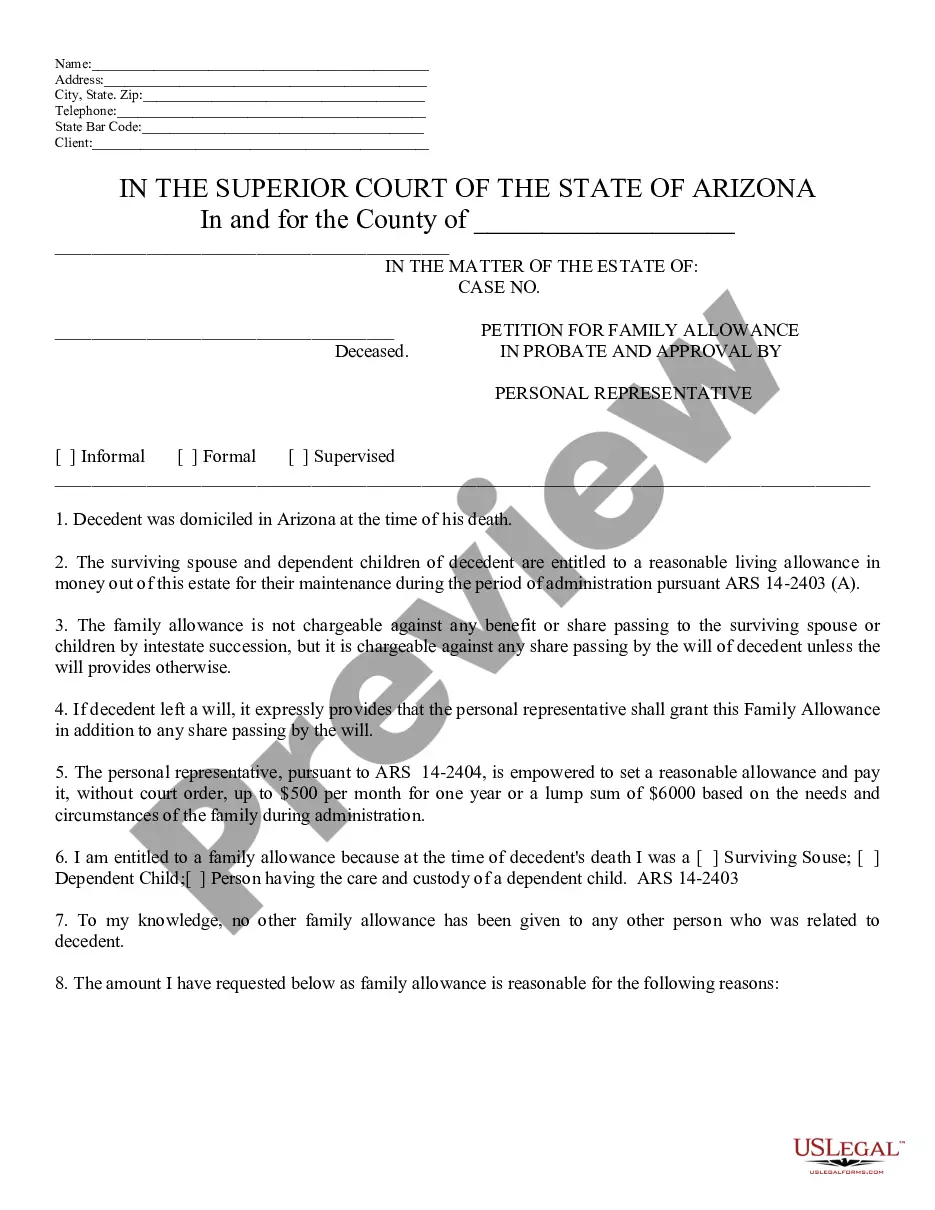

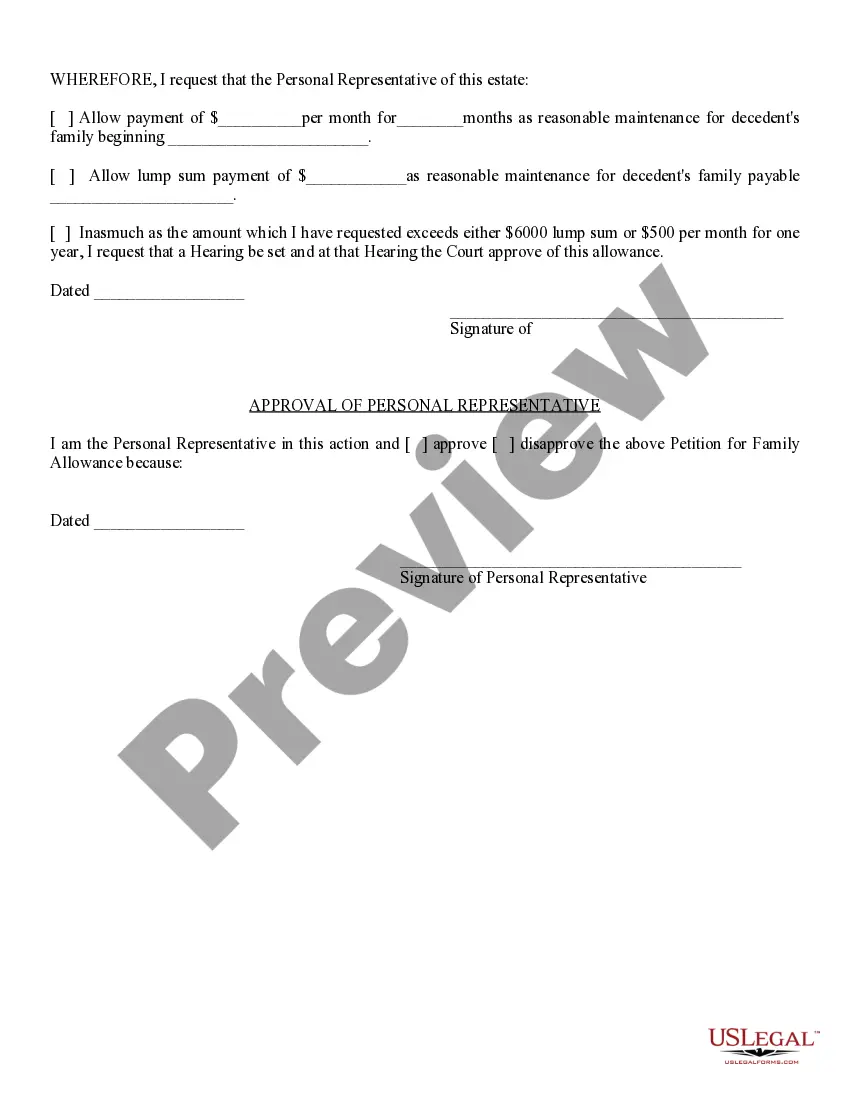

This model form, a Petition for Family Allowance in Probate and; Approval by Personal Representative -Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

Arizona Petition for Family Allowance in Probate and Approval by Personal Representative

Description

How to fill out Arizona Petition For Family Allowance In Probate And Approval By Personal Representative?

If you're looking for the appropriate Arizona Petition for Family Allowance in Probate and Approval by Personal Representative templates, US Legal Forms is exactly what you require; find documents crafted and verified by state-certified attorneys.

Utilizing US Legal Forms not only saves you from concerns about legal paperwork; furthermore, you conserve time, energy, and money! Acquiring, printing, and completing a professional document is truly less expensive than hiring a lawyer to draft it for you.

Choose a suitable format and save the document. And that's all. In merely a few straightforward steps, you obtain an editable Arizona Petition for Family Allowance in Probate and Approval by Personal Representative. After creating an account, all subsequent orders will be processed with even greater ease. When you have a US Legal Forms subscription, just Log In to your account and click the Download option found on the form’s page. Then, whenever you need to use this template again, you'll always be able to access it in the My documents menu. Don't waste your time searching through multiple forms on various platforms. Order exact copies from just one reliable source!

- To begin, finalize your registration process by providing your email and setting up a password.

- Follow the guidelines below to create your account and locate the Arizona Petition for Family Allowance in Probate and Approval by Personal Representative sample to fulfill your needs.

- Utilize the Preview option or review the document details (if accessible) to confirm that the form is the one you seek.

- Verify its suitability for your location.

- Click Buy Now to place an order.

- Select a recommended pricing plan.

- Establish your account and pay with your credit card or PayPal.

Form popularity

FAQ

Probate in Arizona can vary in difficulty based on several factors, such as the complexity of the estate and whether there are disputes among heirs. Generally, having a clear will can simplify the process, while complications can arise with contested wills or debts. The process includes filing the Arizona Petition for Family Allowance in Probate and Approval by Personal Representative, which can be straightforward with proper guidance. Utilizing resources like uslegalforms can help streamline the process and reduce potential challenges.

In Arizona, any estate valued over $75,000 for real property or $50,000 for personal property typically requires probate. If the estate falls below these amounts, alternative procedures may be available, potentially avoiding formal probate. However, for larger estates, you will likely need to file the Arizona Petition for Family Allowance in Probate and Approval by Personal Representative, as this starts the legal process. Understanding these thresholds can help you plan effectively.

