Arizona Consumer Loan Application

About this form

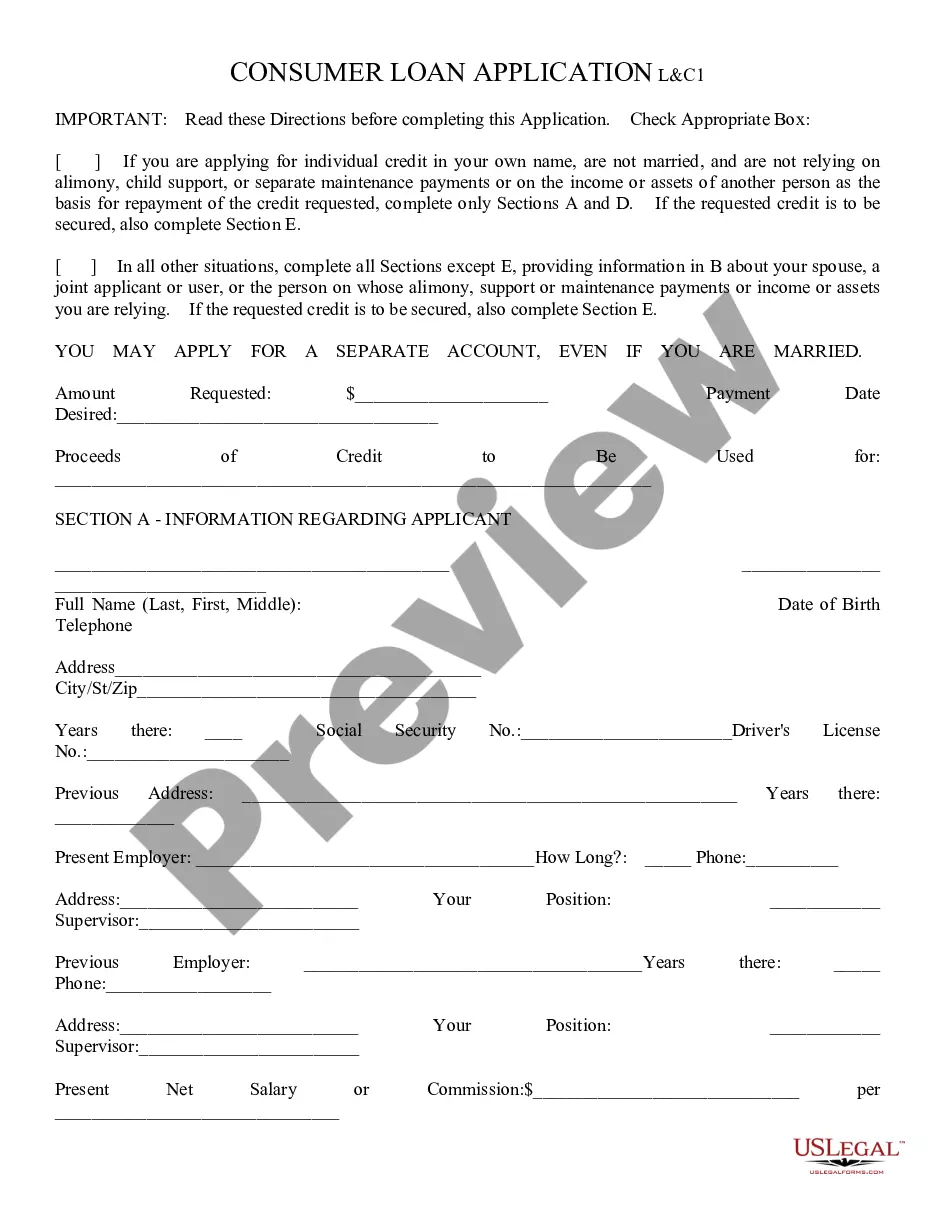

The Consumer Loan Application is a document used by individuals to formally request a loan from a lender. It details the applicant's personal and financial information, which helps the lender assess creditworthiness. This application differs from other forms as it is specifically tailored for consumer loans and includes comprehensive sections for both individual and joint applicants, along with marital and asset information.

