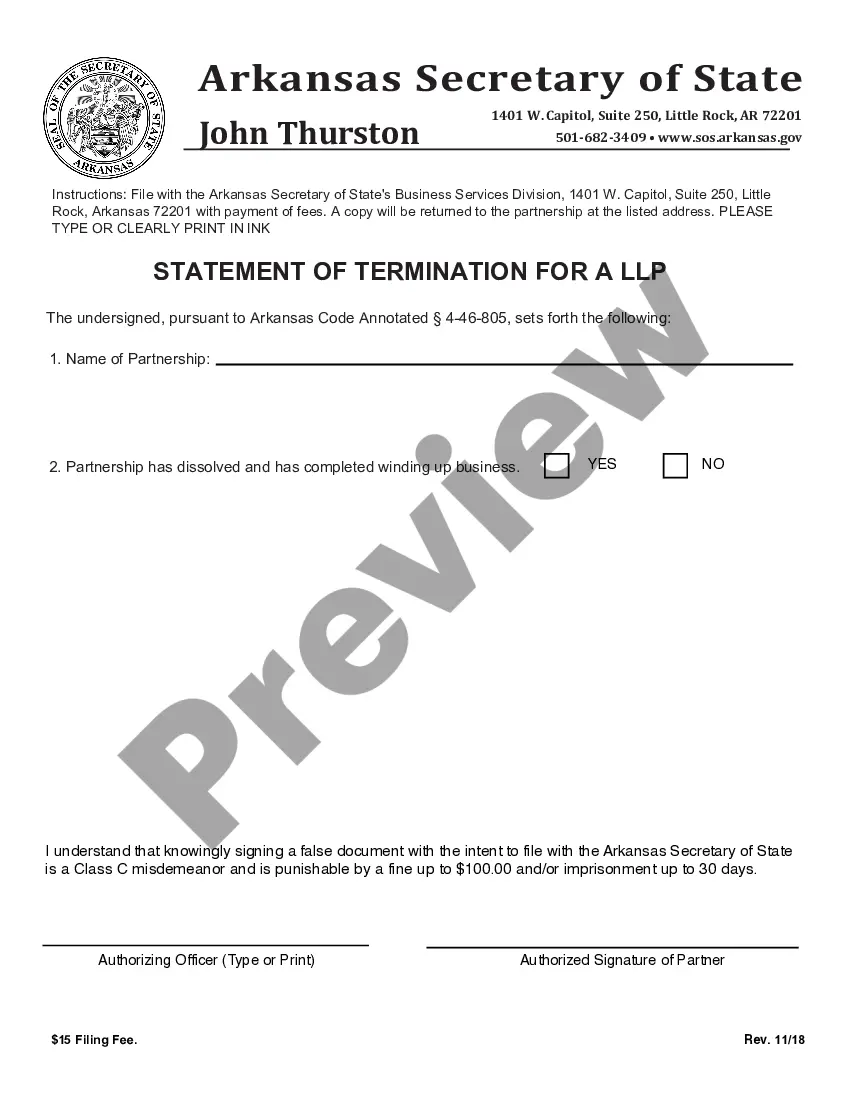

An Arkansas Statement of Termination for LP and LL LP is a document that is filed with the Arkansas Secretary of State in order to terminate a Limited Partnership (LP) or Limited Liability Limited Partnership (LL LP) registered in the state of Arkansas. The termination document must include the name and registered address of the LP or LL LP, the date of termination, and the name and signature of the person filing the termination. Depending on the type of entity, the Arkansas Statement of Termination for LP and LL LP may require additional information, such as the number of partners, the name of the general partner, and the reason for termination. There are two different types of Arkansas Statement of Termination for LP and LL LP: a Certificate of Termination and a Statement of Termination. The Certificate of Termination is used when either all the partners or all the general partners of the LP or LL LP have agreed to the termination. The Statement of Termination is used when not all partners or general partners have agreed to the termination and is more complicated than the Certificate of Termination.

Arkansas Statement Of Termination For LP And LLLP

Description

How to fill out Arkansas Statement Of Termination For LP And LLLP?

How much duration and resources do you generally allocate to drafting official documents.

There’s a better alternative to obtaining such forms than employing legal professionals or investing hours searching the internet for an appropriate template.

Create an account and complete your subscription payment. Payments can be made using your credit card or through PayPal - our service is completely secure for that.

Download your Arkansas Statement Of Termination For LP And LLLP to your device and finish it on a printed hard copy or digitally.

- US Legal Forms is the leading online repository that offers expertly prepared and validated state-specific legal papers for any need, such as the Arkansas Statement Of Termination For LP And LLLP.

- To obtain and prepare an appropriate Arkansas Statement Of Termination For LP And LLLP template, follow these easy steps.

- Browse through the form content to ensure it aligns with your state requirements. To accomplish this, examine the form description or use the Preview option.

- If your legal template does not meet your requirements, find another one using the search tab located at the top of the page.

- If you are already registered with our service, Log In and download the Arkansas Statement Of Termination For LP And LLLP. Otherwise, proceed to the next steps.

- Click Buy now once you identify the correct document. Choose the subscription plan that fits you best to access our library’s full capabilities.

Form popularity

FAQ

How much is the Arkansas LLC Annual Franchise Tax? The Arkansas LLC Annual Franchise Tax is $150 per year. This is a flat-rate fee.

Ing to the IRS, a single-member limited liability company is a "disregarded entity", meaning there is no separation between the business and its owner. By default, the IRS taxes it the same as a sole proprietorship. However, you do have the option to be taxed differently.

How do you dissolve an Arkansas Limited Liability Company? To dissolve your Arkansas LLC, you submit the completed form Articles of Dissolution for Limited Liability Company to the Arkansas Secretary of State, Business and Commercial Services (BCS) by mail or in person. You cannot file articles of dissolution online.

In the state of Arkansas, every business entity is required to complete an annual report filing. Arkansas requires that you file by May 1st of each year, otherwise you may fall into noncompliance and face fees and penalties.

Will I be assessed late fees if I don't file an Arkansas Franchise Tax or Annual Report? The state will charge your Arkansas LLC or corporation (with and without stock) a $25 late fee.

Some states have a general license requirement, which means all businesses operating in those states must have the license, regardless of what they do. But good news: Arkansas doesn't require a general license to do business in the state. Meaning, your Arkansas LLC doesn't need a general state business license.

Do sole proprietors pay a franchise tax in Arkansas? No, income from a sole proprietorship in Arkansas is earned by the business owner. The business owner pays taxes of his income to the state.

A.C.A. § 26-54-101 et al., also known as the ?Arkansas Corporate Franchise Tax Act of 1979?, requires all Corporations, LLC's, Banks, and Insurance Companies registered in Arkansas to pay an annual franchise tax.