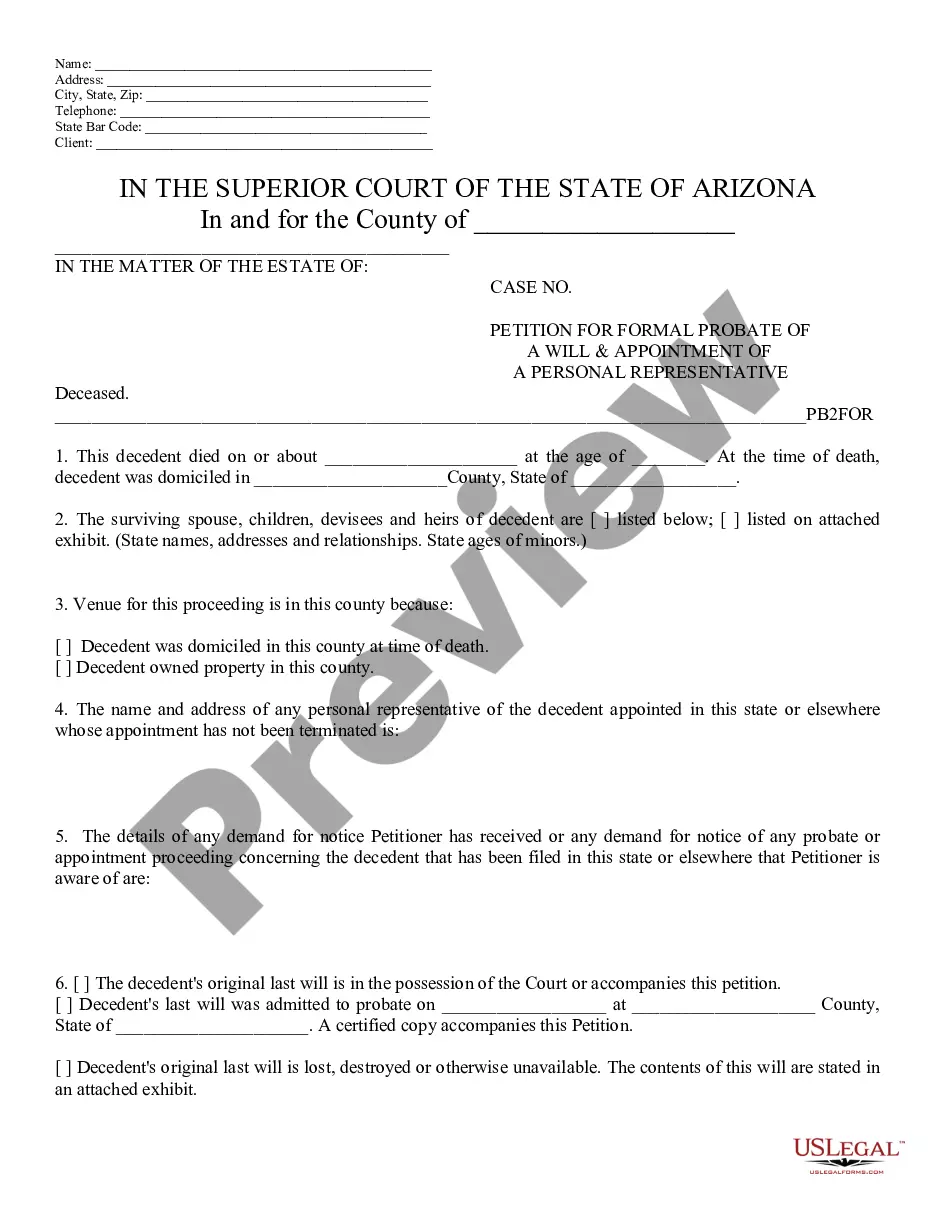

To begin the probate process in Arizona, gather important documents such as the deceased's will, death certificate, and financial records. You must then file a petition for probate, which includes the Arizona Petition for Family Allowance in Probate and Approval by Personal Representative, at your local superior court. Make sure to adhere to local rules and timelines. Consulting with a legal professional is often beneficial to ensure a smooth process.

While it is not mandatory to have a lawyer for the probate process in Arizona, having legal assistance can simplify the procedure significantly. A lawyer can help you understand the complexities of submitting an Arizona Petition for Family Allowance in Probate and Approval by Personal Representative. An experienced attorney can ensure all paperwork is accurate and complete, minimizing delays and potential disputes. Therefore, hiring a lawyer is often a wise decision for navigating probate efficiently.

A letter of appointment of personal representative in Arizona authorizes an individual to manage the estate of a deceased person. This document confirms that the appointed representative has the legal power to act on behalf of the estate, including handling assets and debts. When filing an Arizona Petition for Family Allowance in Probate and Approval by Personal Representative, this letter becomes crucial for ensuring that the representative's actions are recognized by the court. Thus, obtaining this letter is a key step in the probate process.

