This form assumes that the Beneficiary has the right to make such an assignment, which is not always the case. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust

Description

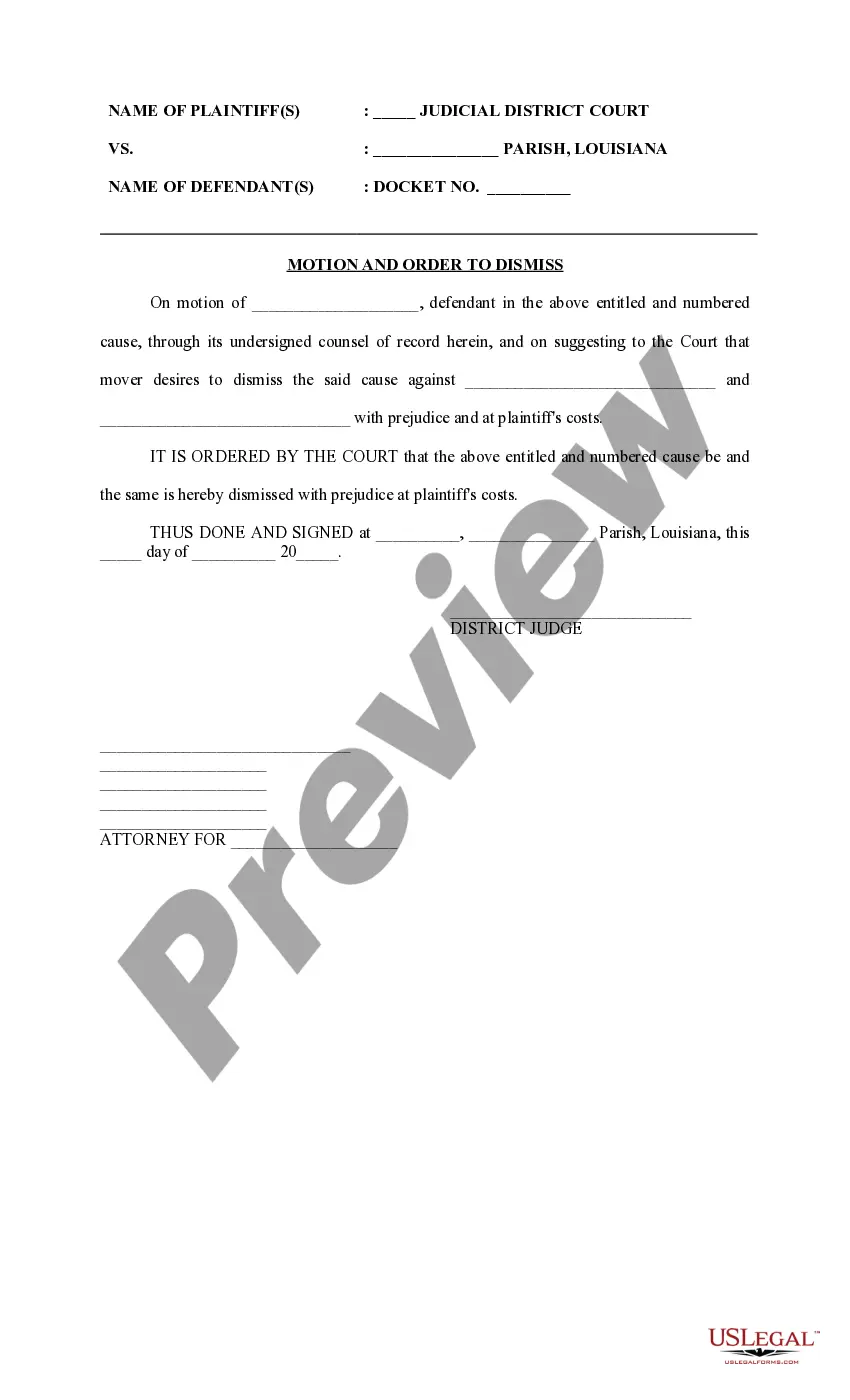

How to fill out Notice To Trustee Of Assignment By Beneficiary Of Interest In Trust?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers a broad selection of legal document formats that you can download or print.

