Nebraska Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

Finding the correct authorized document template can be a challenge. Obviously, there are many templates accessible online, but how will you locate the authorized document you need? Utilize the US Legal Forms website.

The service provides thousands of templates, including the Nebraska Payroll Deduction Authorization Form for Optional Matters - Employee, which you can utilize for both business and personal needs. All of the forms are vetted by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Obtain button to download the Nebraska Payroll Deduction Authorization Form for Optional Matters - Employee. Use your account to search for the authorized forms you have previously obtained. Navigate to the My documents tab of your account and download another copy of the document you need.

US Legal Forms is the largest collection of authorized documents where you can find numerous file templates. Use the service to download professionally crafted paperwork that adhere to state requirements.

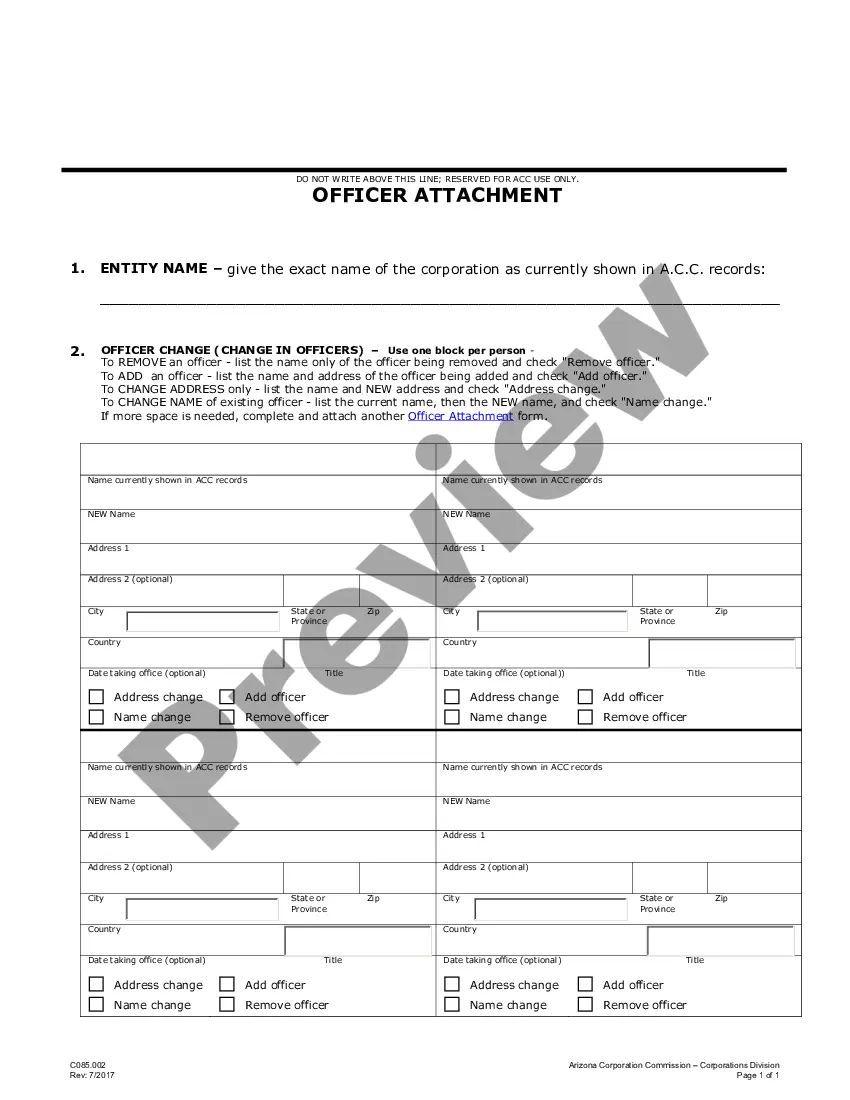

- First, ensure that you have selected the correct form for your locality/region. You may review the document using the Review button and read the document description to confirm it is the correct one for you.

- If the form does not meet your requirements, utilize the Search area to find the right form.

- Once you are confident that the document is appropriate, click the Get now button to obtain the form.

- Choose the pricing plan you prefer and enter the required information. Create your account and make the payment using your PayPal account or credit card.

- Select the file format and download the authorized document template for your use.

- Complete, edit, print, and sign the obtained Nebraska Payroll Deduction Authorization Form for Optional Matters - Employee.

