The Illinois Certificate of Error-Senior Citizen Exemption is a document issued by the Illinois Department of Revenue to provide a monetary exemption to qualified senior citizens. This certificate allows senior citizens who meet certain criteria to be exempt from paying certain taxes on their incomes. There are two types of Illinois Certificate of Error-Senior Citizen Exemptions: the Homestead Exemption and the Special Senior Citizen Exemption. The Homestead Exemption is available to any senior citizen who owns and occupies a primary residence in Illinois. The Special Senior Citizen Exemption is available to senior citizens who are 65 years of age or older, and meet certain income and asset criteria. In order to qualify for either of these exemptions, the applicant must provide proof of age, income, and assets.

Illinois Certificate of Error-Senior Citizen Exemption

Description

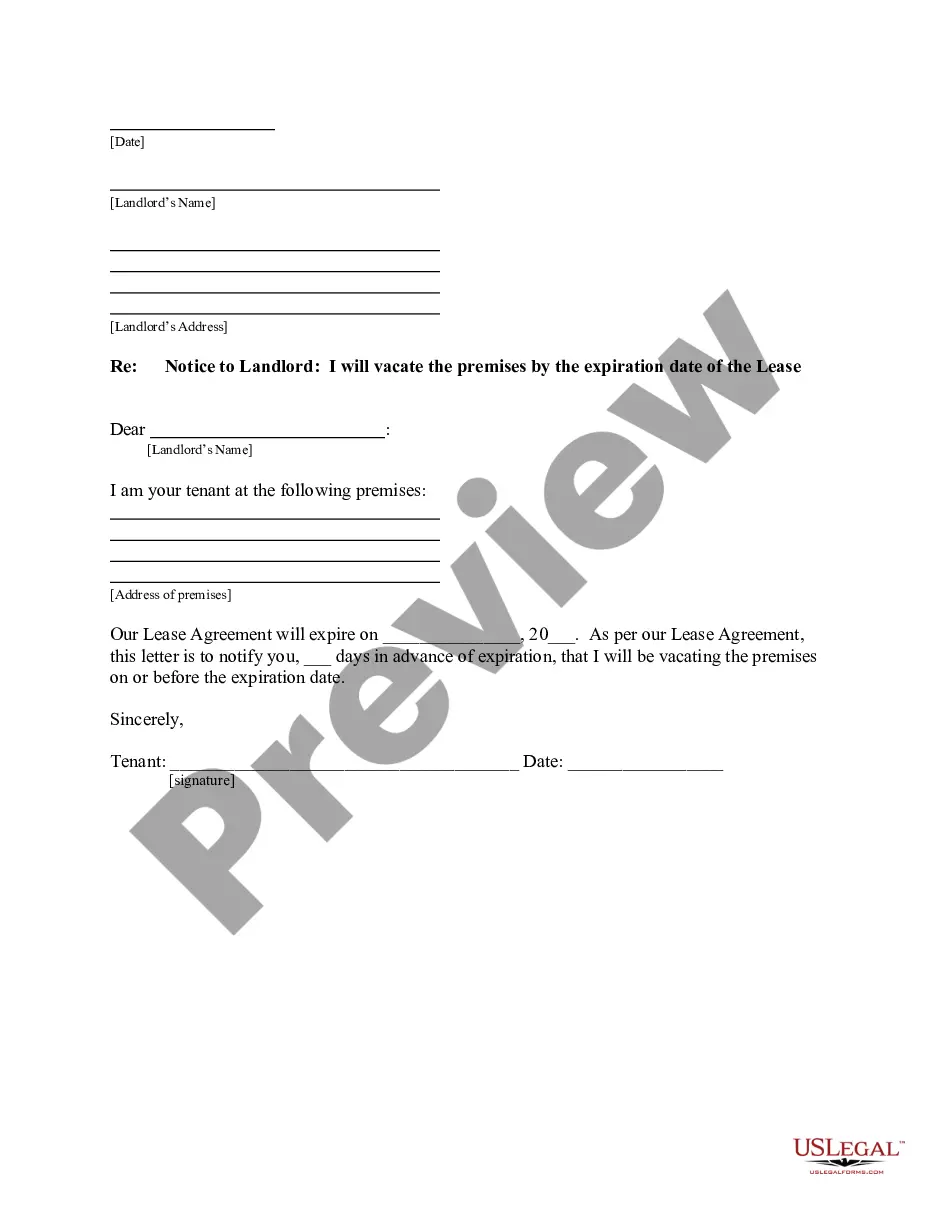

How to fill out Illinois Certificate Of Error-Senior Citizen Exemption?

Drafting legal documents can be quite challenging unless you have accessible fillable templates. With the US Legal Forms online repository of official paperwork, you can trust the forms you discover, as they all adhere to federal and state regulations and are checked by our specialists.

Acquiring your Illinois Certificate of Error-Senior Citizen Exemption through our service is as simple as 1-2-3. Previously registered users with an active subscription need only Log In and click the Download button after finding the right template. Subsequently, if necessary, users can select the same form from the My documents section of their profile. However, even if you are new to our service, registering for a valid subscription will only take a few minutes. Here’s a quick guide for you.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any official document swiftly and effortlessly whenever you require, and keep your paperwork organized!

- Document compliance verification. You should thoroughly inspect the content of the form you wish to use and ensure it meets your requirements and satisfies your state law stipulations. Previewing your document and assessing its general description will assist you in doing this.

- Alternative search (optional). If there are any discrepancies, explore the library using the Search tab above until you locate an appropriate form, and click Buy Now once you find the one you want.

- Account registration and form purchase. Register for an account with US Legal Forms. After your account is verified, Log In and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Illinois Certificate of Error-Senior Citizen Exemption and click Download to save it on your device. Print it to manually finish your paperwork, or utilize a multi-featured online editor to create an electronic version more quickly and effectively.

Form popularity

FAQ

Illinois law provides the Certificate of Error procedure to allow the Cook County Assessor to apply changes to a property tax bill that has already been issued. It is a way to make a correction after the assessment for that tax year is finalized.

Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1957 or prior) and own and occupy their property as their principal place of residence. Once this exemption is applied, the Assessor's Office automatically renews it for you each year.

This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments (up to a maximum of $7,500) on their principal residences.

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2021 calendar year. A "Senior Freeze" Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property.

In Cook County, taxpayers can file an appeal with the County Assessor or the County Board of Review. Call these offices and ask for the date for filing an appeal in your township: The County Assessor's Taxpayer Assistance Department (312) 443-7550. The Board of Review (312) 443-5542.

When can I file an appeal? Property owners can file an appeal when the Board of Review opens their township for appeal each year. Property owners can also pre-register through the online appeals portal . The Board of Review opens townships for appeals after the Assessor has assessed each property in the township.