By using the site, you can access thousands of templates for business and personal needs, organized by categories, states, or keywords. You can find the latest versions of documents like the Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust in moments.

If you already have a monthly subscription, Log In and download the Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust from your US Legal Forms library. The Download option will show up on every document you view. You can access all previously saved templates in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form onto your device. Edit. Fill out, modify, and print and sign the saved Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust. Every template you added to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, just visit the My documents section and click on the form you need. Gain access to the Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust with US Legal Forms, one of the largest collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- Ensure you have selected the correct form for your specific area/region.

- Use the Review option to check the form's content.

- Read the form details to confirm that you have selected the appropriate form.

- If the form doesn’t meet your requirements, use the Search field at the top to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the pricing plan you wish to select and provide your information to register for an account.

Form popularity

FAQ

In Arizona, trustees must distribute trust assets in a timely manner, generally within a reasonable timeframe based on the trust's specific terms. While there is no strict deadline, the trustee must act in the best interests of the beneficiaries and adhere to any conditions set forth in the trust document. If clarification is needed, beneficiaries can issue an Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust, prompting the trustee to provide updates on the timeline for distribution. Efficient asset distribution aligns with the trustee’s duties to the beneficiaries.

Yes, executors in Arizona are required to provide a full accounting to the beneficiaries of the estate. This accounting must detail all income, expenses, and distributions made during the administration process. With this transparency, beneficiaries can understand how the assets are managed. Utilizing the Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust can facilitate communication and clarification regarding any financial matters related to the trust.

In Arizona, beneficiaries have the right to request information regarding the trust. This includes the right to see the trust document, which outlines the terms set by the grantor. Additionally, a beneficiary can utilize the Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust to formally ask for access to this information. Transparency is essential for trust management, ensuring that beneficiaries understand their rights and the trust's operations.

The final accounting to beneficiaries is a comprehensive report prepared by the executor that summarizes all financial activities within the estate. This document includes details about assets, debts settled, and distributions made. Following an Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust is vital for maintaining clear communication with beneficiaries about these transactions. For assistance in preparing this accounting, consider using the templates provided by US Legal Forms, which can streamline the process.

An executor in Arizona is generally required to close the estate and distribute assets within nine months after being appointed. However, they may take additional time if complexities arise, such as disputes among beneficiaries or difficulties in selling estate assets. Scheduling an Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust can help ensure proper communication and distribution timelines are followed. For detailed guidance, check out US Legal Forms.

In Arizona, certain assets can be exempt from probate, including assets held in a living trust, joint tenancy properties, and accounts with designated beneficiaries. Personal property valued under $75,000 and real property valued under $100,000 can also be exempt through a simplified probate process. If you're unsure about how to handle your assets, an Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust is crucial for establishing clear intentions. Utilizing US Legal Forms can provide the resources you need for this process.

In Arizona, bank accounts may go through probate if they are not set up to transfer on death or if they are held solely under the deceased person's name. However, if the account has a designated beneficiary or if it’s in a revocable living trust, it can bypass the probate process. It’s vital to conduct an Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust if changes arise after the account holder's passing. Consider consulting with a legal expert or resources from US Legal Forms for clarity.

To assign a trustee, you typically need to create a formal document known as a trust agreement or a trustee assignment. This document should clearly identify the current trustee and the new trustee, as well as outline the assets involved. Moreover, it’s essential to provide a written Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust to inform all relevant parties about this change. Using platforms like US Legal Forms can simplify this process by providing templates and guidance.

Yes, a beneficiary can transfer their interest in the trust, but this action is subject to the terms of the trust document. The transfer typically requires a legally binding agreement to ensure the rights are properly conveyed. To document this process effectively, using an Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust can provide a clear and formal record.

In Arizona, a trustee is required to notify beneficiaries of the trust within a reasonable time frame, typically within 60 days after their appointment. This notification helps ensure beneficiaries are informed about their rights and the trust's status. Adhering to this requirement is crucial, particularly in light of actions related to an Arizona Notice to Trustee of Assignment by Beneficiary of Interest in Trust.