Form popularity

FAQ

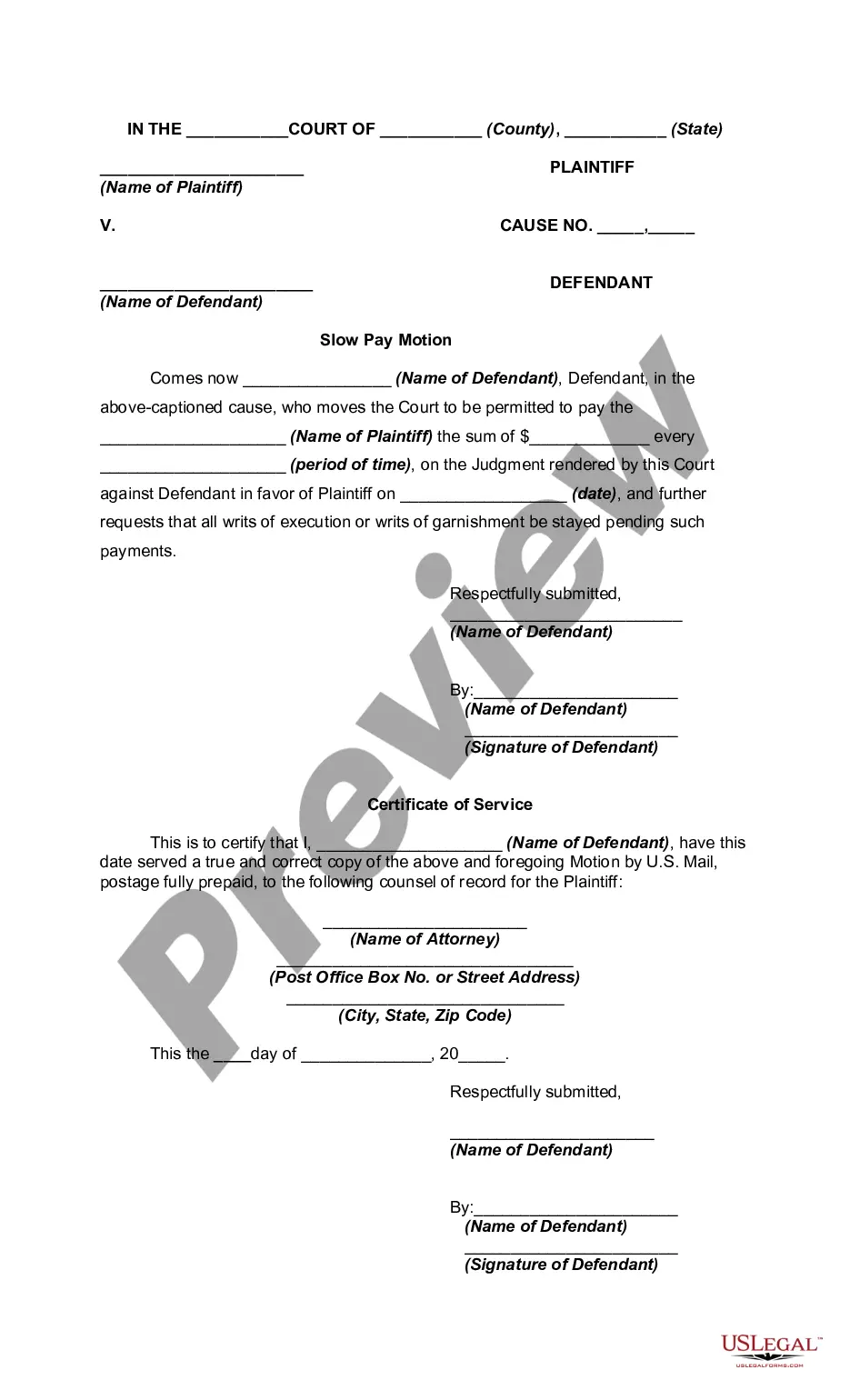

To fill out a withholding exemption, refer to the appropriate form and provide your personal information, including your name and Social Security number. You must specify the reason for the exemption and any relevant documentation. Using the Nebraska Payroll Deduction Authorization Form for Optional Matters - Employee simplifies this process by guiding you through the steps.

Yes, Nebraska has a state-specific W-4 form known as the W-4N. This form serves to report your state income tax withholding. It is important to complete the W-4N along with the Nebraska Payroll Deduction Authorization Form for Optional Matters - Employee to ensure all your withholding information is current.

The number of withholding allowances depends on your individual financial situation, including dependents and other deductions. Generally, the more allowances you claim, the less tax is withheld from your paycheck. Consult the IRS guidelines and consider using the Nebraska Payroll Deduction Authorization Form for Optional Matters - Employee to tailor your withholdings further.

