Arkansas Personal Shopper Services Contract - Self-Employed Independent Contractor

Description

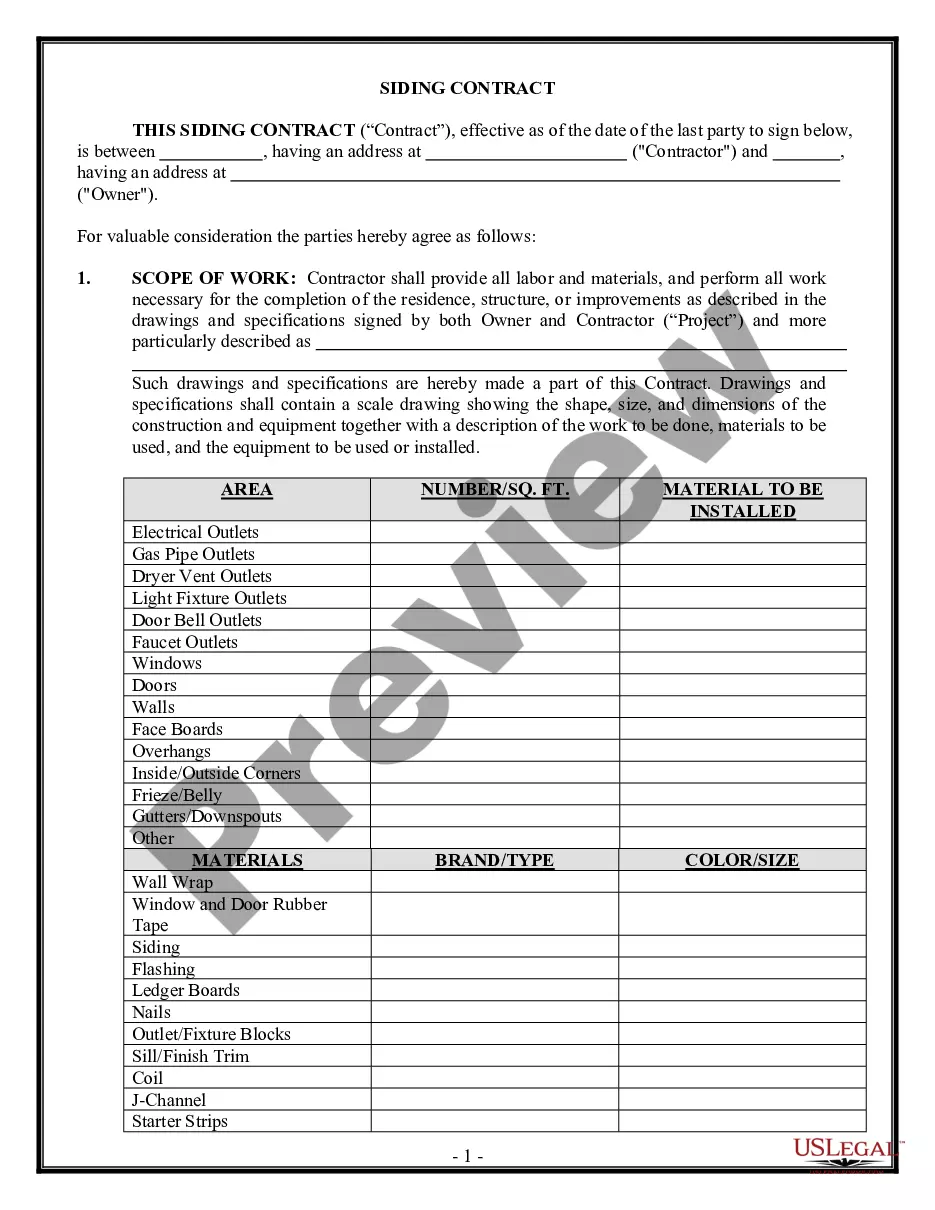

How to fill out Personal Shopper Services Contract - Self-Employed Independent Contractor?

