The Illinois Returning Veterans Exemption (EVE) is a tax break for veterans who have served in the U.S. Armed Forces and are returning to Illinois to live. The exemption applies to homestead property—the home a veteran owns and lives in—and exempts a portion of the assessed value of the property from taxation. There are three types of Ives: the General Homestead Exemption, the Disabled Veterans Homestead Exemption, and the Veterans Homestead Extension. The General Homestead Exemption provides a $5,000 reduction in the assessed value of the veteran’s home, while the Disabled Veterans Homestead Exemption provides a $10,000 reduction. The Veterans Homestead Extension applies to veterans whose property has been assessed at an amount greater than $250,000, and allows them to receive a reduction in the assessed value of up to $20,000. The exemption is available to all veterans who have served in the U.S. Armed Forces and are living in Illinois.

Illinois Returning Veterans Exemption

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

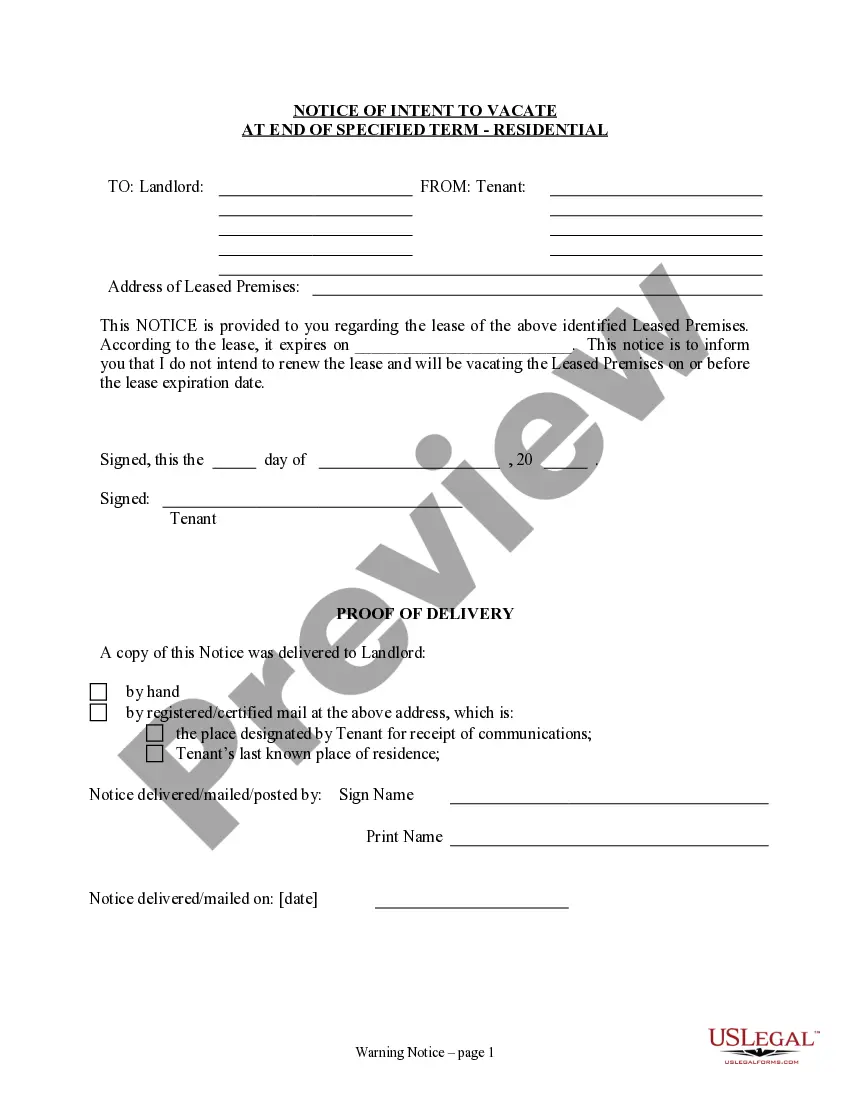

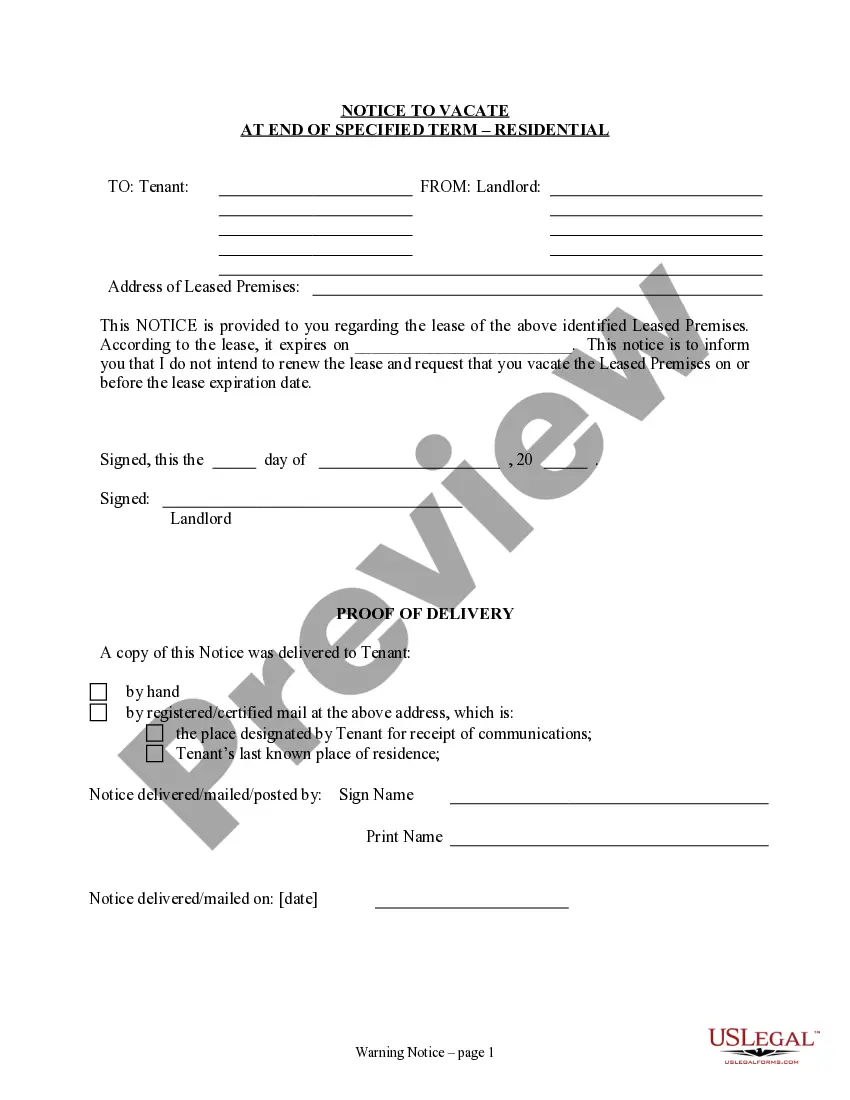

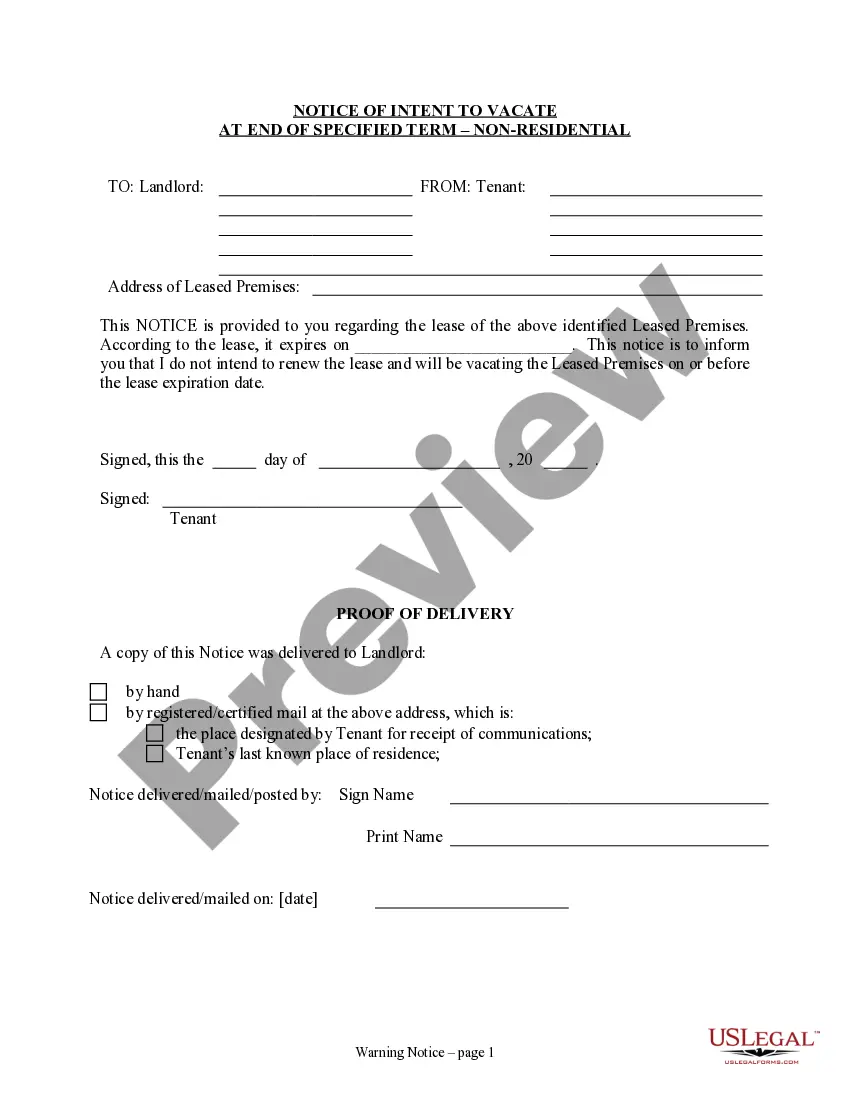

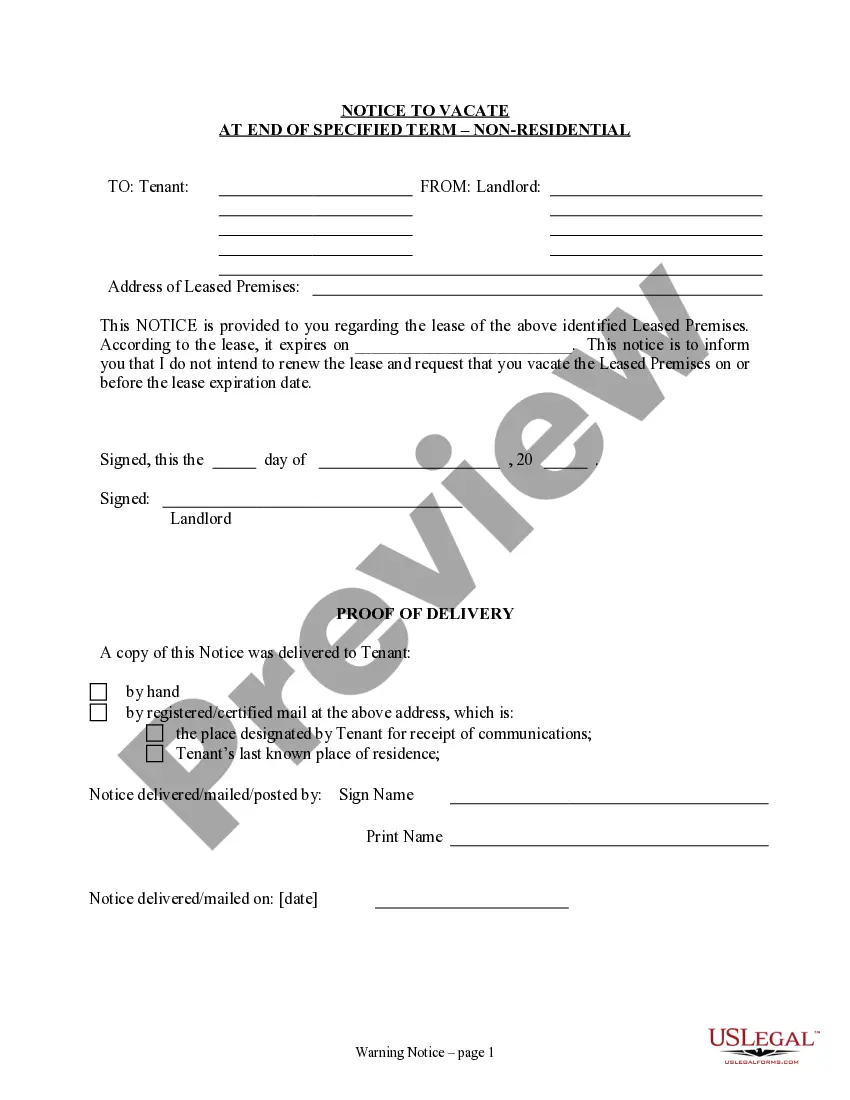

How to fill out Illinois Returning Veterans Exemption?

