Illinois Certificate of Error application For Exempt Property is a form used to request an adjustment of assessed value for certain types of exempt property. It can be used by owners of real estate, religious, educational, charitable, or scientific organizations, and government entities to obtain a reduction in their assessed property values. The Certificate of Error application is submitted to the local taxing body or county assessor’s office and must be supported with evidence of the property’s exemption status. There are two types of Certificate of Error applications: “Real Estate” and “Non-Real Estate”. The “Real Estate” application is used to request a reduction in the assessed value of real estate that is used exclusively for religious, educational, charitable, or scientific purposes. The “Non-Real Estate” application is used to request a reduction in the assessed value of personal property or tangible assets used exclusively for religious, educational, charitable, or scientific purposes.

Illinois Certificate of Error application For Exempt Property

Description

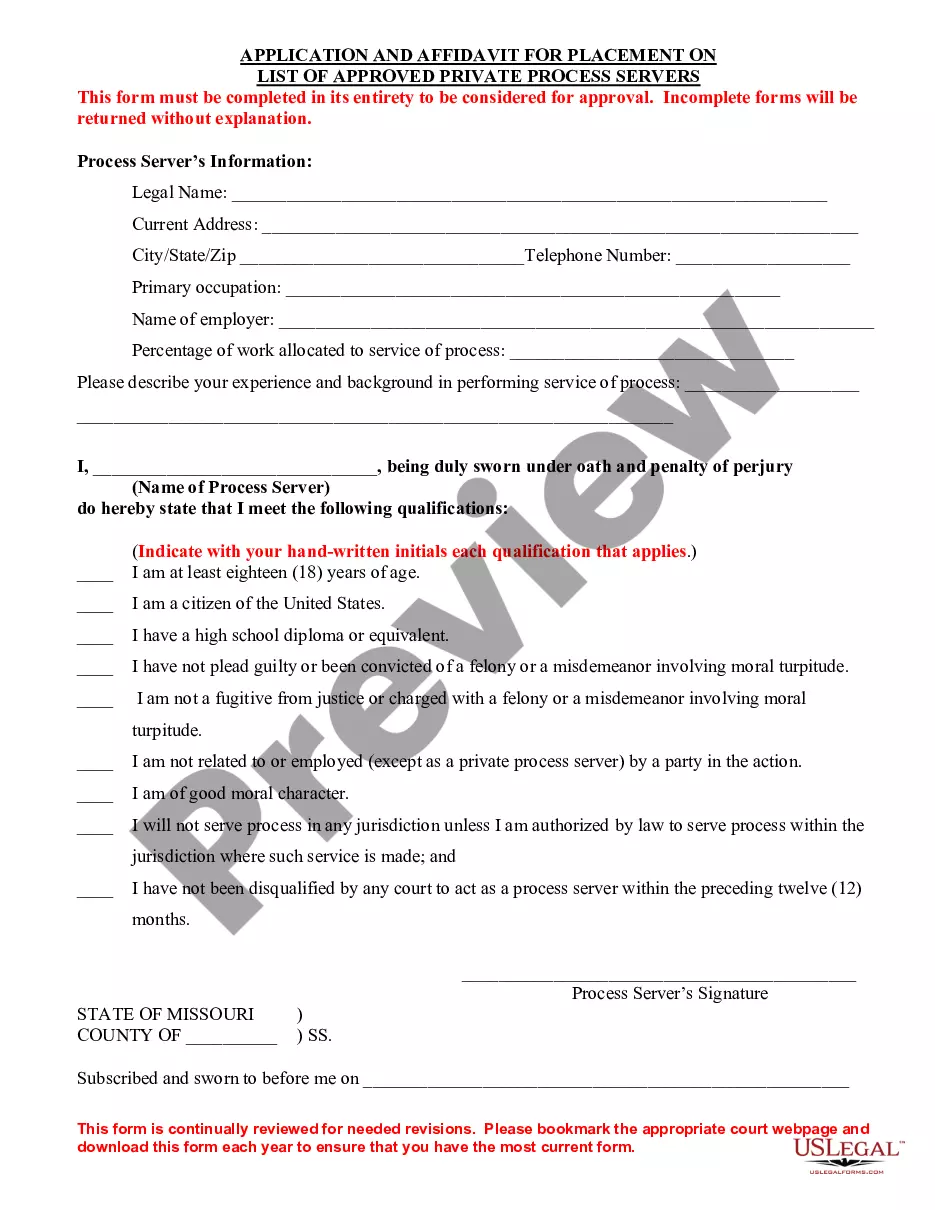

How to fill out Illinois Certificate Of Error Application For Exempt Property?

Drafting legal documents can be quite a hassle unless you have access to ready-made fillable templates.

With the US Legal Forms online repository of official documents, you can trust that the forms you acquire are in accordance with both federal and state regulations and have been verified by our professionals.

Nonetheless, even if you are new to our service, signing up for a valid subscription will only take a few minutes. Here’s a concise guide for you.