What’s included in this form

- Section A: Applicant's personal information, including name, date of birth, and contact details.

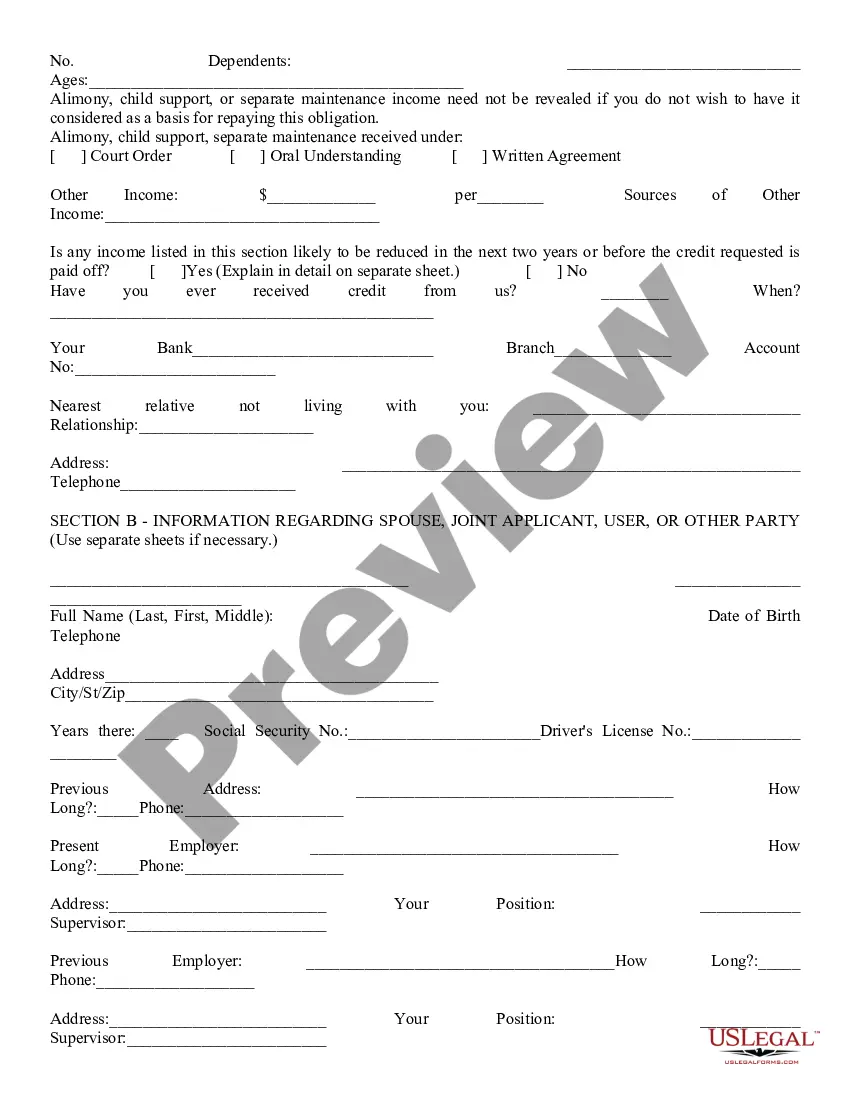

- Section B: Information regarding spouse or joint applicants, if applicable.

