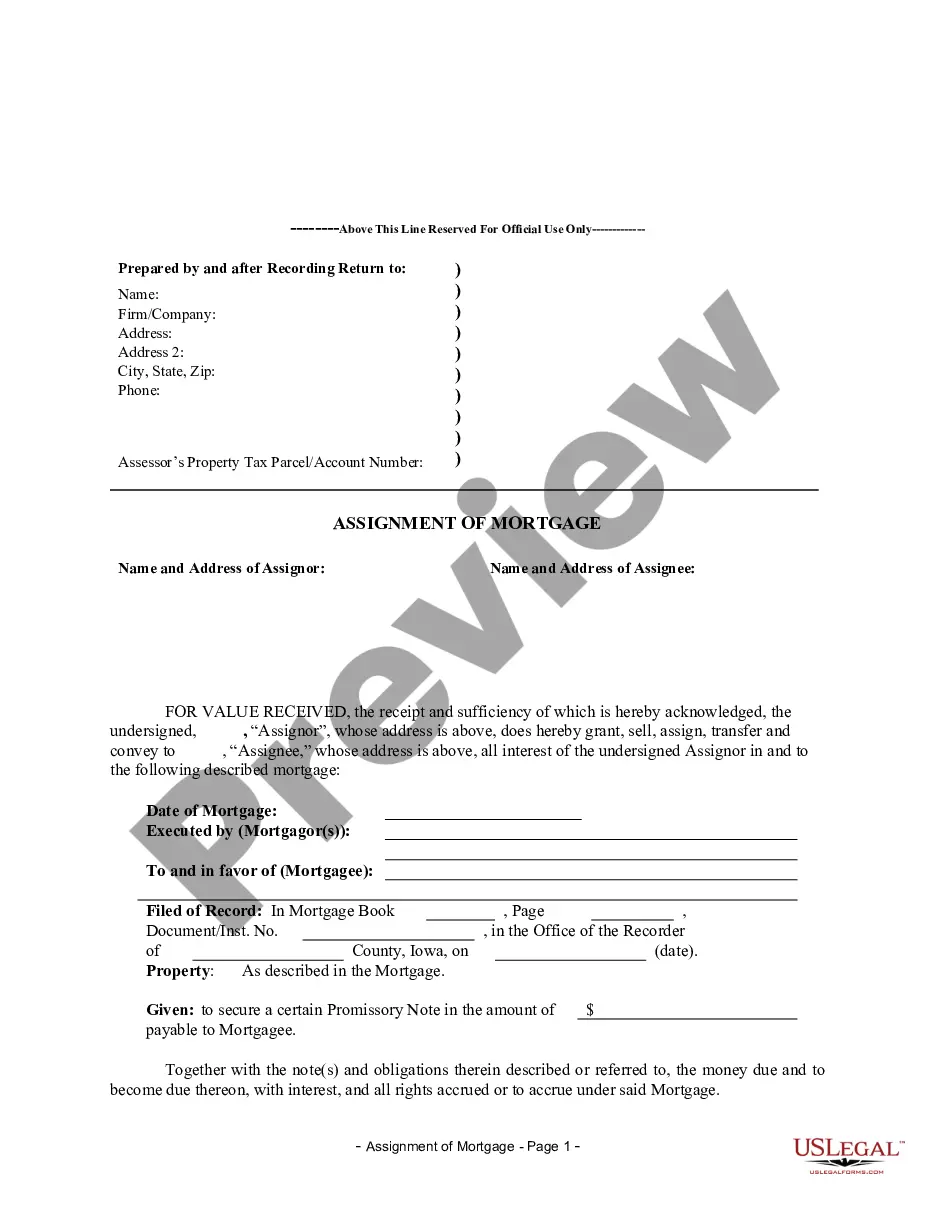

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Iowa Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Iowa Assignment Of Mortgage By Corporate Mortgage Holder?

Utilize the largest collection of sanctioned forms.

US Legal Forms serves as a platform where you can discover any state-specific document with just a few clicks, including examples of Iowa Assignment of Mortgage by Corporate Mortgage Holder.

No need to squander hours attempting to locate a court-acceptable form.

After selecting a pricing plan, register an account. Make payments via card or PayPal. Download the document to your computer by clicking Download. That's it! You need to complete the Iowa Assignment of Mortgage by Corporate Mortgage Holder template and verify it. To ensure that everything is accurate, contact your local legal advisor for assistance. Register and easily browse through over 85,000 valuable samples.

