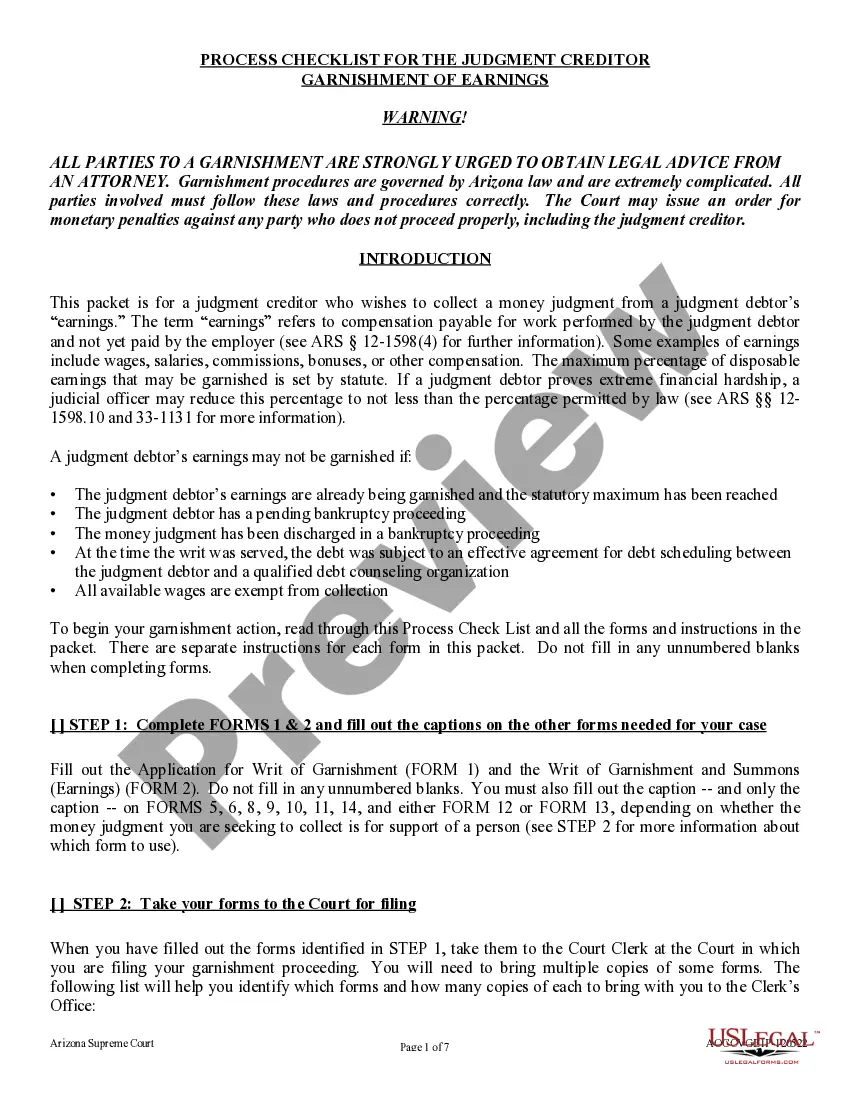

The Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings is a set of steps to take when attempting to collect a debt owed by a non-wage earner. The process begins with filing a Garnishment of Non-Earnings form with the court, which provides the Judgment Creditor with the right to collect the debt from the debtor's bank account or other non-wage earning sources. Once the Garnishment of Non-Earnings form has been filed, the Judgment Creditor must obtain a Writ of Garnishment for Non-Earnings from the court. This Writ authorizes the creditor to collect the debt owed by the debtor from the debtor's bank account or other non-wage earning sources. The next step is to serve the debtor with the Writ of Garnishment. This can be done by certified mail, personal service, or publication in a newspaper. After the debtor has been served, the Judgment Creditor must complete the Garnishment of Non-Earnings form and serve a copy on the debtor. The Judgment Creditor must then submit an Affidavit of Service to the court, which states that the Writ of Garnishment and the Garnishment of Non-Earnings form have been served on the debtor. Once the court has received this Affidavit, the Judgment Creditor may proceed to collect the debt owed by the debtor from the debtor's bank account or other non-wage earning sources. Finally, the Judgment Creditor must file a Satisfaction of Judgment with the court, which states that the debt has been paid in full. Once the Satisfaction of Judgment has been filed, the Garnishment of Non-Earnings process is complete. There are two types of Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings: the Garnishment of Non-Earnings for Wages (GNP) and the Garnishment of Non-Earnings for Non-Wages (GNAW). The GNP is used to collect wages from a debtor, while the GNAW is used to collect from other sources, such as bank accounts or other non-wage earning sources.

Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings

Description

How to fill out Arizona Process Check List For The Judgment Creditor In A Garnishment Of Non-Earnings?

Drafting legal documents can be quite stressful unless you have accessible fillable templates. With the US Legal Forms online repository of official paperwork, you can be assured of the blanks you encounter, as they all adhere to federal and state laws and have been reviewed by our experts.

Obtaining your Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings from our library is as straightforward as 1-2-3. Existing users with an active subscription only need to Log In and click the Download button after they find the correct template. If necessary, users can later access the same document from the My documents section of their account. Nonetheless, even if you are new to our platform, registering for a valid subscription will require just a few moments. Here's a brief guide for you.

Haven’t you tried US Legal Forms yet? Register for our service today to acquire any official document swiftly and effortlessly whenever you need, and keep your paperwork organized!

- Document compliance confirmation. You should carefully examine the details of the form you wish to use to ensure it fulfills your requirements and adheres to your state legislation. Previewing your document and reviewing its overall description will assist you in accomplishing this.

- Alternative search (optional). If there are any discrepancies, explore the library using the Search tab at the top of the page until you locate an appropriate document, and click Buy Now when you find the one you seek.

- Account setup and form purchase. Register an account with US Legal Forms. After confirming your account, Log In and select your desired subscription plan. Complete the payment to proceed (payment options include PayPal and credit card).

- Template download and usage. Select the file format for your Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings and click Download to save it on your device. Print it for manual completion, or utilize a multifunctional online editor to prepare an electronic version more quickly and efficiently.

Form popularity

FAQ

To stop a wage garnishment in Arizona, you can file a motion with the court to request a halt or modification. This can be particularly useful if your financial circumstances have changed. It's recommended to consult the Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings to understand the proper procedures and any necessary documentation required to support your request.

The amount your check can be garnished varies, but generally, Arizona law allows garnishment up to 25% of your disposable income. For judgment creditors, referring to the Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings will provide you with detailed guidance. This will help you understand the limits and ensure you collect the appropriate amount.

In Arizona, the maximum wage garnishment is set by law and typically cannot exceed 25% of your disposable earnings. Understanding these limits is crucial for judgment creditors as you navigate the Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings. This helps ensure that garnishment is both fair and effective while complying with legal standards.

Garnishment processing involves legally obtaining a portion of a debtor's income or assets to satisfy a judgment. In Arizona, as a judgment creditor, you'll need to follow specific steps outlined in the Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings. This ensures compliance with state laws and helps streamline the process effectively.

Yes, creditors can garnish your bank account in Arizona through a process known as non-earnings garnishment. This allows them to access funds directly from your accounts to satisfy a debt. If you are a creditor, the Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings provides the necessary steps to initiate this process effectively.

The new garnishment law in Arizona introduces changes aimed at balancing creditor rights with debtor protections. The law outlines specific procedures and caps on garnishments for various debt types. Keeping these updates in mind can be beneficial, and following the Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings ensures you are on the right track.

In Arizona, a maximum of 25% of your disposable earnings can be garnished for debts. However, federal regulations may also apply, potentially limiting garnishments further. Understanding these limits is essential, and using the Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings helps clarify the rules surrounding wage garnishment.

