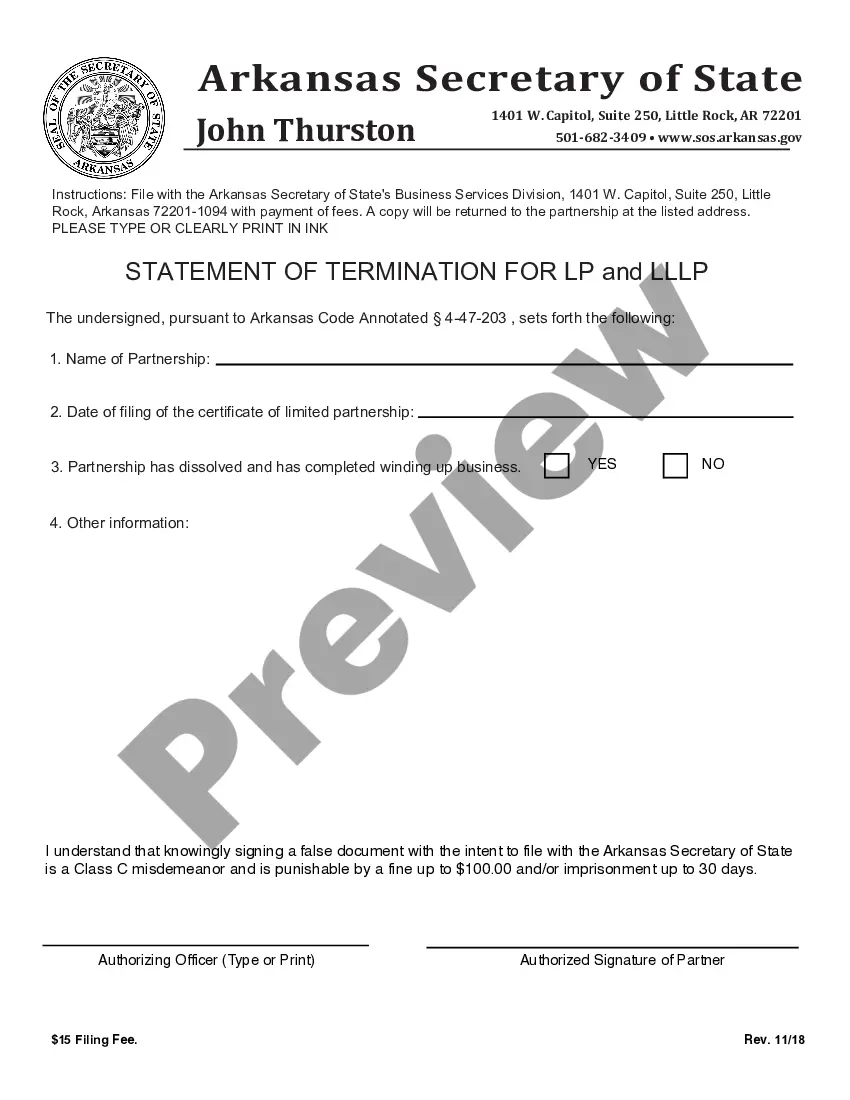

Arkansas Statement Of Termination For A LLP

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arkansas Statement Of Termination For A LLP?

Filling out official documents can be quite a hassle unless you have accessible fillable models. With the US Legal Forms online repository of formal paperwork, you can trust the forms you acquire, as all of them adhere to federal and state laws and are verified by our experts.

So if you're looking to complete the Arkansas Statement Of Termination For A LLP, our platform is the ideal place to obtain it.

Here’s a brief guide for you: Verification of document compliance. You should carefully inspect the contents of the form you need and ensure it meets your requirements and aligns with your state’s legal regulations. Previewing your document and examining its overall description will assist you in this process.

- Getting your Arkansas Statement Of Termination For A LLP from our platform is simple and straightforward.

- Previously registered users with a valid subscription just need to Log In and click the Download button after finding the right form.

- Later, if needed, users can retrieve the same document from the My documents section of their account.

- However, even if you are new to our service, registering with a valid subscription will only take a few minutes.

Form popularity

FAQ

When you want to transfer LLC ownership in Arkansas, you have two options. You can sell the entire LLC, or you can conduct a partial sale of the ownership interests of one or more members. This is often known as a buyout.

How do you dissolve an Arkansas Limited Liability Company? To dissolve your Arkansas LLC, you submit the completed form Articles of Dissolution for Limited Liability Company to the Arkansas Secretary of State, Business and Commercial Services (BCS) by mail or in person. You cannot file articles of dissolution online.

To make a business name change in Arkansas, you'll have to file either a Certificate of Amendment to Certificate of Organization for a limited liability company (LLC) or a Certificate of Amendment to the Articles of Incorporation for a corporation, depending on which type of legal entity structure you've selected for

In the state of Arkansas, every business entity is required to complete an annual report filing. Arkansas requires that you file by May 1st of each year, otherwise you may fall into noncompliance and face fees and penalties.

Will I be assessed late fees if I don't file an Arkansas Franchise Tax or Annual Report? The state will charge your Arkansas LLC or corporation (with and without stock) a $25 late fee.

To dissolve your Arkansas corporation, submit a completed dissolution form to the Arkansas Secretary of State, Business and Commercial Services (BCS) by mail or in person. You cannot file Arkansas articles of dissolution online.

Arkansas does not legally require an operating agreement for an LLC, but it makes sense to have one in place if your LLC has more than one member. This agreement details the ownership and procedures of the business. These are recognized as legally binding governing documents by the state.

LLC ownership is personal property to its members. Therefore the operating agreement and Arkansas state laws declare the necessary steps of membership removal. To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail.