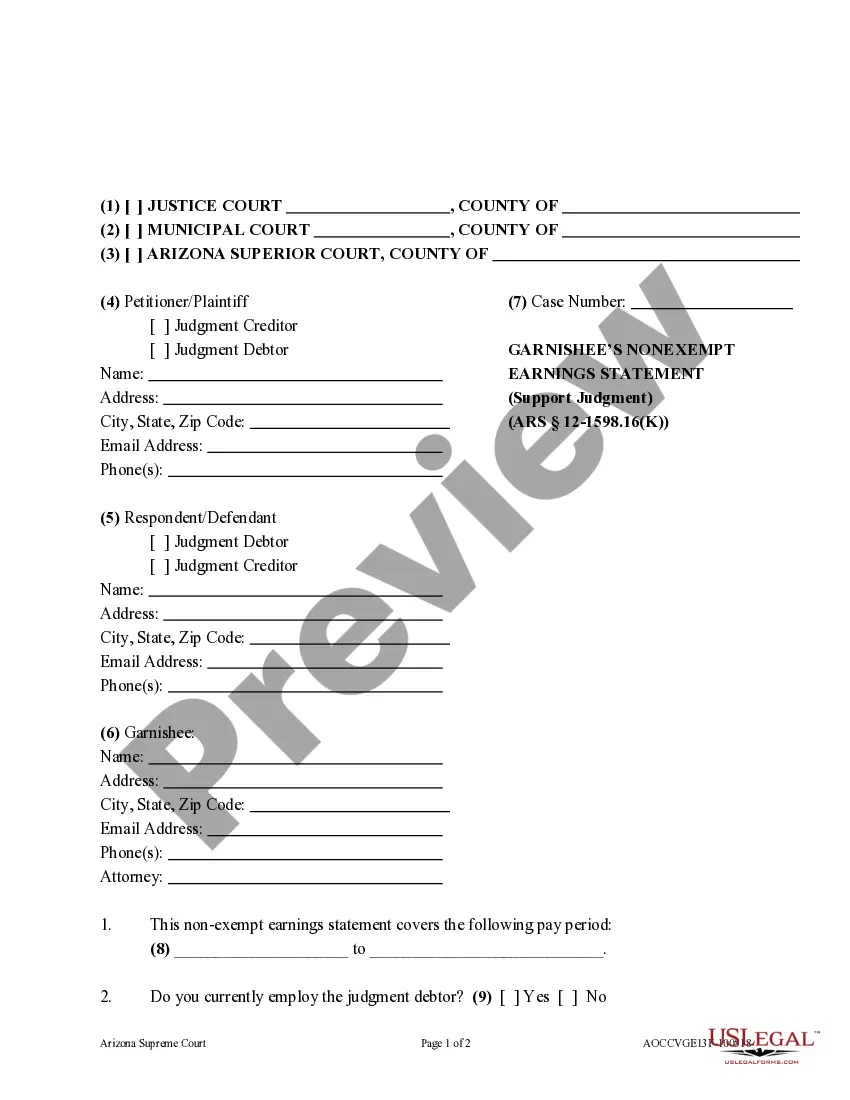

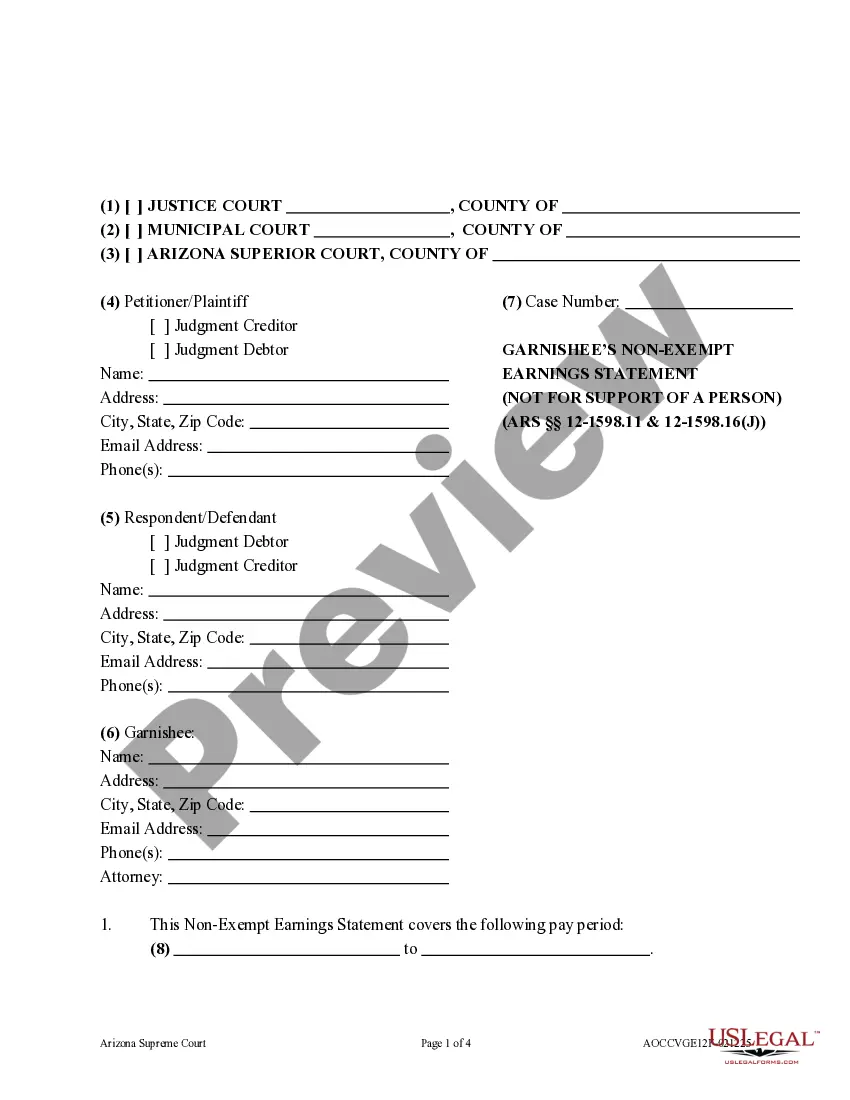

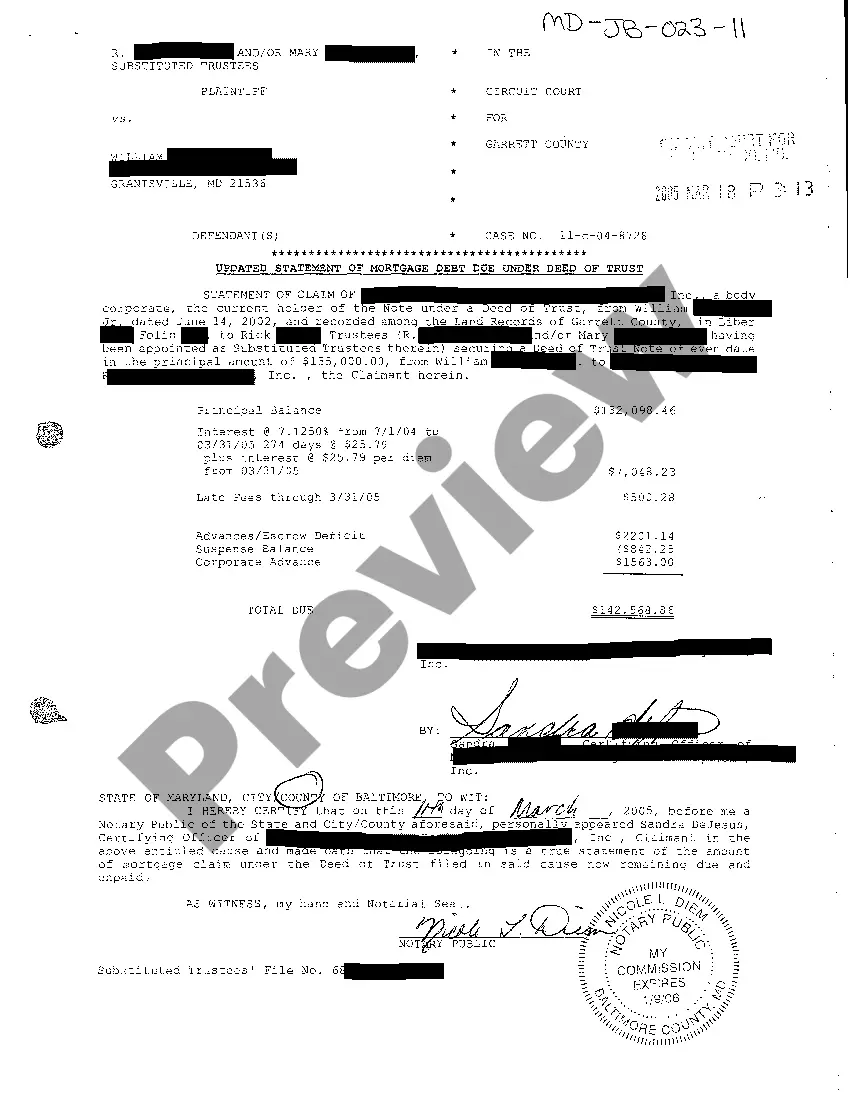

Non Exempt Earnings Statement - Support: A Non-Exempt Earnings Statement gives an employer the calculation to follow when garnishing a debtor/employee's paycheck. This form is available for download in both Word and Rich Text formats.

Arizona Garnishee's Nonexempt Earnings Statement (Support Judgment)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Garnishee's Nonexempt Earnings Statement (Support Judgment)?

If you're looking for precise Arizona Garnishee's Nonexempt Earnings Statement - Support templates, US Legal Forms is precisely what you require; find documents created and verified by state-certified legal professionals.

Using US Legal Forms not only prevents you from issues regarding legal documents; additionally, you conserve time and effort, as well as money! Downloading, printing, and completing a professional document is considerably less expensive than hiring an attorney to do it for you.

And that’s it. With just a few simple steps, you acquire an editable Arizona Garnishee's Nonexempt Earnings Statement - Support. After creating your account, all future requests will be processed even more easily. When you have a US Legal Forms subscription, simply Log In to your profile and select the Download button you can find on the form’s page. Then, when you wish to use this sample again, you'll always be able to locate it in the My documents section. Don’t waste your time comparing countless forms on various web sources. Acquire professional copies from just one secure platform!

- To begin, complete your registration process by providing your email and creating a secure password.

- Follow the instructions below to set up an account and locate the Arizona Garnishee's Nonexempt Earnings Statement - Support template to manage your situation.

- Utilize the Preview option or review the file details (if accessible) to confirm that the sample is the one you desire.

- Verify its legality in your state.

- Click on Purchase Now to place your order.

- Choose a preferred pricing option.

- Establish an account and pay using your credit card or PayPal.

- Pick an appropriate format and save the form.