To fill out your W-4 correctly, start by providing your personal details at the top of the form. Next, determine your filing status and calculate your withholding allowances based on your financial situation. Use the Nebraska Payroll Deduction Authorization Form for Optional Matters - Employee to finalize any optional deductions or contributions.

To fill out a W-4N in Nebraska, start by entering your personal information, including your name and Social Security number. Next, indicate your marital status and number of allowances. Finally, submit the W-4N along with your Nebraska Payroll Deduction Authorization Form for Optional Matters - Employee to your employer, ensuring correct processing.

The amendment form for Nebraska is designed for adjustments to existing tax forms. It allows employees to make changes to their withholding allowances or other pertinent details. By utilizing the Nebraska Payroll Deduction Authorization Form for Optional Matters - Employee, you ensure that your adjustments are properly documented and submitted.

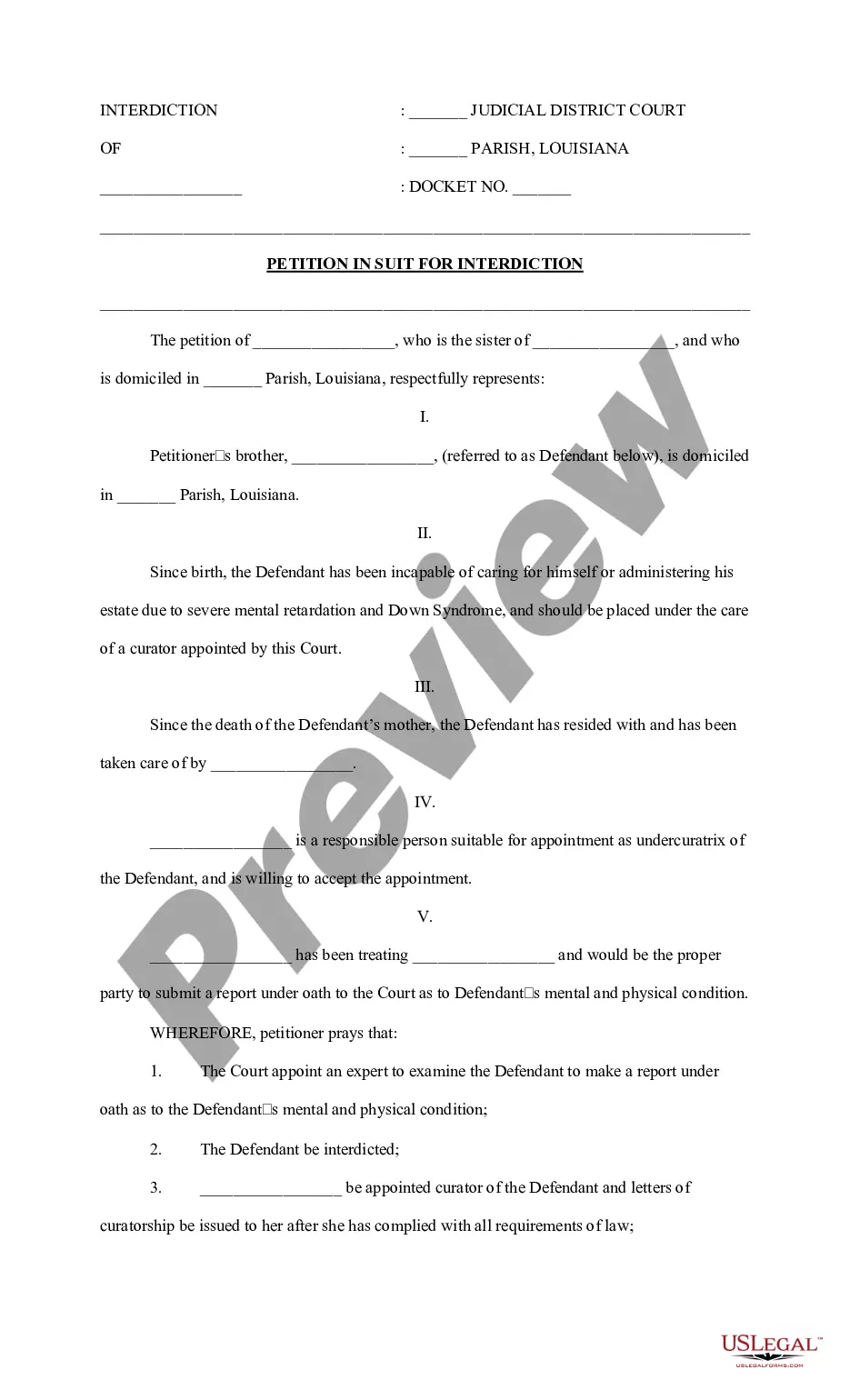

Allowances claimed on the Form W-4N are used by your employer or payor to determine the Nebraska state income tax withheld from your wages, pension, or annuity to meet your Nebraska state income tax obligation.

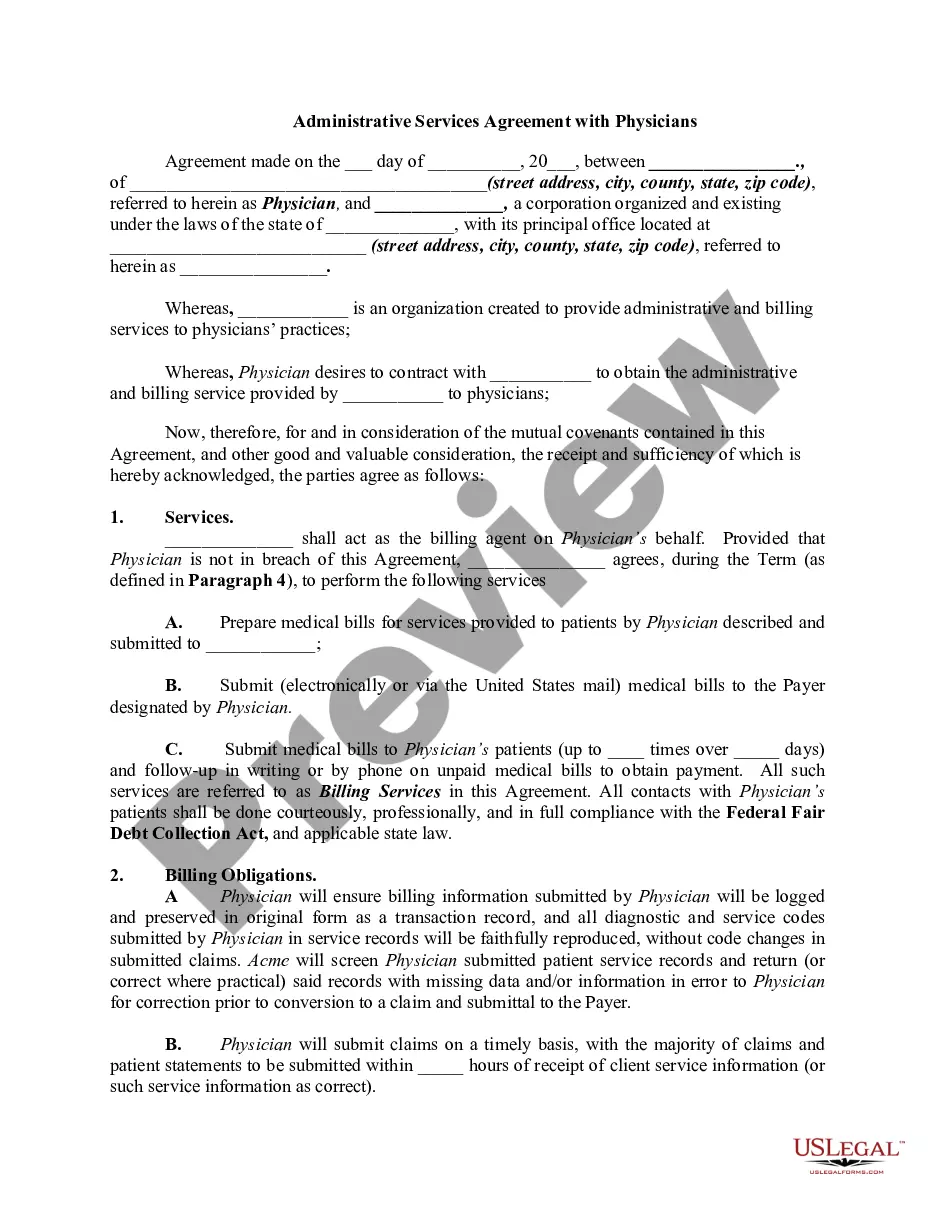

Mandatory payroll deductions are the wages that are withheld from your paycheck to meet income tax and other required obligations. Voluntary payroll deductions are the payments you make to retirement plan contributions, health and life insurance premiums, savings programs and before-tax health savings plans.

Authorized deductions are limited to: deductions which the employer is required to withhold by law or court order; deductions for the reasonable cost of board, lodging, and facilities furnished to the employee; and.

Mandatory Payroll Tax DeductionsFederal income tax withholding. Social Security & Medicare taxes also known as FICA taxes. State income tax withholding. Local tax withholdings such as city or county taxes, state disability or unemployment insurance.