- To utilize the document library, select a subscription and establish your account.

- If you have already done this, just Log In and then click Download.

- The Iowa Assignment of Mortgage by Corporate Mortgage Holder example will be instantly stored in the My documents tab (a section for all forms you save on US Legal Forms).

- To create a new account, follow the simple instructions below.

- If you're required to use a state-specific document, ensure you select the correct state.

- If feasible, review the description to understand all of the specifics of the form.

- Use the Preview feature if available to examine the document's details.

- If everything appears accurate, click on the Buy Now button.

Form popularity

FAQ

An example of an assignment of a mortgage occurs when a bank decides to sell a mortgage to another financial institution. In this situation, the original lender assigns their interest in the mortgage to the new lender, who then collects payments from the borrower. This transfer can happen for various reasons, such as financial reorganization or changes in investment strategy. Exploring the Iowa Assignment of Mortgage by Corporate Mortgage Holder can help you understand real-life scenarios and the documentation involved.

To release an assignment of a mortgage, the mortgage holder must file a release document with the appropriate county or state office, indicating that the obligation has been fulfilled. This document must clearly detail the original mortgage and the assignment that is to be released. By doing this, you officially inform all parties of the change in ownership or claim on the property. Using resources like the Iowa Assignment of Mortgage by Corporate Mortgage Holder can provide guidance and templates for this procedure.

When a bank completes an assignment of a mortgage, they officially transfer the rights to the mortgage from one party to another. This means that the mortgage holder, often a corporate entity, has given up their claim on the property secured by the mortgage. This process can involve various legal documents and ensures that all parties have a clear understanding of their rights. Utilizing the Iowa Assignment of Mortgage by Corporate Mortgage Holder can simplify this process for both lenders and borrowers.

Failure to record an assignment of a mortgage can lead to confusion and disputes regarding property rights. If you don't record the Iowa Assignment of Mortgage by Corporate Mortgage Holder, you may face challenges in asserting your claim against any future creditors or buyers. It is essential to make recording a priority to safeguard your legal rights and establish clear ownership. Consider using services like USLegalForms to help navigate the recording process efficiently.

To complete an assignment of mortgage in Iowa, start by preparing a written document that specifies the details of the assignment, including the names of the parties involved and the legal description of the property. Both parties must sign the document, and it's advisable to have a notary public witness the signing. After it's signed, record the assignment with the local county recorder's office. Utilizing platforms like USLegalForms can streamline this process with templates and guidance.

To ensure a mortgage lien is valid and has priority over other claims, recording is essential in Iowa. Recording the lien allows it to take effect against third parties and protects your rights as a lender. Without this step, other parties may contest your interest in the mortgage. Thus, for an Iowa Assignment of Mortgage by Corporate Mortgage Holder, always prioritize timely recording.

In Iowa, a mortgage does not need to be recorded to be enforceable; however, recording provides important legal protections. When you record the Iowa Assignment of Mortgage by Corporate Mortgage Holder, you establish public notice of the mortgage's existence, which protects your interests. Without recording, you risk challenges from subsequent lien holders. Therefore, recording is a beneficial step to secure your investment.

If the assignment of mortgage is not recorded, it can lead to potential legal complications and disputes about ownership rights. In Iowa, failing to record the assignment may result in the original mortgage holder retaining control over the mortgage until the assignment is officially documented. This can complicate any future transactions involving the property. It's wise to ensure that your Iowa Assignment of Mortgage by Corporate Mortgage Holder is recorded to prevent such issues.

In an Iowa Assignment of Mortgage by Corporate Mortgage Holder, the assignment must be signed by the entity holding the mortgage. This entity can include corporate mortgage holders, banks, or other financial institutions. It is crucial that the signer has the authority to execute the assignment on behalf of the organization. Ensuring proper signatures helps maintain the legal validity of the document.

Code 589.31 in Iowa pertains to specific regulations regarding corporate entities involved in real estate transactions, including the Iowa Assignment of Mortgage by Corporate Mortgage Holder. This code outlines essential obligations and procedures for corporate mortgage holders. Familiarity with this code helps ensure compliance and reduces legal risks when transferring mortgage interests.