- If you require the Illinois Certificate of Error application for Exempt Property, our platform is the ideal spot to download it.

- Acquiring your Illinois Certificate of Error application for Exempt Property from our service is incredibly straightforward.

- Registered users with an active subscription merely need to Log In and hit the Download button once they find the appropriate template.

- If necessary, users can subsequently access the same document from the My documents section of their account.

Form popularity

FAQ

exempt certificate in Illinois is a document that allows qualifying entities to make purchases without paying sales tax. This certificate is crucial for organizations that operate on a nonprofit basis or fulfill governmental functions. To obtain this certificate, you must demonstrate criteria set by the state, often using the Illinois Certificate of Error application For Exempt Property as part of your submission. Proper documentation can prevent unnecessary tax expenses.

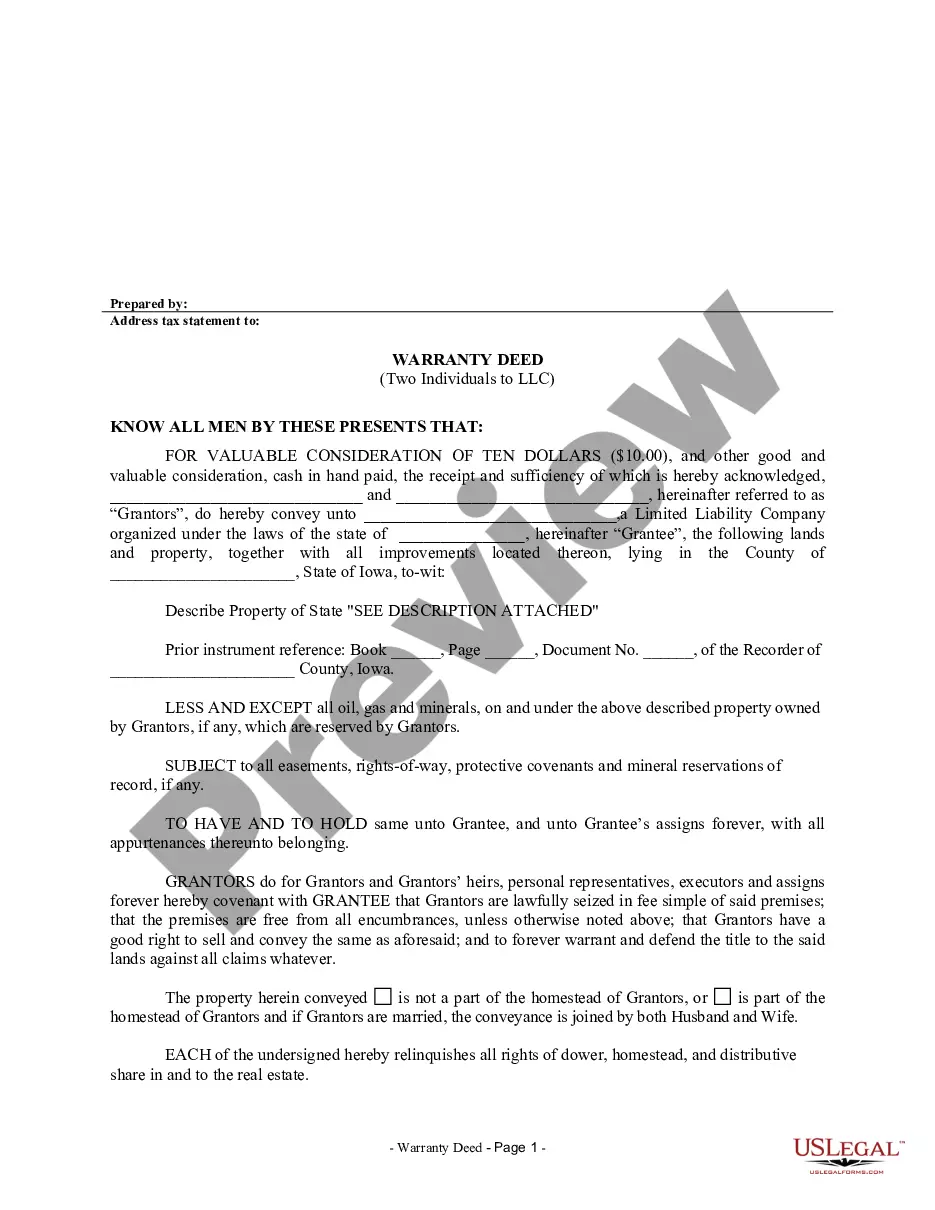

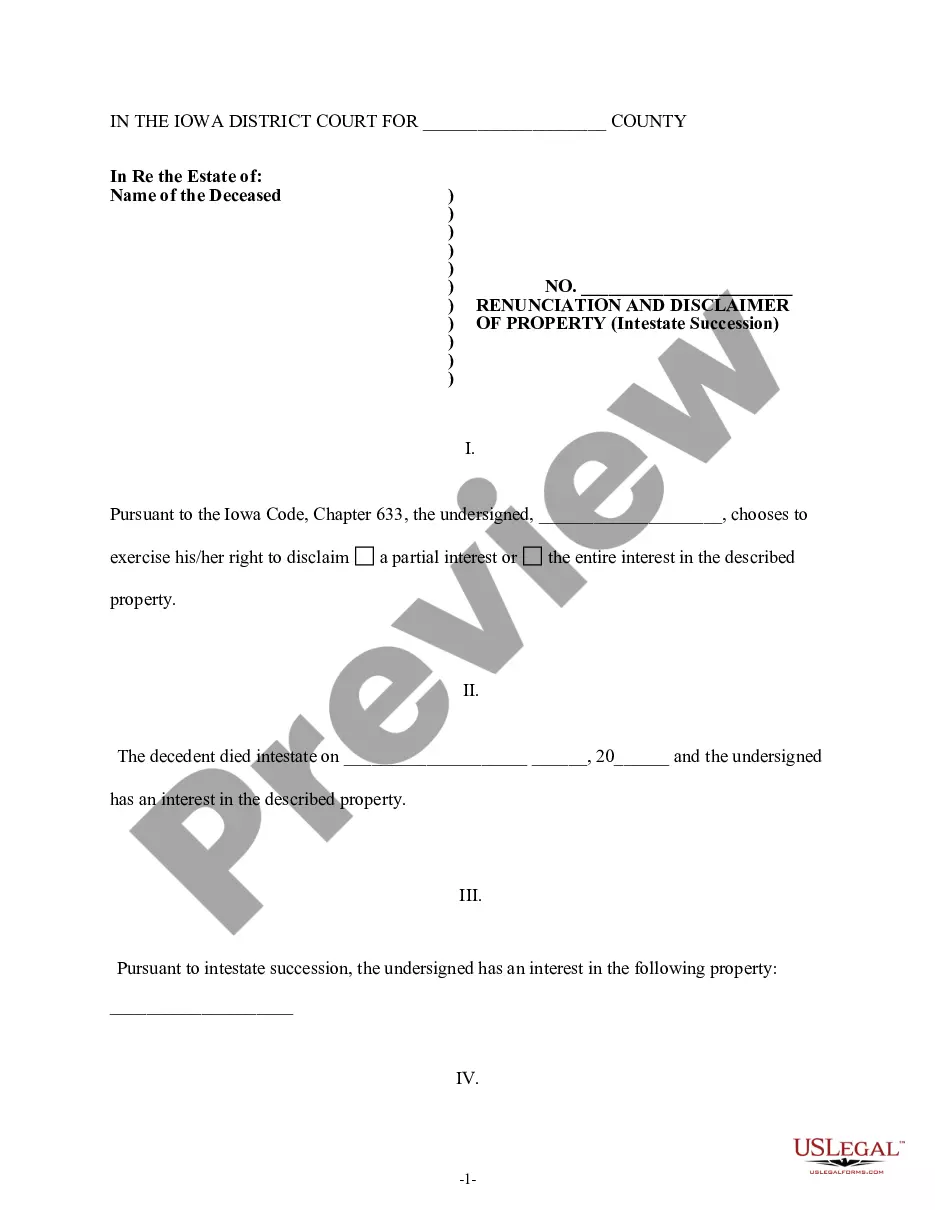

Illinois law provides the Certificate of Error procedure to allow the Cook County Assessor to apply changes to a property tax bill that has already been issued. It is a way to make a correction after the assessment for that tax year is finalized.

The Longtime Homeowner Exemption enables property owners to receive an expanded Homeowner Exemption with no maximum exemption amount. Of the 1.5 million residential properties in Cook County, fewer than 2% qualified for the Longtime Occupant Homeowner Exemption last year.

Under a new law (35 ILCS 200/9-275), the Cook County Assessor is hunting for homeowners who are claiming property tax exemptions for which they do not qualify. The consequences can include repayment of up to 6 years of unpaid tax, plus 10% interest per year plus a penalty of 50% of the total unpaid tax.

Property tax savings from a Homeowner Exemption are calculated by multiplying the Homeowner Exemption amount of EAV reduction ($10,000) by your local tax rate. Property tax savings from a Senior Exemption is calculated by multiplying the Senior Exemption amount of EAV reduction ($8,000) by your local tax rate.

Do I have to apply every year? No. Once you apply, the Homeowner Exemption will renew automatically in subsequent years as long as your residency remains the same.

Senior Citizens Real Estate Tax Deferral Program allows persons 65 years of age and older, who have a total household income of less than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments on their principal residences.

A veteran is eligible to receive the exemption for another tax year in which the veteran returns from active duty. Applicants must file a Form PTAX-341, Application for Returning Veterans' Homestead Exemption, with the Chief County Assessment Office.

The Home Improvement Exemption allows a homeowner to add improvements to their home that add to its value (for example, by increasing the building's square footage, or repairing after structural flood damage) without being taxed on up to $75,000 of the added value for up to four years. No application is required.