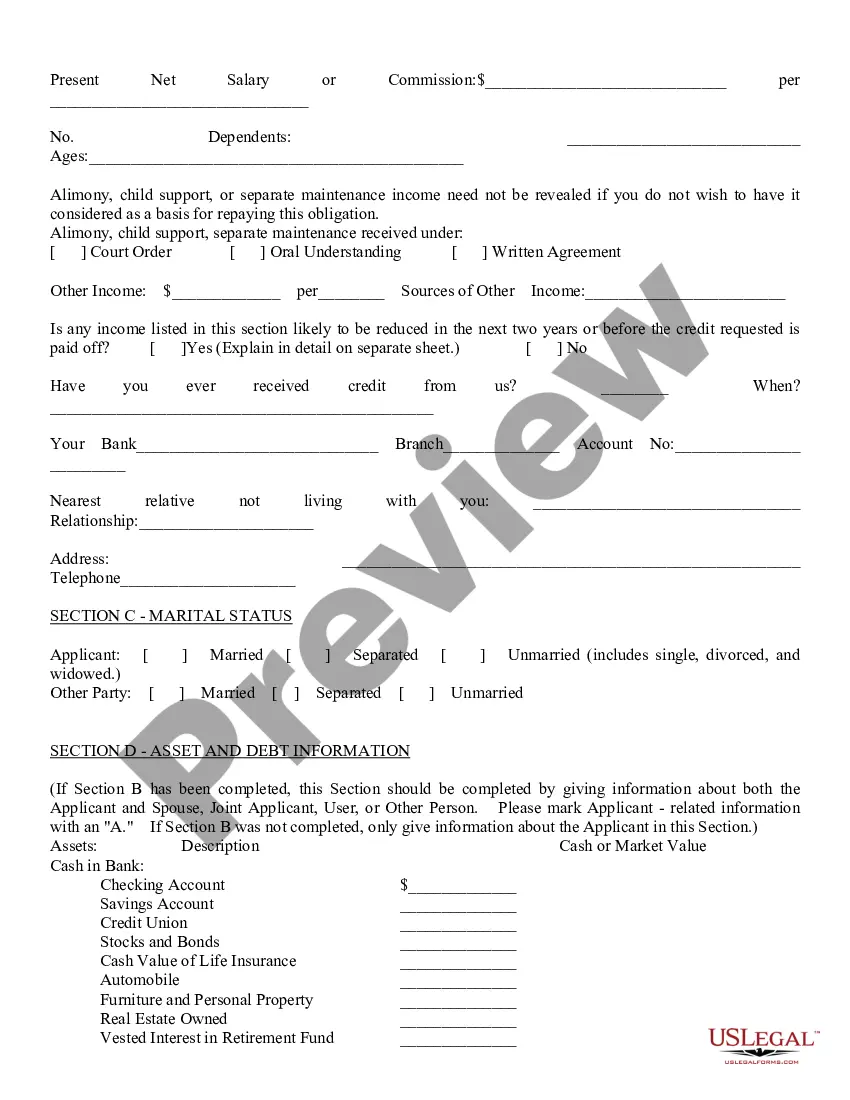

- Section C: Marital status declaration for the applicant and any joint parties.