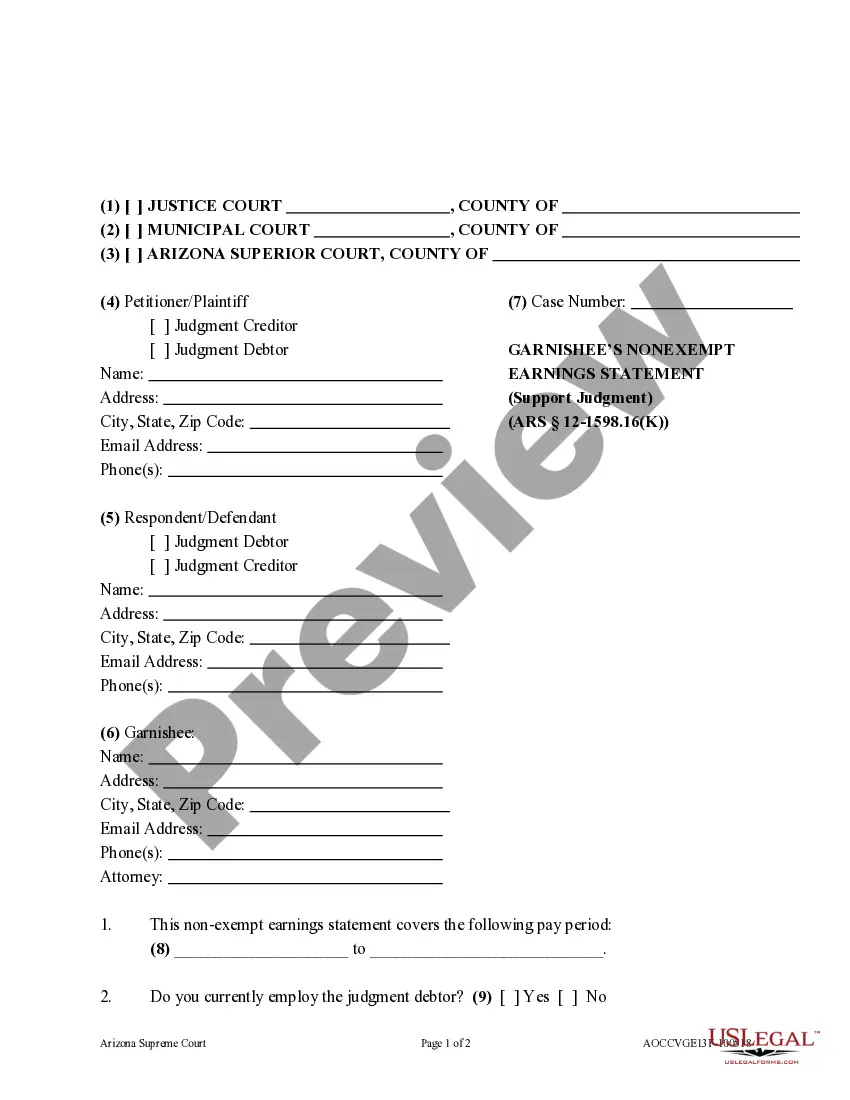

Non-earnings garnishment is a process where creditors collect funds from sources other than wages, such as bank accounts or personal property. In Arizona, this type of garnishment is generally initiated through a writ of garnishment. By following the Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings, you can ensure you comply with all legal requirements during the process.

To stop a garnishment in Arizona, you can file a motion with the court that issued the garnishment. You must provide valid reasons, such as proving the garnishment is excessive or incorrect. The Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings can guide you through this process clearly and effectively.

A writ of garnishment for non-earnings in Arizona is a legal order allowing creditors to collect debts from non-wage sources, such as bank accounts or rental income. This type of garnishment provides a means for creditors to secure payments without impacting your income. Utilizing the Arizona Process Check List for the Judgment Creditor in a Garnishment of Non-Earnings will help you understand the procedures for initiating this process.