Connecticut Accident Report For Workers Comp Compliance

Description

How to fill out Accident Report For Workers Comp Compliance?

You can spend hours online trying to locate the legal document template that satisfies the state and federal criteria you require.

US Legal Forms provides thousands of legal documents that have been reviewed by professionals.

It is easy to obtain or print the Connecticut Accident Report For Workers Comp Compliance from their service.

If you want to obtain another version of the form, utilize the Search field to find the template that fits your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- Next, you can complete, modify, print, or sign the Connecticut Accident Report For Workers Comp Compliance.

- Every legal document template you download is yours permanently.

- To acquire an additional copy of any downloaded form, navigate to the My documents section and click the corresponding option.

- If this is your first time using the US Legal Forms website, follow the straightforward guidelines below.

- First, ensure you have selected the correct document template for your region/city of choice.

- Check the form description to confirm you have chosen the right form.

Form popularity

FAQ

The 30C form is a crucial document used in Connecticut workers' compensation claims. This form notifies your employer about your injury and initiates the workers' comp process. It contains important details about the accident that may influence your claim. Completing this form accurately is vital; it complements your Connecticut Accident Report For Workers Comp Compliance and establishes your case.

The requirements for workers' compensation in Connecticut include being an employee and having suffered a job-related injury. You must also file your claim within the prescribed one-year timeframe. Additionally, your employer must carry workers' comp insurance if they have a certain number of workers. Understanding these requirements is essential for ensuring compliance and facilitating the contents of your Connecticut Accident Report For Workers Comp Compliance.

The workers' compensation law in Connecticut mandates that employers provide benefits to employees suffering work-related injuries. This law ensures that injured workers receive medical care, rehabilitation, and compensation for lost wages. It is important to understand your rights under this law, especially when preparing your Connecticut Accident Report For Workers Comp Compliance. Familiarizing yourself with these laws can empower you in your claims journey.

To obtain workers' compensation in Connecticut, you must be an employee, your injury must arise from your job, and the claim needs to be timely filed. Documentation, like your Connecticut Accident Report For Workers Comp Compliance, will aid in demonstrating that the injury occurred during work. Ensuring you meet these requirements can significantly enhance your claim process. Consistently keeping records of your work-related activities can also be beneficial.

In Connecticut, you have one year from the date of your accident to file a workers' comp claim. It is essential to act promptly to ensure you gather all necessary information, including your Connecticut Accident Report For Workers Comp Compliance. Delaying could jeopardize your chances at receiving compensation. Keeping track of this timeline will help you remain compliant with state regulations.

It is crucial to avoid making statements that could undermine your claim when speaking to a Workers' Comp adjuster. For instance, do not downplay your injury or say you are completely fine unless that is accurate. Careless comments may lead to misinterpretations that affect your case negatively. Always stick to the facts found in your Connecticut Accident Report For Workers Comp Compliance.

