An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arizona Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

It is feasible to allocate time online in an effort to locate the legal form template that fulfills the state and federal requirements you will necessitate.

US Legal Forms offers an extensive array of legal templates that are evaluated by experts.

You can obtain or print the Arizona Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary using their services.

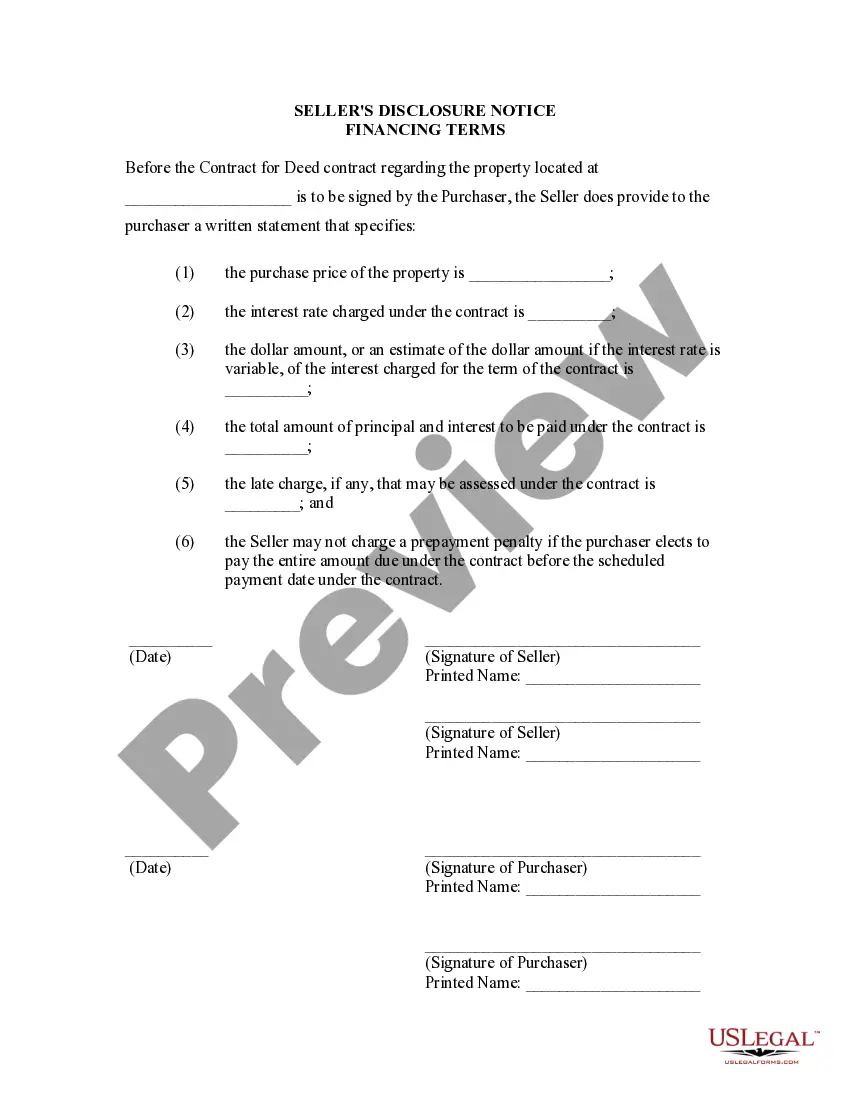

If available, use the Preview button to review the form template as well. If you wish to find another variation of the form, use the Search field to locate the template that fits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and select the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Arizona Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary.

- Every legal document template you download is yours permanently.

- To retrieve another copy of the obtained form, go to the My documents section and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct form template for the area/city you choose.

- Check the form outline to confirm that you have chosen the appropriate template.

Form popularity

FAQ

A beneficiary deed in Arizona provides significant advantages for property owners. It allows the transfer of property directly to beneficiaries upon the owner's death, bypassing the probate process, which can be lengthy and costly. This approach ensures that the intended beneficiaries receive their inheritance swiftly and efficiently. Moreover, the Arizona Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary simplifies estate planning, making it an effective tool for those looking to manage their assets thoughtfully.

Beneficiaries generally have the power to receive income and distributions from the trust, as outlined in the trust agreement. Additionally, they have the right to request information about trust activities and ensure that the trustee is performing their duties properly. Understanding these powers, as stated in the Arizona Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, empowers beneficiaries to advocate for their rights.

Designating a beneficiary means officially naming an individual who will receive benefits from an asset, like a bank account or trust. This important action ensures that your assets are transferred according to your wishes. The idea of the Arizona Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary encapsulates this process effectively.

To designate a beneficiary on a bank account, visit your bank and request the necessary beneficiary designation form. Completing this form allows you to specify who will inherit the account's funds upon your passing. Using the Arizona Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can be a valuable reference to ensure clarity in your financial intentions.

Nominating a beneficiary involves selecting an individual who will receive certain benefits, typically through a will or trust document. In Arizona, this can be streamlined with the Arizona Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, which provides the necessary framework for making your nominations clear and enforceable. It's important to review these designations regularly.

Assigning beneficiaries typically requires formal documentation that specifies the individuals who will receive benefits from a trust. The Arizona Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary serves as an essential tool for you to accurately complete this process. Thoroughly understanding your responsibilities as a trustee is also crucial.

The right to assign interest refers to a beneficiary's ability to transfer their beneficial interest to another individual or entity. In Arizona, this right is governed by the specific rules of the trust and relevant state laws. The Arizona Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can provide guidance on how to exercise this right properly.

Yes, a beneficiary can transfer their interest in a trust to another party, provided the trust's terms allow such transfers. This is often accomplished through the Arizona Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. It is essential to follow the outlined procedures to ensure the transfer is legally valid.

Filing a beneficiary deed in Arizona involves completing a specific form and submitting it to the county recorder. This document designates a beneficiary who will receive the property upon the owner's death. Utilizing the Arizona Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary ensures you have the correct guidelines to streamline this process.

Arizona has specific laws governing beneficiaries and their rights within trusts. These laws not only define how beneficiaries can receive benefits but also outline their responsibilities. Familiarizing yourself with the Arizona Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can help beneficiaries and trustees navigate this legal landscape.