Form popularity

FAQ

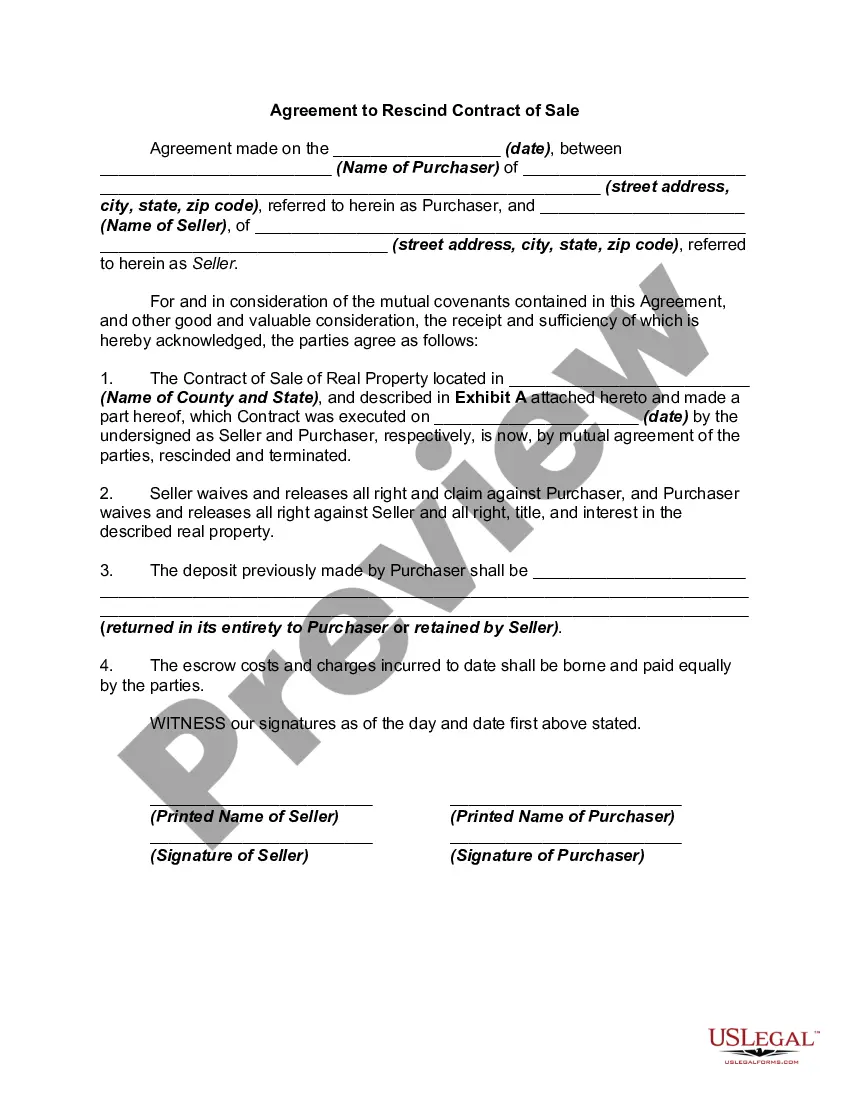

A process of enforcing a money judgment by the seizure or attachment of debts due or accruing to the judgment debtor that form part of his property available in execution. As such, it is a species of execution upon debts, for which the ordinary methods of execution are unavailable.

Garnishee: the person holding the property (money) of the debtor. An employer may be a garnishee because the employer holds wages to be paid to an employee (who is a debtor).

An individual who holds money or property that belongs to a debtor subject to an attachment proceeding by a creditor.In such case, the debtor's employer is the garnishee.

Wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support.

A garnishment order instructs a third-party who owes money to the defendant to pay some or all of that money to the plaintiff instead of the the defendant. This third party is called a "garnishee." Most garnishments affect defendants' wages.

A garnishee order is a common form of enforcing a judgment debt against a creditor to recover money. Put simply, the court directs a third party that owes money to the judgement debtor to instead pay the judgment creditor. The third party is called a 'garnishee'.

A wage or bank account garnishment occurs when a creditor takes a portion of your paycheck or money from your bank account to collect a debt. Most garnishments are by court orders after a judgment. Certain debts owed to the federal government, such as to the IRS, may result in a garnishment without a court order.

What Happens When a Garnishment Summons Is Served?In the case of a nonearnings garnishment, the garnishee must provide a written disclosure to the creditor within 20 days after service of the garnishment summons that identifies all indebtedness, money, or property that the garnishee owes to the debtor.