You can spend hours online searching for the legal document template that fulfills the federal and state requirements you need. US Legal Forms offers a vast array of legal documents that are reviewed by professionals.

You can effortlessly download or print the Arkansas Personal Shopper Services Contract - Self-Employed Independent Contractor from our platform. If you possess a US Legal Forms account, you may Log In and then click on the Download button. After that, you can complete, modify, print, or sign the Arkansas Personal Shopper Services Contract - Self-Employed Independent Contractor.

Every legal document template you obtain is yours permanently. To have an additional copy of any acquired form, visit the My documents tab and click the corresponding button.

Select the template from the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the Arkansas Personal Shopper Services Contract - Self-Employed Independent Contractor. Download and print a wide range of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/town of your choice. Review the form description to make sure you have chosen the right template.

- If available, use the Preview button to view the document template as well.

- If you wish to find another version of the form, use the Search area to locate the template that suits your needs and requirements.

- Once you have found the template you want, click Buy now to continue.

- Choose the pricing plan you prefer, enter your details, and register for your account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal account to pay for the legal template.

Form popularity

FAQ

Creating an independent contractor contract involves several key elements, including the scope of work, payment terms, and duration of the agreement. The Arkansas Personal Shopper Services Contract - Self-Employed Independent Contractor can serve as a great template to start with, ensuring that essential details are covered. It clarifies expectations and protects both you and your client. Take your time to draft a comprehensive contract.

Yes, you are considered self-employed if you work as an independent contractor. This means you operate your own business and are responsible for your own taxes and benefits. The Arkansas Personal Shopper Services Contract - Self-Employed Independent Contractor clearly outlines your responsibilities and the nature of your business relationship. Understanding your self-employment status is crucial for managing your finances and legal obligations.

To write an independent contractor agreement, start with a clear introduction that defines the parties involved and the nature of the work. Next, specify the scope of services, payment terms, and the duration of the contract. Consider using the Arkansas Personal Shopper Services Contract - Self-Employed Independent Contractor as a template, which can provide structure and clarity to your agreement.

Yes, an independent contractor is considered self-employed. This means you operate your own business and are responsible for your own taxes and benefits. Understanding this status is essential when entering into an Arkansas Personal Shopper Services Contract - Self-Employed Independent Contractor, as it impacts your financial and legal responsibilities.

Filling out an independent contractor agreement involves outlining your services, detailing compensation, and specifying the duration of the contract. Be sure to include clauses on confidentiality and liability if applicable. Utilizing the Arkansas Personal Shopper Services Contract - Self-Employed Independent Contractor template can simplify this process and ensure you cover all necessary details.

Independent contractors typically need to fill out the W-9 form for tax purposes, as well as any specific business forms required by their clients. Additionally, consider using a tailored Arkansas Personal Shopper Services Contract - Self-Employed Independent Contractor to define your role and responsibilities. These documents help ensure clarity in your professional relationships.

To fill out an independent contractor form, start by providing your personal information, including your name and address. Next, include details about the services you offer, as well as the payment terms. Make sure to review the entire document for accuracy before submitting it. Utilizing the Arkansas Personal Shopper Services Contract - Self-Employed Independent Contractor can help guide you through this process.

Yes, consulting services are generally taxable in Arkansas. As a self-employed independent contractor offering services, it is important to keep track of your income and understand your tax obligations. Utilizing an Arkansas Personal Shopper Services Contract can help you document your services properly, aiding compliance with state tax laws.

Yes, contract work is considered self-employment. When you engage in contract work, you typically operate your own business and have more control over how you work. An Arkansas Personal Shopper Services Contract can help formalize your relationship with clients, ensuring clarity in expectations and responsibilities.

The rules for self-employed individuals can change, often in relation to taxation and benefits. Recently, self-employed workers should be aware of potential changes in tax deductions and health insurance requirements. Utilizing resources like the Arkansas Personal Shopper Services Contract can help you stay compliant and informed about your responsibilities as a self-employed independent contractor.