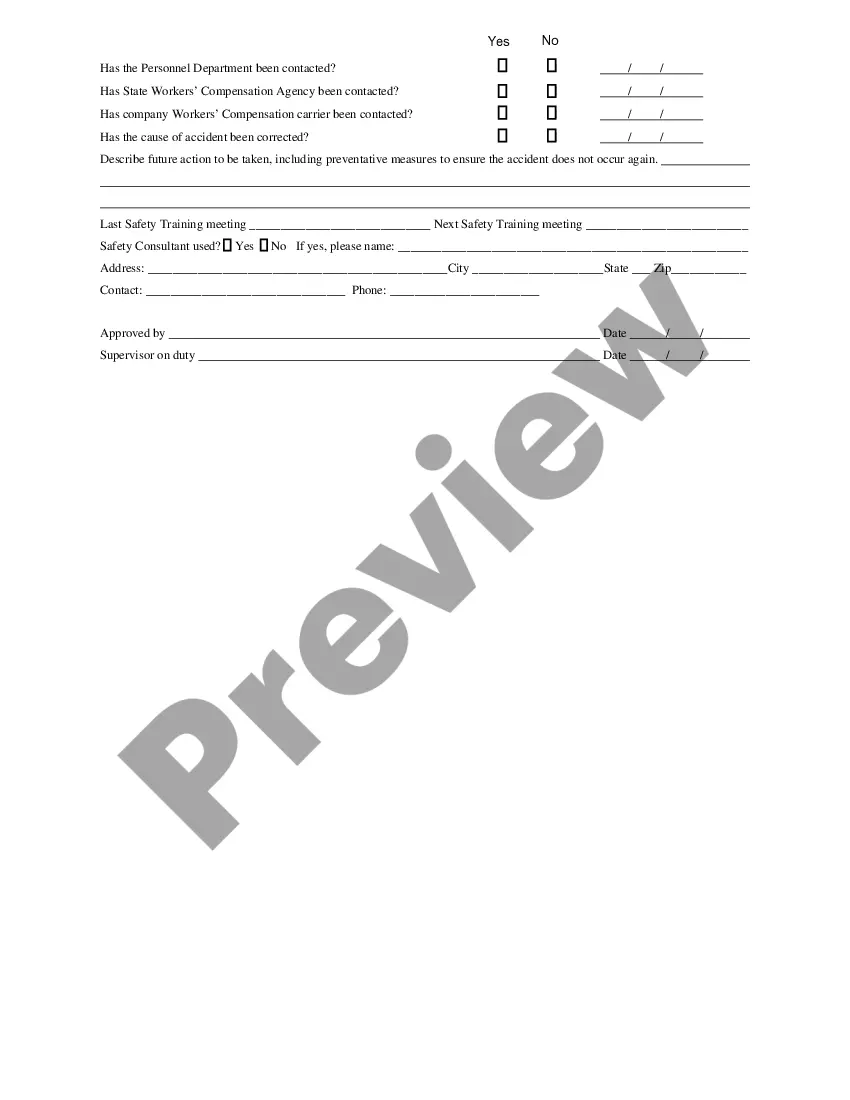

Filing a workers' comp claim in Connecticut starts with notifying your employer about the injury. After this, you need to fill out a form detailing the incident and submit it to the Workers' Compensation Commission. You must also be aware of filing deadlines to ensure compliance. Relevant documentation, such as your Connecticut Accident Report For Workers Comp Compliance, will support your claim.

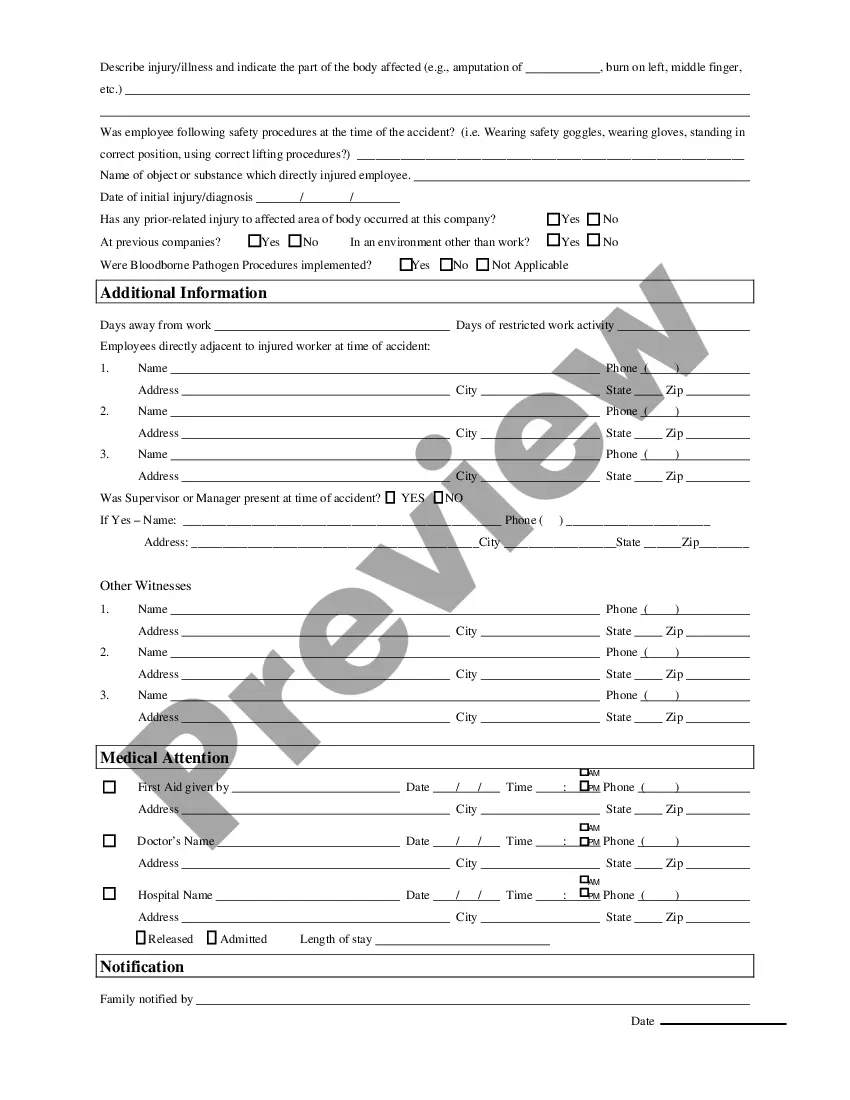

Filling out an injury report requires a clear approach. Begin by documenting the facts, including personal information, accident details, and descriptions of injuries. It is important to be factual and precise, as this aligns with the guidelines of the Connecticut Accident Report For Workers Comp Compliance, thus aiding in a smoother claims process and ensuring that you fulfill all necessary requirements.

When writing an injury report example, begin with a clear and detailed introduction that states who was involved and what occurred. Include sections on the injury details, witness accounts, and any actions taken post-incident. Using a structured template, like the Connecticut Accident Report For Workers Comp Compliance, can provide a solid framework that helps ensure important information is not missed.

Alabama Workers Comp operates as a no-fault insurance system, which means that workers can receive benefits for injuries sustained on the job without proving employer negligence. Benefits typically include medical expenses, partial wage compensation, and vocational rehabilitation if necessary. While this query focuses on Alabama, similar processes exist in Connecticut, where compliance with the Connecticut Accident Report For Workers Comp Compliance is essential for workers wishing to claim benefits.