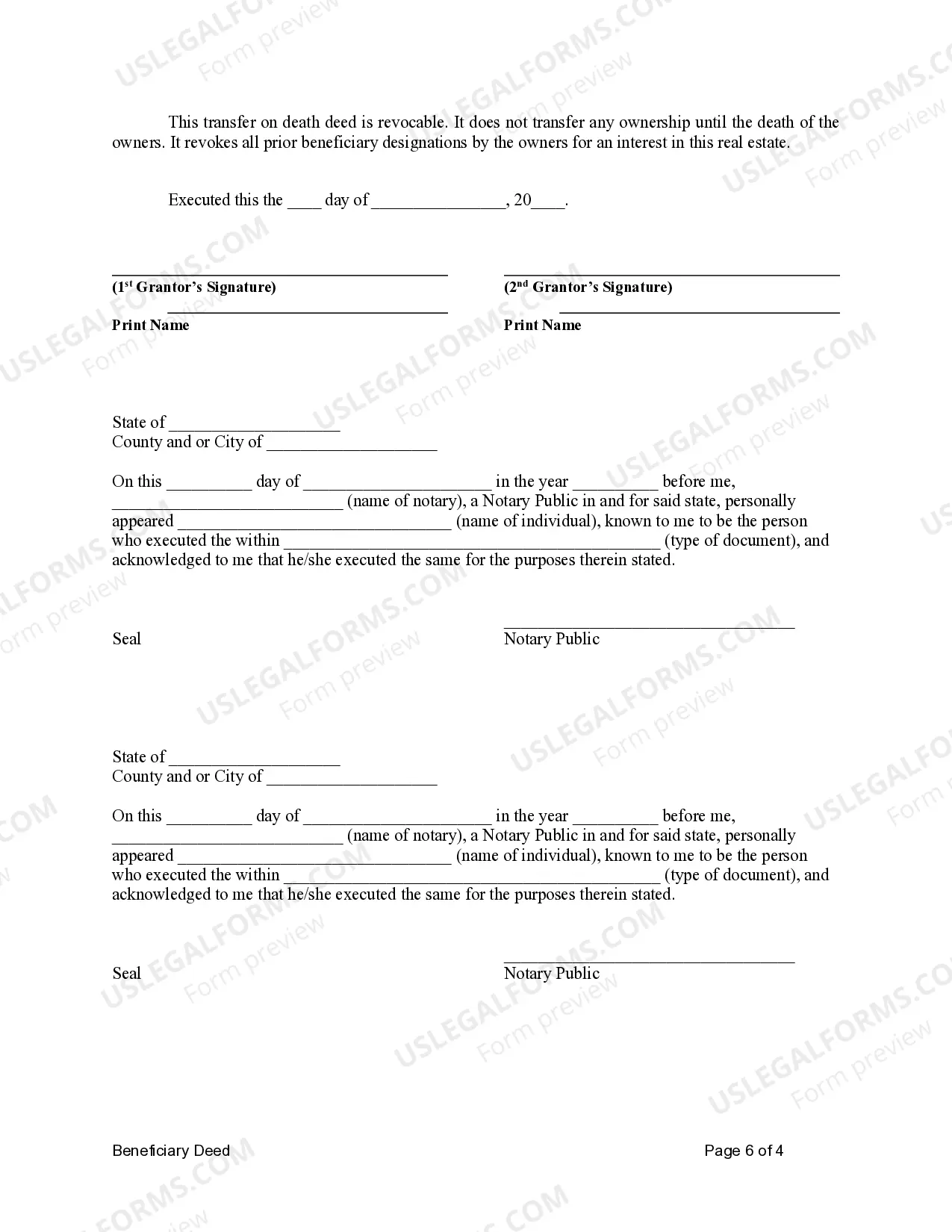

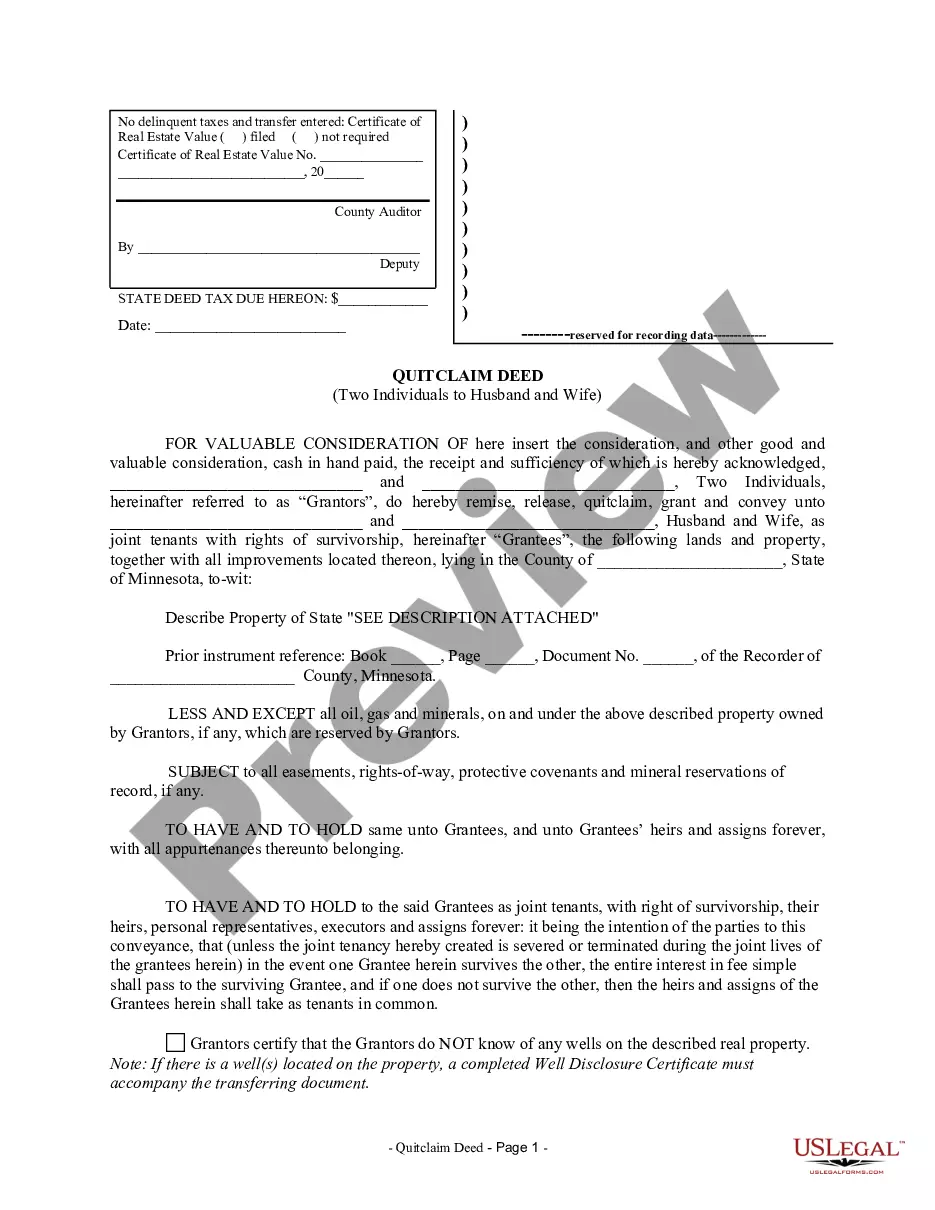

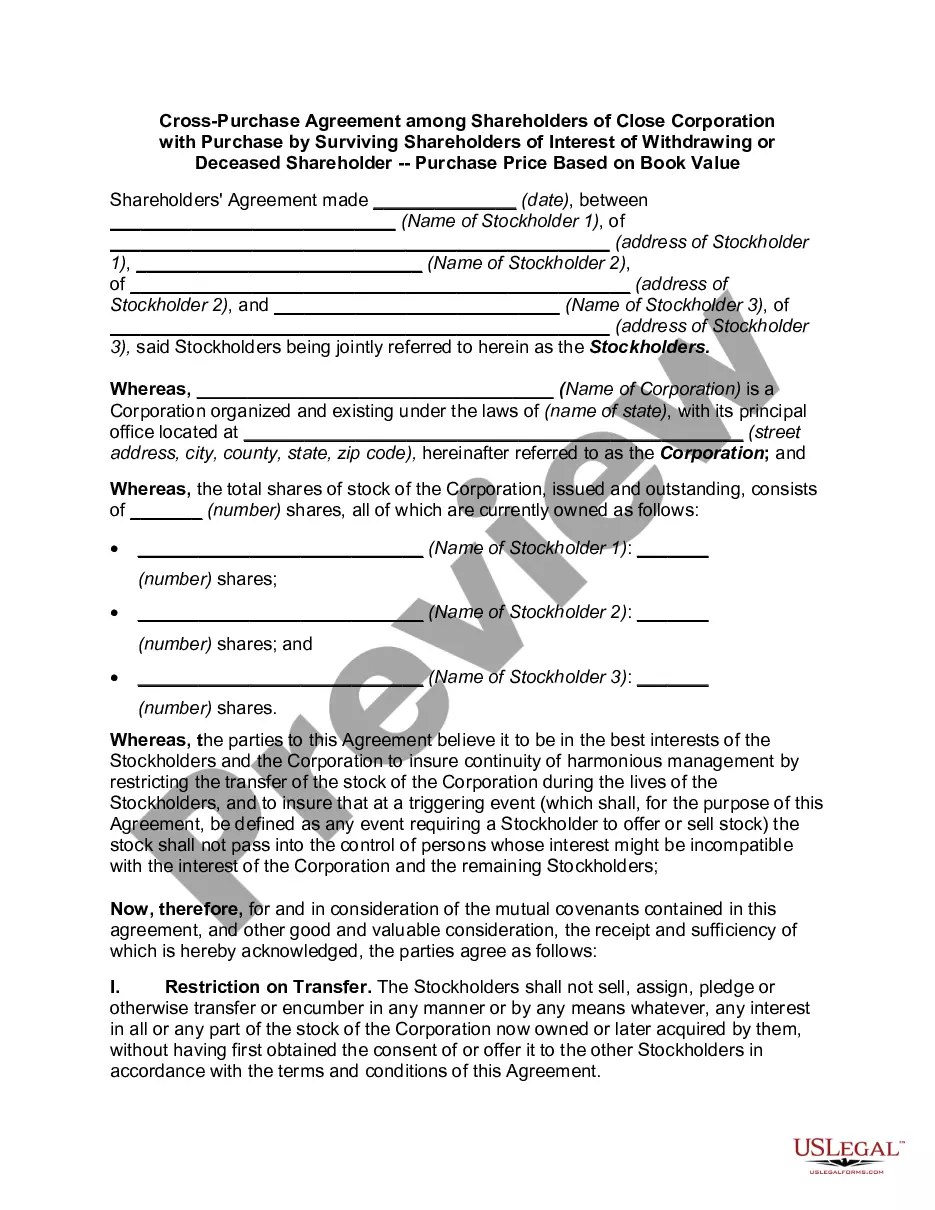

This form is a Transfer on Death Deed where the grantors are husband and wife and the grantees are four individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. The grantees take the property as tenants in common. This deed complies with all state statutory laws.

Missouri TOD - Transfer on Death Deed or Beneficiary Deed - Husband and Wife to Four Individuals

