Missouri Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the website, you can find numerous forms for business and personal purposes, sorted by categories, states, or keywords. You will find the latest versions of forms like the Missouri Payroll Deduction Authorization Form for Optional Matters - Employee within seconds.

If you already have a subscription, Log In and obtain the Missouri Payroll Deduction Authorization Form for Optional Matters - Employee from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms within the My documents tab of your account.

Proceed with the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the acquired Missouri Payroll Deduction Authorization Form for Optional Matters - Employee. Each template you add to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Missouri Payroll Deduction Authorization Form for Optional Matters - Employee with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have selected the appropriate form for your city/state.

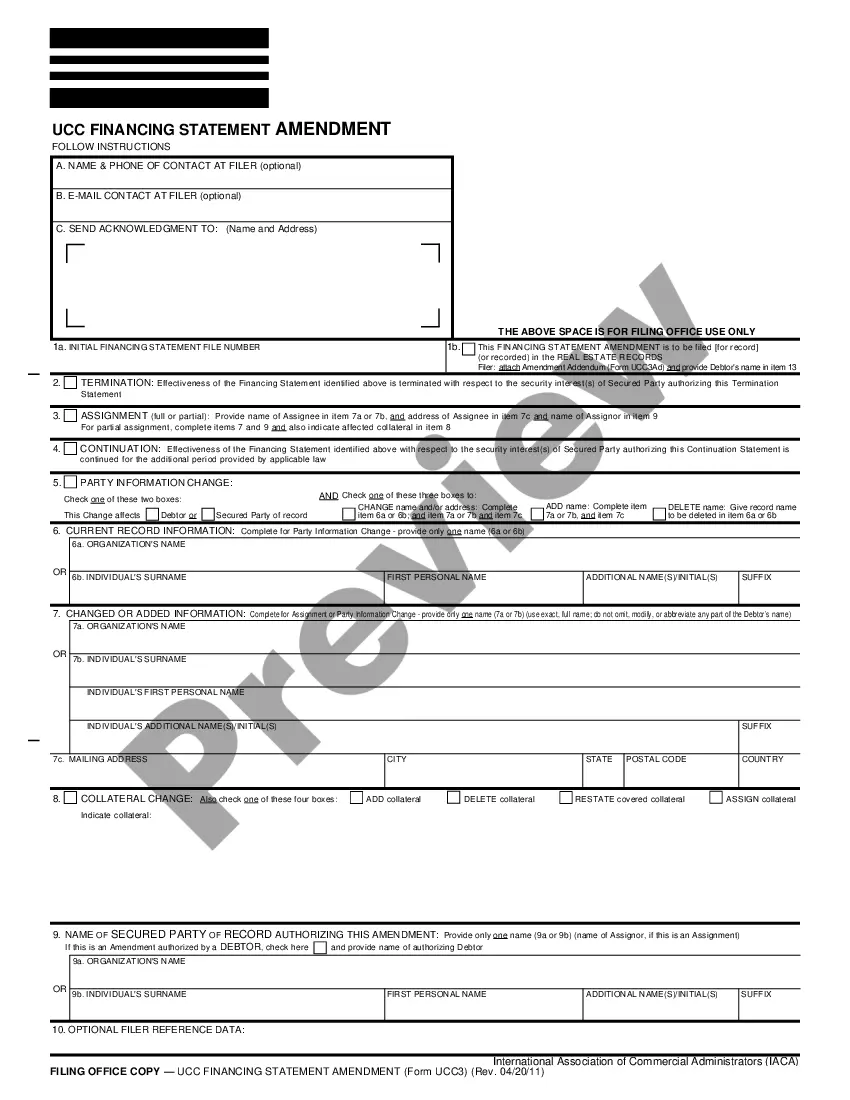

- Click the Preview button to review the content of the form.

- Check the form summary to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy Now button.

- Then, select the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

The form for payroll deduction permission is the Missouri Payroll Deduction Authorization Form for Optional Matters - Employee. This essential document grants employers the authority to deduct specified amounts from an employee's paycheck based on their consent. By completing this form, employees can ensure their preferences for payroll deductions are honored while providing clarity and precision in payroll processing. It ultimately benefits both the employee and the employer by promoting an organized payroll system.

The Missouri Health Care Sharing Ministry deduction allows employees to contribute to health care sharing programs that help manage medical costs among member participants. This option typically requires the use of the Missouri Payroll Deduction Authorization Form for Optional Matters - Employee for proper authorization. By participating in such a program, employees can actively manage their health care expenses while supporting a community-based approach to health care. It's important for employees to review their options to find the best fit for their needs.

Yes, payroll deductions must typically be approved by the employee in writing to ensure legal compliance and transparency. The Missouri Payroll Deduction Authorization Form for Optional Matters - Employee serves as the official documentation that records this approval. By requiring written consent, both the employer and employee have a clear understanding of the deductions being made. This method protects employees’ rights and helps prevent misunderstandings about payroll.

An optional payroll deduction refers to any deduction from an employee's paycheck that the employee has voluntarily chosen. These can include contributions to retirement plans, health insurance premiums, or charitable donations. The Missouri Payroll Deduction Authorization Form for Optional Matters - Employee allows employees to specify these options clearly and ensures they maintain control over their finances. Understanding optional deductions helps employees make informed financial decisions.

The Missouri Payroll Deduction Authorization Form for Optional Matters - Employee is designed to authorize optional payroll deductions from an employee's paycheck. This form allows employees to specify what deductions they consent to, ensuring clarity and compliance. Specifically, form 2159 details the types of deductions available and enables employees to have direct control over their payroll options. Utilizing this form helps streamline the payroll process and keep records organized.

When indicating exempt from withholding on your Missouri Payroll Deduction Authorization Form for Optional Matters - Employee, you need to specify that you meet the criteria prescribed by the IRS. Generally, this means that you did not owe any federal taxes in the previous year and expect not to owe in the current year. Always double-check your eligibility for exemption to avoid any tax liabilities in the future.

Filling out form 53/1 in Missouri requires you to provide basic information about your employment and income. Make sure to indicate any details regarding deductions and benefits applicable to your situation. To ensure accuracy and compliance, you can leverage the Missouri Payroll Deduction Authorization Form for Optional Matters - Employee as a guide while completing the form.

The address you should put on your tax return is typically your permanent residence address where you receive mail. Include the street address, city, state, and ZIP code. If you live in Missouri, ensure that the details match the information you provided on your Missouri Payroll Deduction Authorization Form for Optional Matters - Employee to avoid discrepancies during tax processing.

Completing a 53/1 form in Missouri involves providing your personal information and specifying details about your employment. Additionally, ensure that you select the appropriate options based on whether you are part of a retirement plan or have other considerations. To simplify this task, consider using the Missouri Payroll Deduction Authorization Form for Optional Matters - Employee, which will guide you through related processes.

To fill out your Missouri W4, begin by entering your name and identification information. Then, follow the instructions to calculate your personal allowances, considering factors such as dependents and additional deductions. After ensuring all sections are complete, submit the Missouri Payroll Deduction Authorization Form for Optional Matters - Employee to your employer to adjust your withholding accordingly.