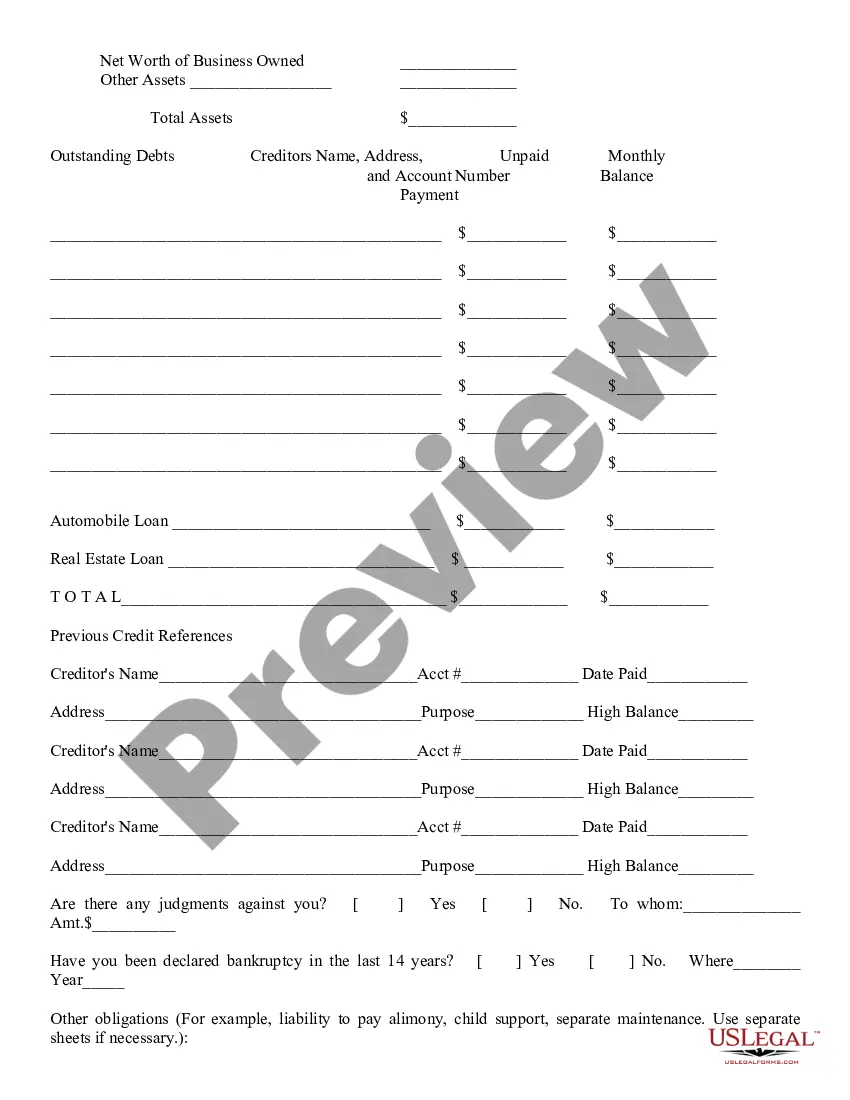

- Section D: Comprehensive details about assets and debts, including income sources.