Description

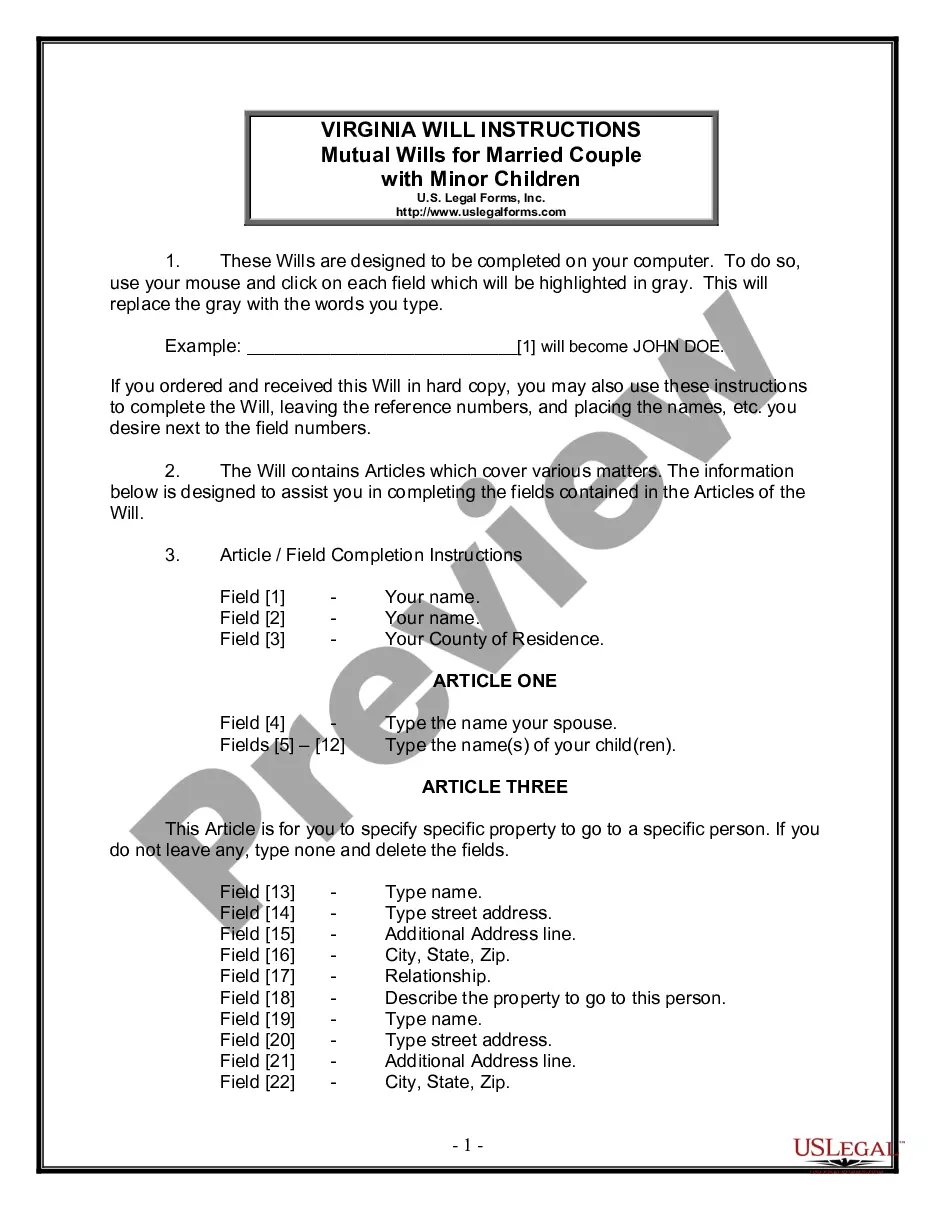

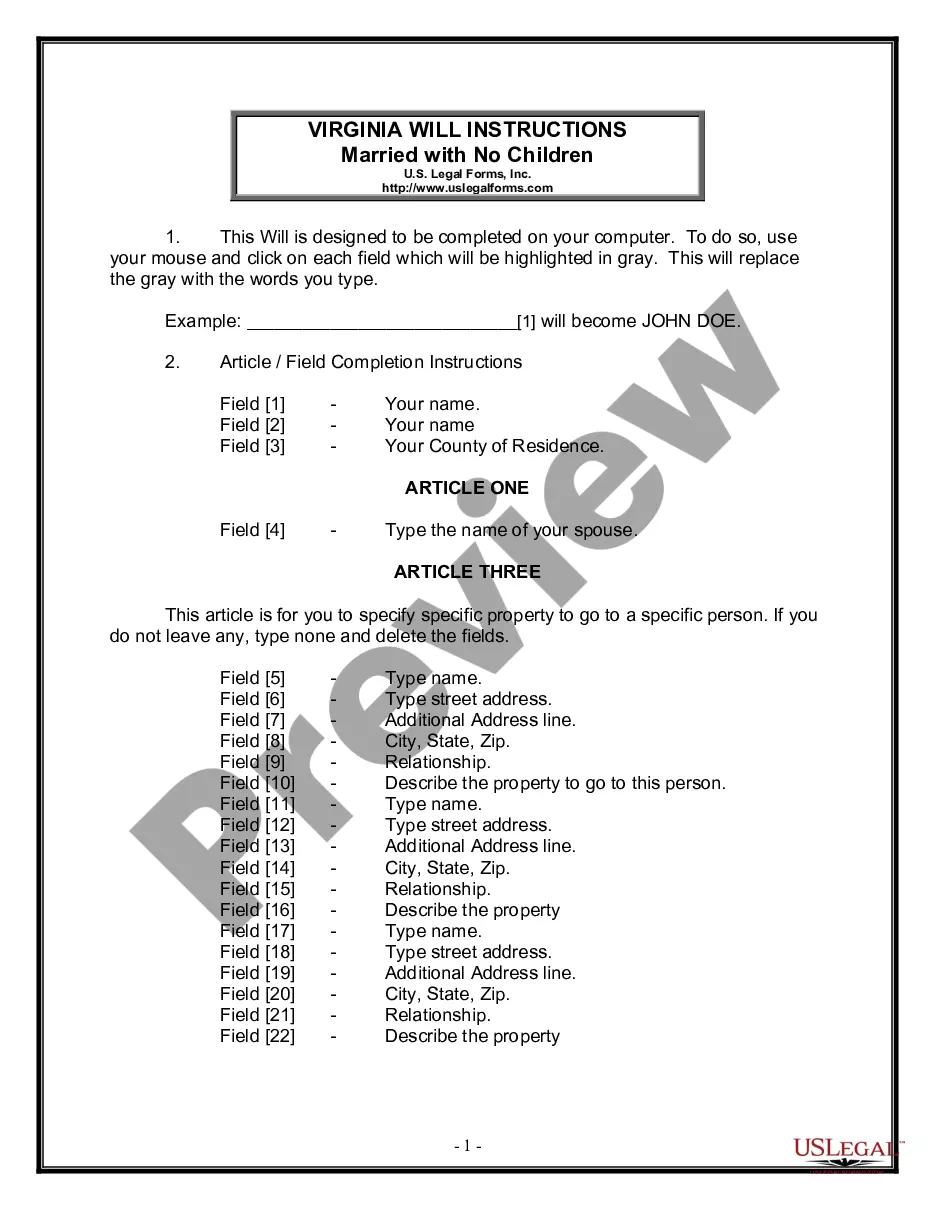

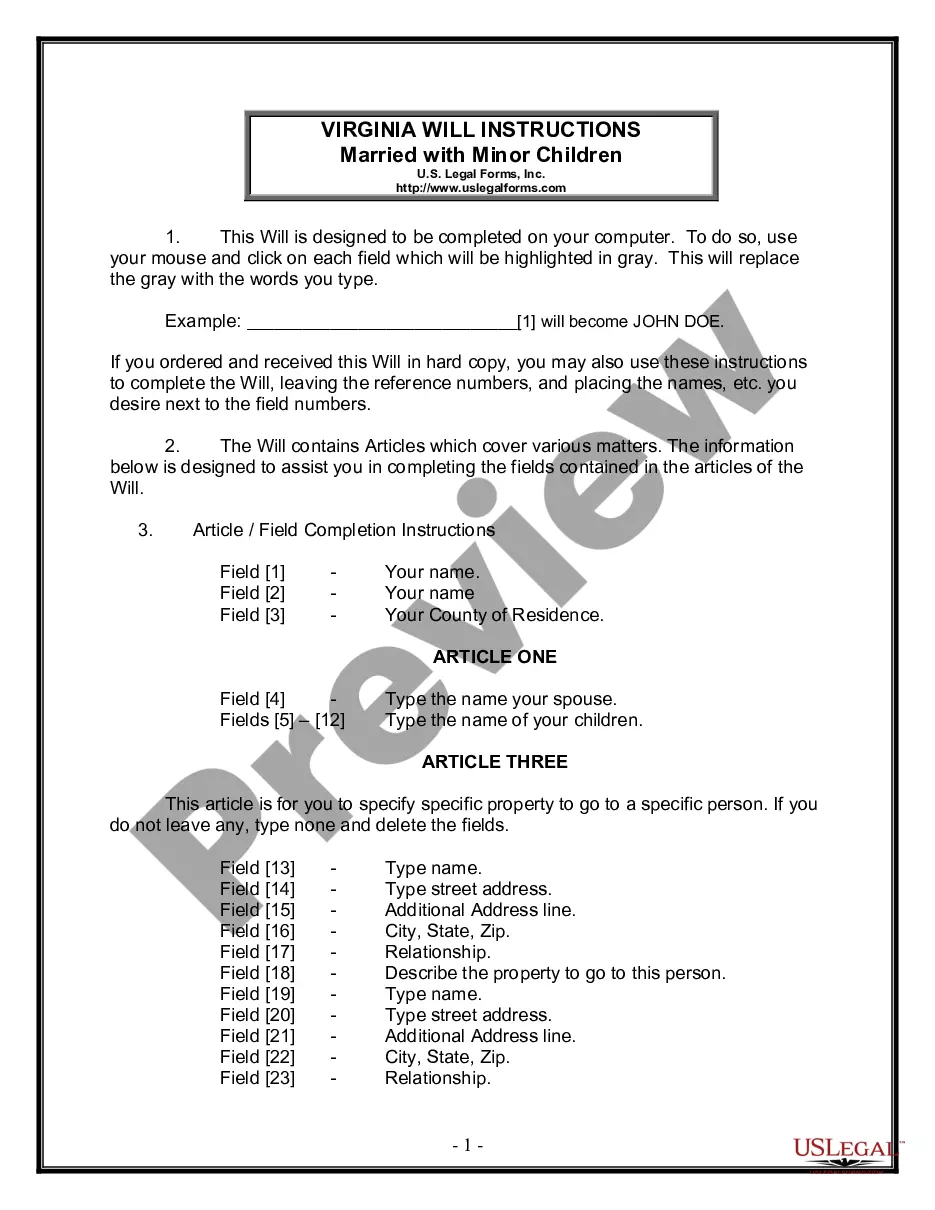

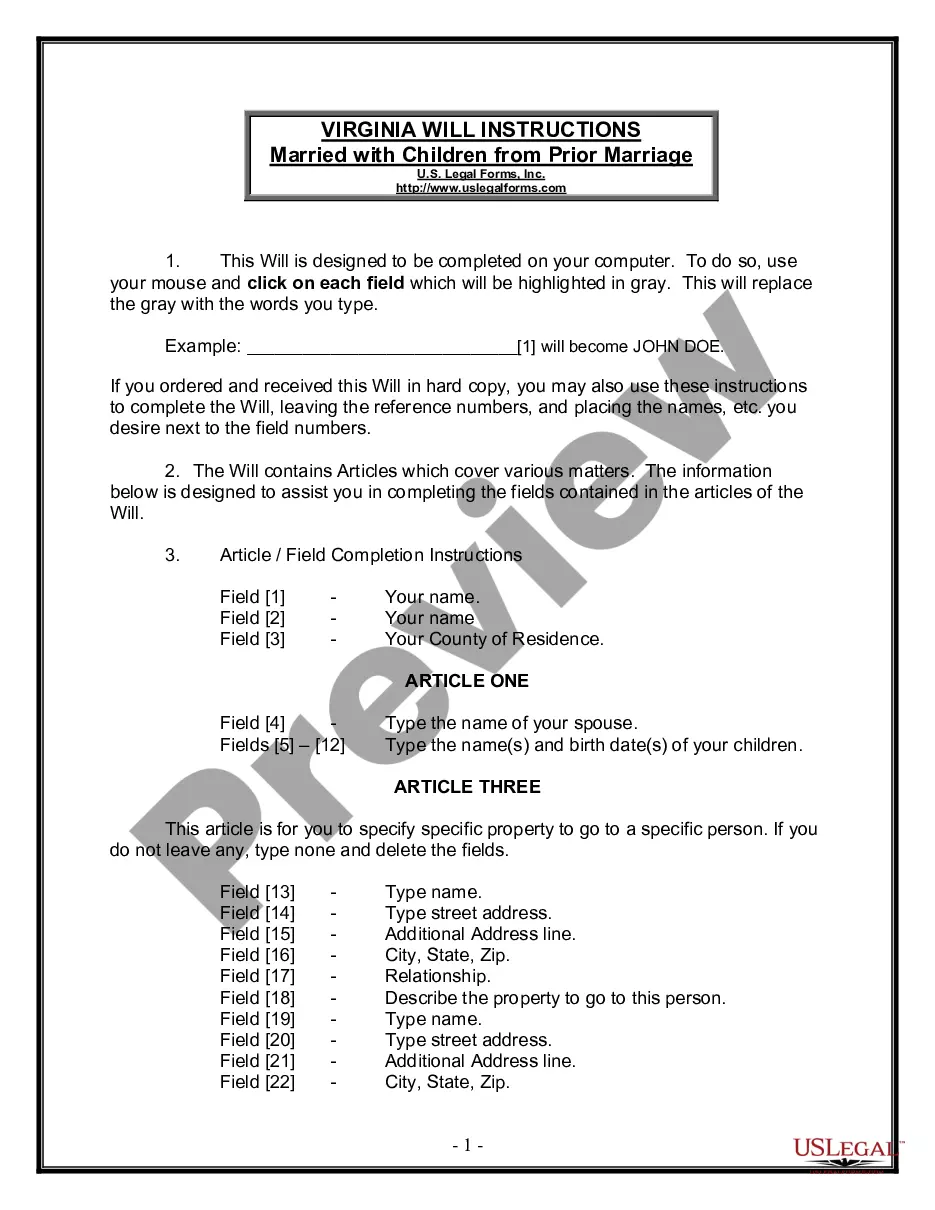

How to fill out Missouri TOD - Transfer On Death Deed Or Beneficiary Deed - Husband And Wife To Four Individuals?

Get any form from 85,000 legal documents such as Missouri TOD - Transfer on Death Deed or Beneficiary Deed - Husband and Wife to Four Individuals on-line with US Legal Forms. Every template is drafted and updated by state-certified legal professionals.

If you have a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the tips below:

- Check the state-specific requirements for the Missouri TOD - Transfer on Death Deed or Beneficiary Deed - Husband and Wife to Four Individuals you need to use.

- Look through description and preview the sample.

- As soon as you’re confident the template is what you need, just click Buy Now.

- Choose a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in a single of two suitable ways: by card or via PayPal.

- Pick a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable template is ready, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the proper downloadable template. The platform gives you access to documents and divides them into categories to streamline your search. Use US Legal Forms to obtain your Missouri TOD - Transfer on Death Deed or Beneficiary Deed - Husband and Wife to Four Individuals fast and easy.

Form popularity

FAQ

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

Fill in information about you and the TOD beneficiary. provide a description of the property. check over the completed deed. sign the deed in front of a notary public, and. record the deed at the recorder's office in the county where the property is located.

To transfer it, you will have to get a succession certificate (for moveable property) and a letter of administration (for Immoveable property). While doing so, get the son and daughter to give no objections in court that they have no objection if all the property is transferred to the widow.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

TOD account holders can name multiple beneficiaries and divide assets any way they like.However, the beneficiaries have no access or rights to a TOD account while its owner is alive. Those beneficiaries can also be changed at any time, so long as the TOD account holder is deemed mentally competent.

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.