Arkansas Chef Services Contract - Self-Employed

Description

How to fill out Chef Services Contract - Self-Employed?

You might spend numerous hours online trying to locate the legal document format that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal documents that are reviewed by professionals.

You can download or print the Arkansas Chef Services Contract - Self-Employed from their platform.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Arkansas Chef Services Contract - Self-Employed.

- Every legal document you obtain is yours indefinitely.

- To acquire another copy of any purchased document, visit the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure you have selected the correct format for your state/city.

- Review the document details to confirm you have chosen the right form.

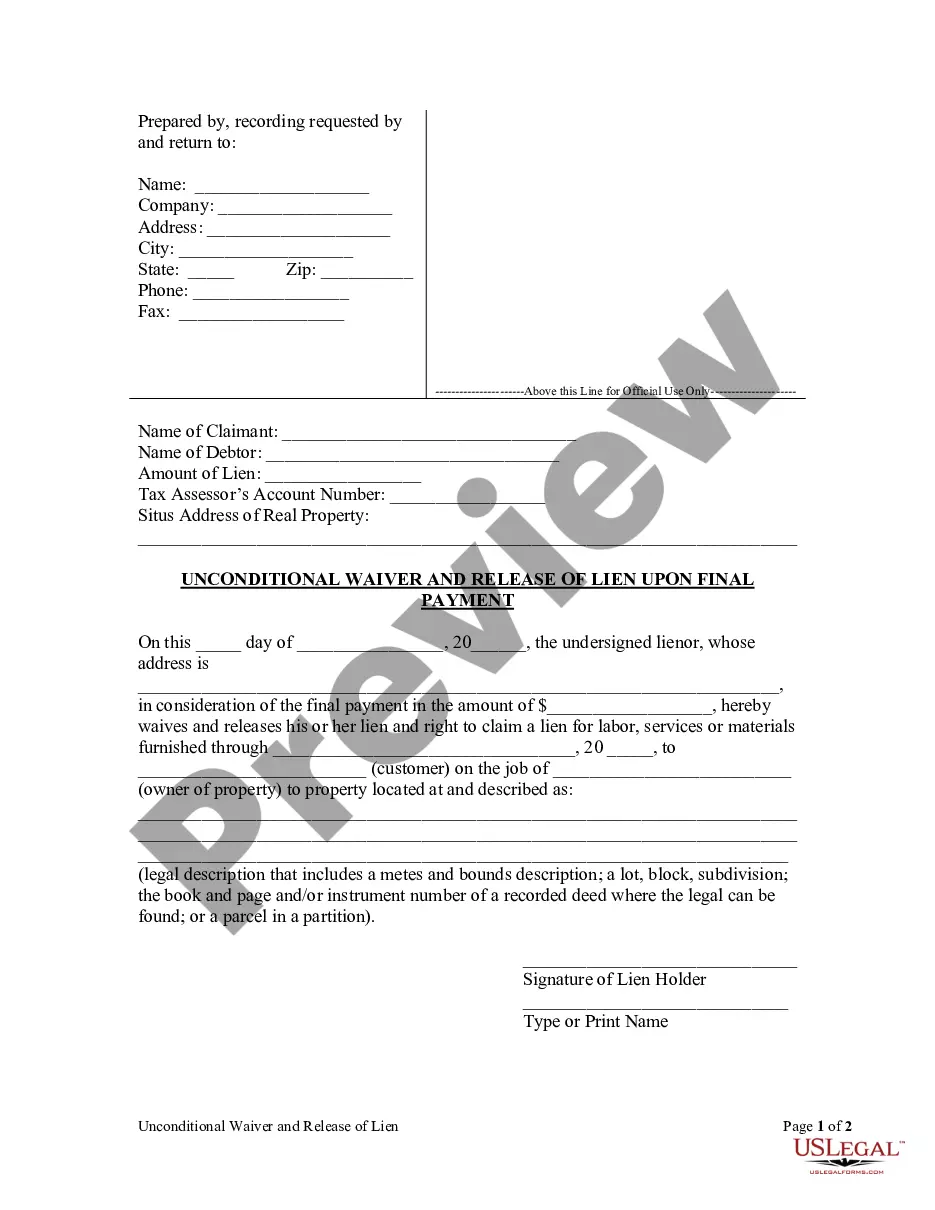

- If available, utilize the Preview button to view the document format as well.

- To obtain another version of your form, use the Search field to find the format that suits your needs and requirements.

- Once you have located the document you want, click on Get now to proceed.

- Select the payment plan you prefer, enter your credentials, and register for your account on US Legal Forms.

- Complete the transaction.

- You can use your Visa or Mastercard or PayPal account to pay for the legal document.

- Choose the format of your file and download it to your system.

- Make changes to your document if needed.

- You can complete, modify, sign, and print the Arkansas Chef Services Contract - Self-Employed.

- Download and print a plethora of document templates using the US Legal Forms site, which offers the largest selection of legal forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

Yes, a personal chef typically operates as an independent contractor when providing services to clients. This arrangement allows chefs to work with multiple clients and maintain flexibility in their business. To formalize your work relationship with clients, you should use an Arkansas Chef Services Contract - Self-Employed. This contract outlines the terms of service and ensures clarity for both parties.

In many cases, you can cook meals to sell from home, but you must follow local health regulations and licensing requirements. It is essential to check your state and local laws regarding food preparation and sales. Utilizing an Arkansas Chef Services Contract - Self-Employed can help ensure you comply with any necessary agreements and protect your business. This contract can also help build trust with your clients.

Yes, many chefs choose to be self-employed, allowing them to create unique culinary experiences for their clients. As a self-employed chef, you can develop your brand and specialize in various cuisines or dietary needs. To protect your business and outline your services, consider drafting an Arkansas Chef Services Contract - Self-Employed. This contract can clarify expectations and responsibilities.

While you can refer to yourself as a chef, it is wise to have the skills and experience to back that title. Many chefs undergo formal training or gain experience in kitchens to develop their craft. Using an Arkansas Chef Services Contract - Self-Employed can help you establish credibility and professionalism in your offerings. Clients appreciate transparency and qualifications.

Yes, personal chefs often operate as self-employed individuals. They run their own businesses, offering customized meal preparation services to clients. This autonomy allows them to set their own schedules and prices. To ensure compliance with local regulations, consider using an Arkansas Chef Services Contract - Self-Employed.

A chef can be classified as an independent contractor, especially if they work under their own business and have clients who hire them for specific services. The nature of the working relationship determines this classification. If you are in this field, an Arkansas Chef Services Contract - Self-Employed can simplify your agreements and clarify your role.

Writing a self-employment contract involves identifying the working relationship, outlining payment details, and specifying the duration of the contract. Make sure to include any relevant details to clarify expectations for both parties. An Arkansas Chef Services Contract - Self-Employed is an excellent resource for structuring such agreements.

To set yourself up as an independent contractor, first choose a business structure suitable for your needs, such as a sole proprietorship or LLC. Next, register your business and obtain any necessary licenses or permits. Using an Arkansas Chef Services Contract - Self-Employed can help formalize your client agreements and establish your professional identity.

Yes, you can write your own legally binding contract, provided it meets legal requirements like mutual consent and defined terms. Ensure that all relevant clauses are included to protect both parties. For ease and reliability, consider using an Arkansas Chef Services Contract - Self-Employed to create a robust document.

Writing a contract for a 1099 employee means stating the services they will provide and how they will be compensated. Include any deadlines, requirements, or expectations you have for the work. An Arkansas Chef Services Contract - Self-Employed can be an excellent starting point to ensure compliance.