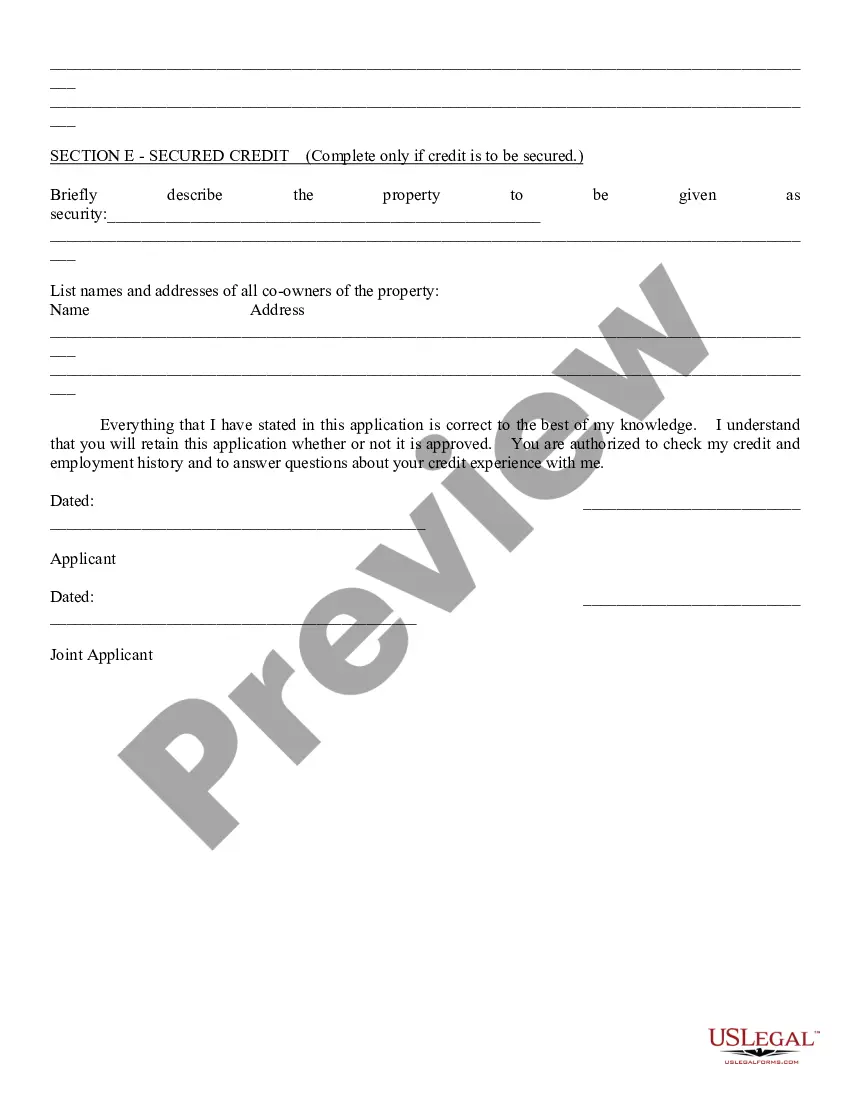

- Section E: Information regarding secured credit, if applicable.

Common use cases

This form should be used when an individual seeks a consumer loan from a lending institution. It is particularly useful when applying for personal loans, auto loans, or any other form of credit where personal financial details are relevant. Completing this application is necessary to initiate the loan approval process.

Who this form is for

- Individuals seeking a personal loan for various purposes.

- Married applicants who need to include spouse information during the loan application process.

- Joint applicants applying for credit together.

- Individuals applying for secured loans that involve property or assets as collateral.

Instructions for completing this form

- Identify the applicant and enter personal details in Section A.

- If applicable, fill out Section B with information about the spouse or any joint applicants.

- Complete Section C by indicating the marital status of the applicant and joint applicants.

- Provide assets and debts information in Section D, ensuring to clearly list all sources of income.

- If the loan is secured, complete Section E with details about the property being used as collateral.

Is notarization required?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Leaving sections blank or failing to provide complete information.

- Not including details about additional income that could strengthen the application.

- Applying for secured credit without filling out Section E.

- Failing to check the applicability of marital status for the application.

Benefits of completing this form online

- Convenient access anytime, allowing users to fill out the form at their own pace.

- Editable fields that enable applicants to save their progress and make adjustments as needed.

- Reliable templates created by licensed attorneys to ensure compliance and accuracy.

Looking for another form?

Form popularity

FAQ

Go to the Company Website: The Better Business Bureau. The Federal Trade Commission. Ripoff Report. spam@uce.gov. Yelp. Planetfeedback. Google Your Attorney General.

To report attorney misconduct you must contact the State Bar of Arizona. Once a report of attorney misconduct is received, the State Bar of Arizona will make a determination if the conduct warrants the filing of a formal complaint.

Pursuant to general consumer laws, attorneys general have authority to investigate, settle with, and litigate against those who may be/are in violation of consumer laws on behalf of the state. This can include the authority to: Require through a formal notice a violator cease and desist from continuing violations.

Title Insurance Issues The Arizona Department of Insurance regulates Title Insurance institutions and transactions in Arizona.

For consumer inquiries, or to request a complaint form, call (602) 542-5763 (Phoenix), (520) 628-6648 (Tucson), or toll-free outside of metro Phoenix, (800) 352-8431.

For consumer inquiries, or to request a complaint form, call (602) 542-5763 (Phoenix), (520) 628-6648 (Tucson), or toll-free outside of metro Phoenix, (800) 352-8431.

Internal Affairs Unit. P.O. Box 6638. Phoenix, Arizona 85005. Office 602-223-2467. Fax 602-223-2922. Duty Office. 602-223-2212. Available 24 hours a day, year round. Area Supervisor. Call 602-223-2000 and request to speak to a supervisor in the area of the incident. This service is also available 24 hours a day, year round.

File a complaint with your state's lawyer discipline agency. Every state has an agency responsible for licensing and disciplining lawyers. Getting compensated. Communicate. Get your file. Research. Get a second opinion. Fire your lawyer. Sue for malpractice.

To ensure Stage 3 complaints are received by the office in a timely manner, we encourage complainants to email Stage 3 complaints to correspondence@attorneygeneral.gov.uk, with the email marked as 'FAO The Director of the AGO'. Your complaint will then be brought to the attention of the Director in the usual way.