Rule 53 of the Arizona Rules of Probate Procedure outlines the process for filing an Arizona Petition for Family Allowance in Probate and Approval by Personal Representative. This rule establishes the legal framework necessary for individuals seeking financial support from the estate of a deceased family member. It ensures that claims for family allowances are addressed in a structured manner, promoting fairness and clarity. Understanding this rule can significantly ease the navigation through probate proceedings.

In Arizona, a trustee is generally required to distribute assets within a reasonable timeframe, but this duration is not strictly defined by law. Factors such as estate complexity, creditor claims, and the trust terms can influence this timeline. Proper management and legal guidance are crucial in ensuring a smooth distribution when dealing with an Arizona Petition for Family Allowance in Probate.

The speed of settling an estate in Arizona can vary widely, from several months to over a year, depending on estate complexity and any disputes. Engaging with experienced professionals can expedite the process and navigate the intricacies of an Arizona Petition for Family Allowance in Probate efficiently.

Rule 51 in probate in Arizona specifically outlines the appointment process for personal representatives, detailing the procedures and requirements for nomination and selection. Familiarity with this rule aids individuals and families in navigating the probate process effectively. This is particularly relevant for those initiating an Arizona Petition for Family Allowance in Probate.

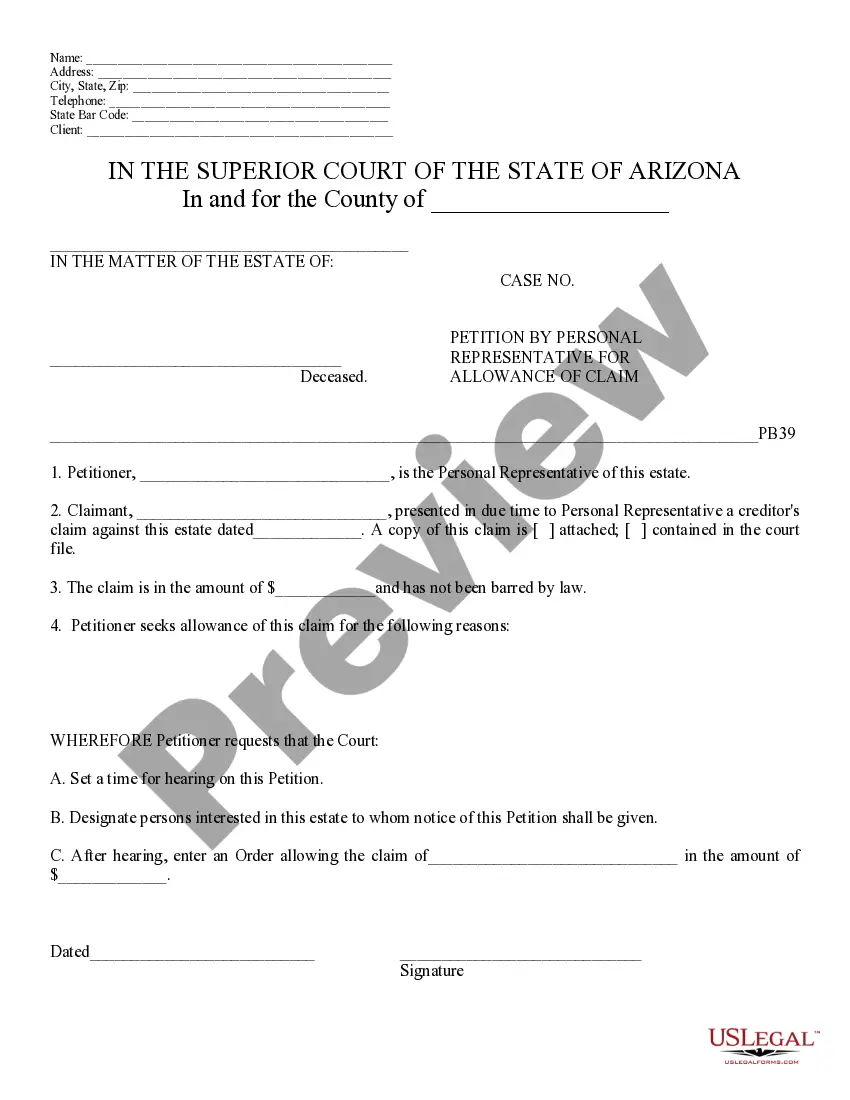

A probate personal representative in Arizona is an individual appointed to administer a decedent's estate following probate procedures. They manage the estate's obligations, including paying debts and distributing assets. Their role is critical in the Arizona Petition for Family Allowance in Probate, ensuring compliance with all legal requirements.