Completing official documents can be quite a hassle unless you have access to ready-to-use fillable formats. With the US Legal Forms online repository of formal paperwork, you can trust the forms you receive, as all of them align with federal and state regulations and are verified by our specialists.

Therefore, if you need to generate the Illinois Returning Veterans Exemption, our service is the ideal place to acquire it.

Here’s a concise guide for you: Document compliance verification. You should thoroughly analyze the content of the form you desire and verify whether it aligns with your requirements and adheres to your state law standards. Previewing your document and reviewing its overall description will assist you in achieving that. Alternative search (optional). If you spot any discrepancies, peruse the library using the Search tab at the top of the page until you locate a suitable template, and press Buy Now upon identifying the one you wish. Account registration and document acquisition. Create an account with US Legal Forms. Once your account is verified, Log In and choose your desired subscription plan. Make a payment to proceed (both PayPal and credit card options are available). Template download and subsequent use. Select the file format for your Illinois Returning Veterans Exemption and click Download to store it on your device. Print it to complete your paperwork manually, or utilize a versatile online editor to prepare an electronic version more quickly and efficiently. Have you experienced US Legal Forms yet? Subscribe to our service now to acquire any formal document swiftly and conveniently whenever you need it, and keep your paperwork organized!

- Acquiring your Illinois Returning Veterans Exemption from our platform is as straightforward as ABC.

- Previously registered members with an active subscription merely need to Log In and click the Download button after finding the right template.

- Later, if necessary, users can reaccess the same form from the My documents section of their account.

- However, even if you are a newcomer to our service, signing up with a valid subscription will only take a few moments.

Form popularity

FAQ

A new law in the Property Tax Code (35 ILCS 200/10-23) will provide a property tax break to veterans and persons with disabilities who make accessibility improvements to their residences.

Taxpayers whose primary residence is a single-family home, townhouse, condominium, co-op or apartment building (up to six units) are eligible. First-time applicants must have been the occupants of the property as of January 1 of the tax year in question.

The Home Improvement Exemption allows a homeowner to add improvements to their home that add to its value (for example, by increasing the building's square footage, or repairing after structural flood damage) without being taxed on up to $75,000 of the added value for up to four years. No application is required.

Properties of religious, charitable, and educational organizations, as well as units of federal, state and local governments, are eligible for exemption from property taxes to the extent provided by law.

A Returning Veterans Exemption is for veterans returning from active duty in armed conflict. They are eligible to receive a $5,000 reduction in the equalized assessed value of their property only for each taxable year in which they return.

Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1957 or prior) and own and occupy their property as their principal place of residence. Once this exemption is applied, the Assessor's Office automatically renews it for you each year.

Senior Citizens Real Estate Tax Deferral Program allows persons 65 years of age and older, who have a total household income of less than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments on their principal residences.

You can get your property taxes lowered by proving that your house is worth less than the assessor says it is. To do this, you have to appeal to your local board of review. You can find contact information for your local board of review on the Illinois Property Tax Appeal Board website.